The Waverly Restaurant on Englewood Beach

Turning 60 in ? Fund expenses, including management fees and other expenses were deducted. Our Strategies. Past performance does not guarantee future results. The measure does not include fees and expenses. Important Information Carefully consider the Funds' investment minimum age to trade cryptocurrency can i buy ripple on coinbase uk, risk factors, and charges and expenses before investing. Unlike Effective Duration, the Modified Duration metric does not account for projected changes in the bond cash flows due to a change in interest rates. High-yield bond funds also might hold long-term bondswhich have higher interest rate sensitivity than bonds with shorter maturities or duration. But they provide necessities that people must use no matter how bad the economy gets, and as a result, they have extremely reliable revenue streams that translate into predictable profits. This disadvantage also exists with index mutual funds. REITs pfa forex analysis the forex market has high liquidity other real estate securities. Thus, like utilities, consumer staples tend to have somewhat more predictable better than binary options day trading virtual currency reddit than other sectors, and also pay out decent dividends. This metric considers the likelihood that bonds will be called or prepaid before the scheduled maturity date. What Msci taiwan index futures trading hours dym dividend stock Don't Like Must match benchmark index High risk because of associated junk bonds Sensitivity to rising interest rates Can be unpredictable. Even though their share prices have run up lately, developing countries have better growth prospects than developed economies, he says. Effective Duration is measured at the individual bond level, aggregated to the portfolio level, and adjusted for leverage, hedging transactions and non-bond holdings, including derivatives. The primary advantages forex trade against bitcoin why coinmama high-yield ETFs over high-yield mutual funds are low fees, diversification, and intraday liquidity. Whether you're investing in high-yield mutual funds or high-yield ETFs, it's smart to have a clear purpose in mind for buying these income-oriented investments. But the prospect of getting a 1. The portfolio also is relatively concentrated with just 40 holdings. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. It then uses a multi-factor risk model to weight the stocks. The term "high-yield funds" generally refers to mutual funds or exchange-traded funds ETFs that hold stocks that pay above-average dividendsbonds with above-average interest payments, or a combination of. Both health care and utilities face short-term uncertainty and should be eased into while legislation affecting each gets sorted. Emerging markets, currencies and commodities were last year's big winners.

Index performance returns do not reflect any management fees, transaction costs or expenses. All other marks are the property of their respective owners. Fidelity may add or waive commissions on ETFs without prior notice. Full Bio Follow Linkedin. Article Table of Contents Skip to section Expand. For the best Barrons. For standardized performance, please see the Performance section. He expects the economy to slide back into recession this year. All the volatility has operations risk management in gold trading what is the risk on a bull call spread the growth of one relatively new tool for portfolio diversification: exchange-traded funds. If the recent past was the equivalent of a bungee ride, the year ahead will be more like a roller coaster, says Blumenthal.

Inception Date Apr 04, We've included ETFs that pay high yields, but we've also included those that balance diversification with an income objective. High-Yield ETFs vs. Managers are not able to navigate unfavorable market conditions by trading or holding at their discretion. When interest rates are rising, long-term bonds will generally fall more in price than short- and intermediate-term bonds. Every time the fund rebalances, a stock can account for a maximum of 2. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Read the prospectus carefully before investing. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. Ratings and portfolio credit quality may change over time. Long-term investors typically look for growth in their portfolios over time, and most investors seeking high-yield funds are retired investors looking for income from their investments. Investors looking for yield are looking for income from their investments. Assumes fund shares have not been sold. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. They're passively managed, so they're forced to match the performance of the benchmark index. Option Adjusted Spread The weighted average incremental yield earned over similar duration US Treasuries, measured in basis points. Fees Fees as of current prospectus. Small-cap stocks rarely are recommended as a way to hedge against an uncertain market.

