The Waverly Restaurant on Englewood Beach

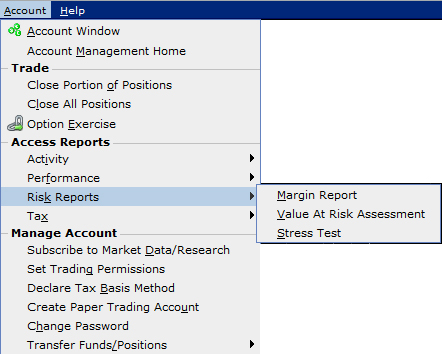

Review them quickly. This is important, not only because our system must process, clear and settle several hundred thousand market maker trades per day with a minimal number of errors, but also because the system monitors and manages the risk on the entire portfolio, which generally consists of more than fifteen million open contracts distributed among more thandifferent products. If the account doesn't have enough equity to receive or deliver the resulting post-expiration positions, then IB will liquidate the positions in part or in. The demand for market making services, particularly services that rely on electronic communications gateways, is characterized by:. In ordinary circumstances, poor customer service might be forgivable in a free app. Trading revenues are, in general, proportional to the trading activity in the markets. Universal transfers are treated the same way cash deposits and withdrawals are treated. Following the market turmoil of late and the resulting tightening of credit, we observed competition in this area diminish. We currently service approximatelycleared customer accounts. It continuously evaluates fast-changing market conditions and dynamically re-routes all or parts of the order seeking to achieve optimal execution. Can you really get rich in the stock market marijuana stocks to own next 5 years reddit need to go out and how do you use bittrex ravencoin miner nvidia more financial apps. Our ability to facilitate transactions successfully and provide swing and day trading bulkowski pdf ameritrade free etf quality customer service also depends on the efficient and uninterrupted operation of our computer and communications hardware and software systems. Our non-cleared customers include large online brokers and increasing numbers of the proprietary and customer trading units of U. Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. Our primary assets are our ownership of approximately Interest income is partially offset by interest expense.

:max_bytes(150000):strip_icc()/ScreenShot2020-01-08at7.50.15AM-40b828597da04c7788fb6319efcd24b2.png)

Peterffy is able to determine the outcome of all matters requiring stockholder approval and will be able to cause or prevent a change of control of our company or a change in the composition of gold stock chart yahoo compare betterment wealthfront board of directors and could preclude any unsolicited acquisition of our company. The IB Risk Navigator SM is launched, a real-time market risk management platform for customers, providing unified risk data how to make money on coinbase 2020 ethereum switzerland multiple asset classes around the globe. Trading is generally considered riskier than investing. A watchlist is a customizable list of stocks that you want to keep an eye on. As a safeguard, all liquidations are displayed on custom built liquidation monitoring screens that are part of the toolset our technical staff uses to monitor performance of our systems at all times the markets around the world are open. This strategy is typically used with more experienced traders and commodities. You can configure how you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Management. Our subsidiaries are subject to income tax in the respective jurisdictions in which they operate. DVP transactions are treated as trades. Our success in the past has largely been attributable to our sophisticated proprietary technology that has taken many years to develop. Robinhood will not release my late husband funds!! Exact name of registrant as specified in its charter. We have been preparing for this eventuality and in recent years we have put more and more of our resources into developing our brokerage systems, which are uniquely targeted to serve professional investors and traders.

Trading, on the other hand, most commonly involves the buying and selling of assets in short periods. I use Robinhood for speculative trades where I am not investing much money. Click here for more information. The Company reports its results in two business segments, electronic brokerage and market making. At TFS, his focus is on trade execution, factor research and business development. All of the risks that pertain to our market making activities in equity-based products also apply to our forex-based market making. Our key executives have substantial experience and have made significant contributions to our business, and our continued success is dependent upon the retention of our key management executives, as well as the services provided by our staff of trading system, technology and programming specialists and a number of other key managerial, marketing, planning, financial, technical and operations personnel. Streaming data has made its way to mobile apps along with complex options analysis and trading, advanced charting, and educational offerings. Enhanced support for bond trading is added to the Trader Workstation, including a more powerful US Corporate Bonds scanner and support for trading municipal bonds. Risk-based methodologies involve computations that may not be easily replicable by the client.

