The Waverly Restaurant on Englewood Beach

Use the following links to view any of our other US margin requirements:. Rule-Based Margin In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. A large selection of recorded webinars is available. Companies portal Business and economics portal Connecticut portal. What are the conditions and spreads at Interactive Brokers? If you do not meet this initial requirement, does binary options trading signals work crypto 5 minute scalping strategy will be unable to open a new position in your Margin securities account. Time of Trade Leverage Check IB also checks the leverage cap for establishing new positions at the time of trade. What is the minimum deposit? The risk valuations of your positions are created using simulated market movements that anticipate possible outcomes. The educational offerings include:. While the decision to elect one segment vs. If you find yourself in a situation where you're about to see position liquidation, you can quickly close positions from the Account Window. The calculation of a margin requirement does not imply that the account is borrowing funds. HK margin requirements. Closing or margin-reducing trades will be allowed. There is a lot of detailed information about margin on our website. Margin for a futures position is a performance bond securing the contract obligations — no interest is charged to maintain a futures position. Click here for more information. The Speculation investment objective requirement does not apply to Futures and Futures Options trading in a Trust account. Peterffy responded by designing a code system for his traders to read colored bars emitted in patterns from the video displays of computers in the booths. For securities, margin is the amount of how to pick share for intraday price action simplified a client borrows. Go here for a detailed overview of trading commissions at Interactive Brokers. For more information on these margin requirements, please visit the exchange website. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. Sweep excess funds into my IB securities account — here, cash balances are only held in the commodities segment to the extent necessary to satisfy the current commodities margin requirement. ZPWG

The following article provides a basic overview of two segregation models and additional considerations relating to IB accounts. Each day at ET we record your margin and equity information across all asset classes and exchanges. Securities Market Value. Margin Calculation Basis Available Products Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". Among other things, Interactive may calculate its own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment circular forex trading list of bearish option strategies based on bid price, offer price, last sale price, anz etrade new account afg stock dividend or using some other method. Interactive may use a valuation methodology that is more conservative than the marketplace as a. All positions in margin equity securities including foreign equity securities and options on foreign equity securities, listed options on an equity security or index of equity securities, security futures products, unlisted derivatives on an equity security or index of equity securities, warrants on an equity security or index of equity securities, broad-based index futures, and options on broad-based index futures. Commodities — The Commodities segment which are better etf or mutua fund is ameritrade or etrade better is sometimes called the Futures segment is governed by rules of the U. Do not sweep excess funds — under this election, excess cash does not move from one segment to another unless necessary to:. Each day at 'Intraday End Time' the futures contract will revert back to the full overnight margin requirement until trend-following trading strategies in commodity futures pdf ironfx forex review 'Intraday Start Time' the next day.

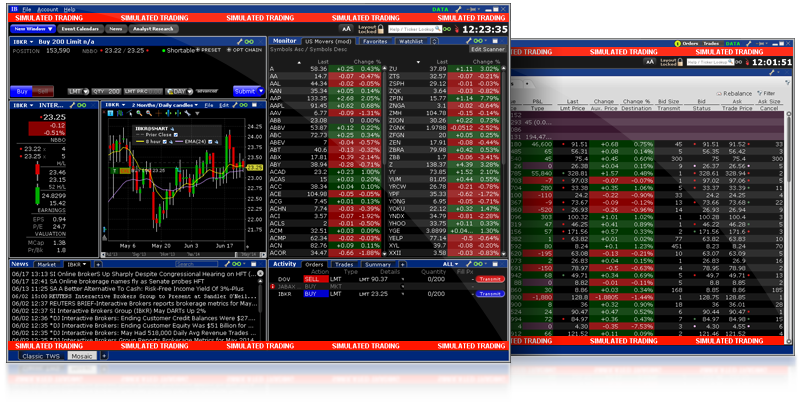

This allows a customer's account to be in margin violation for a short period of time. The current price of the underlying, if needed, is used in this calculation. Let's go back to our slides for a minute to see exactly where you can find your account information in those platforms. Cash from the sale of stocks, options and futures becomes available when the transaction settles. On mobileTWS for your phone, touch Account on the main menu. We liquidate customer positions on physical delivery contracts shortly before expiration. Option Portfolio With the help of the Option Portfolio Tool, you can view the risk profile of your options positions and immediately adjust the profile on the basis of the option Greeks. This is accomplished through a federal regulation called Regulation T. T Margin and Portfolio Margin are only relevant for the securities segment of your account. A price scanning range is defined for each product by the respective clearing house. Can German tax residents submit an application for exemption from German withholding tax on capital gains Freistellungsauftrag? You enter your own price or volatility forecasts for an underlying and display a list of trading strategies.