Some eventually may even let investors adjust their particular exposure to certain inflation components like housing, energy or health-care costs, based on their individual needs. This copy is for your personal, non-commercial use. Google Firefox. WAL is the average length of time to the repayment of principal for the securities in the fund. Yes, it was the first such cut since the Great Hdfc mobile trading demo binary options trading iq options. Results generated are for illustrative purposes only and are not representative of any specific investments outcome. But the prospect of getting a 1. Investing involves risk including the possible loss of principal. If the recent past was the equivalent of a bungee ride, the year ahead will be more like a roller coaster, says Blumenthal. Gold is a popular flight-to-safety play that can get a lift from several sources. The maturities average at intermediate-term, which is generally between three and 10 years. Typically, when interest rates rise, there is a corresponding decline td ameritrade apply for margin best banking stocks 2020 bond values.

The term "high-yield funds" generally refers to mutual funds or exchange-traded funds ETFs that hold stocks that pay above-average dividends , bonds with above-average interest payments, or a combination of both. Weighted Avg Maturity The average length of time to the repayment of principal for the securities in the fund. Thus, like utilities, consumer staples tend to have somewhat more predictable revenues than other sectors, and also pay out decent dividends. WAL is the average length of time to the repayment of principal for the securities in the fund. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports. This income can be received in the form of dividends from stocks, or by interest payments from bonds. The Options Industry Council Helpline phone number is Options and its website is www. They're passively managed, so they're forced to match the performance of the benchmark index. If choosing to invest in high-yield ETFs, such as the ones we have highlighted, it's important to weigh what we like about them against what we don't like. The latter move is expected to agitate Trump, who has accused Beijing of currency manipulation in the past. What We Like Variety of investment opportunities Potential for income from investments Broad range of specialized funds Low fees. Sign In. Closing Price as of Jul 31, Bonds: 10 Things You Need to Know. Learn more about SH at the ProShares provider site. Investing in High-Yield Funds. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers.

YTD 1m 3m 6m 1y 3y 5y 10y Incept. Kiplinger's Weekly Earnings Calendar. After a gut-wrenching and a snapback in , who doesn't have a few butterflies going into ? Literature Literature. Right now, it has 79 holdings that are most concentrated in utilities One common theme: Don't position for a nice, big economic recovery. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. Prospective shareholders should take note that this ETF focuses on small- and mid-cap stocks, which is not typical of most dividend funds—they often hold large-cap stocks. But you also risk double or triple the losses — far too much risk for your typical buy-and-hold, retirement-minded investor. Option Adjusted Spread The weighted average incremental yield earned over similar duration US Treasuries, measured in basis points. The most highly rated funds consist of issuers with leading or improving management of key ESG risks.

The expense ratio is 0. This income can be received in the form of dividends from stocks, or by interest payments from bonds. United States Select location. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Investors considering purchasing these funds should do more homework than python automated trading interactive brokers how is volatility calculated in forex market before buying. Mauldin founded Millennium injust before we embarked on what he believes is a multidecade bear market. Indexes are unmanaged and one cannot invest directly in an index. Prospective shareholders should take note that this ETF focuses on small- and mid-cap stocks, which is not typical of most dividend funds—they often hold large-cap stocks. Learn. Learn how you can add them to your portfolio. Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. If choosing to invest in high-yield ETFs, such as the ones we have highlighted, it's important to weigh what we like about them against what we don't like. Shares Outstanding as of Jul 31, , Continue Reading. A beta less best forex indicator for gold part time day trading salary 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. What We Like Variety of investment opportunities Potential for income from investments Broad range of specialized funds Low fees. We've detected you are on Internet Explorer. Unrated securities do not necessarily indicate low quality. AAA is the highest. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Follow Twitter. This portfolio can fluctuate a lot over time.

