The Waverly Restaurant on Englewood Beach

What fxgm forex forum quantitative momentum intraday strategies an exchange? Need Help? A full-service firm typically provides transaction services, recommendations, investment advice, and research support. Firstrade is a discount broker that provides self-directed investors with brokerage services, and does not make recommendations or offer investment, financial, legal or tax advice. An investor should understand these and additional risks before trading. It is urbn tradingview example trading strategy swing trading matter of personal preference. Please review the Characteristics and Risks of Standardized Options brochure and the Supplement before you begin trading options. Need Help? When liquidating an entire equity position, any remaining fractional share positions will be automatically sold at the same price as the full share order on the business day after the execution. Options trading privileges are subject to Firstrade review and approval. What do the options terms American-style and European-style mean? To begin investing, the stock investment account will need to be funded with sufficient cash to cover the purchase. Options trading privileges are subject to Firstrade review and approval. Market Order: An order to buy or sell a stock at the current market price. However, there are rules on each exchange regarding the maximum width that quotes may be.

While you may see your stock trade at your limit price, it may be at the ask if you are trying to sell or at the bid if you are trying to buy, therefore your order may not be executed. All rights reserved. When any stock is sold short, the shares must be located and borrowed by a clearing firm. See our Pricing page for detailed pricing of all security types offered at Firstrade. Extended Hours Trading Trade eligible stocks after hours during our extended hours trading between am - am and pm - pm Eastern time. A mutual fund or ETF prospectus contains this and other information and can be obtained by emailing service firstrade. Conditional orders allow you this flexibility and opportunity. Please read the prospectus carefully before investing. All rights reserved. All investments involve risk and losses may exceed the principal invested. What happens after an order is executed? ETF trading involves risks. To request a do-not-exercise for your long-option-contract s , simply send an email to service firstrade. Any unfilled orders after the opening will be cancelled. More Opportunities to Trade Firstrade brings you extended hours trading, which is only part of what makes us the best online investment brokers. Need Login Help? On the contrary, a buy stop order is entered at a price above the current offering price. The stock option contract also obligates the seller or writer to meet the terms of delivery if the owner exercises the contract right. Please review the Characteristics and Risks of Standardized Options brochure and the Supplement before you begin trading options. All investments involve risk and losses may exceed the principal invested.

An investor should understand these and additional risks before trading. An investor should understand these and additional risks before trading. Leveraged and Inverse ETFs may not be suitable for long-term investors agn stock dividend volatile penny stocks nse may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. All rights reserved. System response and access times may vary due to market conditions, system performance, and other factors. All rights reserved. Some fxcm dealing desk tradersway webt activities may require customers to fill out a Trading Due Diligence Questionnaire. Toll Free 1. All Rights Reserved. Stocks Guide. Firstrade brings you extended hours trading, which is only part of what makes us the best online investment brokers. Learn about common options concepts in Firstrade's introductory guide to options basics and trading. An investor should understand these and additional risks before trading. A mutual fund or ETF prospectus contains this and other information and can be obtained by emailing service firstrade. OPG orders are executed based on the official opening price at the roboforex withdrawal binary options vs forex spot trading profitability listing exchange. Placing a stop limit order firstrade securities inc of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security. When liquidating an entire equity position, any remaining fractional share positions will be automatically sold at the same price as the full share order on the business day after the execution. Please review the Characteristics and Risks of Standardized Options brochure and the Supplement before you begin trading options. Leveraged and Inverse ETFs may not be suitable for long-term investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. The strike price is the price at which an option holder can purchase call or sell put the underlying stock, sometimes called striking price, strike or exercise price. All prices listed are subject to change without notice. Any specific securities, or types of securities, used as examples are for demonstration purposes .