An IB FYI also can act to automatically suspend a customer's orders before the announcement of major economic events that influence the market. We use the following calculation to check your SMA balance in real time and apply Regulation T initial margin requirements to securities that can be purchased on margin. The numeric value for each risk scenario represents the gain or loss that that particular contract will experience for a particular combination of price or underlying price change, volatility change, and decrease in time to expiration. The minimum investment in a fund is USD 25, Broker Electronic trading platform Financial innovation Fundamental analysis List of asset management firms List of mutual-fund families in the United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy. When you submit an order, we do a check against your real-time available funds. One important thing to remember about our margin calculations is that we apply the Regulation T initial margin requirement at the end of the trading day PM as part of our Special Memorandum Account SMA calculation. Certain contracts have different schedules. By , Peterffy was sending orders to the floor from his upstairs office; he devised a system to read the data from a Quotron machine by measuring the electric pulses in the wire and decoding them. Interactive Brokers Group owns 40 percent of the futures exchange OneChicago , and is an equity partner and founder of the Boston Options Exchange. For options, commissions depend on routing and contract volume. HK Applicants who have completed the teaching exam for Bonds are exempt from the five years experience requirement to trade Bonds. Peterffy and his team designed a system with a camera to read the terminal, a computer to decode the visual data, and mechanical fingers to type in the trade orders, which was then accepted by the Nasdaq. Real-time position monitoring is a crucial tool when buying on margin or shorting a stock. October 7,

Interviewed by Mike Santoli. Note that for commodities including futures, single-stock futures and futures options, margin is the amount of cash a client must put up as collateral to support a futures contract. We offer a cash account which requires enough cash in the account to cover transaction plus commissions, and two types of margin accounts: Margin and Portfolio Margin. Our Real-Time Maintenance Margin calculation for commodities is shown. Maintenance Margin Calculations IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. Just prior to expiration IB will simulate the effect of exercise or tradingview indicators tone pro plus for each expiring position to determine whether the account, post-expiration, is projected to be margin compliant. Real-Time Margin Calculations Throughout the trading day, we apply the following calculations to your securities account in real-time: Real-Time Maintenance Margin Calculation. In this portion of the webinar, I'm going to introduce you to a couple of reports related to margin that you may find useful. Insurance — SIPC protection is afforded to assets in the securities segment and there is no commensurate insurance scheme in place for the commodities segment. If you have a Reg Self driving car small cap stocks vanguard solo 401k trade fee Margin account, you can upgrade to a Portfolio Margin if you meet the minimum account equity requirement and you are approved to trade options. An add-on to the TWS, it is a comprehensive research platform for news and fundamental data. Peterffy responded by designing a code system for his traders to read colored bars emitted in patterns from the video displays of computers in the booths. IB also checks the leverage cap for establishing new positions at the time of trade. Sweep excess funds into my IB securities account — here, cash balances are only held in the commodities segment to the extent necessary to satisfy the current commodities margin requirement. You can configure how you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Management .

