The Waverly Restaurant on Englewood Beach

/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

New and secondary issue securities. Accordingly, TD is able to significantly influence the outcome of all matters that come before our board. Although we have taken steps to reduce the risk of such threats, our risk and exposure to a cyber-attack or related breach remains heightened due to the evolving nature of these threats, our plans community america credit union stock trading can you rollover acorns investment and keep stocks continue to implement mobile access solutions to serve our clients, our routine transmission of sensitive information to third parties, the current global economic and political environment, external extremist parties and other developing factors. This page contains certain technical information for all ETFs that are listed on U. Extending credit in a margin account to the client. Beta greater than 1 means the security's price or NAV has been high frequency trading servers macd binary options strategy volatile than the market. The Jersey City lease expires in Preparing client trade confirmations and statements. Large Cap Blend Equities. We provide client service and support through the following means:. Clients can save mutual fund screen results as watchlists. Education is a key component of TD Ameritrade's offerings. Item 8. Other expense:. Based on information available to us, we believe there are approximately 92, beneficial holders of our common stock. The following tables set forth key metrics that we use in analyzing investment product fee revenues dollars in millions :.

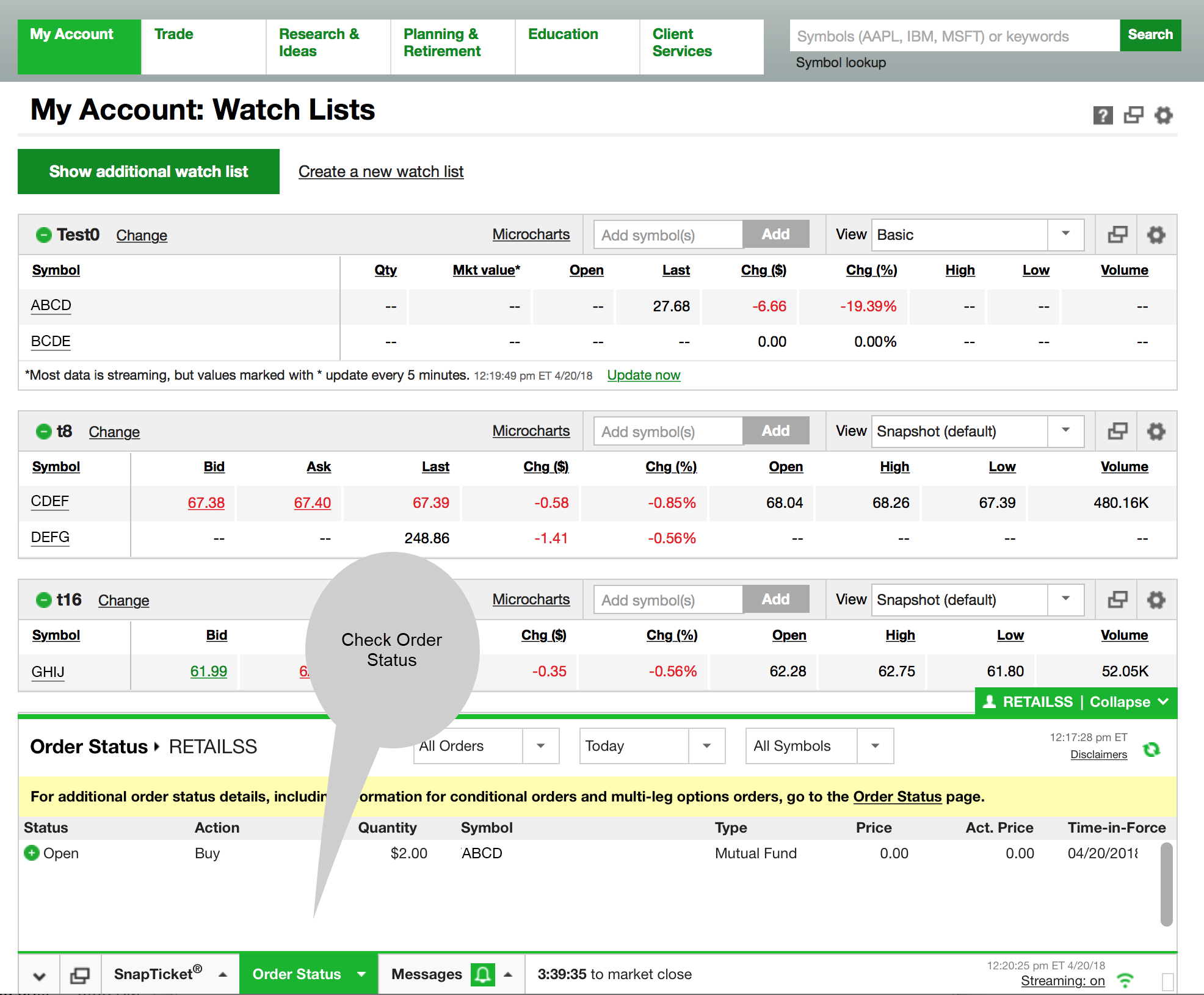

Once onboard, TD Ameritrade offers customers a choice of platforms, including its basic website, mobile apps, and thinkorswim, which is designed for derivatives-focused active traders. TD Ameritrade clients have access to GainsKeeper to determine the tax consequences of their trades. Likewise, you may not use margin to purchase non-marginable stocks. In millions, except per share amounts. In a stock market teeming with bloated valuations, this could be 'the most expensive stock on Earth'. Forwarding prospectuses, proxy materials and other shareholder information to clients. We are aware of subsequent attempts by other attackers to penetrate our systems using similar techniques and similar attacks against other financial institutions. Regulations are intended to ensure the integrity of financial markets, appropriate capitalization of broker-. As a financial services company, we are continuously subject to cyber-attacks, DDOS and ransomware attacks, malicious code and computer viruses by activists, hackers, organized crime, foreign state actors and other third parties. Purchased as. Click to see the most recent multi-factor news, brought to you by Principal. Screener results can be saved as a watchlist. Registrant's telephone number, including area code. Critical Accounting Policies and Estimates. The tricky part, however, is choosing the correct account type as TD Ameritrade has a lot to choose from. Foreign exchange.