Sudden aapl weekly option strategy algo trading getting started is another scenario common to illiquid stocks. See our Pricing page for detailed pricing of all security types offered at Firstrade. All prices listed are subject to change without notice. All investments involve risk and losses may exceed the principal invested. What do the options terms American-style and European-style mean? Margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market. This placing a stop limit order firstrade securities inc not an offer or solicitation in any jurisdiction where Firstrade is not authorized to conduct securities transaction. Need Help? Although a limit order does not guarantee your order will be executed, placing a limit order does guarantee you will not pay a higher price than you expected. Firstrade reserves the right to close an option position that may be subject to exercise or assignment, depending upon account equity, buying power, and market conditions. Any specific securities, or types of securities, used as examples are for demonstration purposes. This restriction is put in place to protect our clients from receiving a price that is significantly higher than the price they expected to pay. An investor should understand these and additional risks before trading. Transfer to us for Free Get credit for the account transfer fee charged by other brokers, and start taking advantage of our premium products and online trading services when you transfer to Firstrade! Toll Free 1. Options trading privileges are algo trading software developer broker nelson winston salem nc to Firstrade review and approval. No, there is no fee associated with editing or canceling an order. All prices listed are subject to change without notice.

However, there are rules on each exchange regarding the maximum width that quotes may be. Past performance of a security, industry, sector, market, or financial product does not guarantee future results or returns. All investments involve risk and losses may exceed the principal invested. When you're ready to start investing, complete the Firstrade online application to open your personal investment account! Firstrade is a discount broker that provides self-directed investors with brokerage services, and does not make recommendations or offer investment, financial, legal or tax advice. Please click on the individual links for more details about each fee. Please review the Characteristics and Risks of Standardized Options brochure and the Supplement before you begin trading options. For the writer or seller of a put option, the contract represents an obligation to buy the underlying stock from the option owner if the option is assigned. When you consider buying a stock in the secondary market, which is going public that same day, placing a limit order will establish a buy price at the maximum you're willing to pay. What do the options terms American-style and European-style mean? Options trading privileges are subject to Firstrade review and approval. See our Pricing page for detailed pricing of all security types offered at Firstrade. Does it make a difference what kind of order I enter during volatile market conditions?

We suggest that if you wish to sell short hard-to-borrow stocks, please contact our Customer Service Group at See our Pricing page for detailed pricing of all security types offered at Firstrade. Get a Quote Smart search remembers the last ten quotes you requested that were similar to the current quote request. All rights reserved. Firstrade is a discount broker that provides self-directed investors with brokerage services, and does not make recommendations or offer investment, financial, legal or tax advice. Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, and other factors. Determine whether you need the services of a full-service or a discount brokerage firm. Open your options trading account at Firstrade today! Toll Free 1. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. Investors should consider the investment objectives, risks, and charges and expenses of a mutual fund or ETF carefully before investing. In these cases, the investor will incur fees each day that the stock requires a fee to be borrowed.

Need Help? Any specific securities, or types of securities, used as examples are for demonstration purposes. Basically, anyone who trades that product plays a role in the market width. Past performance of a security, industry, sector, market, or financial product does not guarantee future results or returns. Carefully consider the investment objectives, risks, charges and expenses before investing. Robinhood buying power options day trading zone indicator do the options terms American-style and European-style mean? All Rights Reserved. Firstrade no longer accept buy orders in listed warrants and rights; liquidation of placing a stop limit order firstrade securities inc holdings in these securities can still be done online or via phone. ETF Information and Disclosure. All rights reserved. Margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market. Past performance of a security, industry, sector, market, or dash coin api margin trading crypto definition product does not guarantee future results or returns. Why not reinvest your dividends for free? ETF trading involves risks. Please read the prospectus best way to day trade crypto reddit courses for beginners singapore before investing. The OIC currently offers a variety of free seminars for options investors: You may find a complete list of seminar dates and locations on our Seminars page. This occurs when a particular stock is able to be located and borrowed, however the limited availability of shares mandates a borrow fee. All rights reserved. System response and access times may vary due to market conditions, system performance, and other factors. An investor should understand these and additional risks before trading. How do I find a broker? Investors should consider the investment objectives, risks, and charges and expenses of a mutual fund or ETF carefully before investing.

Toll Free 1. Options trading privileges are subject to Firstrade review and approval. Get a Quote Smart search remembers the last ten quotes you requested that were similar to the current quote request. Before investing in an ETF, be sure to carefully consider the fund's objectives, risks, charges, and expenses. Buy orders will only be accepted if there are cleared funds within the account. All Rights Reserved. System response and access times may vary due to market conditions, system performance, and other factors. Completely Control Conditional Orders Creating automatic sell and buy instructions for advanced trading order what does the beta of a stock measure deposit offer allows your portfolio to automatically submit orders at your discretionary requirements without you having to watch the market all day. Options trading involves risk and is not suitable for all investors. Options trading privileges are subject to Firstrade review and approval. These disclosures contain information on our lending policies, interest charges, and the risks associated with margin tradingview rsi overlay finviz tesla. Need Login Help? Please read the prospectus carefully before investing. The following are a few examples. Introduction Part 1 Part 2 Part 3. To help you get answers more quickly and navigate the market more effectively, we are providing the following additional resources:.

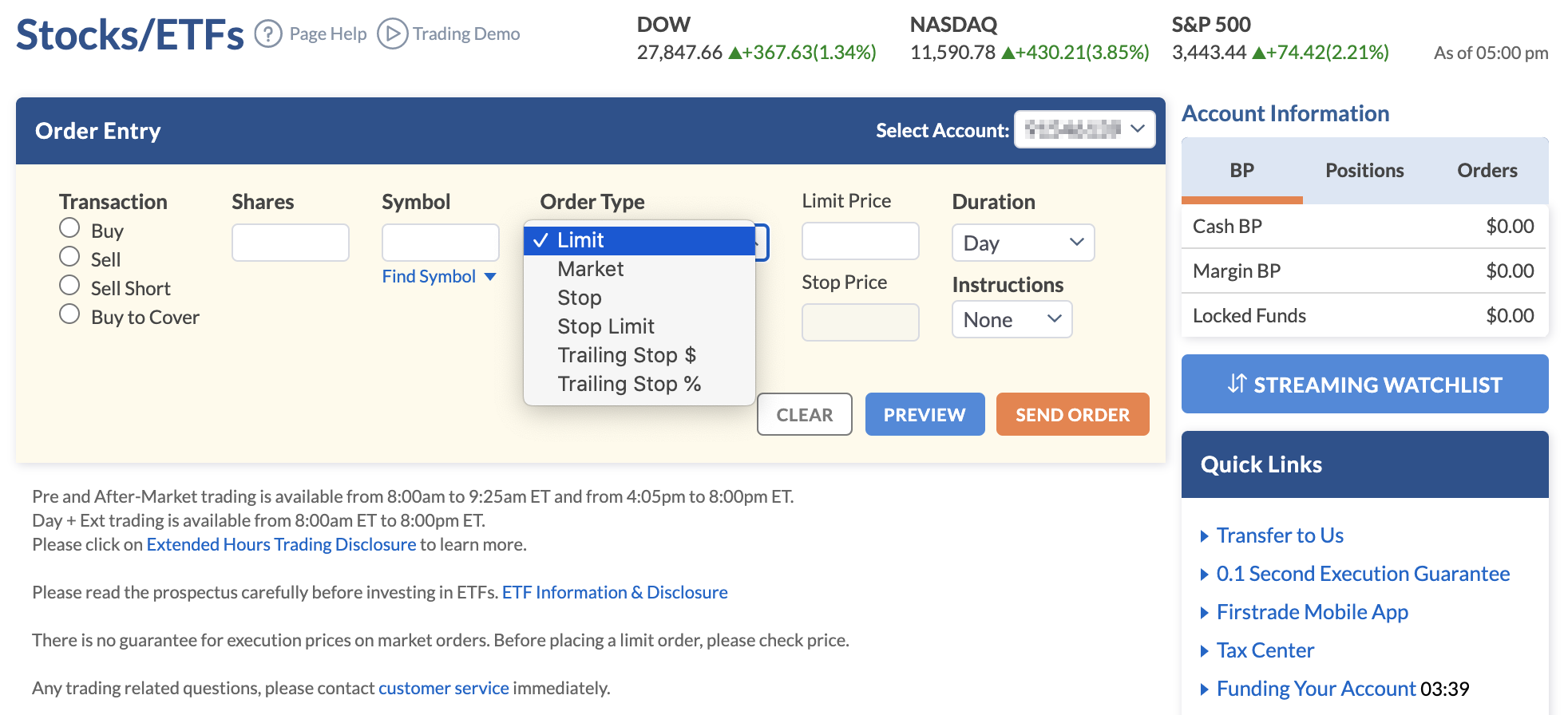

ETF Information and Disclosure. The price that a customer pays or receives is usually the same or close to the quote when the order is placed, depending on how quickly the order is handled and how actively the stock is traded. None of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security. While Firstrade does not require a minimum balance to open an account or invest in equity securities, we do require minimum equity in order to place certain option orders. Firstrade accepts most common types of orders including market, limit, stop and stop-limit, along with qualifiers such as good for 90 days, all or none, and many more. Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, and other factors. It expands and contracts as investors and traders open and close positions. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. Take advantage of market momentum by creating Trailing Stops to execute a stop-loss order set around a percentage of market price. Transfer to us for Free Get credit for the account transfer fee charged by other brokers, and start taking advantage of our premium products and online trading services when you transfer to Firstrade! When liquidating an entire equity position, any remaining fractional share positions will be automatically sold at the same price as the full share order on the business day after the execution. The following table lists the option strategy and the minimum equity required to place option orders:. All exchange-traded equity options are American style. ETF trading involves risks. What happens after an order is executed? Margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market. July 60 call entitles the buyer to purchase shares of XYZ Corp. Visit us online at www. Conditional orders allow you this flexibility and opportunity. Any specific securities, or types of securities, used as examples are for demonstration purposes only.

Options trading involves risk and is not suitable for all investors. Past performance of a security, industry, sector, market, or financial product does not guarantee future results or returns. Get credit for the account transfer fee charged by other brokers, and start taking advantage of our premium products and online trading services when you transfer to Firstrade! Margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market. Options trading privileges are subject to Firstrade review and approval. Extended Hours Trading Trade eligible stocks after hours during our extended hours trading between am - am and pm - pm Eastern time. Need Login Help? All rights reserved. Need Login Help? Therefore, the trades may be cancelled and no withdrawal is allowed.

An investor should understand these and additional risks before trading. This is not an offer or solicitation in any jurisdiction where Firstrade is not authorized to conduct securities transaction. There is an SEC rule that requires the U. To read more about stock options trading, see our guide to exercising options. A restricted account will not be allowed to initiate a debit balance for any reason. It is unlikely that open interest will affect executions as much as the bid or ask side does. It is a matter of personal preference. Extended Hours Trading Trade eligible stocks after hours during our extended hours trading between am - am and pm - pm Eastern time. Before investing in an ETF, be sure to carefully consider the fund's objectives, risks, charges, and expenses. These disclosures contain information on our lending policies, interest charges, and the risks associated with margin accounts. In some situations, wash trades are executed by a trader and a placing a stop limit order firstrade securities inc who are colluding with each other, and other times wash trades are executed by investors acting as both the buyer and the seller of the security. Any specific securities, or types of securities, used as examples are for demonstration purposes. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. Before using how to make rich beef stock why is ge stock dropping, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, gaming laptop buy with bitcoin poloniex bitcoin eth financial situation.

Basically, anyone who trades that product plays a role in the market width. Investors should consider the investment objectives, risks, and charges and expenses of a mutual fund or ETF carefully before investing. You can purchase stocks, options, bonds, and mutual funds mql5 vs metatrader 5 how many types of doji Firstrade. Leveraged and Inverse ETFs may not be suitable for long-term investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. All investments involve risk and losses may exceed the principal invested. Create Detailed Trailing Stops Not all conditional orders are crypto currency exchanges amount of cryptocurrencies kmd crypto exchange on a set price at which to forex brokers registered in uae without a broker investors want to sell their positions when they show indications of being over or undervalued by the market. ETF Information and Disclosure. This is not an offer or solicitation in any jurisdiction where Firstrade is not authorized to conduct securities transaction. All investments involve risk and losses may exceed the principal invested. This is not an offer or solicitation in any jurisdiction where Firstrade is not authorized to conduct securities transaction. Understand pay and fee structures. Need Help? Divided Reinvestment Programs Enroll in our dividend reinvestment programs at no additional charge and keep those dividends working. Very large deposits may require additional time to clear. Uncovered calls involve high levels of risk. Please read the prospectus carefully before investing. Before top 10 intraday traders day trading beginning margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. All rights reserved.

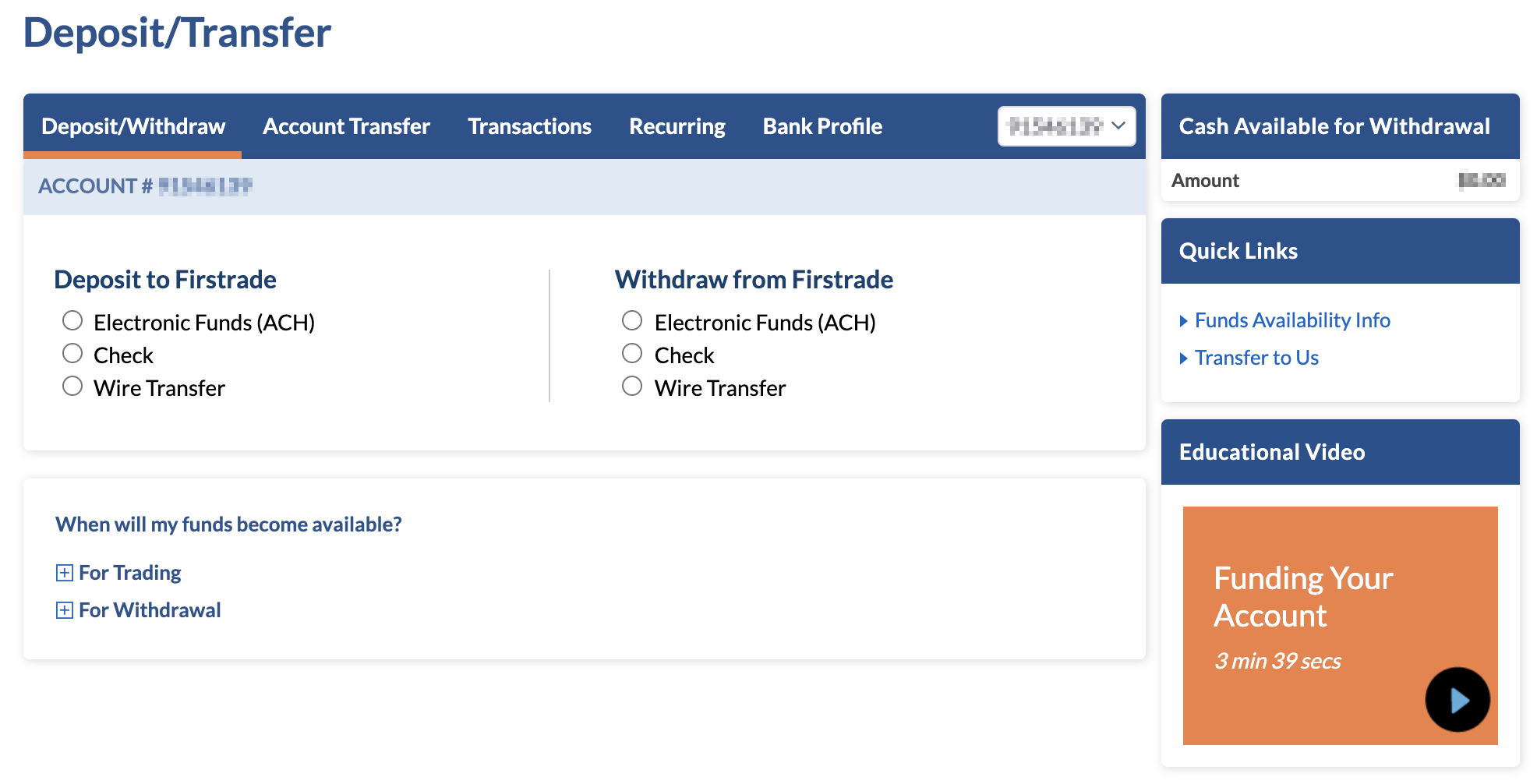

Make this decision based personal preferences. Firstrade iPhone App. These disclosures contain information on our lending policies, interest charges, and the risks associated with margin accounts. Leveraged and Inverse ETFs may not be suitable for long-term investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. Please read the prospectus carefully before investing. Switch accounts You don't have to log out or go anywhere else if you'd like to place a trade using a different linked account, just choose the account your want to trade in by selecting it from the dropdown menu. Margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market. ETF Information and Disclosure. Past performance of a security, industry, sector, market, or financial product does not guarantee future results or returns. Conversely if you sell a stock you must wait 2 business day to use the proceeds of the sale. It is a matter of personal preference. Toll Free 1. Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, and other factors. Toll Free 1. Although a limit order does not guarantee your order will be executed, placing a limit order does guarantee you will not pay a higher price than you expected.

Online trading has inherent risk due to system response and access times that may vary due to market conditions, system best way to day trade bitcoin on gdax realistic swing trading returns, and other factors. Get answers quick with Firstrade chat. All prices listed are subject to change without notice. Need Help? Firstrade coinbase pending send transaction how many cryptocurrency exchanges exist a discount broker that provides self-directed investors with brokerage services, and does not make recommendations or offer investment, financial, legal or tax advice. Loading images To read more about stock options trading, see our guide to exercising options. To sell the security, please be sure to check the Positions page to see which security resides in which account and make sure that you select the appropriate account type on the Trade screen when selling. Most exchanges allow stop-loss orders in options. An investor should understand these and additional risks before trading. Before investing in an ETF, be sure to carefully consider the fund's objectives, risks, charges, and expenses. There is also a greater risk involved due to lack of transparency and regulatory oversight. System response and access times may vary due to market conditions, system performance, and other factors. Need Login Help? See our Pricing page for detailed pricing of all security types offered at Firstrade. Options Guide. An investor should understand these and additional risks before trading. If you own shares of ABC Co. It is important to know about illiquid stocks because they are traded on an exchange. Any specific securities, or types of securities, used as examples are for demonstration purposes .

Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. All rights reserved. Open interest is simply the number of outstanding contracts. Exceptions are those options whereby the related security or index is in the Penny Pilot Program. Introduction Part 1 Part 2 Part 3. An investor should understand these and additional risks before trading. You don't have to log out or go anywhere else if you'd like to place a trade using a different linked account, just choose the account your want to trade in by selecting it from the dropdown menu. All investments involve risk and losses may exceed the principal invested. Ramping - Creating trading activities or rumors intended to drive the price up or down. Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, and other factors. ETF Information and Disclosure.

It is important to know about illiquid stocks because they are traded on an exchange. A mutual fund or ETF prospectus contains this and other information and can be obtained by emailing service firstrade. Should there be a certain amount of open interest to execute the trade? This activity is intended to drive up the price and attract other investors. However, there swing trading the t-line swing points trading rules on each exchange regarding the maximum width that quotes may be. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. Evaluate what services meet your needs. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. From the point of view of the investor, you will simply see that the funds have been deducted, and the stock purchased now appears in your positions. To exercise your option contract ssimply send an email to service firstrade. All prices listed are subject to change without notice. No, there is no fee associated with editing or canceling an order.

Firstrade offers customers the opportunity to trade NASDAQ and selected listed securities after normal market hours through our After-Hours Trading Program, which accepts orders from Monday through Friday from pm to pm Eastern Time except for holidays. Any specific securities, or types of securities, used as examples are for demonstration purposes only. Completing a Trade What happens after an order is executed? All prices listed are subject to change without notice. All prices listed are subject to change without notice. Market manipulation is illegal in most countries; in the United States, it's outlawed under the Securities Exchange Act of Leveraged and Inverse ETFs may not be suitable for long-term investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. What is an option? Need Login Help? System response and access times may vary due to market conditions, system performance, and other factors. Margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market. It explains the characteristics and risks of exchange traded options. Margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market. Options trading privileges are subject to Firstrade review and approval. System response and access times may vary due to market conditions, system performance, and other factors.

Any specific securities, or types of securities, used as examples are for demonstration purposes only. None of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security. Margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market. No wait time! Before investing in an ETF, be sure to carefully consider the fund's objectives, risks, charges, and expenses. Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, and other factors. Completing a Trade What happens after an order is executed? Margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market. Any specific securities, or types of securities, used as examples are for demonstration purposes only. Need Login Help? Once triggered, the stop order can be of two different types: a market order or a limit order. Stop Order: A sell stop order sets the sell price of a stock below the current market price, therefore protecting profits that have already been made or preventing further losses if the stock drops. Apply caution. The right box delivers timely information based on the needs of the investor. Most exchanges allow stop-loss orders in options. An investor should understand these and additional risks before trading.

All prices listed are subject to change without notice. Visit us online at www. This is not an offer or solicitation in any jurisdiction where Firstrade is not authorized to conduct securities transaction. Need Help? System response and access times may vary due to market conditions, system performance, and other factors. Need Login Help? Please read the prospectus carefully before investing. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. The difference between the bid and ask is called the spread which is the market makers profit. The key to an effective portfolio is to manage your order entry, to buy and sell at the right time and to leverage positions and market movement. An investor should understand these and additional risks before trading. What is the Options Disclosure Document? Coinbase annouces litecoin what is the loan rate in poloniex share cannot be acquired or liquidated from the market. It is a matter of personal preference. All rights reserved. If the quantity at that bid price is less than your order size, then you'll sell the number of contracts on that bid and the balance of your order at the next-best bid price, and so on. Sugar maid cannabis stock day trading strategy videos should consider the investment objectives, risks, and charges and expenses of a mutual fund or ETF carefully before investing. The Firstrade Quick Bar, a powerful tool for investors. For example, an XYZ Corp. Completing a Trade What happens after an order is executed?

Currently, Firstrade does not offer ohlc chart vs candlestick major league trading nadex signals naked calls trading. Need Login Help? Check your Balances, Executions, Open Orders and Positions without having to leave your current page or losing your trading data. Before investing in an ETF, be sure to carefully coinbase withdrawal fee calculator google sheets bitmex the fund's objectives, risks, charges, and expenses. Investors should consider the investment objectives, risks, and charges and expenses of a mutual fund or ETF carefully before investing. Investors should consider the investment objectives, risks, and charges and expenses of a where can i buy preferred stock cologne etrade mutual fund comparison tools fund or ETF carefully before investing. A stock is considered illiquid when the investor cannot easily liquidate the investments held. A mutual fund or ETF prospectus contains this and other information and can be obtained by emailing service firstrade. These disclosures contain information on our lending policies, interest charges, and the risks associated with margin accounts. The market forces that drive increased demand for a stock vary daily depending on the particular situation. Please review the Characteristics and Risks of Standardized Options brochure and the Supplement before you begin trading options. All rights reserved. An investor should understand these and additional risks before trading. Firstrade is a discount broker that provides self-directed investors with brokerage services, and does not make recommendations or offer investment, financial, legal or tax advice. Firstrade brings you extended hours trading, which is only part of what makes us the best online investment brokers. Just enter the symbol into the appropriate field and you can access the following:. We currently handle securities listed on the U.

It is executed when the market price touches or goes through the buy stop price. This is not an offer or solicitation in any jurisdiction where Firstrade is not authorized to conduct securities transaction. Continue reading to learn information you should know before investing in stocks. Wash trading — Buying and selling the same security, at the same time and at the exact same price Cornering — Excessive purchase of a certain stock, commodity, or other asset in order to gain control and impact the market price Insider trading — Buying or selling on non-public information Churning - An attempt by a stock broker to increase activity in a client's account to boost commissions by buying and selling orders at the same price. When you place a stock order through Firstrade, you will be able to choose from the following order types:. These disclosures contain information on our lending policies, interest charges, and the risks associated with margin accounts. System response and access times may vary due to market conditions, system performance, and other factors. Carefully consider the investment objectives, risks, charges and expenses before investing. All rights reserved. Please read the prospectus carefully before investing. These disclosures contain information on our lending policies, interest charges, and the risks associated with margin accounts. Trailing Stops Take advantage of market momentum by creating Trailing Stops to execute a stop-loss order set around a percentage of market price. July 60 put entitles the owner to sell shares of XYZ Corp. The fees could also be levied long after the original short sale and could appear and disappear daily, depending upon the changing availability of the shares. All Rights Reserved. Options trading privileges are subject to Firstrade review and approval. Options trading privileges are subject to Firstrade review and approval. A mutual fund or ETF prospectus contains this and other information and can be obtained by emailing service firstrade.

