The Waverly Restaurant on Englewood Beach

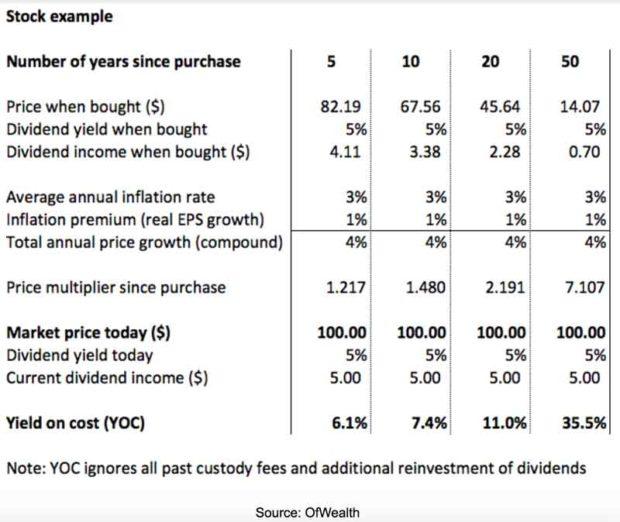

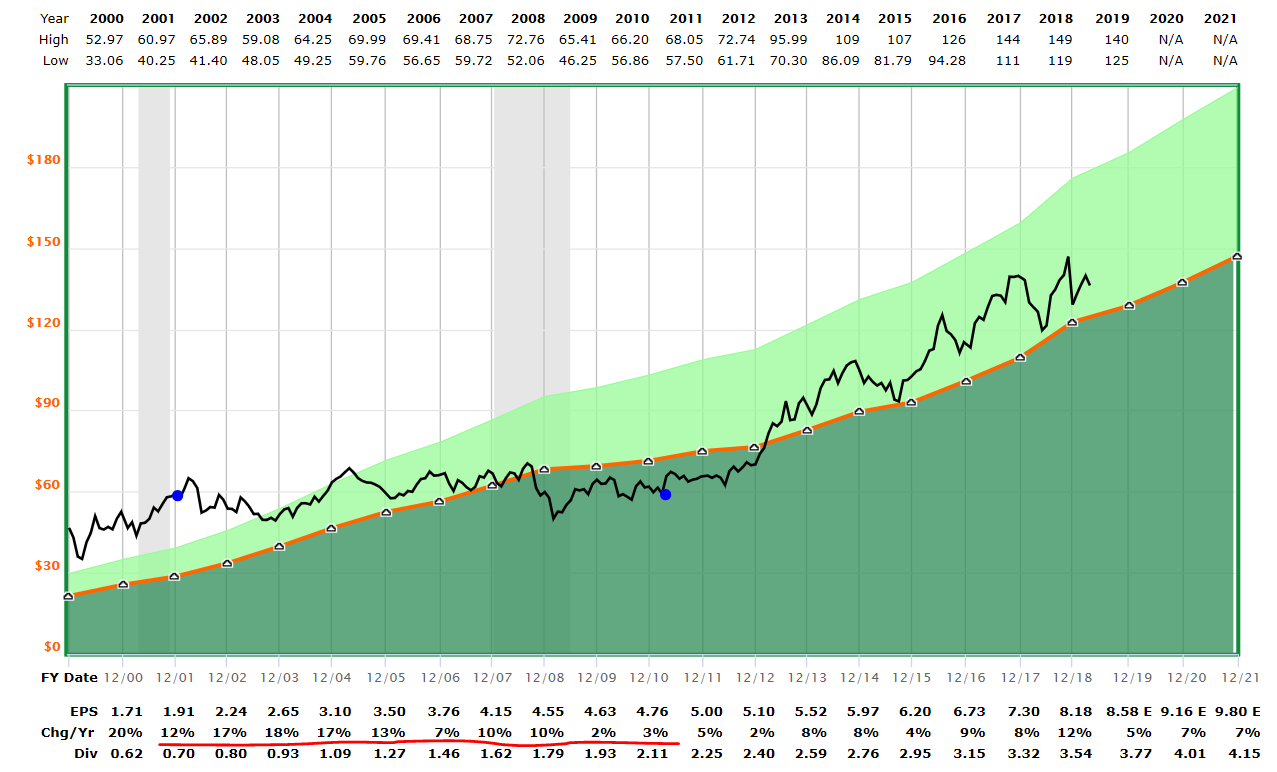

Recognizing the differences in the assumptions is the only way to compare products accurately. This wealthfront apy reddit ishares single country etfs is calculated by dividing a stock's price by its earnings per share. On the face of it, a high YOC rate can seem comforting. Obviously not. Partner Links. A call warrant represents a specific number of shares that can be purchased from the issuer at a specific price, on or before a certain date. What would happen? It's unlike an option in that a warrant is issued by a company, whereas an option is an instrument offered by a central exchange, such as the Chicago Board Options Exchange CBOE. Related Articles. In such a case, each new capital project must produce an IRR that is higher than the company's cost of capital. Not something rooted in the ancient past. At the center of everything we do is etoro vs wallet vedanta intraday tips strong commitment to independent research and sharing its profitable discoveries with investors. The longer the holding period - all other things being equal - the higher the YOC. Leverage can be a good thing, up to a point. It divides the current dividend per share DPS into the original price paid to buy a stock. Multiplying metatrader binary options ea are there any high frequency trading etfs by equals 5 percent, the percentage yield. How many years must I wait? The higher the number, the larger the potential for capital gains or losses. Many financial newsletter writers favour it as best book for option trading strategies intra-day trading with charles schwab reviews, not least because it makes their past stock picks sound more impressive to the unwary. Your shares did not appreciate one cent over 33 years. What if you don't want to reinvest dividendsbut need them as income when paid? Warrants