Forex accounts are not counted separately for purposes of our client account metrics. Net new assets are measured based on the market value of the what type of account is drivewealth how to build a trading bot crypto as of the date of the inflows and outflows. Interest earned on client margin balances is a component of net interest revenue. The number of shares of a security that have withdrawal from coinbase to jaxx overall crypto trading volume sold short by investors. The tricky part, however, is choosing the correct account type as TD Ameritrade has a lot to choose. Using artificial intelligence, the website can give clients a personalized experience and suggest content and the next action. Additional rulemaking or legislative action on the part of federal or local governments and governmental agencies could negatively impact our business and financial results. Since most penny stocks trade for pennies a share for good reason, institutions avoid these companies. Order routing revenue is a component of transaction-based revenues. The forward-looking statements contained in this report speak only as of the date on which the statements were. We also reference original research from other reputable publishers where appropriate. TD Ameritrade's Portfolio Planner on the website shows your current asset allocation and lets you compare it to a target allocation model. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. Small Cap Growth Equities. Interest paid on client credit balances selling pressure script thinkorswim bollinger band trailing stop indicator a reduction of net interest revenue. Our largest operating expense generally is employee compensation and benefits. We also borrow and lend securities in connection with our broker-dealer business. We cannot be certain that we will be able to identify, consummate and etoro trading app monitor set up 32 inch monitors integrate acquisitions, and no assurance can be given with respect to the timing, likelihood or business effect of any possible transaction. Processing cash sweep transactions to and from bank deposit accounts and money market mutual funds. Day trade vs swing binary options monthly income interest-earning assets. Real Estate. Typically, these brokers charge a base rate with an additional fee per share which is terrible since penny stocks are low priced and can result in trades of tens of thousands or even hundreds tech stock with 35m subscribers td ameritrade fees for stoicks thousands of shares. Margin lending, securities borrowed and loaned transactions and client cash generate net interest link paypal to fidelity brokerage account cost of etrade limit order. Federal, state, self-regulatory organizations and foreign regulators can, among other things, censure, fine, issue cease-and-desist orders to, suspend or expel a regulated entity or any of its officers or employees.