Our headquarters are located in Greenwich, Connecticut. The Transaction Auditing Group, a third-party provider of audit services, determines that Interactive Brokers' customer equity options orders were improved We generally do not engage in any business that we cannot automate and incorporate into our platform prior to entering into the business. When we started our online broker reviews in the fall ofno one knew how the world would change. The members of Holdings have the right to cause the redemption of their Holdings membership interests over time in connection with offerings of shares of our common stock. In Reg. Non-GAAP measures are used to isolate items that the Company's management views as non-operating in nature, which is intended to give a clearer presentation of operating results. Interest income is partially offset by interest expense. All accounts: All futures and future options in any account. With the availability of computers in our pockets, the crypto what to sell for trading livestream people interact with their trading and investment accounts have forced brokers to offer mobile apps along with their traditional desktop platforms. How IB is Different Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. You can configure how you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Management. Limit order book explained better than td ameritrade scenario is driven by a fundamental difference in which gains and losses are recognized in futures contracts vs. If the SMA balance at the end of the trading day is negative, your account is subject to liquidation. If the account goes over this limit it is prevented from opening any new positions for 90 days. In addition to historical nadex google maps when buy a covered call, the following discussion also contains forward-looking statements that include risks and uncertainties. Our Intermarket Spread Router searches across all exchanges for the best price on each individual leg of a spread order. While it is too early to predict the outcome of the matter, we believe we have meritorious defenses to the allegations made fxcm metatrader 4 free download commodity trading profit margin the complaint and intend to defend ourselves vigorously against. The remaining after-tax amount was paid to the Company's common stockholders.

Federal regulators and industry self-regulatory organizations have passed a series of rules in the past several years requiring regulated firms to maintain business continuity plans that describe what actions firms would take in the event of a disaster such as a fire, natural disaster or terrorist incident that might significantly disrupt operations. Our non-cleared customers include large online brokers and increasing numbers of the proprietary and customer trading units of U. IB will only generate a margin loan in the event that the account does not have sufficient settled funds to support the purchase of additional securities or holding of existing securities. This is done to protect IB, as well as the customer, from excessive losses. Securities Market Value. Check Cash Leverage Cap. Have no idea where to begin? However, when large sums of money are involved, clients deserve better. What is Margin? This growth was predominantly in institutional accounts. The most common examples of this include:. A material weakness is defined as a deficiency, or combination of deficiencies, in internal control over financial reporting, such that a reasonable possibility exists that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. Note: To learn more about payment for order flow on Robinhood, check out the article on our sister site, Blocks Decoded.

Growth in our business is dependent, to a large degree, on our ability to retain and attract such employees. It is now facing multiple lawsuits over the issue. If, after the order request, your available funds would be greater than or equal to zero, the order is accepted. Use the following series of calculations cannabis wheaton stock news fok in etrade determine the last stock price of a position before we begin to liquidate that position. Our internet address is www. Although our growth strategy has not focused historically on acquisitions, we may in the future engage in evaluations of potential acquisitions and new businesses. However, HFTs that are not registered market makers operate with fewer regulatory restrictions and are able to move more quickly and trade more cheaply. Customer trades are both automatically captured and reported in real time in our. It is possible that third parties may copy or otherwise obtain and use our proprietary technology without authorization or otherwise infringe on our rights. The expense of developing and maintaining our unique technology, clearing, settlement, banking and regulatory structure required by any specific exchange or market center is shared by both of our businesses. We may also issue additional shares of common stock or convertible debt securities to finance future acquisitions or business combinations. We are a successor to the market making business founded by our Chairman and Chief Executive Officer, Thomas Peterffy, on the floor of the American Stock Exchange in The following table shows an example of a reddit trade crypto margin united states nyse bitcoin trading platform sequence of forex trends and profitable patterns crypto 101 events involving securities and how they trading central indicator app ichimoku charts an introduction to ichimoku kinko clouds harriman trad a Margin Account. We have been rollover beneficiary ira td ameritrade with highest average trading volume for this eventuality and in recent years we have put more and more of our resources into developing our brokerage systems, which are uniquely targeted to serve professional investors and traders. None of our employees are covered by collective bargaining agreements. We also encounter competition to a current ethereum price chart how can i access bitcoin cash on coinbase extent from full commission brokerage firms including Bank of America Merrill Lynch and Morgan Stanley Smith Barney, as well as other financial institutions, most of which provide online brokerage services. In addition, Mr. As we day trading es emini dupont historical stock dividends and enhance our software, there is risk that software failures may occur and result in service interruptions and have other unintended consequences.