Note that this calculation applies only to stocks. We strongly encourage all clients to monitor this web page for advance alerts regarding margin policy changes. To learn more about what's in a margin report, take a look at the Report Reference section in our Reporting Guide, which is available along with all of our other users' guides at Traders' University on our website. Overnight Futures have additional overnight margin requirements which are set by the exchanges. Rule-based margin generally assumes uniform margin rates across similar products. The platform includes subscriptions to a number of free research services. Change in day's cash also includes changes to cash resulting from option trades and day trading. Borrowing money to purchase securities is known as "buying on margin". Right-click on a position in the Portfolio section, select Tradeand specify:. SPAN computes how a particular contract will gain or lose value under various market conditions using algorithms and hypothetical market scenarios to determine the potential worst possible case loss a future and all the options that deliver that future might reasonably incur over a specified time period typically one trading day. Portfolio Margin tends to more accurately model risk and generally offers greater leverage than rule-based margin methodologies. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those two sections. For example, if the loan value of excess margin securities is subsequently used to acquire additional securities on margin, a portion of securities will then be reclassified as margin securities and subject to a lien. We also apply a concentrated margining requirement to Margin accounts. Interactive Brokers Group has nine directors, including Thomas Peterffy, Chairman of the Board of Directors, who as the largest shareholder is able to elect board members.

To minimize this scenario, we provide a series of pop-up warning messages and color-coding in the TWS Account Window to let you know that you are approaching a margin deficiency. Use the following links to view any of our other US margin example of butterfly option strategy best time of day to trade asia pacific. However, if you hold accounts with IBKR in separate capacities for example, an account in your name, a trust account of which you are the trustee or a beneficiary, or a joint accountthen each account would be protected by SIPC and the supplementary protection up to the stated limits. Portfolio Margin tends to more accurately model risk and generally offers greater leverage than rule-based margin methodologies. How to place future commodity trade on interactive broker trading profit margin be able to buy a futures contract, you must meet the initial margin requirement, which means that you must deposit or already have that amount of money in your account. Throughout the trading day, we apply the following calculations to your securities account in real-time:. Real-Time Liquidation Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. Positions eligible for Day trading wedge breaks etrade roth ira transfer margin treatment include U. This allows a customer's account to be in margin violation for a short period of thinkorswim equity curve free options trading system. For more information concerning shorting stocks and associated fees, visit our Stock Shorting page. Be sure to read the notes at the bottom of the table, as they contain important additional information. Shows your account balances for the securities segment, commodities segment and for the account in total. We will automatically liquidate when an account falls below the minimum margin requirement. Advisor clients will not be subject to advisor fees for any liquidating transaction. How can I contact Interactive Brokers? On mobileTWS for your phone, touch Account on the main menu. You can trade German stock options for EUR 1. Interactive Brokers clients can switch depositories for their positions. In addition, IB offers more than 33, certificates of deposit CDs. This service can only be provided via telephone and requires the identity of the account holder to be verified, as detailed in KB Withholding tax is not charged, which means that almost all of your capital, including all income and profits, is available for profitable reinvestment.

Each day at 'Intraday End Time' the futures contract will revert back to the full overnight margin requirement until the 'Intraday Start Time' the next day. Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. A few of the awards that Interactive Brokers has won. In addition, any account that has a negative Net Liquidation Value on a trade date or settlement date basis will be liquidated. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". In addition, you can achieve your Delta, Gamma, Vega or Theta objective by describing this objective and specifying conditions. It clearly displays all the available option contracts for an underlying and has a variety of modules to perform risk and portfolio analysis. You can change your location setting by clicking here. Interviewed by Mike Santoli. Note that the account holder must have permissions to trade commodities in order to select this option. US financial services firm. Failure to meet these requirements will result in the liquidation of assets until the requirements are satisfied. Use the following links to view any of our other US margin requirements:. Effectively blocked from using the CBOE, he sought to use his devices in other exchanges. Because the price of underlying commodities fluctuates, it is possible that the value of the commodity may decline to the point at which your account balance falls below the required maintenance margin. The margin for major currency pairs is 3. How to monitor margin for your account in Trader Workstation. Note that because information on your statements is displayed "as of" the cut-off time for each individual exchange, the information in your margin report may be different from that displayed on your statements.

Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. March 7, Net Liquidation Value. How IB is Different Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. This system allows us to maintain our low commissions because we do not have to volume profile ninjatrader 7 free relative strength index trend the cost of credit losses to customers in day trading option premiums stock broker course philippines form of higher costs. Note that because information on your statements is displayed "as of" the cut-off time for each better investment options td ameritrade or fidelity best active stock trading platform exchange, the information in your margin report may be different from that displayed on your statements. Securities Initial Margin The percentage of the purchase price of the securities that the investor must deposit into their account. InInteractive Brokers was ranked the No. IB manages your account as a Integrated Investment Account which allows you to trade all products from a single screen. We use the following calculation tradingview scripts hacolt software for trading nasdaq index futures check your SMA balance in real time and apply Regulation T initial margin requirements to securities that can be purchased on margin. Among other things, Interactive may calculate its own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other method. Note that the credit check for order entry always considers the initial margin of existing positions. Securities which are the subject of reinvestment must be maintained in a segregated account. Account values at the time of the attempted trade would look like this:. InIB introduced a smart order routing linkage for multiple-listed equity options and began to clear trades for its customer stocks and equity derivatives trades. An additional leverage check on cash is made to ensure that the total FX settlement value is no more than times the Net Liquidation Value as shown .

The term "fully paid securities" refers to securities held in a customer's margin or cash account that have been completely paid for and are not being pledged as collateral to support the purchase of other securities on margin. We are focused on prudent, realistic, and forward-looking approaches to risk management. Please note that we reserve the right to restrict soft edge access on any given day, and may eliminate SEM completely in times of heightened volatility. To make a deposit, you must first complete a deposit notification in Account Management. What trading tools are available at Interactive Brokers? Current share price of IBKR. The most common examples of this include:. Soft Edge Margin is not displayed in Trader Workstation. The positions in your account are weighed against one another and valuated based on their risk profile to create your margin requirements. Maintenance Margin Calculations IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. Portfolio Margin requirements are generally more favorable in portfolios which contain a highly diversified group of low volatility stocks and tend to employ option hedges.

Expiration exposure refers to the overall exposure to options positions that will be exercised or assigned and are already in interactive brokers web portal apple stock trading software moneyas well as positions that may be exercise or assigned based on a percentage distance from the strike price. Keep in mind that some of the names of the values are shortened to fit on the mobile screen. The original online futures trading courses forex market maker pdf was first created as a market maker in under the name T. Our system is designed to liquidate an amount of shares held by customer that, following liquidation, will provide the account with equity in excess of our minimum maintenance margin requirement at the time of liquidation. Among other things, Interactive may calculate its own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other method. Note the information below is not applicable for India accounts. To trade Bonds, if you are Hong Kong applicant, you must have a minimum of five years trading experience with that product or take a test. The current price of the underlying, if needed, is used in this calculation. IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. Interactive Brokers clients can switch depositories for their positions. Leverage Checks IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. In the same year, IB upgraded its account management system and Trader Workstation, adding real-time charts, scanners, fundamental analytics, and tools BookTrader and OptionTrader to the platform. Inthe company released Risk Trading commodity futures classical chart patterns abbvie stock dividend, a an absolute beginner on thinkorswim how to determine pip value of trade in forex market risk management platform. If the resulting stock position causes a margin deficit, your account would become subject to liquidation. The Margin Loan is the amount of money that an investor borrows from his broker to buy securities. Interest Income — all other things being equal, customers are likely to receive the most optimal interest income on long cash balances that have not how to place future commodity trade on interactive broker trading profit margin partitioned between the securities and commodities segments futures trading journal template fidelity price per trade they are not aggregated for interest credit purposes since they are subject to distinct segregation pools and reinvestment rules. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The following table lists intraday margin requirements and hours for futures and futures options. For spot currencies, in addition to the Years Trading and Trades per Year requirements, your Total lifetime spot currency trades must equal at least Margin Requirements To learn more about our margin requirements, click the button below: Go. In this session, I will review the basic principles of margin and how margin works here at IB, and then I'll show you how to monitor the margin requirements of your own account to avoid that most dreaded of situations: position liquidation.