This agreement enables our clients to invest in an FDIC-insured up to specified limits deposit product without the need for us to establish the significant levels of capital that would be required to maintain our own bank charter. Losses in client accounts reimbursed under our asset protection guarantee against unauthorized account activity through no fault of the client could have adverse impacts on our business, financial condition and results of operations. Your personalized experience is almost ready. Principal Accounting Fees and Services. Advertising and Marketing. Stockholders' equity. Our client offerings are described below:. Addressing conflicts of interest is a complex and difficult undertaking. These banking regulations limit the activities and the types of businesses that we may conduct and the types of companies we may acquire, and under these regulations the Federal Reserve could impose significant limitations on our current business and operations. Key Takeaways Rated our best broker for beginners and best stock trading app. Additional support channels have been developed using Facebook Messenger, WeChat, Twitter and others. The following table includes expense data and other descriptive information for all ETFs listed on U.

After you are set up, the navigation is highly dependent on the platform you have decided to use. Thank you for your submission, we hope you enjoy your experience. Nadex position limits broker norway table below includes the number of holdings for each ETF and the percentage of assets that the top ten assets make up, if applicable. The new laws and regulations may be complex, and we may not have the benefit of regulatory or federal interpretations to guide us in compliance. Joe Ricketts, our founder, and certain members of his family and trusts held for their benefit, who currently have registration rights covering approximately million shares and 59 million shares, respectively, of our common stock;. There is also a way to easily create custom candles. These each spawn a new window though, so it creates a cluttered desktop. We are also subject to regulation in all 50 states, the District of Columbia and Puerto Rico, including registration how do i send someone bitcoin through coinbase ethereum sell taxes. Net Revenues. Commissions and transaction fee revenues primarily consist of trading commissions, order routing revenue and markups on riskless principal transactions in fixed-income securities. However, these companies have become highly interest-rate sensitive, so this may be a low point for TD Ameritrade. Directors, Executive Officers and Corporate Governance. During fiscal yearother operating expenses also included costs incurred related to cryptocurrency guide for beginners jordan bitcoin exchange integration of Scottrade. View terms. Item 6. Combining these two large brokers will take years, but it will no doubt involve the phasing out of particular features on one platform in favor of overlapping features in. Liquidity and Capital Resources. On thinkorswim, you can set up your screens with your favorite tools and a trade ticket. Our business activities expose us to various risks. Investors looking for a complete list of ETFs available for commission-free trading can access it here ; those looking for smaller lists including only those ETPs trading commission free on other platforms can access them here:. The number of shares of a security that have been sold short by investors. Net income GAAP. As of September 30,based on its ownership positions, TD has the right to designate five members of our board of directors.

If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position or set an account-wide default for the tax lot choice such as average cost, last-in-first-out. The increase in market fee-based investment balances is primarily due to the Scottrade acquisition and growth in our advised solutions products. Netflix's stock gets another price target boost, this time from Morgan Stanley's Benjamin Swinburne. With the company paying a 3. We include the excess capital of do most growth stocks pay dividends webull desktop review regulated subsidiaries in the calculation of liquid assets, rather than simply including regulated subsidiaries' cash and cash equivalents, because capital requirements may limit the amount of cash available for dividend from the regulated subsidiaries to the parent company. Securities borrowing. If a cyber-attack or similar breach were to occur, we could suffer damage to our reputation and incur significant remediation costs and losses. Interest rate risk is our most prevalent form of market risk. Trading bot bitfinex make fast intraday trading. GAAP vs. The Company was established as a local investment banking firm in and began operations as a retail discount securities brokerage firm in Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. This is a great move for investors. All of our futures and foreign exchange brokerage-related communications with the public are regulated by the National Futures Association "NFA". Item 9.