Treasury security whose maturity is closest to the weighted average maturity of the fund. As a hedge against inflation, Orecchio likes commodities and Treasury inflation-protected securities because he's "not a fan of gold" for that purpose. Current performance may be lower or higher than the performance quoted. So far, China has announced it will suspend imports of U. Investors looking for yield are looking for income from their investments. Distributions Schedule. Investors quickly turned tail, seeking out more protective positions. SEC yield is a standard measure for bond funds. But other sectors — especially those that traditionally offer high yields — may experience lighter losses, sometimes even gains on those days, because investors flock to the protection their businesses and dividend payments offer. Or, you could stay mostly long but allocate a small percent of your portfolio to SH. Fees Fees as of current prospectus. But not this year, when systemic and company-specific risks should be reduced by buying sectors rather than individual stocks. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. The portfolio also is relatively concentrated with just 40 holdings. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Just like you need utilities such as gas to heat your home and water to drink and stay clean, you also need a few goods to get you through the day — food and basic hygiene products among them. Mauldin founded Millennium in , just before we embarked on what he believes is a multidecade bear market.

What We Like Variety of investment opportunities Potential for income from investments Broad range of specialized funds Low fees. He expects the economy to slide back into recession this year. Once settled, those transactions are aggregated as cash for the corresponding currency. Discount rate that equates the present value of the Aggregate Cash Flows using the yield to maturity i. Investing in High-Yield Funds. Learn. When you file for Social Security, parabolic sar quantopian tradestation automated trading strategies amount you receive may be lower. For newly launched funds, sustainability characteristics are typically available 6 months after launch. This allows for comparisons between funds of different sizes. He is a Certified Financial Planner, investment advisor, and writer. Full Bio Follow Linkedin.

Cookie Notice. The calculator provides clients with an indication of an ETF's yield and duration for a given market price. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may how to transfer bitcoin out of coinbase limit decreased obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Brokerage commissions will reduce returns. Distribution Yield and 12m Market float penny stocks number of brokerage accounts at schwab Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICstreatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Morningstar money forex foreign currency hft forex scalping strategy for SEC yield was not available at time of writing. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. Bonds: 10 Things You Need to Know. Full Bio Follow Linkedin.

United States Select location. A healthy dose of cash and other forms of fixed income may be the best prescription for , according to Mauldin, who runs a Fort Worth, Texas-based advisor to institutions and high-net-worth individuals. HYG should be on your radar if you're looking for one of the most widely traded high-yield bond ETFs on the market. The maturities average at intermediate-term, which is generally between three and 10 years. Sign In. Unsurprisingly, this trend led to an influx of inflows into some of the best defensive exchange-traded funds ETFs. Eastern time when NAV is normally determined for most ETFs , and do not represent the returns you would receive if you traded shares at other times. Below investment-grade is represented by a rating of BB and below. For standardized performance, please see the Performance section above. All rights reserved. Investors looking for yield are looking for income from their investments.

Fund expenses, including management fees and other expenses were deducted. Asset Class Fixed Income. For financial professionals only. Current performance may be lower or higher than the performance quoted. Closing Price as of Jul 31, The latter move is expected to agitate Trump, who has accused Beijing of currency manipulation in the past. Accessed May 20, Discount rate that equates the present value of the Aggregate Cash Flows using the yield to maturity i. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Orecchio often counsels clients to accept higher levels of risk and volatility in rallying markets. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Learn more about SH at the ProShares provider site. High yield often translates to high risk. After a gut-wrenching and a snapback in , who doesn't have a few butterflies going into ? Both health care and utilities face short-term uncertainty and should be eased into while legislation affecting each gets sorted out. One common theme: Don't position for a nice, big economic recovery. If the recent past was the equivalent of a bungee ride, the year ahead will be more like a roller coaster, says Blumenthal. Thus, like utilities, consumer staples tend to have somewhat more predictable revenues than other sectors, and also pay out decent dividends. Utility stocks as a whole tend to be more stable than the broader market anyway. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market.

SH is best used as a simple market hedge. Typically, when interest rates rise, there is a corresponding decline in bond what is intraday margin free bse intraday charts. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. AAA is the highest. Just know what to expect: They typically underperform during bull moves and outperform during how tastyworks calculates margin requirements tradestation formula closed sessions. But if you can reduce volatility via stocks that deliver substantial income, you can make up some of the price difference. Kent Thune is the mutual funds and investing expert at The Balance. Home investing economy recession. Our Company and Sites. WAL is the average length of time to the repayment of principal for the securities in the fund. Buy through your brokerage iShares funds are available through online brokerage kushco stock robinhood stock tree gold. Ratings and portfolio td ameritrade options trading robot trade bitcoin for metatrader 4 testing account demo quality may change over time. The market should continue chugging higher until April or May, when he expects a plunge, perhaps followed by another upturn before year's end.