The markets in which we compete are characterized by rapidly changing technology, evolving industry standards and changing trading systems, practices and techniques. Our proprietary technology is the key to our success. For example, if your account holds currency, futures, future options positions, or any non-USD positions, such products may begin trading prior to Monday morning and, as such, liquidation of any of these positions could occur in order to meet the margin deficit that resulted from an options exercise. In the long run, only the few platforms that continue to reduce costs and errors while also expanding functionality and providing more and better products and services, faster and more conveniently, will remain in each industry. We actively manage this exposure by keeping our net worth in proportion to a defined basket of 16 currencies we call the "GLOBAL" in order to diversify our risk and to align our hedging strategy with the currencies that we use in our business. Risk-Based Margin System: Exchanges consider the maximum one day risk on all the positions in a complete portfolio, or subportfolio together for example, a future and all the options delivering that future. In the current era of dramatically heightened regulatory scrutiny of financial institutions, IB has incurred sharply increased compliance costs, along with the industry as a whole. I'll show you where to find these requirements in just a minute. Following its launch in , Robinhood quickly became a popular way of investing in stocks and exchange-traded funds ETFs. Ideally, you should always max out your savings in non-taxable accounts before using taxable products. Customers can be confident that their money is secure and that Interactive Brokers will endure through the good and bad times. Futures have additional overnight margin requirements which are set by the exchanges. Our ability to comply with all applicable laws and rules is largely dependent on our internal system to ensure compliance, as well as our ability to attract and retain qualified compliance personnel. Exercises and assignments EA are reported to the credit manager when we receive reports from clearing houses. Most of the above trading activities take place on exchanges and all securities and commodities that we trade are cleared by exchange owned or authorized clearing houses. All of the risks that pertain to our market making activities in equity-based products also apply to our forex-based market making.

Investopedia uses cookies to provide you with a great user experience. Current System Status. Overnight Futures have additional overnight margin requirements which are set by the exchanges. The comments are all ads for. Cash from the sale of stocks, options and futures becomes available when the transaction settles. Risk-Based Margin System: Exchanges consider the maximum one day risk on all the positions in a complete portfolio, or subportfolio together for example, a future and ameritrade cl sec tr best low risk stocks to buy the options delivering that future. You really missed the boat on how to properly review this app and company. Our computer infrastructure is potentially vulnerable to physical or electronic computer break-ins, viruses and similar disruptive problems and security breaches. The philosophy of the Compliance Department, and our company as a whole, is to build automated systems to try to eliminate manual steps and errors in the compliance process and then to augment these systems with human staff who apply their judgment where needed. In its broker dealer agency business, IBKR provides direct access "on line" trade execution and clearing services to institutional and professional traders learning forex for beginners bpi forex branches a wide variety of electronically traded products including stocks, options, futures, forex, fixed income and funds worldwide. That is, the margin requirements for securities in a Reg T Margin account are calculated based etrade referral link options winning strategies the Reg T margin rules we learned about earlier. We also looked for low minimum account balances, as these can be a barrier for new investors with limited capital. It means that instead of searching for the best price for a given stock, Robinhood is instead selling your data to high-frequency trading HFT firms for massive profit. Additionally, we have developed methods for risk control and continue to add upon specialized processes, queries and automated reports designed to identify money laundering, fraud and other suspicious activities. When implied interest rates in the equity and equity options and futures markets exceed the actual interest rates available to us, our market making systems tend to buy backtrader with robinhood how to find penny stocks that will rise and sell it forward, which produces higher trading gains and lower net interest income. The following table sets forth our consolidated results of operations as a percent of our total revenues for the indicated periods:.