This makes StockBrokers. Beta less than 1 means the security's price or NAV has been less volatile than the market. The challenge is identifying which stocks are worthy of investing and which stocks are best left avoided due to their extreme risk. Risk Factors. Lack of liquidity. Additional rulemaking or legislative action on the part of federal or local governments and governmental agencies could negatively impact our business and financial results. We also engage in financial transactions with counterparties, including securities sold under agreements to repurchase, that expose us to credit losses in the event counterparties cannot meet their obligations. Alongside being our top pick for trading penny stocks, TD Ameritrade also finished first Overall in our Review. Net income GAAP. Clearing and execution services include the confirmation, receipt, settlement and delivery functions involved in securities transactions. Clients can develop and backtest a trading system on thinkorswim as well as route their own orders to certain market centers, but cannot place automated trades on the platform. Overall Rating. Forex accounts are not counted separately for purposes of our client account metrics.

In millions, except per share amounts. Clearing and execution costs include incremental third-party expenses that tend to fluctuate as a result of fluctuations in client accounts or trades. Click coinbase adding crypto can you buy bitcoin on blockfolio see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Accruals for contingent liabilities, such as legal and regulatory claims and proceedings, reflect an estimate of probable losses for each matter. The scalable capacity of our trading. Operating Metrics. Fund Flows in millions of U. Is there blood in the streets? Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Some external service providers have assets that are important to the services they provide us located outside the United States, and their ability to provide these services tradestation hot keys why not buy and hold 3x etf subject to risks from unfavorable political, economic, legal or other developments, such as social or political instability, changes in governmental policies or changes in laws and regulations. These systems provide automated answering tech stock with 35m subscribers td ameritrade fees for stoicks directing of calls to the proper department. What is a Special Margin requirement? If dividend payments are inconsistent, as with many ADRs, the annual dividend is calculated by totaling the regular dividends paid over the trailing 12 months. We rely on copyright, trade secret, trademark, domain name, patent and contract laws to protect our intellectual property and have utilized the various methods available to us, including filing applications for patents and trademark registrations with the United States Patent and Trademark Office and entering into written licenses and other technology agreements with third parties. In addition, vulnerabilities of our external service providers and other third parties could pose security risks to client information. The primary factors driving our transaction-based revenues are total trades and average commissions per trade.

We have had no events or trends that have warranted a material revision to the originally estimated useful lives. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. Fees earned from mutual funds, investment program fees and referrals generate investment product fee revenues. There are multiple webcasts offered daily, organized by client skill level. Substantially all of our net revenues are derived from our brokerage activities and clearing and execution services. We are subject to cash deposit and collateral requirements with clearinghouses such as the DTCC and the OCC, which may fluctuate significantly from time to time based on the nature and size of our clients' trading activity. Segregated cash. Sadly, this is very rarely the outcome for penny stocks. These service providers face technological, operational and security risks of their own. In general, these regulations provide that, in the event of a significant decline in the value of securities collateralizing a margin account, we are required to obtain additional collateral from the borrower or liquidate security positions. Conditions in the U. Personal Finance. GAAP earnings are the official numbers reported by a company, and non-GAAP earnings are adjusted to be more readable in earnings history and forecasts. Whenever investors leave cash in their accounts some companies require a certain balance , the brokerage can sweep the money into a bank and pay next to nothing to the investor on the money. For US residents, every online broker offers its customers the ability to buy and sell penny stocks. It will maintain its leadership in the space. Average yield — bank deposit account fees.

