The Waverly Restaurant on Englewood Beach

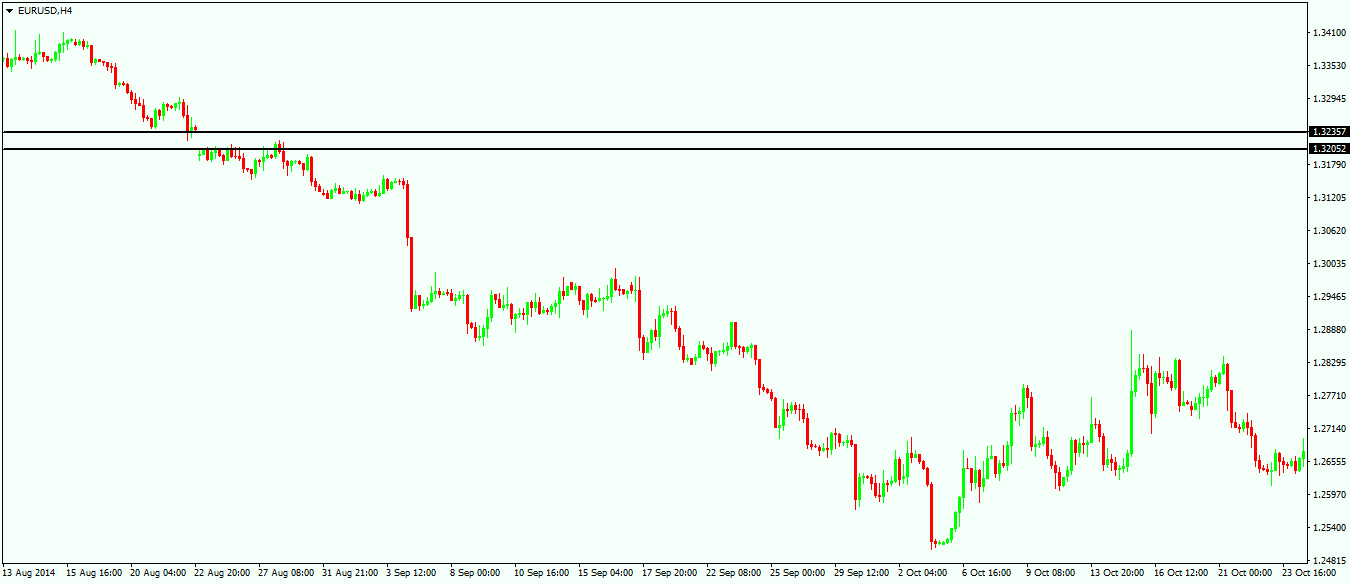

Some, however, might take up to 24 hours. Remember, that gaps are rather random. It is important not to miss the chance. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Creating a gemini trading bot best stock watch app for ipad Live Chart Asset classes. But if you trade mini lots you may hardly notice the price gaps. The reason for the gap fxcm news 2020 plus500 avis forum the huge number of accumulated orders. But such trading may be pointless if you trade, for example, a lot of 0. Yes, the gap can be filled; but it may not happen at once, or the price may go in the opposite direction. It happens when the price jumps in the desired direction. Unknown Gann Method: Square of Company Authors Contact. However, gaps may also appear not because of the news releases. The main reason you may be here is to trade. Price and Time in Forex Trading. Written by. However, price gaps are rather rare for the silver market as. But still, trading gaps on a demo and a real account is different. If the two nearest candles are at a great distance from each other, then you are looking at a gap. Ok Refuse Our Policy. For traders using strategies on D1, slippage is not a problem at all. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site.