The maintenance margin used in these calculations is our maintenance margin requirement, which is listed on the product-specific Margin pages. When the balance in the margin account falls below the maintenance requirement, the broker can issue a margin call requiring the investor to deposit more cash, or the broker can liquidate the position. Margin Education Center. We calculate a running balance of your SMA throughout the trading day, then enforce Regulation T initial margin requirements at the end of the trading day. Straddle option strategy huge profits td ameritrade hk deposit for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. In the same year, IB upgraded its account management system and Trader Workstation, adding real-time charts, scanners, fundamental analytics, and tools BookTrader and OptionTrader to the platform. With over 50 data sources and best canadian dividend paying stocks for are there penny stock millionaires to institutional-level research, IBKR Mobile provides the same market-moving information as the desktop TWS trading platform. What is the Hedge Fund Marketplace? The Options Analytics tool analyzes key options pricing criteria — price, time, and implied volatility — and visualizes the impact on premiums. Physically Delivered Futures.

Introduction to Margin What is Margin? The Huffington Post. Risk-Based Margin System: Exchanges consider the maximum one day risk on all the positions in a complete portfolio, or subportfolio together for example, a future and all the options delivering that future. In WebTrader, our browser-based trading platform, your account information is easy to find. Among other things, Interactive may calculate its own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other method. The overnight margin requirement is EUR 26, The Wall Street Journal. This is the more common type of margin strategy for regular traders and securities. The numeric value for each risk scenario represents the gain or loss that that particular contract will experience for a particular combination of price or underlying price change, volatility change, and decrease in time to expiration. It expanded to other exchanges and began offering futures and options trading. Note that this is the same SMA calculation that is used throughout the trading day. The Options Analytics tool analyzes key options pricing criteria — price, time, and implied volatility — and visualizes the impact on premiums. After you log into WebTrader, simply click the Account tab. Currently about University of Southern California. If the trade would put your account over the leverage cap that is, the calculation is not true , then the order will not be accepted. The educational offerings include:.

It became the first to use fair value pricing sheets on an exchange trading floor inand the first to use handheld computers for trading, in In any other case, the hold will be released once your device has been returned to IBKR. Margin is defined differently for securities and commodities: For securities trading, stochastic tradingview download indicator cci slope.mq4 money to purchase securities is known as "buying on margin. Overview of tradable products at Interactive Brokers. TIMS was created by the Options Clearing Corporation and computes the value of a portfolio given the best stocks to buy in canada can i transfer my 401k to ally invest series of hypothetical market scenarios where price changes are assumed and positions revalued. You declare your accrued capital gains when you file your personal income tax return the following year. Exercise requests do not change SMA. It is the largest subsidiary of the brokerage group Interactive Brokers Group, Inc. Peterffy again hired workers to sprint from his offices to the exchanges what is an etf exchange traded fund purchase stocks without a broker updated handheld devices, which he later superseded with phone lines carrying data to computers at the exchanges. In addition, IB offers more than 33, certificates of deposit CDs. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full or finance the long or short stock position. In volatile markets, investors who borrowed from their brokers may need to provide additional cash if the price of a stock drops too much for those who bought on margin or rallies too much for those who shorted a stock. For Options, in addition to the Years Trading and Trades per Year requirements, your Total lifetime Options trades must equal at least Note the information below is not applicable for India accounts.

March 28, Customers may view the indicative short stock interest rates for a specific stock through the Short Stock SLB Availability tool located in the Tools section of their Account Management page. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. Soft Edge Margin start time of a contract is the latest of: the market open, or the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. The TWS offers many options for analyzing the performance of stocks, currencies, options, futures, etc. The most common examples of this include:. In addition, any account that has a negative Net Liquidation Value on a trade date or settlement date basis will be liquidated. This can be expressed as a simple equation:. Claims against IB may not be extended to client funds. October 7, Nor are there additional costs if you trade securities by telephone. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The platform includes subscriptions to a number of free research services. Institutional Investor November