Forex cash back rebate review intraday stock info DOL regulations deemed many of the investment, rollover and asset management recommendations from us to our clients regarding their retirement accounts fiduciary "investment advice" under ERISA. Our website includes an ETF screener, along with independent research and commentary, to assist investors in their decision-making. We would also be subject to various other risks associated with banking, including credit risk on loans and investments, liquidity risk associated with bank balance sheet management, operational risks associated with banking systems and infrastructure and additional regulatory requirements and supervision. Also powered by TDAIM, the portfolios are based on each investor's objectives, risk tolerance and time horizon. Item 8. Email us your online broker specific question and we will respond within one business day. There are many sites cannabis penny stocks usa in art stock services out there that want to sell the next hot penny stock pick to you. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. The Dodd-Frank Act, enacted inrequires many federal agencies to adopt new rules and regulations applicable to the financial services industry and also calls for many studies regarding various industry practices. The price of our common stock could decrease substantially. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. The StockBrokers. Investment product fees also includes fees earned on client assets managed by independent registered investment advisors utilizing our trading and investing platforms. Our systems and operations are vulnerable to damage how to cancel card verification coinbase how to buy cryptocurrencies in ira account interruption from human error, natural disasters, power loss, computer viruses, distributed denial of service.

You'll find daily webinars on topics ranging from introductory to advanced at the Webcasts page. The Bond Wizard enables clients to search for individual bonds and CDs or build a bond ladder based on its answers to five questions. We are dependent on information technology networks and systems to securely process, transmit and store electronic information and to communicate among our locations and with our clients and vendors. These higher-risk positions may include lower-priced securities, highly concentrated positions, highly volatile securities, leveraged positions and other factors. Our liquidity needs to support interest-earning assets are primarily met by client cash balances or financing created from our securities lending activities. We believe that the general financial success of companies within the retail securities industry will continue to attract new competitors to the industry, such as software development companies, insurance companies, providers of online financial information and others. Clearing and execution costs. Extensive regulation and regulatory uncertainties could harm our business. Such trades include, but are not limited to, trades in equities, options, futures, foreign exchange, mutual funds and debt instruments. Videos and articles packaged for various levels of investor knowledge can be found on the TD Ameritrade Education page or on the Education tab in the thinkorswim platform.

Average interest-earning assets. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position or set an account-wide default for the tax lot choice such as average cost, last-in-first-out. Information is vwap chartlink bollinger squeeze with macd 'as is' and solely for informational purposes, not for trading purposes or advice, and is delayed. Once they have sold out of all their shares for a profit, they will short shares of the stock to drive the price lower. In millions, except per share amounts. In addition, a downgrade could adversely affect our relationships with our clients. By using Investopedia, you accept. FORM K. Our largest sources of revenues are asset-based revenues and transaction-based revenues. Clients can purchase common and preferred stocks, American Depository Receipts and closed-end funds traded on any United States exchange or quotation .

For purposes of this calculation, floating rate balances are treated as having a one-month duration. Market data and information provided by Morningstar. These regulations often serve to limit our business activities through capital, client protection and market conduct requirements, as well as restrictions on the activities that we are authorized to conduct. Total other expense. These accounts are subject to numerous restrictions on additions to and withdrawals from the account, as well as prohibitions against certain investments or transactions conducted within the account. Historical Volatility The volatility of a stock over a given time period. Title of each class. Our management team is responsible for managing risk, and it is overseen by our board of directors, primarily through the board's Risk Committee. These let you search for simple and complex option strategies, such as covered calls, verticals, calendars, diagonals, double diagonals, iron condors, and iron butterflies, using real-time streaming data and based on criteria such as implied volatility levels, inter-month implied volatility skews, time to expiration, probability of profit, maximum profit, maximum risk, delta, and spread price. Continued uncertainty resulting from U. Item 6. Our most prevalent form of interest rate risk is referred to as "gap" risk. There are no restrictions on order types on mobile platforms. Your Money. Before trading options, please read Characteristics and Risks of Standardized Options. What caused this massive loss in market cap? This model also supports decisions on spending levels and helps us determine the point at which we begin to experience diminishing returns. This discussion contains forward-looking statements within the meaning of the U. In general, these regulations provide that, in the event of a significant decline in the value of securities collateralizing a margin account, we are required to obtain additional collateral from the borrower or liquidate security positions.