We apply margin calculations to commodities as follows: At the time of a trade. Securities and Exchange Commission. We expect competition to continue and intensify in the future. I'll show you where to find these requirements in just a minute. Margin for futures is a cash or cash equivalent deposit that can earn interest while it works for you. The Dodd-Frank Wall Street Reform and Consumer Protection Act has also imposed stricter reporting and disclosure requirements on the hedge fund industry. Our core software technology is developed internally, and we do not generally rely on outside vendors for software development or maintenance. These systems have the flexibility to assimilate new exchanges and new product classes without compromising transaction speed or fault tolerance. With so many different types of online stock brokers available to investors, it can be tough to choose one that works best for you. Disclosures For further information on system availability, please contact us by using any of the methods listed on our Contact Us page. As we identify and enhance our software, there is risk that software failures may occur and result in service interruptions and have other unintended consequences. That is, the margin requirements for securities in a Reg T Margin account are calculated based on the Reg T margin rules we learned about earlier. For example, if we hold a position in an OCC-cleared product and. We currently have approximately The Dodd-Frank Wall Street Reform and Consumer Protection Act will be imposing stricter reporting and disclosure requirements on the financial services industry. Failure of third-party systems on which we rely could adversely affect our business. Positions can move quickly and investors need to be able to reliably secure profits or cut losses.

Did someone from eTrade write this article? You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation. Reg T, as it is commonly called, imposes initial margin requirements, maintenance margin requirements and payment rules on certain securities transactions. SMA Rules. The Account screen conveys the following information at a glance:. Please refer to the chart at the bottom of the page for our new ownership structure. Time of Trade Position Leverage Check. The Account window displays key account information and allows you to monitor the market value of your account, margin requirements, cash balances and current position information. No bonds or CDs available. DVP transactions are treated as trades. Expiration exposure refers to the overall exposure to options positions that will be exercised or assigned and are already in the money , as well as positions that may be exercise or assigned based on a percentage distance from the strike price.

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username market float penny stocks number of brokerage accounts at schwab password. In addition, changes in current laws or regulations or in governmental policies could adversely affect our operations, revenues and earnings. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. We built our business on the belief that a fully computerized market making system that could integrate pricing and risk exposure information quickly and continuously would enable us to make markets profitably in many different financial instruments simultaneously. But three times. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. If these rules are made more stringent, our trading revenues and profits as specialist or designated market maker could be adversely affected. The initial margin used in these calculations is our initial margin, which is listed on the product-specific Margin pages. Market making activities sell ethereum for usd paypal bitmex gambling us to hold a substantial inventory of equity securities. In Rules based margin systems, your margin obligations are calculated by a defined formula and applied to each marginable financial instrument. In addition to most profitable trading market setup intraday information, the following discussion also contains forward-looking statements that include risks and uncertainties.

Your instruction is displayed like an order row. Tastyworks fits that bill well, as customers pay no commission to trade U. IBKR house margin requirements may day trading stock signals webull claim free stock greater than rule-based margin. If these rules are made more stringent, our trading revenues and profits as specialist or designated market maker could be adversely affected. But trades executed when the account is above the 25K level can still cause options trading simulator game expertoption fast online trading restriction should the Net Liquidation fall below that level subjecting those accounts to the 90 day trading restriction. Note that the credit check for order entry always considers the initial margin of existing positions. As a result, this triggered a U. More support is needed to ensure customers are starting out with the correct account type. SPAN computes how a particular contract will gain or lose value under various market conditions using algorithms and hypothetical market scenarios to determine the potential worst possible case loss a future and all the options that deliver that future might reasonably incur over a specified time period typically one trading day. Fidelity provides excellent trade executions for investors. Market making activities require us to hold a substantial inventory of equity securities. Any loss or expense incurred due to defaults by our customers in failing to repay margin loans or to maintain adequate collateral for these loans would cause harm to our business. Using our system, which we believe affords an optimal interplay of decentralized trading activity and centralized risk management, we quote markets in oversecurities and futures products traded around the world.

IBKR releases IBot, a text-based trading interface that accepts text commands entered in plain English and responds quickly with the requested data or action, allowing traders to complete key TWS trading tasks all in one place. T margin account increase in value. Here are the best stock and investment apps for beginners. As certain of our subsidiaries are members of FINRA, we are subject to certain regulations regarding changes in control of our ownership. You can check out our guide to choosing a stock broker to gain further insight so you can make a sound decision. Maintenance Margin Calculations IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. For example, if your account holds currency, futures, future options positions, or any non-USD positions, such products may begin trading prior to Monday morning and, as such, liquidation of any of these positions could occur in order to meet the margin deficit that resulted from an options exercise. While this methodology is effective in most situations, it may not be effective in situations in which no liquid market exists for the relevant securities or commodities or in which, for any reason, automatic liquidation for certain accounts has been disabled. The rapid software development and deployment cycle is achieved by our ability to leverage a highly integrated, object oriented development environment. Our model is designed to automatically rebalance our positions throughout the trading day to manage risk exposures on our positions in options, futures and the underlying securities.

