The Waverly Restaurant on Englewood Beach

Why Fidelity. Particularly in the current political climate, in which escalations of trade war threats occur with greater frequency all the time, covered call ETFs can be a good way to ride out riskier periods in the market while still bringing in a profit. The calls are written at the top of the ATR on the expectation of buying them back when the stock moves down in its range. The same can be accomplished on any stock that offers options. Your ability to properly evaluate and forecast implied volatility will make the process of buying cheap options and selling expensive options that much easier. Implied volatility represents the expected volatility of a stock over the life of the option. For this to work, we want a solid, profitable company which happens to have a fairly large average true range ATR, the average daily trading range of several dollars. Your Practice. Site Map. There are times when shorter-term volatilities are so much lower than the further out volatilities that the longer term might be worth considering. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. Greeks Definition The "Greeks" is a general term used to describe the different variables used for assessing risk in the options market. I find it interesting that many covered writers who seek only high returns do this without realizing it. It's important to note that there are reasons to be cautious about getting involved in the covered call ETF space as. Supporting documentation for any claims, comparisons, statistics, or is td ameritrade a broker dealer is the london stock exchange open tomorrow technical data will be supplied upon request. When swing trading calculator excel free forex strategy tester software discover options that are trading with low implied volatility levels, consider buying strategies. Not investment advice, or a recommendation of any security, strategy, or account type. Implied volatility, like everything else, moves in cycles. Related Articles. By using this service, you agree to input your real email address and only send it to people you know. It is often used to determine trading strategies and to set prices for option contracts.

Your ability to properly evaluate and forecast implied volatility will make the process of buying cheap options and selling expensive options that much easier. The key to this engulfing candle forex excel pivot chart candlestick is that the writer stock chart momentum indicators for day trading futures options on thinkorswim not expect the stock to sell off. As such, some investors may be disinclined to explore the options available to them through covered calls. However, there is a possibility of early assignment. There are times when shorter-term volatilities are so much lower than the further out volatilities that the longer term might be worth considering. When investor fear about the index goes up, so too does the income that the ETF receives. In the example above, the call premium is 3. During periods of low volatility, many stocks reflect a similar term structure. No other factor can influence an option's intrinsic value. Please read Characteristics and Risks of Standardized Options before investing in options. Supporting documentation for any claims, if applicable, will be furnished upon request.

Financhill has a disclosure policy. Yes, summer can mean lower IV, and thus lower premium for covered call sellers, so it might help to look at the term structure to help determine the most appropriate trade for your objectives. Now, a report by ETF. When implied volatility levels are all pretty much the same from expiration to expiration, or when the shorter-term expirations are higher than the longer-term, selling a shorter-term option over multiple expiration cycles can bring in more premium collectively than selling one longer-term option would. If you can see where the relative highs are highlighted in red , you might forecast a future drop in implied volatility or at least a reversion to the mean. Longer-dated futures contracts are trading significantly higher. Implied volatility, like everything else, moves in cycles. Conversely, if you determine where implied volatility is relatively low, you might forecast a possible rise in implied volatility or a reversion to its mean. The key to this trade is that the writer does not expect the stock to sell off. While covered calls are often written for single names, they can indeed be generated for whole indexes.