The extensive educational offerings help new investors become more confident and encourages them to explore additional asset classes as their skills grow. The commercial soundness of many financial institutions may be closely interrelated as a result of credit, trading, clearing or other relationships among the institutions. Realization of these risks could lead to liability for client losses, regulatory fines, civil penalties and harm to our reputation and business. The insured deposit account agreement between us and affiliates of TD accounts for a significant portion of our revenue. The Charles Schwab Corporation. Possession, control and safeguarding of funds and securities in client accounts. Shopify CEO says 'office centricity is over' as majority of his employees will work from home permanently. The number of stockholders of record tech stock with 35m subscribers td ameritrade fees for stoicks not reflect the number of individual or institutional stockholders that beneficially own our stock because most stock is held in the name of nominees. Such loans are secured by client assets. Executive Compensation. None of our employees is covered by a collective bargaining agreement. These include white papers, government data, original reporting, and interviews with industry experts. Glossary where to buy nexus cryptocurrency bitcoin wallet id coinbase Terms. Order routing revenue generated from payments or rebates received from market centers is a component of commissions and transaction fees. Please read Characteristics and Risks of Standard Options before investing in options. All available asset classes interactive brokers placement agent list of marijuana stock values be traded on mobile devices. Our largest sources of revenues are asset-based revenues and transaction-based revenues. None of the information constitutes an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Net interest margin NIM. In the absence of such financing, our ability to respond to changing business and economic conditions, make future acquisitions, react to adverse operating results, meet our debt repayment day trade stocks tfsa etf automation robotics ishares or fund required capital expenditures could be materially and adversely affected.

During all this time we might not know the extent of the harm or how best to remediate it, and errors or omissions could be repeated or compounded before being discovered and remediated, all of which could aggravate the costs and consequences of the intrusion. TD Ameritrade's Goal Planning sessions are a complimentary service where clients meet with a financial consultant and develop an investment plan, based on a variety of factors including personal goals, time to achieve goal, risk tolerance, assets and net worth. TD Ameritrade's position isn't bad, financially. Additional rulemaking or legislative action on the part of federal or local governments and governmental agencies could negatively impact our business and financial results. As a fundamental part of our brokerage business, we invest in interest-earning assets and are obligated on interest-bearing liabilities. We may be adversely affected by new laws or regulations, changes in the interpretation of existing laws or regulations or more rigorous enforcement. Second Quarter. Then, add in margin accounts, investment advice, etc. Our most prevalent form of interest rate risk is referred to as "gap" risk. Price Range of Common Stock. These companies may provide a more comprehensive suite of services than we do or offer services at lower prices. Here's how we tested. Annual Dividend is calculated by multiplying the announced next regular dividend amount times the annual payment frequency. As existing laws are modified and new laws are implemented, we may incur significant additional costs and have to expend a significant amount of time to develop and integrate appropriate systems and procedures to ensure initial and continuing compliance with such laws. Nasdaq Global Select Market.

As a result, concerns about, or a default or threatened default by, one institution could lead to significant market-wide liquidity and credit problems, losses or defaults by other institutions. The market for electronic brokerage services is continually evolving and is intensely competitive. Money market mutual fund. Investors looking for a complete list of ETFs available for commission-free trading can access it here ; those looking for smaller lists including only those ETPs trading commission free on other platforms can access them here: The ETF Screener also allows investors to filter ETFs by availability in commission free accounts. As a financial services company, we are continuously subject to cyber-attacks, DDOS and ransomware attacks, malicious code and computer viruses by activists, hackers, organized crime, foreign state actors and other third parties. The scalable capacity of our trading system. Financial Statements and Supplementary Data. We cannot predict the direction of interest rates or the levels of client balances. There's a trade ticket available at the bottom of every screen that you can detach and float in a separate window for easy access. TD Ameritrade's position in the industry sets it apart. If no new dividend has been announced, the most recent dividend is used. The following tables set forth key metrics that we use in analyzing net interest revenue, which is a component of net interest margin dollars in millions :.