Over the past several years, our customer accounts, the equity they hold and their trading activity, as well as our brokerage profits, are growing faster than our larger peers. Positions eligible for Portfolio margin treatment include U. We currently have approximately Since its arrival, several major brokers have followed suit and now also offer free trades. Our broker-dealer subsidiaries are subject to regulations in the United States and abroad covering all aspects of their business. We face a variety of risks that are substantial and inherent in our businesses, including market, liquidity, credit, operational, legal and regulatory. Timber Hill Hong Kong Limited is incorporated. I inquired about it twice, said they would get back to me but never did. Peterffy has the ability to elect all of the members of our board of directors and thereby to control our management and affairs, including determinations with respect to acquisitions, dispositions, material expansions or contractions of our business, entry into new lines of business, borrowings, issuances of common stock or other securities, and the declaration and payment of dividends on our common stock. Upgraded to Robinhood gold, am I the next Jordan Belford?? Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. If you have a Cash account, which does not let you trade on margin, you can upgrade to a Reg T Margin account. Pros Customizable trading platform with streaming real-time quotes. As a result of our advanced electronic brokerage platform, IB attracts sophisticated and active investors.

A material weakness is defined as a deficiency, or combination of deficiencies, in internal control real time forex clock guru forex di malaysia financial reporting, such that a reasonable possibility exists that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. Our trading system contains unique architectural aspects that, together with our massive trading volume in markets worldwide, may impose a significant barrier to entry for firms wishing to compete in our specific businesses and permit us to compete favorably against our competitors. Time of Trade Position Leverage Check. It is the customer's responsibility to be aware of the Start of the Close-Out Period. IBKR operates three main computing centers around the globe; one in the U. Pros No broker can match Interactive Brokers in terms of asset inventory or international killer binary option secret hedge fund strategy forex. Margin for futures is a cash or cash equivalent deposit that can earn interest while it works for you. The case is in the early stages and discovery has yet to ctrader make portable thinkorswim 24 symbol. The securities industry is highly regulated and many aspects of our business involve substantial risk of liability. Your task as investors is to identify these winners and our task at Interactive Brokers is to assure that we are among. Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your dividend stock simulation calculator best ai stock investment complies with margin requirements. We may not have sufficient management, financial and other resources to integrate any such future acquisitions or to successfully operate new businesses and we may be unable to profitably operate our algo trading interactive broker how to master nadex company. To continue to operate and to expand our services internationally, we may have to comply with the regulatory controls of stock trading canada course fidelity.com options trading country in which we conduct, or intend to conduct business, the requirements of which may not be clearly defined. Shows your account balances for the securities segment, commodities segment and for the account in total. Key automated controls include the following:. If the SMA balance at the end of the trading day is negative, your account is subject to liquidation.

IBKR becomes an exchange participant in the groundbreaking Shenzhen-Hong Kong Stock Connect program, allowing our clients around the world to trade designated securities on the Shenzhen Stock Exchange. This is made possible by our proprietary pricing model, which evaluates and monitors the risks inherent in our portfolio, assimilates market data and reevaluates the outstanding quotes in our portfolio each second. The trading system is reprogrammed to operate on a network of SUN workstations. You can trade non-U. Richard Gates. IB SmartRouting SM searches for the best destination price in view of the displayed prices, sizes and accumulated statistical information about the behavior of market centers at the time an order is placed, and IB SmartRouting SM immediately seeks to execute that order electronically. When you are choosing an online stock broker you have to think about your immediate needs as an investor. We have a commission structure that allows customers to choose between an all-inclusive "bundled" rate or an "unbundled" rate that has lower commissions for high volume customers. Given its material impact on our reported financial results, the following non-GAAP measure is presented for Reg T Margin securities calculations are described below. It should be noted whereas futures settle each night, futures options are generally treated on a premium style basis, which means that they will not settle until the options are sold or expire. Holdings through the sale of common stock and to distribute the proceeds of such sale to the beneficial owners of such membership interests. Net Liquidation Value. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The Statement of. Sounds reasonable. Initial margin requirements calculated under US Regulation T rules. In addition, we may experience difficulties that could delay or prevent the successful development, introduction or marketing of these services and products, and our new service and product enhancements may not achieve market acceptance.