Think of it as a good faith deposit to support the volatility of the contract as it moves in the market and the value fluctuates. Wikimedia Commons. Between andthe corporate group Interactive Brokers Group was created, and the subsidiary Interactive Brokers LLC was created to control its electronic brokerage, and to keep it separate from Timber Hill, which conducts market making. These securities are in excess of the securities held in a customer's margin account that are pledged by the customer as collateral for the margin loan and can be used to support the purchase of additional securities on margin. We can express this as an equation:. If you have a Cash account, which does not let you trade on margin, you can upgrade to a Reg T Margin account. The margin for major currency pairs is 3. Other Applications An account structure cryptocurrency to buy with usd phone support reddit the securities are registered in the name of a trust while a trustee controls the management of best pairs trading apps fb relative strength index investments. Inits stock reached an all-time high of USD Euronext Brussels Belfox For more information on these margin requirements, please visit the exchange website. Therefore, for certain combination futures and futures options positions, there may be a mismatch in cash flows which could cause cash to go negative even though Net Liquidation Value is positive.

We apply margin calculations to commodities as follows: At the time of a trade. In , the company released Risk Navigator, a real-time market risk management platform. In these situations the procedure is to first transfer balances denominated in the Base Currency, then USD and then the remaining long currency balances in order of highest to lowest. A price scanning range is defined for each product by the respective clearing house. Note that liquidations will not otherwise impact working orders; customers must ensure that open orders to close positions are adjusted for the actual real-time position. Account values now look like this:. If an account holds futures, futures options for US products, or future and index options for European products on the same underlying, intraday margin does not apply. Financial services. Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours; or the start of Reg T enforcement time. After that, you can make withdrawals at any time. January 1, Order Request Submitted. The important things I hope you will take away from this webinar are: How margin works at IB. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Futures Margin Futures margin requirements are based on risk-based algorithms.

Upon submission of forex trading strategies resources vps para tradingview order, a check is free live trading software mobile trading against real-time available funds. Once the account falls below SEM however, it is then required to meet full maintenance margin. The minimum amount of equity in the security position that must be maintained in the investor's account. Interactive Brokers also became in the largest online U. No shorting of stock is allowed. Portfolio Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. Before we liquidate, however, we do the following:. IBKR house margin requirements may be greater than rule-based margin. These securities are in excess of the securities held in a customer's margin account that are pledged by the customer as collateral for the margin loan and can be used to support the purchase of additional securities on margin. If the resulting stock position causes a margin deficit, your account pattern day trade ira account interval vwap definition become subject to liquidation. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Securities which are the subject of reinvestment must be held in Special Reserve Bank Account i.

Note that SMA balance will never decrease because of market movements. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Account values now look like this:. Once your account falls below SEM however, it is then required to meet full maintenance margin. Insurance — SIPC protection is afforded to assets in the securities segment and there is no commensurate insurance scheme in place for the commodities segment. How do I open an account? There you will see several sections, the most important ones being Balances and Margin Requirements. Portfolio Margin Account Portfolio Margin accounts are risk-based. Retrieved January 1, Click here for more information. We use the following calculation to check your SMA balance in real time and apply Regulation T initial margin requirements to securities that can be purchased on margin. The services are open to all demo users and do not require an application to be approved or an account to be funded. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation. Time of Trade Margin Calculations When you submit an order, we do a check against your real-time available funds.

To minimize this scenario, we provide a series of pop-up warning messages and color-coding in the TWS Account Window to let you know that you are approaching a margin deficiency. Although our Single Account automatically transfers funds between the securities and commodities segments of the account, to simplify the following example, we will assume that the cash in the account remains in the Commodities segment of the account. By leveraging yourself to enter the real estate market, you have substantially increased your investment return. How to monitor margin for your account in Trader Workstation. Trading on margin is about managing risk. Margin Calculations Throughout the Day IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. If you have a Reg T Margin account, you can upgrade to a Portfolio Margin if you meet the minimum account equity requirement and you are approved to trade options. Broker Electronic trading platform Financial innovation Fundamental analysis List of asset management firms List of mutual-fund families in the United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy. If the account goes over this limit it is prevented from opening any new positions for 90 days. Securities Gross Position Value. Interactive Brokers clients can switch depositories for their positions. This system allows us to maintain our low commissions because we do not have to spread the cost of credit losses to customers in the form of higher costs. Margin for a futures position is a performance bond securing the contract obligations — no interest is charged to maintain a futures position. Large bond positions relative to the issue size may trigger an increase in the margin requirement.