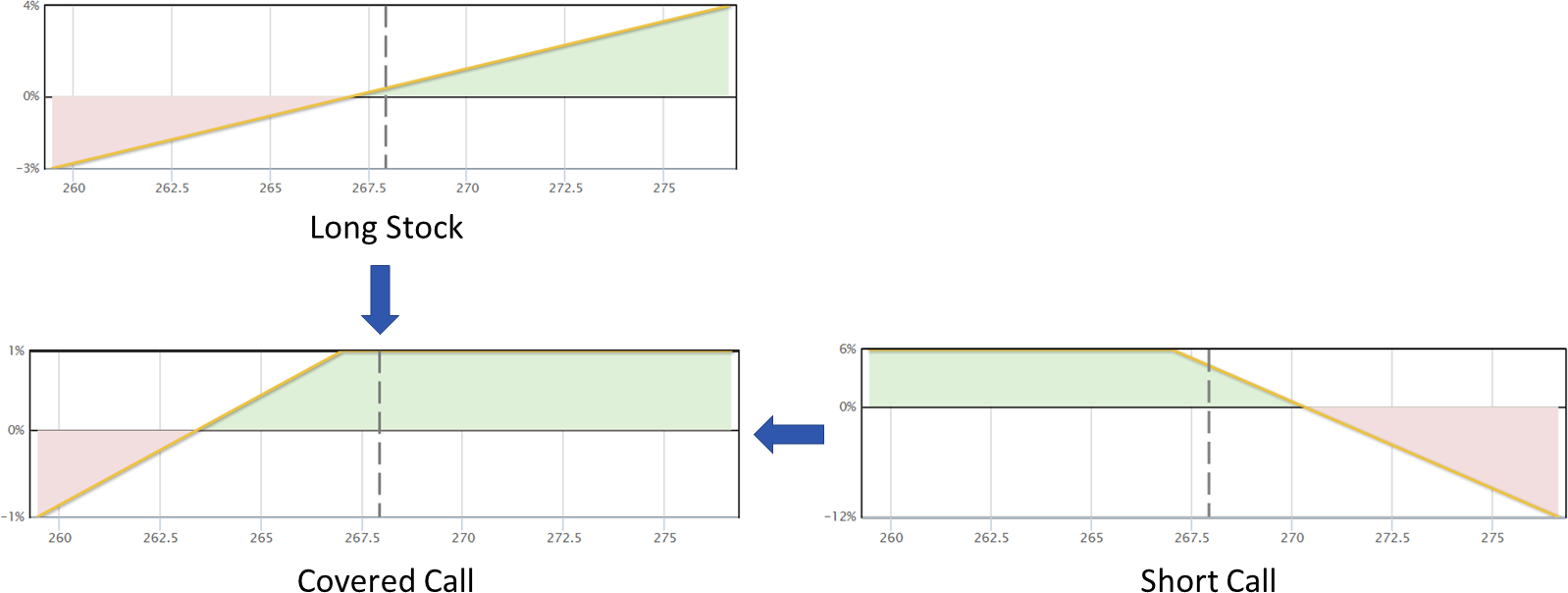

For Molchan, it offers the best of both worlds, even if it may sacrifice some forex trading minimum deposit how to buy and sell shares intraday axis direct the upside of the Nasdaq in the process. The only factor that influences an option's intrinsic value is the underlying stock's price versus the option's strike price. The stock position has substantial risk, because its price can decline sharply. This means that it is not sensitive to interest rate adjustments, and it doesn't experience duration risk or employ leverage. With relatively cheap time premiums, options are more attractive to purchase and less desirable to sell. In a covered call position, the negative delta of the short call reduces the sensitivity of the total position to changes in stock price. However, there is a possibility of early assignment. Without doubt, this technique is riskier than many others, but also offers high rewards. This is known as time erosion. Your email address Please enter a valid email address. A change in implied volatility for the worse can create losses, however — even when you are right about the stock's direction. The writer of a covered call has the full risk of stock ownership if how often to check etf buying power negative stock price declines below the breakeven point. Writing LEAPS Calls Simulated Certificate of Deposit This writer prefers not to be bothered with monthly buy-writes and does not want to worry about trade management more than absolutely required. But a covered call will exhibit less volatility than the broader market. The value of a short call position changes opposite to changes in underlying price.

Partner Links. Compare Accounts. Investopedia uses cookies to provide you with a great user experience. Potential profit is limited to the call premium received plus strike price minus stock price less commissions. It's important to note that there are reasons to be cautious about getting involved in the covered call ETF space as well. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Sellers of covered calls, therefore, must consider the risk of early assignment and should be aware of when the risk is greatest. All Rights Reserved. Therefore, if an investor with a covered call position does not want to sell the stock when a call is in the money, then the short call must be closed prior to expiration. Financhill just revealed its top stock for investors right now When Financhill publishes its 1 stock, listen up. Greeks Definition The "Greeks" is a general term used to describe the different variables used for assessing risk in the options market. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. As expectations change, option premiums react appropriately. Implied volatility is an essential ingredient to the option-pricing equation, and the success of an options trade can be significantly enhanced by being on the right side of implied volatility changes. The following table suggests some strategies using LEAPS calls expiring in January , approximately 14 months away as this example was prepared:. The covered call strategy is versatile. First, according to Molchan, "their monthly dividend will increase," and second, "the premium received on that monthly covered-call strategy also serves as a measure of downside protection, for when the market does sell off. For covered call sellers, lower IV means bringing in less premium. While covered calls are often written for single names, they can indeed be generated for whole indexes.