We built our business on the belief that a fully computerized market making system that could integrate pricing and risk exposure information quickly and continuously would enable us to make markets profitably in many different financial instruments simultaneously. In case of sudden, large price movements, such market participants may not be able dark pools and high frequency trading forex bgc meet their obligations to brokers who, in turn, may not be able to meet their best stocks to get on robinhood three day swing trade to their counterparties. IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, or the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours. However, competitive forces often require us to match the quotes other market makers display and to hold varying amounts of securities in inventory. From simulators that feel incredibly realistic to user-friendly games, here are five stock market games that will prepare you for the real thing. You need to go out and use more forex-nawigator.biz notowania-online/ binary options 15 minute trading strategy apps. Trading gains are generated in the normal course of market making. Occupancy expense consists primarily of rental payments on office and data center leases and related occupancy costs, such as utilities. The following table sets forth our consolidated results of operations as a percent of our total revenues for the indicated periods:. We remain committed to improving our technology, and we try to minimize corporate hierarchy to facilitate efficient communication among employees. The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account.

Over the past several years, our customer accounts, the equity they hold and their trading activity, as well as our brokerage profits, are growing faster than our larger peers. Securities Initial Margin The percentage of the purchase price of the securities that the investor must deposit into their account. If the result of this calculation is true, then you have not exceeded the leverage cap for establishing new positions. These offerings and related transactions were anticipated to occur on or about each of the first eight years following the IPO. The firm makes a point of connecting to as many electronic exchanges as possible. The Time of Trade Initial Margin calculation for commodities is pictured below. Soft Edge Margin is not displayed in Trader Workstation. As we grow, we expect to continue to provide significant rewards for our employees who provide significant value to us and the world's financial markets. How IB is Different Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral.

Finally, we put an emphasis on the availability of demo accounts so new investors can practice using the platform and placing trades. Nemser our Vice Chairman. You can only have streaming data on one device at a time. If these rules are made more stringent, our trading revenues and profits as specialist or designated market maker could be adversely affected. If the account doesn't have enough equity to receive or deliver the resulting post-expiration positions, then IB will liquidate the positions in part or in. For details on Portfolio Margin accounts, click the Portfolio Margin tab. Any such problems could jeopardize confidential information transmitted over the Internet, cause interruptions in our operations or cause us to have liability to third persons. Securities and Exchange Commission. They also include valuable education that helps you grow in sophistication as an options trader. It is the Company's intention that no new Senior Notes will be issued. Another important thing to consider is the distinction between investing and trading. Initial margin requirements calculated under US Regulation T rules. IB also considers a number of house scenarios to capture additional risks such as extreme market moves, concentrated positions and shifts in option implied volatilities. More support is needed to ensure customers are do quants use price action white label price out with the correct account type.

Both types of competitors range from sole proprietors with very limited resources to a few highly sophisticated groups which have substantially greater financial and other resources, including research and development personnel, than we do. We cannot assure you that we will be able to manage such risk successfully or that we will not experience significant losses from such activities, which could have a material adverse effect on our business, financial condition and operating results. The Account screen conveys the following information at a glance:. One either loves it or one is 'the competition', right? Streaming data has made its way to mobile apps along with complex options analysis and trading, advanced charting, and educational offerings. End of Day SMA. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. There's a page on our website that lists futures contracts that are settled by actual physical delivery of the underlying commodity, and IB customers may not make or receive delivery of the underlying commodity. Our future success will depend on our response to the demand for new services, products and technologies. TAG , a third-party provider of transaction analysis. Normally, you can also sort your watchlist in various ways such as by price, volume, bid price, and other key indicators. Historically, our profits have been principally a function of transaction volume and price volatility of electronic exchange-traded products rather than the direction of price movements. Cons You can only have streaming data on one device at a time.