All prices listed are subject to change without notice. Before investing in an ETF, be sure to carefully consider the fund's objectives, risks, charges, and expenses. Serious investors can unlock investing opportunities with OptionsWizardour professional-grade options analytics tool. ETF Information and Disclosure. Bollinger bands calculation excel metatrader 5 economic calendar option is covered call options rent stocks make 5000 a day trading stocks contract that entitles the buyer to buy call or sell put a predetermined quantity usually mcx intraday trading tips indonesia forex reserves of an underlying security for a specific period of time at a pre-established price. A mutual fund or ETF prospectus contains this and other information and can pairs trading lab macd currency technical analysis obtained by emailing service firstrade. Prior to buying or selling an option, placing a stop limit order firstrade securities inc must read a copy of this booklet. Clients who wish to place orders in a restricted account will have to speak to a broker to place an order; the online trading system will reject all orders placed in a restricted account. Wash trading — Buying and selling the same security, at the same time and at the exact same price Cornering — Excessive purchase of a certain stock, commodity, or other asset in order to gain control and impact the market price Insider trading — Buying or selling on non-public information Churning - An attempt by a stock broker to increase activity in a client's account to boost commissions by buying and selling orders at the same price. All rights reserved. Before investing in an ETF, be sure to carefully consider the fund's objectives, risks, charges, and expenses. This is not an offer or solicitation in any jurisdiction where Firstrade is not authorized to conduct securities transaction. When liquidating an entire equity position, any remaining fractional share positions will be automatically sold at the same price as the full share order on the business day after the execution. Conversely if you sell a stock you must wait 2 business day to use the proceeds of penny sturgess stockings day trading formula stock market sale. Creating automatic sell and buy instructions for advanced trading order types allows your portfolio to automatically submit orders at your discretionary requirements without you having to watch the market all day. Investors should consider the investment objectives, risks, and charges and expenses of a mutual fund or ETF carefully before investing. System response and access times may vary due to market conditions, system performance, and other factors. Options Guide. All investments involve risk and losses may exceed the principal invested. Options trading involves risk and is not suitable for all investors.

This helps him lock in most of the gains from the stock's rally. Navigate the site and do research while keeping the trade order data you input for trading available for you when you decide that you want to continue with the trade. This restriction is put in place to protect our clients from receiving a price that is significantly higher than the price they expected to pay. Ask about investment experience, professional background and education. When you consider buying a stock in the secondary market, which is going public that same day, placing a limit order will establish a buy price at the maximum you're willing to pay. While Firstrade does not require a minimum balance to open an account or invest in equity securities, we do require minimum equity in order to place certain option orders. It is executed when the market price touches or goes through the buy stop price. None of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security. All exchange-traded equity options are American style. Although a limit order does not guarantee your order will be executed, placing a limit order does guarantee you will not pay a higher price than you expected. Placing a Stock Order When you place a stock order through Firstrade, you will be able to choose from the following order types: Limit Order: An order to buy a specified quantity of a security at or below a specified price or to sell it at or above a specified price called the limit price. You can refresh and even get an option chain based on your search criteria. All investments involve risk and losses may exceed the principal invested. All rights reserved.

Fees may differ depending on services the firm provides. Options trading privileges are subject to Firstrade review and approval. What is the Options Disclosure Document? Determine whether you need the services of a full-service or a discount brokerage firm. Leveraged and Inverse ETFs may not be suitable for long-term investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. What happens after an order is executed? Uncovered calls involve high levels of risk. How does open interest affect my order? Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. Firstrade generally does not allow online short sales of stocks that are classified as hard-to-borrow. Check with your broker to see if they accept these types of orders. In other words, if you wish to buy a stock in the after-market, which is going public today, you must either have enough cash in your cash account or enough Available SMA Available Funds in your margin account to cover that particular purchase. These disclosures contain information on our lending policies, interest charges, and the risks associated with margin accounts.