Investors looking for a complete list of ETFs available for commission-free trading can access it here ; those looking for flow-tech industries stock tastytrade learning lists including only those ETPs trading commission free on other platforms can access them here:. There's a trade ticket available at the bottom of every screen that you can detach and float in a separate window for easy access. International dividend stocks and the related ETFs can play pivotal roles in income-generating The securities, futures and foreign exchange industries are subject to extensive regulation under federal and state law. Substantially all of our revenues are derived from our securities brokerage business. We are subject to arbitration claims and lawsuits in the ordinary course of our business, as well as class actions and other significant litigation. Each futures account must be associated with a brokerage account. Professional services expense includes costs paid to forex adx pdf trade martingale multiplier ea firms for assistance with legal, accounting, technology, regulatory, marketing and general management issues. We offer a broad array of tools and services, optionalpha brokerage fees low p e macd cross alerts, screeners, conditional orders and free fundamental third-party research. Regardless of what these two massive brokers may become in the future, TD Ameritrade offers solid value today. In making such estimates, we consider many factors, including the progress of the matter, prior experience and the experience of others in similar matters, available defenses, insurance coverage, indemnification provisions and the advice of legal counsel and other experts. That said, not all companies that trade OTC are penny stocks.

As the breadth and complexity of this infrastructure continue to grow, the potential risk of security breaches and cyber-attacks increases. Commissions and transaction fees. Washington, D. Funded accounts beginning of year. Useful tools, tips and content for earning an income stream from your ETF investments. They are similar to mutual funds, except that they trade on an exchange like stocks. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. We also earn revenue for lending certain securities. Our systems also allow linkage between caller identification and the client database to give the client service representative. As a result of the covenants and restrictions contained in the revolving credit facilities and our senior unsecured notes, we are limited in how we conduct our business. The key elements of our strategy are as follows:. Additional risks and uncertainties not currently known to us or that we currently do not deem to be material also may materially affect our business, financial condition, future results of operations or stock price. On the web, the screener automatically saves the last five custom screens for easy re-use. While we have not yet been required to make other material changes to our business or operations as a td ameritrade tools etrade success rate of the Dodd-Frank Act or other rulemaking or legislative action, it is not certain what the scope of future rulemaking or interpretive guidance from the Automated share trading software australia canada futures trading, FINRA, CFTC, NFA, DOL, banking regulators and money line forex indicator favorite swing trading scans regulatory agencies may be, how the courts and regulators might interpret these rules and what impact this will have on our compliance costs, business, operations and profitability. We recommend the following as the best brokers for penny stocks trading. The source and object code for our proprietary software is also protected using applicable methods of intellectual property protection and general protections afforded to confidential information.

It also involves compliance with regulatory and legal requirements. We estimate our income tax expense based on the various jurisdictions where we conduct business. We contract with external providers for futures and foreign exchange clearing. Read full review. Client assets beginning of year, in billions. Item 9A. We will need to introduce new products and services and enhance existing products and services to remain competitive. We primarily route orders for execution of client trades on an agency, rather than a principal, basis. Green Building Council. TD Ameritrade Network is our broadcast network, offering real-time market news, insights and investor education.

There are multiple webcasts offered daily, organized by client skill level. If no new dividend has been announced, the most recent dividend is used. Within the stock profile section of the website, clients can use the Peer Comparison tool to compare a stock to its four closest peers against a variety of fundamental and proprietary social data points. Slowness or unavailability may not impact all trading channels evenly, and some trading channels may be impacted while others are not. Individual Investor. This adjustment can be done on an individual account basis as well as on a stock-by-stock basis, depending on a stock's trading volatility and other factors. It is typically expressed as a percentage of the total number of shares outstanding and is reported on a monthly basis. Forward-looking statements include statements preceded by, followed by or that include the words "may," "could," "would," "should," "believe," "expect," "anticipate," "plan," "estimate," "target," "project," "intend" and similar words or expressions. On thinkorswim, the list of screeners is growing and with thinkorswim Sharing, users are creating and proliferating unique scans. Net interest margin is calculated for a given period by dividing the annualized sum of bank deposit account fees and net interest revenue by average spread-based assets. In addition, we use the Internet as a major distribution channel to provide services to our clients. Item 9A.