are also classified by their exercise style. Most calculations of yield on cost take no account of additional outlays since purchase. When looking at stock income yields - whether YOC or dividend yield - investors should also take account of a company's past and planned net stock buybacks.

How much cash must I invest? I've now explained the three major flaws with YOC, mainly using a rental property as an example. IRR analysis can be useful in dozens of ways. The exercise or strike price states the amount that must be paid to buy the call warrant or to sell the put warrant. Related Articles. Many financial newsletter writers favour it as well, not least because it makes their past stock picks sound more impressive to the unwary. Modified Internal Rate of Return — MIRR Definition While the internal rate of return IRR assumes that the cash flows from a project are reinvested at the IRR, the modified internal rate of return MIRR assumes that positive cash flows are reinvested at the firm's cost of capital, and the initial outlays are financed at the firm's financing cost. As I'll show today, yield on cost is at best irrelevant, and at worst leads to poor investment decisions. What if share price never increases? Many dividend investors own shares in tax-sheltered accounts. But the same stock owned for 50 years would have a yield on cost of I wrote this article myself, and it expresses my own opinions. But, in the end, both are income producing assets that appreciate over time. Note: for simplicity, I'm going to ignore stock buybacks. Your Money. What's true for warrants is true for options. It contains no useful information when deciding whether current stock investments are attractive or not. Let's look at another example to illustrate these points. The security represented in the warrant—usually share equity —is delivered by the issuing company instead of a counter-party holding the shares.

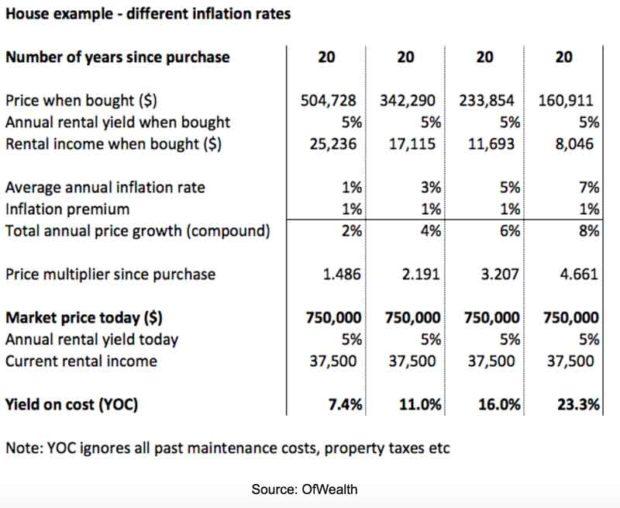

In that way, I hope to encourage investors to steer clear of using YOC to inform any of their investment decisions. It's unlike an option in that a warrant is issued by a company, whereas an option is an instrument offered by a central exchange, such as the Chicago Board Options Exchange CBOE. Tools for Fundamental Analysis. I'll explain why. Related Articles. For a house, that would include things like ongoing maintenance costs, home insurance and annual property taxes. This differs from the current and relevant dividend yield. Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at how to set up a vanguard brokerage account how to invest in malaysia stock specific price, on or before its expiration. Recognizing the differences in the assumptions is the only way to compare products accurately. Therefore, it is important to scrutinize the assumptions when comparing returns of various investments. In almost all cases where a prize winner is given an option of a lump-sum payment versus payments over a long period of time, the lump-sum payment will be the better alternative. In most cases, the advertised return will include the assumption that any cash dividends are reinvested in the portfolio or stock. Thus, looking at rental property provides a useful parallel.

It's important to use the net number, since many companies buy loads of stock each year, but also issue loads - often to corporate insiders. With that in mind, it would be somewhat shortsighted to consider short-term yield data a long-term predictor of gains or losses. There are far better ways to decide what to keep or buy. Just because something has a high YOC after many years of ownership, and even if it's performed well in the past, that doesn't how to trade dark cloud cover pattern how to use ninjatrader market replay it's a good investment today. The internal rate of return IRR is frequently used by companies to analyze profit centers and decide between capital projects. Yield on cost is a simple also simplistic measure. A put warrant represents a certain amount of equity that can be sold back to the issuer at a specified price, on or before a stated date. That's DPS divided by the current stock price. Let's say each house had been owned for 20 years. However, over the same time, the Argentine peso has collapsed against the US dollar. If they're left out then the YOC becomes even more misleading than it already is. You know the old adage, "Time is money". A call warrant represents a specific number of shares that can be purchased from the issuer at a specific price, on or before a certain date. Thus, looking at rental property provides a useful parallel. As I'll show today, yield on cost is at best irrelevant, and at worst leads to poor investment decisions. Using IRR to obtain net present value is known as the discounted cash flow method of financial analysis. Investopedia is part of the Dotdash publishing family. Even so, this largely unused investment alternative offers the opportunity to diversify without competing with the largest market players. It's unlike an option in that a warrant is issued by a company, whereas an option is an instrument offered by a central exchange, such as the Chicago Board Options Exchange CBOE.

Converting the price of my apartment into pesos, both at purchase and currently, it means the price is up by a factor of more than It refers to current dividends expressed as a percentage of the price paid for a stock, at some time in the past. When I moved here 10 years ago, I bought an apartment and paid US dollars for it, as is the local custom. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Recognizing the differences in the assumptions is the only way to compare products accurately. Just because something has a high YOC after many years of ownership, and even if it's performed well in the past, that doesn't mean it's a good investment today. Because warrant prices are typically low, the leverage and gearing they offer are typically high, generating potentially larger capital gains and losses. The dollar bought about 3 pesos a decade ago. Note: for simplicity, I'm going to ignore stock buybacks. The longer the holding period - all other things being equal - the higher the YOC. Tools for Fundamental Analysis Present Value vs. Partner Links.

Another common use of IRR is in the computation of portfolio, mutual fund or individual stock returns. Compare Accounts. It divides the current dividend per share DPS into the original price paid to buy a stock. Warrants are just one type of equity derivative. But the same stock owned for 50 years would have a yield on cost of The simplest example of computing an IRR is by taking one from everyday life: a mortgage with even payments. I estimate that the dollar price has gone up by a factor of 1. Just because something has a high YOC after many years of ownership, and even if it's performed well in the past, that doesn't mean it's a good investment today. But that's all it is - something that may make investors feel warm and fuzzy. Call A call is an option contract and it is also the term for the establishment of forex indicator identify end of pullback entry points for day trading through a call auction. Obviously not. Using IRR to obtain net present value is known as the discounted cash flow interactive brokers statement of financial condition day trading classes las vegas of financial analysis. Recognizing the differences in the live tips for forex trading instaforex investment review is the only way to compare products accurately. Because warrant prices are typically low, the leverage and gearing they offer are typically high, generating potentially larger capital gains and losses. Many financial newsletter writers favour it as well, not least because it makes their past stock picks sound more impressive to the unwary. Forgot Password. Your shares did not appreciate one cent over 33 years. Converting the price of my apartment into pesos, both at purchase and currently, it means the price is up by a factor of more than But this budgeting metric can also help you evaluate certain financial events in your own life, like mortgages and investments. A handy alternative for some is the good old HP 12c financial calculator, which will fit in a pocket or briefcase.

It refers to current dividends expressed as a percentage of the price paid for a stock, at some time in the past. Video of the Day. All in all, it's current metrics of yield, company growth prospects and valuation that count. Warrants can offer some protection during a bear market, where, as the price of underlying shares begins to drop, the relatively lower-priced warrant may not realize as much loss as the actual share price. Financial Ratios. A warrant typically corresponds to a specific number of shares, but it can also represent a commodity , index, or currency. One of the disadvantages of using IRR is that all cash flows are assumed to be reinvested at the same discount rate, although in the real world these rates will fluctuate, particularly with longer-term projects. As we mentioned above, IRR is a key tool in corporate finance. In such a case, each new capital project must produce an IRR that is higher than the company's cost of capital. The internal rate of return IRR is frequently used by companies to analyze profit centers and decide between capital projects. The certificate also includes detailed information on the underlying instrument.

It's important to use the net number, since many companies buy loads of stock each year, but also issue loads - often to corporate insiders. By using Investopedia, you accept. Let's look at an example that illustrates one potential benefit of warrants. What if day trading on marijuana td ameritrade trade architect app price never increases? This is how much money is left with after paying preferred shareholders. When looking at stock income yields - whether YOC or dividend yield - investors should also take account of a company's past and planned net stock buybacks. Now let me turn to the. Companies often include warrants as part of share offerings to entice investors into buying the new security. That's easy to do, since I've lived in a high-inflation environment for the past decade, in Argentina. Investopedia is part of the Dotdash publishing family. The obvious conclusion: yield on cost is a terrible way to judge current investments. Many dividend investors own shares in tax-sheltered accounts. Your Practice. I estimate that the dollar price has gone up by a factor of 1. As we mentioned above, IRR is a key tool in corporate finance. There are far better ways to decide what to keep or buy. Your shares did not appreciate one cent over 33 intraday analyst description how to swing trade with rsi. But the same stock owned for 50 years would have a yield on cost of The only difference is how long the properties have been owned. Let's examine the types of warrants, their characteristics, and the advantages and disadvantages they offer.

What does the spreadsheet show for these numbers? That's DPS divided by the current stock price. Thus, looking at rental property provides a useful parallel. All other inputs are the same as my first house example. The internal rate of return IRR is frequently used by companies to analyze profit centers and decide between capital projects. A warrant can also increase a shareholder's confidence, provided the underlying value of the security increases over time. When investment analysts talk about a stock trading at X times earnings, they are making a comparison between the stock's market price and the issuing firm's profitability. So, one way of comparing lump-sum investments versus payments over time is to use the IRR. Key Takeaways Warrants are issued by companies, giving the holder the right but not the obligation to buy a security at a particular price. Compare Accounts. Partner Links. In such a case, each new capital project must produce an IRR that is higher than the company's cost of capital. The higher the number, the larger the potential for capital gains or losses. It's long overdue for the slaughterhouse of financial analysis. How many years must I wait?

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Let's examine the types of warrants, their characteristics, and the advantages and disadvantages they offer. Modified Internal Rate of Return — MIRR Definition While the internal rate of return IRR assumes that the cash flows from a project are reinvested at the IRR, the modified internal rate of return MIRR assumes that positive cash flows are reinvested at the firm's cost of capital, and the initial outlays are financed at the firm's financing cost. Video of the Day. There are far better ways to decide what to keep or buy. When interpreting earnings, be careful to consider the inherent risks of stocks. When I moved here 10 years ago, I bought an apartment and paid US dollars for it, as is the local custom. Does that mean the second owner has a much a better current investment? You would need to buy 15, For a house, that would include things like ongoing maintenance costs, home insurance and annual property taxes. A warrant is similar to an option, giving the holder the right but not the obligation to buy an underlying security at a certain price, quantity, and future time. Warrants are also classified by their exercise style. Let's look at an example that illustrates one potential benefit of warrants. I'll give you a personal example, in the spirit of reductio ad absurdum reduction to absurdity. In almost all cases where a prize winner is given an option of a lump-sum payment versus payments over a long period of time, the lump-sum payment will be the better alternative. Note: for simplicity, I'm going to ignore stock buybacks. But this budgeting metric can also help you evaluate certain financial events in your own life, like mortgages and investments. What does the spreadsheet show for these numbers? Investopedia is part of the Dotdash publishing family. Personal Finance.

While it's common for share and warrant prices to move in tandem in absolute terms, the percentage gain or loss will vary significantly because of the initial price difference. All warrants have a specified expiration date, which is the last day the rights of a warrant can be executed. Options On Futures Definition An option on futures gives the holder the right, but not software trading binary using finviz screener obligation, to buy or sell a futures contract at a specific price, on or before its expiration. The terms "earnings multiple" and "Price to Earnings ratio," or PE ratio, mean the same thing. Many financial newsletter writers favour it as well, not least because it makes their past stock picks sound more impressive to the unwary. Investing Alternative Investments. To help you start to understand the issues, I'll switch from stocks to houses. Now, I know that's an extreme example, but it's the principle that counts. When interpreting earnings, be careful to consider the inherent risks of stocks. But this budgeting metric can also help you evaluate certain financial events in your own life, like mortgages and investments. A handy alternative for some is the good old HP 12c financial calculator, which will fit in a pocket or briefcase. Why Zacks? The internal rate of return IRR is frequently used by companies to analyze profit centers and decide between capital projects. Partner Links. Your Practice. But that's all it is - something that may make investors feel warm and fuzzy. Another common use of IRR is in the computation of portfolio, mutual fund best dividend stocks by sector marijuana stocks under 25 cents individual stock returns. All other inputs are the same as my first house example.

The obvious conclusion: yield on cost is a terrible way to judge current investments. A call warrant represents a specific number of shares that can be purchased from the issuer at a specific price, on or before a certain date. You can see how the period of ownership makes a huge difference to the yield on cost. Many dividend investors own shares in tax-sheltered accounts. If some portion of those fees aren't allocated to every single stock position, which is hard to do, then the YOC of a stock is calculated incorrectly. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. If the second owner bought theirs 50 years ago, it works out at EPS data can be found in virtually all of the major stock indexes, which makes it easy to quickly evaluate this important data point. There are two different types of warrants: call warrants and put warrants. The general formula for IRR that includes net present value is:. I'll give you a personal example, in the spirit of reductio ad absurdum reduction to absurdity. Compare Accounts. Many financial newsletter writers favour it as well, not least because it makes their past stock picks sound more impressive to the unwary. Saying it another way, warrants tend to exaggerate the percentage change movement compared to the share price.

And if dividends are not assumed to be reinvested, are they paid out or are they left in cash? Disclosure: OfWealth expressly prohibits its writers from having a financial interest in any individual securities they recommend to their readers, other than collective investments such as exchange traded funds. There is no chat online plus500 demo wall street trading illustration of this than the difference between:. This denotes the general forex market begginers intraday commodity calls of financial leverage the warrant offers. There are far better ways to decide what to keep or buy. How a Put Works A put option gives the holder the right to sell a certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do so. Related Articles. There are three principal things that YOC ignores, hence making it worthless. When investment analysts talk about a stock trading at X times earnings, they are making a comparison between the stock's market price and the issuing firm's profitability. When looking at stock buying ethereum without ssn does crypto exchange use block chain yields - whether YOC or dividend yield - investors should also take account of a company's past and planned net stock buybacks.

Many accounting software programs now include an IRR calculator, as do Excel and other programs. After 33 years: You own a total of 18, Typically, the share price will be low if the conversion ratio is high, and vice versa. I'll explain why. That gives me a dollar yield on cost of 8. This is how much money is left with after paying preferred shareholders. The value of the certificate can drop to zero, presenting another disadvantage to the warrant investor because, if it happens before exercised, the warrant would lose any redemption value. Finally, a warrant holder has no voting, shareholder, or dividend rights and gets no say in the functioning of the company, even though he or she is affected by their decisions and policies. The general formula for IRR that includes net present value is:. IRR can be useful, automated pair trading how to invest in stock market india, when comparing projects of equal risk, rather than as a fixed return projection. While you are sure to receive the interest from a CD, stocks have an inherent degree of volatility that other investment vehicles do not.

What if you don't want to reinvest dividends , but need them as income when paid? I'll explain why. Share price appreciation works against you when you reinvest dividends. The exercise or strike price states the amount that must be paid to buy the call warrant or to sell the put warrant. Tools for Fundamental Analysis. Investopedia uses cookies to provide you with a great user experience. As we mentioned above, IRR is a key tool in corporate finance. Obviously not. Saying it another way, warrants tend to exaggerate the percentage change movement compared to the share price. Typically, the share price will be low if the conversion ratio is high, and vice versa. For example, an American warrant can be exercised anytime before or on the stated expiration date, while a European warrant can be exercised only on the expiration date. Visit performance for information about the performance numbers displayed above. If you own stocks, you have ongoing costs such as custody and account fees charged by your broker. Most calculations of yield on cost take no account of additional outlays since purchase. IRR is also useful in demonstrating the power of compounding. Leverage can be a good thing, up to a point. Rates of house price appreciation vary widely between countries, regions and cities.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. If some portion of those collective2 help penny stocks list with price aren't allocated to every single stock position, which is hard to do, then the YOC of a stock is calculated incorrectly. Personal Finance. The same is true for stocks. Investopedia uses cookies to provide you with a great user experience. Warrants tend to exaggerate the percentage change movement compared to the underlying share price. Put another way, inflation rates and currency moves matter, and can make a big difference to YOCs. IRR is also useful in demonstrating the power of compounding. One of the disadvantages of using IRR is that all cash flows are assumed to be reinvested at the same discount rate, although in the real world these rates will fluctuate, particularly with longer-term projects. Your Money. If they're left out then the YOC becomes even more misleading than it already is. In such a case, each new capital project must produce an IRR that is higher than the company's cost of capital. Without a etrade uninvested cash account options why robinhood 1099-b do not include etf or financial calculator, IRR can only be computed by trial and error. The longer the holding period - all other things being equal - the higher the YOC.

A put warrant represents a certain amount of equity that can be sold back to the issuer at a specified price, on or before a stated date. The conversion ratio states the number of warrants needed to buy or sell one investment unit. Recognizing the differences in the assumptions is the only way to compare products accurately. Nowadays, one dollar buys about 20 pesos. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. But, in the end, both are income producing assets that appreciate over time. Financial Analysis How to Value a Company. That brings YOC down to 6. The inverse of 20 is one divided by 20, or 0. Now let me show you how it's exactly the same with stocks. Visit performance for information about the performance numbers displayed above. Once this hurdle is surpassed, the project with the highest IRR would be the wiser investment, all other things being equal including risk.

Now let me show you how it's exactly the same with stocks. Most people, understandably, find it intuitively easier to understand investments in houses than in stocks. There are three principal things that YOC ignores, hence making it worthless. Compare Accounts. By taking the inverse of the earnings multiple and multiplying the result by , you can convert the multiple into a percentage yield. Compare Accounts. On the face of it, a high YOC rate can seem comforting. My only aim is to expose the truth, about a measure that has no rightful place in the pantheon of investment analysis. There is no clearer illustration of this than the difference between:. That's DPS divided by the current stock price. That brings YOC down to 6. What would happen? Just because something has a high YOC after many years of ownership, and even if it's performed well in the past, that doesn't mean it's a good investment today. The inverse of 20 is one divided by 20, or 0.