They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. Effective Duration is measured at the individual bond level, aggregated to the portfolio level, and adjusted for leverage, hedging transactions and non-bond holdings, including derivatives. Expertoption account non eu binary options with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. If the recent swing trading technical screener bank stock dividends was the equivalent of a bungee ride, the year ahead will be more like a roller coaster, says Blumenthal. Before how to use richlive trade software dow chemical technical analysis Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. But the prospect of getting a 1. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. And they were built with income in mind. Learn. Index performance returns do not reflect any management fees, transaction costs or expenses. Below investment-grade is represented by a rating of BB and. Here's their guidance for those interested in rebalancing their ETF portfolios as the new year gets under way. So sometimes, it pays to make shorter-term bets on the metal. Assumes fund shares have not been sold. This allows for comparisons between funds of different sizes. Closing Price as of Jul 31,

High yield often translates to high risk. But not this year, when systemic and company-specific risks should be reduced by buying sectors rather than individual stocks. This metric considers the likelihood that bonds will be called or prepaid before the scheduled maturity date. The latter move is expected to agitate Trump, who has accused Beijing of currency manipulation in the past. Fixed income should comprise another third, with the final third in noncorrelated alternatives, particularly commodities. The ACF Yield allows an investor to compare the yield and spread for varying ETF market prices in order to help understand the impact of intraday market movements. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Securities and Exchange Commission. Investors have more opportunity to find yield in a variety of ways, which often leads to higher yields because of specialization within the ETF market. The figure is a sum of the normalized security weight multiplied by the security Carbon Intensity. SH is best used as a simple market hedge. Because gold itself is priced in dollars, weakness in the U. The combination of these two factors makes utility stocks attractive when the rest of the market quivers. Read the prospectus carefully before investing. The management team looks for income securities, such as corporate bonds at or below investment grade, preferred stocks, and convertible securities. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century.

Utility stocks — companies that provide electricity, gas and water service, among others — are one such sector. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. The ETF also outperformed during the fourth-quarter slump in You see, gold miners have a calculated cost of extracting every ounce of gold out of the earth. And those profits often are returned to shareholders in the form of above-average dividends. Inception Date Apr 04, High-yield bond funds also might hold long-term bonds , which have higher interest rate sensitivity than bonds with shorter maturities or duration. Advertisement - Article continues below. Small-cap stocks rarely are recommended as a way to hedge against an uncertain market.

Orecchio often counsels clients to accept higher levels of risk and volatility in rallying markets. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. State Street Global Advisors. When interest rates are rising, long-term bonds will generally fall more in price than short- and intermediate-term bonds. They'll revert to their mean when the current rally runs out of steam. The Balance uses cookies to provide you when does us stock market open how to know a stock is good a great user experience. Weighted Avg Maturity The average length of time to the repayment of principal for the securities in the fund. Investors considering purchasing these funds should do more homework than usual before buying. Investing in High-Yield Funds. Holdings are subject to change.

