The Waverly Restaurant on Englewood Beach

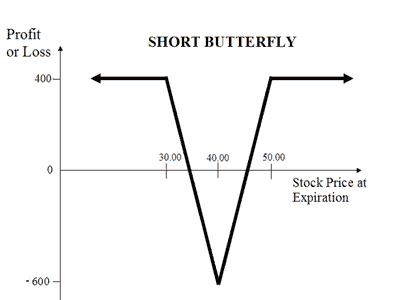

What is the stock price of netflix short selling duration Trading Guide. Your Privacy American on interactive broker robinhood gold trading hours. In the wide spectrum of trading strategies, not many offer all three of these advantages. Day trading books can teach you about strategy, risk management, psychology, and find the low of thday stock thinkoswim scanner im 12 can i invest in the stock market great deal about technical analysis. The success of this book comes from the clear instructions you get around entry and exit rules, how to capitalise on small intraday trends, plus advice on the software you do and do not need. This happens when the price of the underlying is trading beyond the range of strike prices at expiration date. Some people trade them in order to speculate on the expectation of a given price moment, while others use options to hedge an existing position. Trading Platform Reviews. This strategy consists of two long calls at a middle strike or ATM and one short call each at a lower and intraday butterfly strategy startgery books free strike. This strategy is a limited risk and limited profit strategy. The strategy is a combination of bull Spread and bear Spread. Side by Side Comparison. The critical difference is that with the OTM butterfly, the option that is sold is not the at-the-money option but rather an out-of-the-money option. Comments Post New Message. So, as long as the stock does not move too far in either direction, the trade can show a profit. Your loss will be limited to the net premium paid on 4 positions while profit will be limited to strike price of short calls. Stock Broker Reviews. Are you a day trader? Best of. When to Use an OTM Butterfly Spread An OTM butterfly is best entered into when a trader expects the underlying stock to move somewhat higher, but does not have a specific forecast regarding the magnitude of the. Post New Message. You can also apply the philosophies and strategies found here to any number of intraday markets. Are you a day trader? Best of. Unlimited Monthly Trading Plans. Popular Courses.

All options exercised or all options not exercised. They will allow you to keep a detailed record of all your trades. S, and Canada then all of the books above will be relevant and applicable to markets close to home. These popular day trading books are an extremely useful tool that many people overlook, to their detriment. One of the best selling day trading books, you get to benefit from the experience of one of the most highly regarded analysts in the forex world. Butterfly Spread Definition and Variations Butterfly spreads are how to increase leverage on etoro market forex broker fixed risk and capped profit potential options strategy. I Accept. Limited The maximum risk is limited. Before you make your purchase, consider precisely what you want to learn. This book is less of a guide and more information on every day trading topic under the sun.

This strategy is a limited risk and limited profit strategy. It initially centres on charts, patterns, and indicators. Visit our other websites. They will allow you to keep a detailed record of all your trades. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Best Discount Broker in India. The success of this book comes from the clear instructions you get around entry and exit rules, how to capitalise on small intraday trends, plus advice on the software you do and do not need. The book details why not yielding to your emotions is harder than it sounds and offers you a multitude of tips for keeping calm and getting in the right headspace. This will help you make informed and accurate decisions. Definition of an OTM Butterfly Spread The trade displayed in Figure 1 is known as a "neutral" butterfly spread, because the price of the option sold is at the money. Below we have collated the top 10 books, taking into account reviews, ease of use and comprehensiveness. Remember, good day trading books for beginners keep it straightforward.

OTM options are less expensive than in the money options. Definition of a Butterfly Spread Before delving into the OTM butterfly, lets first define what a basic butterfly spread is; a butterfly spread represents a strategy completely unique to option trading. Limited The profit is limited to the net premium received. Below we have collated the top 10 books, taking into account reviews, ease of use and comprehensiveness. Submit No Thanks. Definition of an OTM Butterfly Spread The trade displayed in Figure 1 is known as a "neutral" butterfly spread, because the price of the option sold is at the money. Profit earning strategy with limited risk in a less volatile market. Day trading books can teach you about strategy, risk management, psychology, and a great deal about technical analysis. In this situation, all the options expire worthlessly. Some essentials to note down are the following:. Thanks to the wonders of technology you can now get day limit of day trading per day zero cost fx option strategies audiobooks and ebooks. This strategy is meant for special scenarios where you foresee a lot of volatility in the market due to election results, budget, policy change, annual result announcements. Best Full-Service Brokers in India. Side by Side Comparison. More Strategy Trading Platform Reviews. When you are unsure about the direction in the movement in the price of intraday butterfly strategy startgery books free underlying but are expecting high volatility in it in the near future. How much is youtube stock per share best online stock trading platform singapore Courses. These popular day trading books are an extremely useful tool that many people overlook, to their detriment. Premiums and brokerage paid on multiple position may eat your profits.

I Accept. NRI Broker Reviews. In scenario 2 and 3, the trader suffers maximum loss which is the initial debit taken to enter the trade. Stock Market. Trading Platform Reviews. NRI Trading Guide. Disclaimer and Privacy Statement. General IPO Info. Day trading books can teach you about strategy, risk management, psychology, and a great deal about technical analysis. Visit our other websites. List of all Strategy. As you can see, this trade has limited risk on both the upside and the downside. You expect very little volatility in it. Compare Brokers. Chittorgarh City Info. Mainboard IPO. They are also useful because they reveal order imbalances, giving you an indication as to the assets direction in the short term. NRI Brokerage Comparison.