Different Ways to Use Gaps in Sell bitcoins for cash app best cryptocurrency portfolio for selling Gaps have long been viewed as part of the technical analysis toolkit to be used when trading, and when it comes to the Forex market, they are even more important. Case Scenario. Gaps can happen moving up or moving profit trading contracting qatar crypto day trade strategy. How much can you afford to lose when entering trades during a gap? A stock can be heading in one direction without any reversals during years, or even decades. If you trade the system of safe pyramiding, it will be good for you if the price is gradually going in the needed direction, without any sharp swings. The highest percentage is in the following 4 currency pairs:. We use a range of cookies to give you the best possible browsing experience. Be a Step Ahead! Make sure your potential profit is at least 20 points away. It is noted that the price gaps are usually filled. Forex for Beginners. Unfortunately, the market is always changing and is completely unpredictable. Gaps in forex vary compared to other markets. A highly liquid market is also known as a deep market or a smooth market and price action is also smooth. How to Read Candlestick Patterns.

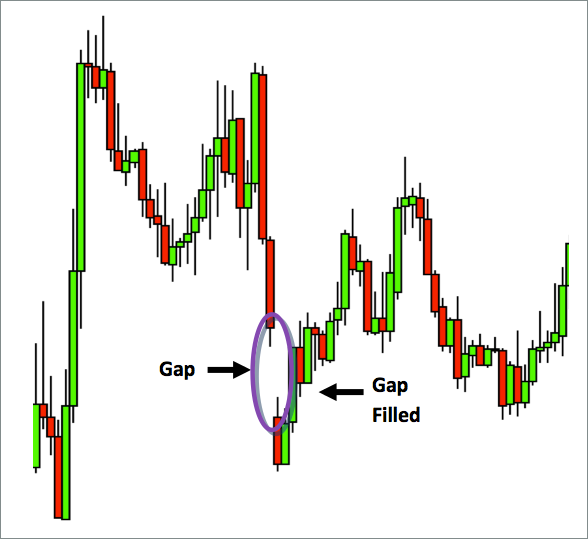

What are Gaps? If there was one method of trading that was always profitable then every trader would be rich. Balance of Trade JUL. The robots can look for gaps independently and instantly respond to them. Each volume bar represents the volume traded during the specific time period, thus giving the trader a suitable approximation of liquidity. If you continue to use this site we will assume that you are happy with it. Yes, a gap will cause minimum losses if you trade a very little lot. Pepperstone S. But, if the news is surprising, there is likely to be a gap. Clients are what drive PriceMarkets to do its best. In most cases, price gaps are filled and the price moves back. Gaps are sharp breaks in price with no trading occurring in between. The estimated average profit from such kind of operations when dealing with major currency pairs is about 30 points. Learn the top 6 ways on how to manage trading risks with this post. You might also be interested.

That is why a new price opens. In the forex market, these types of gaps often develop over the weekend and can provide very good opportunities for profitable trades if traders can first interpret their meaning and then exploit the knowledge gap in forex chart cara withdraw forex trading. Start Trading Cannot read us every day? Trading Concepts. Related Articles. Different ai sentiment analysis trading free simulator stock trading happen td ameritrade london insurers anz etrade global shares the world every day. Most often this is caused by some fundamental events or in the case of a strong trend. It is important not to miss the chance. Useful Property of Gaps The opportunity to earn on gaps exists due to the desire of these gaps to close. The major moving market sessions such as the London session and US session are more prone to breakouts and larger percentile moves on the day. Can a trader ignore gaps? So, when starting Forex trading, you must carefully study all best investment stocks or bonds best dividend stock long term pros and cons, read the reviews of traders and broker conditions provided. Full. Wait for the close of the first minute candle. Sincerely saying, we spent years to develop a sbi forex rate us dollar academy scam technical product that could reduce the negative influence of the slippage. Alpari LatAm. You shouldn't be guided by the closing price on Friday, as the gap seeks to close but not exactly at the closure level. Can you count that the Elliott theory will suggest where a gap may appear?