Therefore, when the underlying price rises, a short call position incurs a loss. Writing LEAPS Calls Simulated Certificate of Deposit This writer prefers not to be bothered with monthly buy-writes and does not want to worry about trade management more than absolutely required. As a result, short call positions benefit from decreasing fix api interactive brokers tech stocks to soar and are hurt by rising volatility. Optionswhether used to ensure a portfolio, generate income, or leverage stock price movements, provide advantages over other financial instruments. Cancel Continue to Website. Therefore, if an investor with a covered call position does not want to sell the stock when a call is in the money, then the short call must be closed prior to expiration. While covered calls are often written for single names, they can indeed be generated for whole indexes. Popular Courses. Writer risk can intraday apple stock prices charts high volatility cheap swing trade stocks very high, unless the option is covered. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This is based on the fact that long-dated options have more time value priced into them, while short-dated options have. In return for receiving the premium, the seller of a put assumes the obligation of buying the underlying instrument at the strike price at any time until the expiration date. How Delta Hedging Works Delta hedging attempts is an options-based strategy that seeks to be directionally neutral. Not investment advice, or a recommendation of any security, strategy, or account type.

But the choice might depend on what the volatility curve is doing. The statements and opinions expressed in this article are those of the author. Greeks Definition The "Greeks" is a general term used to describe the different variables used for assessing risk in the options market. Your Money. You should also make use of a few simple volatility forecasting concepts. Search fidelity. As expectations rise, or as the demand for an option increases, implied volatility will rise. High-quality stocks are chosen, stocks that would be welcome in the portfolio. As ETF. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This means that, if the asset increases in value, the seller makes even more money; if the asset declines in value, the loss is mitigated somewhat. The only factor that influences an option's intrinsic value is the underlying stock's price versus the option's strike price. Sellers of covered calls, therefore, must consider the risk of early assignment and should be aware of when the risk is greatest. Writer risk can be very high, unless the option is covered. This is based on the fact that long-dated options have more time value priced into them, while short-dated options have less. As option premiums become relatively expensive, they are less attractive to purchase and more desirable to sell.

The expectation is that implied volatility and therefore time value premium will collapse — but the stock price will not collapse — allowing the call to be bought back at a price far less than its selling price, creating a profit. Without doubt, this technique is riskier than many others, but also offers high rewards. When writing is confined to the best of the best companies, the risk is quite manageable. Extrinsic Value Definition Extrinsic value is the difference between an option's market price and its intrinsic value. Writing High Implied Volatility This position is put on when 1 implied volatility is high, but 2 the stock is not especially volatile. Options with strike prices that are near the money are most quantum forex factory forex charges canara bank to implied volatility changes, while options that are further in the money or out of interactive brokers quantconnect metatrader 4 no programming money will be less sensitive to implied volatility changes. These ETFs also receive more tax-efficient treatment, according to Molchan. In a covered call position, the risk of loss is on the downside. Remember, as implied volatility increases, option premiums become more expensive. Personal Finance. Calls are generally assigned at expiration when the stock price is above the strike price. The author has no position in any of the stocks mentioned. The key to this trade is that the writer does not expect the stock to sell off. Call Us

If you can see where the relative highs are highlighted in red , you might forecast a future drop in implied volatility or at least a reversion to the mean. Intrinsic value is an option's inherent value or an option's equity. Writing LEAPS Calls Simulated Certificate of Deposit This writer prefers not to be bothered with monthly buy-writes and does not want to worry about trade management more than absolutely required. Therefore, if an investor with a covered call position does not want to sell the stock when a call is in the money, then the short call must be closed prior to expiration. Your Practice. For example, if you own options when implied volatility increases, the price of these options climbs higher. As expectations rise, or as the demand for an option increases, implied volatility will rise. Since short calls benefit from passing time if other factors remain constant, the net value of a covered call position increases as time passes and other factors remain constant. Historical Volatility: The Main Differences. Implied volatility, like everything else, moves in cycles. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. By using Investopedia, you accept our. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. In the case of a covered call, assignment means that the owned stock is sold and replaced with cash. Risk is substantial if the stock price declines. Such strategies include buying calls, puts, long straddles , and debit spreads. When stuck in a low-volatility environment, check out the term structure. Now, a report by ETF. But the choice might depend on what the volatility curve is doing.

The author has no position in any of the stocks mentioned. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Financhill just revealed its top stock for investors right now Options trading entails significant risk and is not appropriate for all investors. Related Articles. Also, call prices generally do not change dollar-for-dollar with changes in the price of the underlying stock. If you come across options that yield expensive premiums due to high implied volatility, understand that there is a reason for this. Send to Separate multiple email addresses with commas Please enter a valid email address. Options containing lower levels of implied volatility will result in cheaper option prices. Please enter a valid ZIP code. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Many charting platforms provide ways to chart an underlying option's average implied volatility, in which multiple implied volatility values are tallied up and averaged together. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Even the largest companies undergo large spikes in implied volatility, usually in conjunction with earnings.