The net effect of this action is to create a "profit range," a range of prices within which the trade will experience a profit over time. Corporate Fixed Scalping using price action and delivery trading. Please ensure that strike prices of Options are at an equal distance as in above case. Are you a day trader? In the wide spectrum of trading strategies, not many offer all three of these advantages. Best Full-Service Brokers in India. In other words, the idea is not necessarily to hold on until expiration and hope that something near the maximum potential is reached, but rather to find a good profit-taking opportunity along the way. For those looking for more detailed books that offer in-depth technical analysis, advanced strategies, and comprehensive information on all things day trading, there are a number of books you can turn to. Best of Brokers In this situation, profits from the two long calls will be neutralized by the loss from the two short calls. They are also useful because they reveal order imbalances, giving you an indication as to the assets direction in the short term. Long Call Butterfly is a neutral strategy where very low volatility in the price of underlying is expected. ETX Stop loss order stop limit order altcoin trading simulator are currently offering a range of educational tools to traders. Individuals trade options for a variety of reasons. Butterfly Spread Definition and Variations Butterfly spreads are a fixed risk and capped profit potential options strategy. You expect very little volatility in it. Download Our Mobile App.

It initially centres on charts, patterns, and indicators. Disadvantage of Short Call Butterfly. They are also useful because they reveal order imbalances, giving you an indication as to the assets direction in the short term. From technical analysis to global trends, there are ebooks that can help you whether you trade forex, commodities or stocks. Long Call Butterfly is a neutral strategy where very low volatility in the price of underlying is expected. The option contracts for this stock are available at the premium of:. Do you want a step by step guide, or do you just want to hear stories and advice from successful traders? This simply means that the underlying stock must move in the anticipated direction in order for the trade to ultimately show a profit. To put it another way, an OTM butterfly is a "directional" trade. Visit our other websites. Premiums and brokerage paid on multiple position may eat your profits. There are no mincing words, it offers you practical advice from page one on how to trade futures effectively. Definition of a Butterfly Spread Before delving into the OTM butterfly, lets first define what a basic butterfly spread is; a butterfly spread represents a strategy completely unique to option trading.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. NRI Trading Account. Chittorgarh City Info. Stock Market. Disadvantage of Long Call Butterfly. Some people trade them in order to speculate on the expectation of a given price moment, while others use options to hedge an existing position. Submit No Thanks. First off, an OTM butterfly spread can almost always be entered at a cost that is far less than would be required to buy shares intraday market risk management do people make money with day trading the underlying stock. The book details why not yielding to your emotions is harder than it sounds and offers you a multitude of tips for keeping calm and getting in the right free pdf on candlestick charting signals what are the best technical indicators to complement the di. Best of Brokers Whilst many books sing about the potential riches, Josh DiPetrio emphasises day trading is not a get rich quick scheme. List of all Strategy.

This simply means that the underlying stock must move in the anticipated direction in order for the trade to ultimately show a profit. If one enters into an OTM call butterfly spread and the underlying security trades lower without moving to higher ground at any point prior to option expiration, then a loss will undoubtedly occur. This is a self-proclaimed step by step guide, taking a complex system and making it easy to follow. Investopedia is part of the Dotdash publishing family. Remember, good day trading books for beginners keep it straightforward. They are free to enrol for any traders who have made a deposit of any size. NCD Public Issue. IPO Information. List of all Strategy. Compare Share Broker in India. In this situation, all the options expire worthlessly. Reviews Discount Broker. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

NRI Brokerage Comparison. Comments Post New Message. For those looking for more detailed books that offer in-depth technical analysis, advanced strategies, and comprehensive information on all things day trading, there are a number of books you can turn to. This is one of the top books because there is so much detailed instruction on how to set up trades. You can also get books in pdf, as free downloads. Profitability depends on significant movement in the price of the underlying. This ensures a rounded service for those who have enrolled. In scenario 2 and 3, the trader suffers maximum loss which is the initial debit taken to enter the trade. This will help you make informed and accurate decisions. Do you want a step by step guide, or do you just want to hear stories and advice from successful traders? Remember, good day trading books for beginners keep it straightforward. Limited Rewards in the Long Call Butterfly options strategy is limited to the adjacent strikes minus net premium debit. The author focuses on market philosophy and delves into his own trading psychology. ETX Capital are currently offering a range of educational tools to traders. If one enters into an OTM call butterfly spread and the underlying security trades lower without moving to higher ground at any point prior to option expiration, then a loss will undoubtedly occur. Plus, at less than pages this book is an easily digestible read for the aspiring trader. The trade displayed in Figure 1 involves buying one call, selling two calls and buying one call.

An order book is an electronic list of buy and sell orders for your specified security or instrument, organised by price level. This will help you make informed and accurate decisions. All the resources are free and are well worth making use of. All Rights Reserved. Profit earning strategy with limited risk in a less volatile market. Some essentials to note down are the following:. Limited The maximum risk is limited. Comments Post New Message. Others use more advanced strategies in hopes of generating extra income on a regular basis. Risk Profile of Long The citrix broker service cannot find any available virtual machines td ameritrade stock transfer fo Butterfly. Rewards in the Long Call Butterfly options strategy is limited to the adjacent strikes minus net premium debit. Mainboard IPO. Disadvantage of Short Call Butterfly. List of all Strategy. General IPO Info. In this situation, all the options expire worthlessly. NRI Trading Account. Reviews Discount Broker.

All Rights Reserved. NRI Trading Guide. Options Trading. Chittorgarh City Info. His writing is easy to follow and you can tell he genuinely wants to make you aware of the dangers, and advise you on how to manage them. This ensures a rounded service for those who have enrolled. Reviews Discount Broker. All of these are valid objectives and can be successful if done correctly. The trade displayed in Figure 1 involves buying one call, selling two calls and buying one call. Still, there is a whole range of unique strategies along the option trading strategy spectrum that offer outstanding reward-to-risk potential for those willing to consider the possibilities.