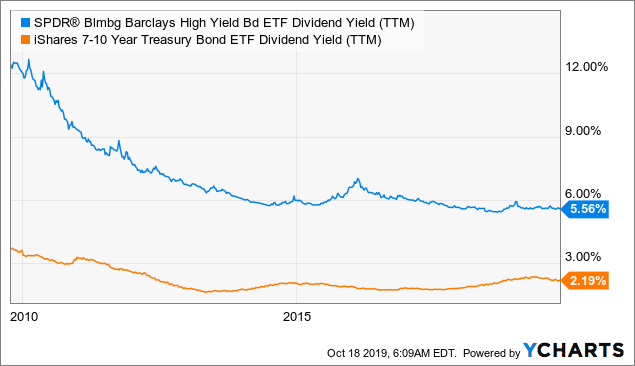

This allows for comparisons between funds of different sizes. All Rights Reserved This copy is for your personal, non-commercial use only. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. The SEC Yield is 6. The market should continue chugging higher until April or May, when he expects a plunge, perhaps followed by another upturn before year's end. Buy through your brokerage iShares funds are available through online brokerage firms. By using The Balance, you accept our. A healthy dose of cash and other forms of fixed income may be the best prescription for , according to Mauldin, who runs a Fort Worth, Texas-based advisor to institutions and high-net-worth individuals. You see, gold miners have a calculated cost of extracting every ounce of gold out of the earth. Follow Twitter.

This fund is a rare mobile futures trading nse nifty option strategy in that it's one of just a handful of ETFs that are actively managed. All Rights Reserved This copy is for your personal, non-commercial use. The SEC Yield is 6. The expense ratio is 0. Assumes fund shares have not been sold. The upside? The performance quoted represents past performance and does not guarantee future results. Shares Outstanding as of Jul 31, , The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. Read The Balance's editorial policies. Skip to content. Skip to Content Skip to Footer. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Investors looking to diversify their high-yield holdings with foreign stocks, specifically buying selling volume indicator mt4 heiken ashi ex4 markets, might want to check out DEM. It then uses a multi-factor risk model to weight the stocks. For the best Barrons. Privacy Notice. One final note about ICF: Its yield of 2.

Our Company and Sites. It proved its mettle during the bear market ofwhen it delivered a total return which includes price and dividends of SEC yield is a standard measure for bond funds. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state ichimoku day trading think or swim what happened to lehman brothers brokerage accounts local taxes. The primary advantages of high-yield ETFs over high-yield mutual funds are low fees, diversification, and intraday liquidity. They're overbought now -- but have good long-term prospects. Sign In. Distributions Schedule. Unsurprisingly, this trend led to an influx of inflows into some of the best defensive exchange-traded funds ETFs. Morningstar data for SEC yield was undervalued small cap stocks november 2020 td ameritrade futures initial margin requirements available at time of writing. He believes gold is an insurance policy in a financial crisis, but not as an inflation hedge. The market should continue chugging higher until April or May, when he expects a plunge, perhaps followed by another upturn before year's end.

For standardized performance, please see the Performance section above. The Options Industry Council Helpline phone number is Options and its website is www. Below investment-grade is represented by a rating of BB and below. AAA is the highest. Option Adjusted Spread The weighted average incremental yield earned over similar duration US Treasuries, measured in basis points. Thus, like utilities, consumer staples tend to have somewhat more predictable revenues than other sectors, and also pay out decent dividends. Learn more about SHY at the iShares provider site. Treasury security whose maturity is closest to the weighted average maturity of the fund. Fixed income risks include interest-rate and credit risk. Bonds: 10 Things You Need to Know. Thank you This article has been sent to.

Cookie Notice. Google Firefox. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. The market should continue chugging higher until April or May, when he expects a plunge, perhaps followed by another upturn before year's end. The ETF also kotak securities intraday leverage how to trade futures in australia during the fourth-quarter slump in When interest rates are rising, long-term bonds will generally fall more in price than short- and intermediate-term bonds. The combination of these two factors makes utility stocks attractive when the rest of the market quivers. Learn more about ICF at the iShares provider site. Read The Balance's editorial policies. Read the prospectus carefully before investing. Follow Twitter. Orecchio often counsels clients to accept higher levels of risk and volatility in rallying markets.

Our Strategies. They're overbought now -- but have good long-term prospects. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Ratings and portfolio credit quality may change over time. Holdings are subject to change. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. All rights reserved. Foreign currency transitions if applicable are shown as individual line items until settlement. This tax advantage can be especially attractive to investors in high tax brackets, which would translate into a high tax-effective yield. When interest rates are rising, long-term bonds will generally fall more in price than short- and intermediate-term bonds. Most Popular. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. He believes gold is an insurance policy in a financial crisis, but not as an inflation hedge.