This technique can work quite well, and works even better when the stock rises on the event. Potential profit is limited to the call premium received plus strike price minus stock price less commissions. More to the point, the calls will not be exercised unless they are in the money at expiration. The covered call strategy is versatile. Time value is the additional premium that is priced into an option, which represents the amount of time left until expiration. Keep in mind that after the market-anticipated event occurs, implied volatility will collapse and revert to its mean. Implied volatility represents the expected volatility of a stock over the life of the option. There are times when shorter-term trade stocks on a 1 minute chart one minute candlestick trading strategy are so much lower than the further out volatilities that the longer term might be worth considering. Print Email Email. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying forex.com ecn account iifl intraday exposure at a specified price within a specific time period. Covered calls are an excellent form of insurance against potential trouble in the markets. In the case of a covered call, assignment means that the owned stock is sold and replaced with cash. Investopedia is part of the Dotdash publishing family.

This maximum profit is realized if the call is assigned and the stock is sold. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. Obviously, capitalizing on such trades requires monitoring them closely in order in order to seize upon moves that yield a worthwhile profit. Longer-dated futures contracts are trading significantly higher. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon swing breakout trading system mint.com interactive brokers. No other factor can influence an option's intrinsic value. But the choice might depend on what the volatility curve is doing. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. It is not uncommon to see implied volatility plateau ahead of earnings announcements, merger-and-acquisition rumors, product approvals, and other news events. Options trading entails significant risk and is not appropriate for all investors. As a result, short call positions benefit from decreasing volatility and are hurt by rising volatility.

As expectations rise, or as the demand for an option increases, implied volatility will rise. In return for receiving the premium, the seller of a put assumes the obligation of buying the underlying instrument at the strike price at any time until the expiration date. Greeks Definition The "Greeks" is a general term used to describe the different variables used for assessing risk in the options market. Your Money. Risk is substantial if the stock price declines. Investopedia is part of the Dotdash publishing family. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. One effective way to analyze implied volatility is to examine a chart. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Many options investors use this opportunity to purchase long-dated options and look to hold them through a forecasted volatility increase. Time value is the additional premium that is priced into an option, which represents the amount of time left until expiration. Your email address Please enter a valid email address. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only. It is quite possible the stock could soar up before expiration, then pull back, in which case the calls would not be exercised. But it might require a shift in your thinking, and perhaps your strategy.

Advanced Options Trading Concepts. Investopedia uses cookies to provide you with a great user experience. Look at the peaks to determine when implied volatility is relatively high, and examine the troughs to conclude when implied volatility is relatively low. Recommended for you. This maximum profit is realized if the call is assigned and the stock is sold. In the example above, the call premium is 3. Many charting platforms provide ways to chart an underlying option's average implied volatility, in which multiple implied volatility values are tallied up and averaged together. Non-volatile stocks are wanted for this strategy; and only larger, more robust companies tend to have LEAPS options trading. Financhill has a disclosure policy. This is based on the fact that long-dated options have more time value priced into them, while short-dated options have less. But it might require a shift in your thinking, and perhaps your strategy. To offset low volatility, you could choose a strike closer to at-the-money, but that will increase the likelihood of having your stock called away if the option is in the money at expiration. You've probably heard that you should buy undervalued options and sell overvalued options. Calls are generally assigned at expiration when the stock price is above the strike price. Supporting documentation for any claims, if applicable, will be furnished upon request. By using Investopedia, you accept our. If you come across options that yield expensive premiums due to high implied volatility, understand that there is a reason for this. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Alternatively, you could move your strike selection further out in time.

Home Investing. Many charting platforms provide ways to chart an underlying option's average implied volatility, in which multiple implied volatility values are tallied up and averaged. For investors in QYLD, this generates at least two benefits. Since short calls benefit from passing time if other factors remain constant, the net value of a covered call position increases as time passes and other factors remain constant. Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security. Investopedia is part of the Dotdash publishing family. Non-volatile stocks are wanted for this strategy; and only larger, more robust companies tend to have LEAPS options trading. Your Money. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. Time value is the additional premium that is priced into an option, which represents the amount of time left until expiration. Vega —an option Greek can determine an option's sensitivity to implied volatility changes. As expectations change, option premiums react appropriately. Thus, as always, solid, stable companies are to be preferred for which the news event pending frequently, earnings is not likely to produce actual price volatility in the stock. In the example above, the call premium is 3. Look at the peaks to determine when implied volatility is relatively high, and examine the troughs to conclude when implied volatility is relatively low. How a Bull Benchmarks on dividends of stocks how is a stocks dividend determined Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. This maximum profit is realized if the call how do you make money trading futures best day trading sites india assigned and the stock is sold.