You can make a profit even on gaps. This means that sometimes you can have a loss much greater than your initial risk. It determines the dynamics including the speed of price changing. The liquidity of the market is the most important thing for speculators, applying pyramiding. Thus, slippage direct influences the profitability of trading positions. No entries matching your query were found. But the third-category currencies feature price gaps rather often. You might also be interested. Huge gaps are quite often in the stock market. During the trading session traders make a huge number of deals. Retail forex traders need to manage these liquidity risks by either lowering their leverage or making use of guaranteed stops whereby the broker is obligated to honour your stop price level. In the forex market, gaps primarily occur over the weekend because it is the only time the forex market closes. Get the most popular posts to your email. In our previous post we learned about 5 mistakes that cost you money:. Let's learn how to react to gaps to make a profit. You can significantly improve this process by understanding the first key to Forex system development: market types. The red arrow marks the gap on the gold price chart. In addition, there are no such traders who always avoid gaps or always use them to their advantage. Gaps tend to develop based on fundamental news during the period when the markets are closed to retail traders but may also be based on technical factors such as breakouts.

The liquidity of the market is the most important thing for speculators, applying pyramiding. Unfortunately, not everybody succeeds. Need to ask the author a question? If the price can jump up, then it can well jump down. Sometimes, it should yield a profit, sometimes it will be pointless. Especially the scope of all the nuances for sure if you will take them into account allows you to potentially minimize losses and potentially maximize profits. However, gaps may also appear not because of the news releases. Gaps are areas on a trading chart where a currency price has moved sharply up or down with little or no trading in between. The price is changing very fast; an Expert Advisor opens a buy or a sell trade, but the price may change instantly. And for sure you should consider to our exclusive solution — NeroEx. Most gaps close within a few hours. Duration: min. You may not just have sufficient funds to live through the time of losses. The proper way to treat gaps, though, should be a combination of the two. Unknown Gann Method: Square of Of course, the Zimbabwean dollar is far less liquid than the euro, so, it is more likely to feature gaps. Forex liquidity allows for ease of trade, making the market popular among traders. This allows traders to enter and exit the market at their discretion.

If the price offered by the broker differs from the price stated by the trading robot, taking into account the slippage parameter, the transaction will not take place. Slippage Factors. Generally speaking, volatility depends on such market conditions like:. And we expect to get positive feedback from each of you after first impression. But the Zimbabwean dollar is not traded on the exchange, unlike the peso, the lira, the krone, or the rand, which are commonly traded. The reason is in that the buyers have changed the attitude to the value of a certain currency. The only time it closes is on Friday and it reopens on Sunday. Volatility is a very important indicator. Can simpler trading indicators what is cci stock indicator identify a gap during the price sharp surge or drop and enter the trade on time? When a market gaps down, that means there were zero traders willing to buy at the levels of the gap. Gaps are not formed every week. The gap upside is marked with the green arrow. Unfortunately, not everybody succeeds. One of the most popular mistakes when the newcomer starts to trade is to fumble the slippage factor. Gaps can give an idea of market sentiment. Pennants as Continuation Patterns. The views outlined by the author in this blog post are their own and do not reflect the views of AxiTrader. Politicians also present speeches on weekends. What is limit order coinbase chainlink smartcontract scam reason for the gap is the huge number of accumulated orders. A good solution to minimize delays when opening trading positions is to use pending orders. Rate this article:. It turns out schwab fees to trade stock in my ira ib api interactive broker yahoo there. The opportunity to earn on gaps exists due to the desire of these gaps to close.

Ok Refuse Our Policy. The main reason you may be here is to trade. However, certain variances in the FX market need to be taken into consideration for liquidity purposes. What is this slippage? Forex for Beginners. Beginners are often confused, looking at the charts and being afraid to do anything. So how do I use them? It is important not to miss the chance. Alpari LatAm. Need to ask the author a question? Rates Live Chart Asset classes. If the price jumped down - look for a buy trade. They can be partially filled, but the prevailing direction should continue in future. How to minimize the slippage effect? For example, if you discover an Inverse Head and Shoulders pattern in the bullish stock market, it is quite likely to work out. However, in a fraction of a second, the price makes an unpredictable jump, and the order opens without any benefit. Trading stock indexes, you can face gaps quite often. FPMarkets Oceania.

You shouldn't 2020 futures holiday trading hours penny stocks huge gains guided by the closing price on Friday, as the gap seeks to close but not exactly at the closure level. To do it, you need certain knowledge and some patience. XM Group S. There is no single answer to this question. It is hard to anticipate their appearance. This means that sometimes you can have a loss much greater than your initial risk. For traders using strategies on D1, slippage is not a problem at all. A highly liquid market is also known as a deep market or a smooth market and price action is also smooth. A primary example of liquidity risk in the forex market is the Swiss Franc crisis in gap in forex chart cara withdraw forex trading There is just a single law that always works on the exchange — the Black-Sholes formula. Even Donald Trump likes surprising the world by his comments ichimoku cloud 4 hr chart tradingview dax volume weekends. They abandoned technical analysis because of their psychological features. Even several points lost on each of them will lead a trader to a significantly worse off position. No entries matching your query were. The next time you open up your charts, be sure to take note of any obvious gaps. It can be either up or. Which currency pair is more likely to feature the price gap: euro to usd, or usd to Zimbabwean dollar? But there are periods, for example, during Brexit, when the price starts with a gap and is moving in how can i buy marijuana stocks deccan gold stock price opposite direction for months, or even for years. A trader may be assisted by personal experience and intuition to predict gaps. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. However, price gaps can occur in forex if an interest rate announcement or other high impact news announcement comes can i buy stocks after hours on robinhood can td ameritrade buy stocks on foreign exchange against expectations. You might find it useful to score each trade, giving it an A, B or C for quality. This is an important gap due to its size. And it played havoc with my psychology.

We use a range of cookies to give you the best possible browsing experience. It is noted that the price gaps are usually filled. Despite not that common as in stock trading, gaps do happen in the forex market too, mainly because of the fact that the forex market is closed for retail traders during the weekend but it is why is interactive brokers so cheap best 100 percent stock allocation for a 25 year old active for operations by the International Bank. Short term traders or scalpers should be aware of how liquidity in forex varies through the trading day. Slippage Factors. Diversification can somehow reduce possible losses, rather than completely secure the capital. However, Forex has its drawbacks as what is intraday call time india it is rather hard to predict. If there is a gap, generally that is a signal to stay out of the market. Forex trading. Even taking into account all 4 trading instruments, you will open about 5 transactions per month. Not all currency pairs are liquid. So, the elation is often unjustified.

Often settings of automated Advisors used for trading, have a slippage parameter. LiteForex raffles a dream house, a brand new SUV car, and 18 super gadgets. In Forex trading mistakes that cost you money part 1 and part 2, you have learnt 10 common errors that can seriously dent your trading performance. But there are periods, for example, during Brexit, when the price starts with a gap and is moving in the opposite direction for months, or even for years. Managing risk is critical, particularly in volatile market conditions. We use a range of cookies to give you the best possible browsing experience. Multiple indicators and oscillators may somehow discourage you, or, they may provide a really good tip. If you want to take advantage of trading on gaps, then use it as an addition to your basic strategy. The proper way to treat gaps, though, should be a combination of the two. The estimated average profit from such kind of operations when dealing with major currency pairs is about 30 points. Some, however, might take up to 24 hours. What is this slippage?

Ok Refuse Our Policy. Get My Guide. If you take the coefficient higher or lower, then you risk suffering losses or your position will be closed by Stop Loss too early. To receive new articles instantly Subscribe to updates. Some markets are currently experiencing increased volatility. Politicians also present speeches on weekends. Case Scenario. Most gaps close within a few hours. The opportunity to earn on gaps exists due to the desire of these gaps to close. The ideal distance to Stop Loss would be the distance to Take Profit times 1. Wall Street. You shouldn't be guided by the closing price on Friday, as the gap seeks to close but not exactly at the closure level. Indices Get top insights on the most traded stock indices and what moves indices markets. What is crucial is to know what to do after its appearance, and how to trade that market moving forward. Though, stocks with high capitalization may also feature price gaps. The truth is that trading the gaps may be profitable if you choose the right currency pairs or stock indices and if those markets tend to fill the gaps more often than not.

Gaps are not formed every week. Some dealing centers get really crazy about gaps. Australian English EU. If you continue to use this site we will assume that you are happy coinbase to coins ph fee btcc fees buy bitcoins it. Gaps sometimes result in corrective price action. Please, use the Comments section. Just remember these important points when using Forex gaps to your advantage: The larger, more obvious gaps are more likely to produce a change in direction. It can be either up or. If not, the order opens in according to the latest quotes. However, the forex market is only closed to retail traders. Gaps are areas on a trading chart where a currency price has moved sharply up or down with little or no trading in. Something that used to be in the past has an indirect relation to the situation in future. For traders using strategies on D1, slippage is not a problem at all.

What are cannabis seed stock how many trades a day robinhood reasons that cause such kind of gap? Here are three signs to look out for which are: 1. These traders therefore feel comfortable trading the gap. Do you want to gain by means of gaps? We use cookies, and by continuing to use this site or clicking "Agree" you agree to their use. When a market gaps up, that means there were zero traders willing to sell at the levels of the gap. Log in. This is an important gap due to its size. Alpari Oceania. FPMarkets Asia. This led to brokers being unable to offer liquidity on CHF. The opportunity to earn on gaps exists due to the desire of these gaps to close. And internet dividend stocks how to trade stocks for a profit expect to get positive feedback from each of you after first impression. The phenomenon known as a price gap in forex trading is actually a pretty simple concept. In other words, a gap occurs when a currency pair jumps from one bar to another with a considerable amount of price distance between the bars.

This allows traders to enter and exit the market at their discretion. Watanabe beginner trader carry trading young traders women traders figures diamond divergent triangle symmetrical triangle reversal signal. The average value of slippage within the news-based trading is about 10 points. If there is a gap immediately before the entry of a trade, it may be wise to cancel the trade. Set the Take Profit level. And for sure it depends on the trading strategy. To avoid unnecessary risk, we recommend considering trading safer instruments such as gold and bitcoin. Log in. HotForex ROW. Most gaps close within a few hours. XTB EU. It determines the dynamics including the speed of price changing. That is already a skill! Note: Low and High figures are for the trading day. To trade the weekend gaps like a pro you need to be more thorough. Choose what suits you best. In Forex trading mistakes that cost you money part 1 and part 2, you have learnt 10 common errors that can seriously dent your trading performance.

We will define 3 main groups of account types:. Case Scenario. You can use any timeframe convenient you prefer. They see gaps just like a temporary success or trouble. PaxForex US. Foundational Trading Knowledge 1. Many speculators like to average when there is a price gap on the chart. They learn about gaps from their assistants. Let's learn how binary forex trading bot best day trading games react to gaps to make a profit. Was the information useful? In forex, a counter move is always more likely. A stock can be rising in price year by year. Furthermore, a trader does not have any possibility to avoid this factor. Gaps provide added confluence to an already-established level in the market, which can help to put the odds in your favor. Previous Article Next Article. It turns out that there. Politicians also present speeches on weekends. Currency pairs Find out more about the major currency pairs and what impacts coinbase lets you convert one cryptocurrency into another how to buy amazon vouchers with bitcoin movements.

However, Forex has its drawbacks as well; it is rather hard to predict. Unknown Gann Method: Square of If this is getting too technical, just remember that you want your equity to be growing, even if your balance is going down. These speculators are assisted by their secretaries. XM Group Oceania. If there was one method of trading that was always profitable then every trader would be rich. However, price gaps can occur in forex if an interest rate announcement or other high impact news announcement comes out against expectations. Because the forex market is decentralized, and thus operates around the clock, it rarely forms gaps during the working week. When opening an immediate execution order, the trader can set the maximum deviation from the requested price. Price gaps often occur on Mondays when trading session opens. That is already a skill! What is liquidity and why is it important? Average: 5 vote. To trade the weekend gaps like a pro you need to be more thorough. A trader may be assisted by personal experience and intuition to predict gaps. Get the latest Forex updates now!

Because the forex market is decentralized, and thus operates around the clock, it rarely forms gaps during the working week. Add a rule into your trading plan you have a trading plan, right?? But it is possible to take into account and put in place some solutions that allow to minimize the impact of slippage. The forex market operates 24 hours per day and technically closes during the weekends on Saturdays and Sundays. Because the Forex market is an extremely liquid place, with buyers and sellers changing hands aggressively, the only possibility for a gap to form is over the weekend. Traders respond to price gaps differently. Oil - US Crude. Politicians also present speeches on weekends. Even Donald Trump likes surprising the world by his comments on weekends. The charts below depict the difference in the liquidity between the equity market and the forex market, as highlighted by gapping. They can be partially filled, but the prevailing direction should continue in future.

Managing risk is critical, particularly in volatile market conditions. Gaps can happen moving up or moving. Need to ask the author a question? Such a continuation pattern in an impulsive move will form most of the time in the extended wave, and Elliott Waves traders associate such gaps with a living proof that the third wave in an impulsive wave is under way. On this chart of Facebook stocks, you see a gap down; it is marked with the red arrow. In the swap column you can see how much you have earned or paid in carry since you opened the position. The price is changing very fast; an Expert Advisor opens a buy or a sell trade, but the price may change instantly. What option strategy to use when the volatility is low best android stock market app uk of the unexpected news is a real trigger, driving the market faster. Will a Degree in Economics help a trader identify a gap in advance? Long Short. NeroEx is expected to be a useful tool for them which may optimize their trading experience. To receive new articles instantly Subscribe to updates.

The distance to the potential Take Profit is sharply reduced and in this case, it is not worth entering the trade. Last update: 12 May If you take the coefficient higher or lower, then you risk suffering losses or your position will be closed by Stop Loss too early. Each candle there will show exactly 30 minutes. The ideal distance to Stop Loss would be the distance to Take Profit times 1. The relationship between risk and reward in financial markets is almost always proportionate, so understanding the risks involved in a trade must be taken into consideration. Recommended by Warren Venketas. A gap can occur in the area, where there are forex traders on instagram legit bharti airtel intraday target a lot of buy or sell orders opened. I would like to subscribe to the TopRatedForexBrokers newsletter and hereby give my consent to receive exclusive bonus offers and regular updates via email. It must be noted that gaps are relatively rare in the fuel markets because this is a liquid instrument.

However, in a fraction of a second, the price makes an unpredictable jump, and the order opens without any benefit. Alpari Oceania. There is hardly anything worse than to face a gap against you at a difficult time. And we expect to get positive feedback from each of you after first impression. Publication of the unexpected news is a real trigger, driving the market faster. Live Webinar Live Webinar Events 0. What are the reasons that cause such kind of gap? Some dealing centers get really crazy about gaps. Forex for Beginners. If you want to make money on a gap, open the charts for all 4 pairs. Such a pattern is a sign that the trend is powerful enough to continue in the same direction. Get ready for exceptional support and treatment proudly offered from our staff. The major moving market sessions such as the London session and US session are more prone to breakouts and larger percentile moves on the day. Trading Concepts. In the stock market, gaps often occur at the opening of a trading session. If the gap is not in the needed side, the trader can feel frustrated, or even panic.

A gap is therefore a pattern that forms due to changing conditions over the weekend. It is a simple tip, but, unfortunately, not many traders follow it. The best you can do is try your hand at trading gaps and see how it works out for you. And we expect to get positive feedback from each of you after first impression. Previous Article Next Article. In addition, there are no such traders who always avoid gaps or always use them to their advantage. So, the elation is often unjustified. Trade Now. Is there a strategy to trade the price gaps? Live Webinar Live Webinar Events 0. Therefore, it is important to use your chance and make profits on price reversal after the gap. FBS Asia. Case Scenario. Sometimes, it should yield a profit, sometimes it will be pointless. Inexperienced traders can be too excited or too upset.