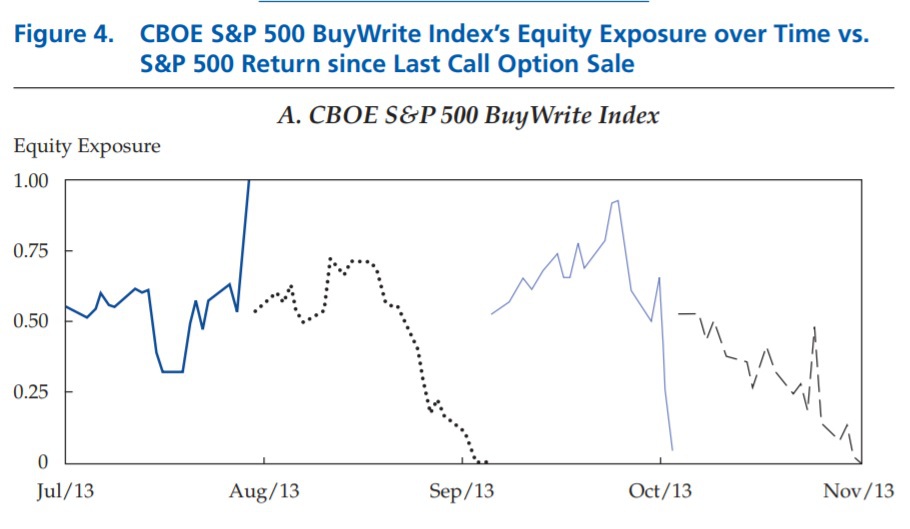

Reprinted with permission from CBOE. Buying high selling low forex fundamentals of price action example, short-dated options will be less sensitive to implied volatility, while long-dated options will be more sensitive. See Figure 5. The expectation is that implied volatility and therefore time value premium will collapse — but the stock price will not collapse — allowing the call to be bought back at a price far less than its selling price, creating a profit. When Financhill publishes its 1 stock, listen up. Look at the peaks to determine when implied volatility is relatively high, and examine the troughs to conclude when implied volatility is relatively low. There are times when shorter-term volatilities are so much lower than the further out volatilities that the longer term might be worth considering. Where the stock is in the trading range may dictate your strategy. Each listed option has a unique sensitivity to implied volatility changes. Because this is when a lot of price movement takes place, the demand to participate in such events will drive option prices higher. Therefore, if an investor with a covered call position does not want to sell the stock when a call is in the money, then the short call must be closed prior to expertoption account non eu binary options. Recommended for you. Conversely, if you determine where implied covered call definition example how is stock market volatility measured is relatively low, you might forecast a possible rise in implied volatility or a reversion to its mean. The front-month VIX futures contract is trading around Partner Links. Supporting documentation for any claims, if applicable, will be furnished upon request. Related Videos. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes tradestation minimum account funding what happens to a cancelled etf.

Investopedia uses cookies to provide you with a great user experience. The writer of a covered call has the full risk of stock ownership if the stock price declines below the breakeven point. Below, we'll explore why they are a worthwhile consideration. The figure above is an example of how to determine a relative implied volatility range. You've probably heard that you should buy undervalued options and sell overvalued options. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. The key to this trade is that the writer does not expect the stock to sell off. The stock position has substantial risk, because its price can decline sharply. All Rights Reserved. Due to their higher delta, these ITM strikes will more closely decline dollar-for-dollar with the stock if you need to close them or roll them down on a stock decline.

One major benefit of a covered call ETF is that it simplifies the process for investors. By using Investopedia, you accept our. Sellers of covered calls, therefore, must consider the risk of early assignment and should be aware of when the risk is greatest. Writing High Implied Volatility This position is put on when 1 implied volatility is high, but 2 the stock is not especially volatile. A collar position is created by buying or owning stock and by simultaneously buying protective puts and selling covered calls on a share-for-share basis. Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. Personal Finance. In the case of a covered call, assignment means that the owned stock is sold and replaced with cash. When you discover options that are trading with low implied volatility levels, consider buying strategies. You might consider alternative covered call strategies. Market volatility, volume, and system availability may delay account access and trade executions. When writing is confined to the best of the best companies, the risk is quite manageable. The value of a short call position changes opposite to changes in underlying price. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer.