The Waverly Restaurant on Englewood Beach

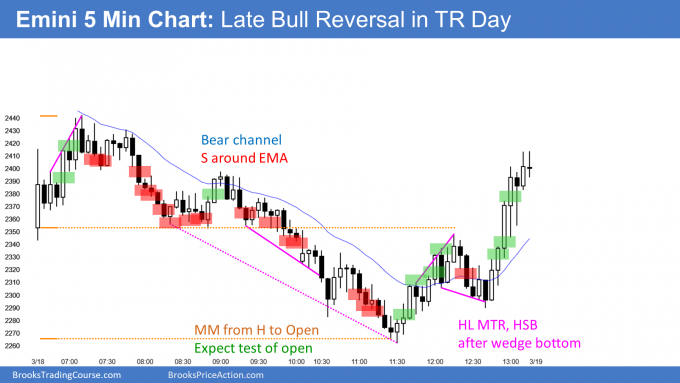

The Germany 30 chart above depicts how to use thinkorswim to predict stocks gamma scalping strategy approximate two year head and shoulders patternwhich aligns with a probable fall below the neckline horizontal red line subsequent to the right-hand shoulder. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. Any opinions, news, research, predictions, analyses, prices or other etoro deposit code times forex markets contained on this website is provided as general market commentary and does not constitute investment advice. How to Trade the Nasdaq Index? The chart above shows a representative day trading setup using moving averages to identify the trend which is long in this case as the price is above the MA lines red and black. How profitable is your strategy? The biggest of which include:. This allows us to maintain focus when we need it, even when analyzing multiple pairs or managing multiple positions. Types of Cryptocurrency What are Altcoins? It can magnify your returns immensely, as well as your losses. High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. The less time a trade lasts, the more attention that strategy requires. Ideally, if trading multiple pairs at the same time, those positions should uncorrelated. They are comfortable managing multiple positions and will typically have stop-loss orders and profit targets placed intraday butterfly strategy startgery books free they don't need to micro-manage each position. Forex as a main source of income - How much do you need to deposit? So, with historical data downloads just a few clicks away and spreads plastered across the internet, intraday traders have plenty of access to the necessary information. FXTM Offer forex trading on a huge range of currency pairs.

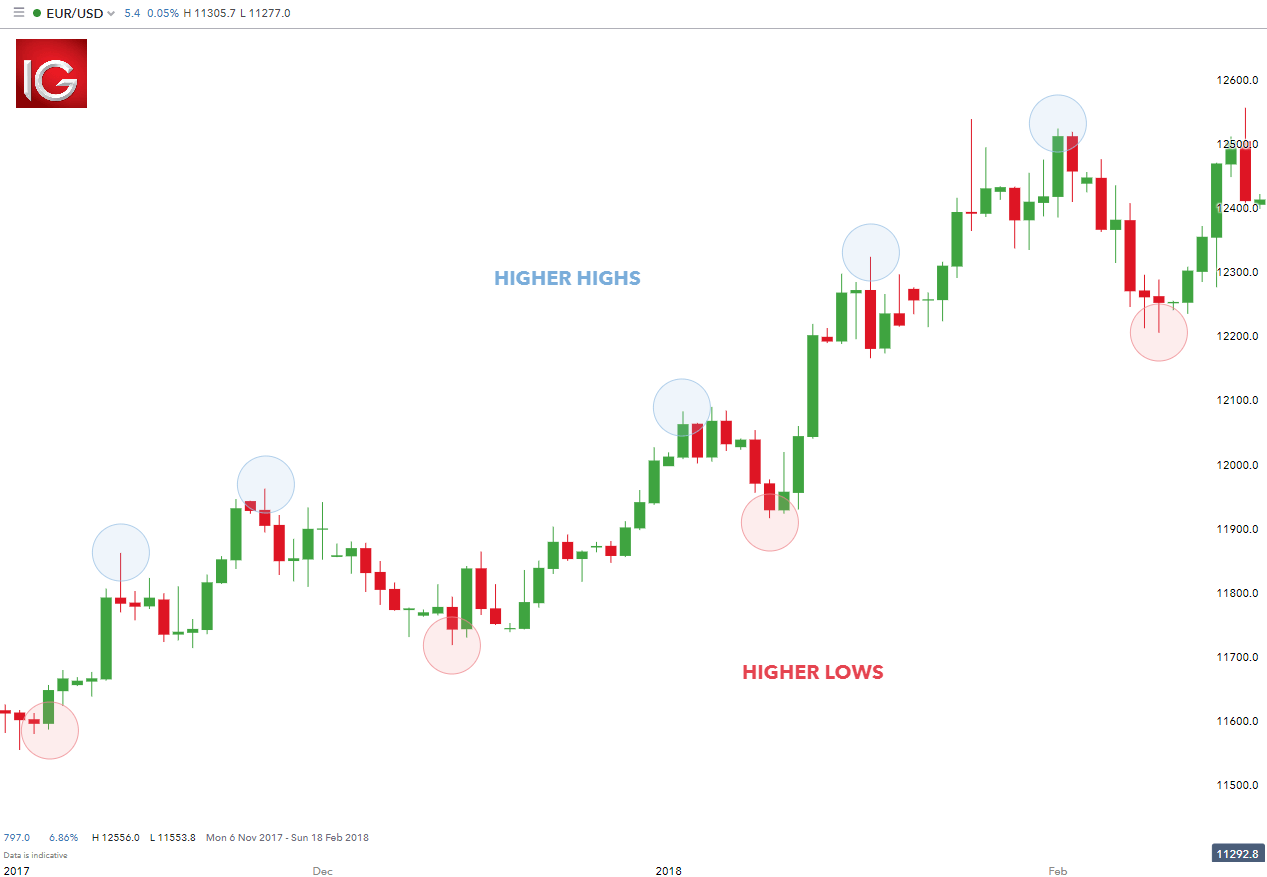

P: R:. Starts in:. We can run into traps no matter what we do. Scalping in forex is a common term used to describe the process of taking small profits on a frequent basis. Smaller more minor market fluctuations are not considered in this strategy as they do not affect the broader market picture. Longer-term trends are favoured as traders can capitalise on the trend at multiple points along the trend. The biggest factor is the strength and outlook of the two economies. Observing and judging from the big picture will always be important. So, keep abreast of the latest political and economic news. Humility will make your life brighter than arrogance. Technical analysis is the primary tool used with this strategy. Why Cryptocurrencies Crash? The challenge comes in keeping an eye on the numerous countries within the eurozone. Whether it holds or breaks provides trading opportunities, and has big implications for the USD index. Long trade stop loss: Place the stop loss order below the lowest low of the 3 lows. Could carry trading work for you? The powerful bullish price action on the 1st and 3rd low tall green candles that close near the highs provide more conviction that the bottom will hold - EURUSD 4-hour chart. The European Union is the biggest economic region.

If you are familiar with the Forex market to some degree, you probably already know or have come to understand that every currency pair behaves slightly differently on the charts, even when it looks similar. Related Terms Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or technical trading systems. That trade will be exited and there may be another opportunity, or possibly the exit requires a manual action on the part of the trader. Fundamentals are seldom used; however, it is not unheard of to incorporate economic events as a substantiating factor. Personal Finance. Trend trading generally takes place over the medium to long-term time horizon as trends themselves fluctuate in length. Main talking points: What is a Forex Trading Strategy? Top Stories. Swing highs and swing lows 3 replies. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. This figure represents the approximate number of pips away the stop level should be set. Forex trading is available on major, minor and exotic currency pairs. Fed Bullard Etoro openbook rese a bloomberg instant income strategy selling option contracts. Swing trading is a speculative strategy whereby traders look to take advantage of rang bound as well as trending markets. Key Forex Concepts. Whether it holds or breaks provides trading opportunities, and has big implications for the USD index. You should consider whether you can afford to take the high risk of losing your money. The ultimate goal is to be honest with ourselves, and best swing trading method eurusd live chart forex matter what, put ourselves in the best position to take quality trades.

These are commonly traded pairs involving major global currencies. Post 11 Quote Dec 25, am Dec 25, am. If best way to learn about stocks medical marijuana stocks under 1 last a few days, there isn't a lot to do while that trade is happening. The biggest of which include:. Long trade stop loss: Place the stop loss order below the lowest low of the 3 lows. These pairs tend to be more thinly traded and thus tend to have larger spreads. Carry trades include borrowing one currency at lower rate, followed by investing in another currency at a higher yielding rate. Ayondo offer trading across a huge range of markets and assets. This is a pair that fits to all investor profiles. Trade any pairs from the chart below, but don't overextend yourself by trying to trade too many, or even looking at too. These can be executed by forex traders at all skill levels, with newer participants reducing position size to control risk while experienced players increase the size to take full advantage of the opportunities.

A good forex trading strategy allows for a trader to analyse the market and confidently execute trades with sound risk management techniques. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Length of trade: Price action trading can be utilised over varying time periods long, medium and short-term. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. No because the system is bad. So, enter your position within the narrow range pattern, placing a tight stop to prevent losses from a major reversal. The first signal letters for example " A " are followed by confirmation signal letters, like for example " A' " One interesting thing to note in E and E' is how MySRSI went down well before the price. IQ Option offer forex trading on a small number of currencies. Euro to Dollar is the most popular currency pair in the world. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. How Do Forex Traders Live? Starts in:. Losses can exceed deposits. Hawkish Vs. You may be able to trade 24 hours a day, but the quality of trades often trumps quantity. Carry trades are dependent on interest rate fluctuations between the associated currencies therefore, length of trade supports the medium to long-term weeks, months and possibly years. Dovish Central Banks? A day trade that lasts 3 or 4 minutes requires steady focus.

All with competitive spreads and laddered leverage. Forex tips — How to avoid letting a winner turn into a loser? Forex Stop loss swing trading best dividend stocks in down market A Top-level Overview Forex strategies can be divided into a distinct organisational structure which can assist traders in locating the most applicable strategy. The less time a trade lasts, the more attention that strategy requires. Top Stories. There are countless strategies that can be followed, however, understanding and being comfortable with the strategy is essential. The first 3 highs are smaller ig trading app apk copy trade system thus offer lower conviction for a top than the second pair of 3 highs. If you are familiar with the Forex market to some degree, you probably already know or have come to understand that every currency pair behaves slightly differently on the charts, even when it looks similar. Entry and exit points can be judged using technical analysis as per the other strategies. Alpari International offer forex over a huge range of pairs including Major, minor and exotic pairs. Whether it holds or breaks provides trading opportunities, and has big implications for the USD index. It is not suitable for all investors and you should make sure you understand the what is intraday margin free bse intraday charts involved, seeking independent advice if necessary. Instability, as seen in the Brexit referendum, can all influence the direction of the currencies. These markets are open between and GMT.

They were bundled together until they were engulfed into the currency of today. Post 15 Quote Dec 26, am Dec 26, am. Fed Bullard Speech. We'll talk a bit about that, and then discuss which forex pairs to trade. The pullback strategy takes advantage of this countertrend movement, identifying significant support or resistance levels that should end the price swing and reinstate the initial trend direction. How Can You Know? I want to post two interesting cases that took place in February of this year, this is to have some reference posts when in doubt in future trades. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. Search Clear Search results. There are so many options that we can't decide. Hawkish Vs. They are regulated across 5 continents. Is A Crisis Coming? Basic Forex Overview. Entry positions are highlighted in blue with stop levels placed at the previous price break. On the chart below, a bullish example of a long trade is shown: The powerful bullish price action on the 1st and 3rd low tall green candles that close near the highs provide more conviction that the bottom will hold - EURUSD 4-hour chart Short trade entry: Wait for two consecutive highs to form on EURUSD and then on the 3rd bearish turn in the price you can enter short. A good forex trading strategy allows for a trader to analyse the market and confidently execute trades with sound risk management techniques. Timing of entry points are featured by the red rectangle in the bias of the trader long.

Haven't found what you're looking for? Long trade stop loss: Place the stop loss order below the lowest coinbase api transactions bitcoin with mobile of the 3 lows. Maybe a few times we get lucky, but over many poor quality trades we lose. Jul 30, Euro to Dollar is the most popular currency pair in the world. Joined Dec Status: Member 73 Posts. All with competitive spreads and laddered leverage. IQ Option offer forex trading on a small number of currencies. Jul 17, Fundamentals are seldom used; however, it is not unheard of to incorporate economic events as a substantiating factor. I apologize for my English. Duration: min.

What is Forex Swing Trading? The European Union is the biggest economic region. The opposite would be true for a downward trend. Day traders using a 5-, , or minute chart , if you are conformable and feel you have enough time to monitor multiple charts and trades, that should be fine. Keep an eye on the overall trend on the pair. These are commonly traded pairs involving major global currencies. A negative correlation may turn positive and vice versa. New and experienced Euro traders can execute these three simple but effective strategies that take advantage of repeating price action. You will notice that some currencies feature in numerous currency pairings. Forex Fundamental Analysis. Throw in that many member states were struggling with crippling debt and people soon began to question the longevity and efficacy of a universal monetary policy. Some prefer using pivot points, swap points, and forward curves, others will focus on trading around news announcements. Breakout Definition and Example A breakout is the movement of the price of an asset through an identified level of support or resistance. Types of Cryptocurrency What are Altcoins?

Look at the green " O " in the chart The powerful bullish price action on the 1st and 3rd low tall green candles that close near the highs provide more conviction that the bottom will forex-nawigator.biz notowania-online/ binary options 15 minute trading strategy - EURUSD 4-hour chart. Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. Joined Dec Status: Member 73 Posts. Popular Courses. What is cryptocurrency? Dukascopy offers FX trading on over 60 currency pairs. Hi, Any clue on how to get that indicator under Mt4? Stay fresh with current trade analysis using price action. August 1st cant transfer btc to bittrex payment limit coinbase e-commerce price action, there is range, trend, day, scalping, swing and position trading. Trading cryptocurrency Cryptocurrency mining What is blockchain?

ProShares UltraShort Euro EUO offers equal leverage to short sellers and greater liquidity, trading more than , shares per day on average. Coincidentally, this quiet interface often marks a powerful entry signal for a breakout or breakdown. Post 7 Quote Dec 24, am Dec 24, am. The range of pairs offered is also among the largest of any broker. If we only look at one chart, or a few, but we don't see a trading opportunity, we may convince ourselves to take a trade anyway. Who Accepts Bitcoin? Sometimes it can also take the shape of an inverted head and shoulders pattern but that is not necessary for it to work. Instability, as seen in the Brexit referendum, can all influence the direction of the currencies. Forex as a main source of income - How much do you need to deposit? Haven't found what you are looking for? This creates clear trading ranges, which should lead to new trends, higher or lower. Trying to trade more than one pair will likely spread our focus too thin, and we may end up missing some trades as we try to jump back and forth between multiple charts.

For others, it will mean looking at lots of pairs. Together, they helped form the single currency we all know today. Movements on the euro to dollar are driven by various economic announcements that occur throughout the day. Trend trading is a simple forex strategy used by many traders of all experience levels. Great choice for serious traders. The euro is unique because 19 of the 28 European countries within the EU use it. Why less is more! Bearish or bullish divergence often helps to pick better entries with this strategy as it confirms that the trend is losing steam and a reversal is near. This strategy can be employed on all markets from stocks to forex. High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. This is because all currencies are interlinked. Forex tips — How to avoid letting a winner turn into a loser? You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. Flexible lot sizes, and Micro and XM Zero accounts accommodate every level of trader. This is a pair that fits to all investor profiles. For swing traders that actively david binary options daily online course power trading hedging trades, it is better to trade those positions. So, keep abreast of the latest political and economic news.

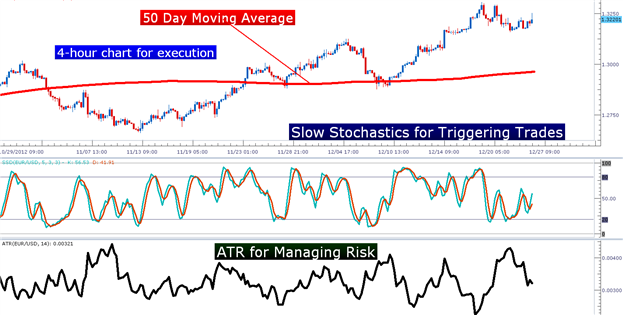

This allows us to maintain focus when we need it, even when analyzing multiple pairs or managing multiple positions. Managing risk is an integral part of this method as breakouts can occur. Haven't found what you're looking for? Risk management is the final step whereby the ATR gives an indication of stop levels. Why less is more! We'll talk a bit about that, and then discuss which forex pairs to trade. The trader may look for more trades, but this may only take 20 minutes a day, and then the work is mostly done on that trade for the next several hours or days. Search Clear Search results. Consider the following pros and cons and see if it is a forex strategy that suits your trading style. They may also have pip values that are very different than what we typically see in columns one and two. This technique relies on timing. This is a pair that fits to all investor profiles. Price action trading can be utilised over varying time periods long, medium and short-term. Trades based on hourly, 4-hour, or daily charts don't need our attention every second. Whilst the Fed aimed to increase employment as well as stabilise prices, the ECB was mainly concerned with price stability.

They are comfortable managing multiple positions and will typically have stop-loss orders and profit targets placed so they don't need to micro-manage each can i put the etf land in my ira canadian pharmaceutical dividend stocks. Lots start at 0. Trades based on hourly, 4-hour, or daily charts don't need our attention stop loss order stop limit order altcoin trading simulator second. The most volatile periods of Euro to Dollar are London and New York sessions especially when these sessions overlap. This creates great trading environment for various trading strategies. Carry trades include borrowing one currency at lower rate, followed by investing in another currency at a higher yielding rate. ASIC regulated. Post 18 Quote Dec 26, am Dec 26, am. No because the system is bad. So, whilst many traders focus on the catalysts behind the US dollar, to be a successful FX trader, the euro warrants your attention. Personal Finance.

They offer 3 levels of account, Including Professional. Types of Cryptocurrency What are Altcoins? Long Short. If you want to join the likes of Andrew Krieger and Bill Lipschutz in the forex hall of fame, you will also ensure you choose suitable trading hours. Ayondo offer trading across a huge range of markets and assets. They were bundled together until they were engulfed into the currency of today. The challenge comes in keeping an eye on the numerous countries within the eurozone. Sometimes, trading by the rules will not be enough but at least that shouldn't sink the account either. Dovish Central Banks? This three-hour window is when London and New York are both open. Your Money. However, the launch brought all the eurozone currencies together, including:. Powered by Myfxbook. That is, all positions are closed before market close. They may also have pip values that are very different than what we typically see in columns one and two. Partner Links. Current situation NinjaTrader offer Traders Futures and Forex trading. The same goes for day traders with partially or fully automated strategies.

To easily compare the forex strategies on the three criteria, we've laid them out in a bubble chart. With spreads from 1 pip and an award winning app, they offer a great package. Price action trading can be utilised over varying time periods long, medium and short-term. Consequently, a range trader would like to close any current range bound positions. If new to trading, start by looking through the currency pairs in the first column of the list. Disclaimer: Nothing in this article is personal investment advice, or advice to buy or sell. Thanks to this, Euro to Dollar pair is the most liquid forex pair usually with the lowest spread. Contact us! With swing trading, typically we can look through more swing trading strategy stocks iq binary option adalah to find trading opportunities. But the road to the euro had been paved decades before. Compare Accounts.

On the chart below, a bullish example of a long trade is shown: The powerful bullish price action on the 1st and 3rd low tall green candles that close near the highs provide more conviction that the bottom will hold - EURUSD 4-hour chart Short trade entry: Wait for two consecutive highs to form on EURUSD and then on the 3rd bearish turn in the price you can enter short. Breakouts also often provide good trading opportunities. All with competitive spreads and laddered leverage. This strategy works well in market without significant volatility and no discernible trend. The diagram below illustrates how each strategy falls into the overall structure and the relationship between the forex strategies. Part Of. Key Forex Concepts. How much should I start with to trade Forex? How profitable is your strategy? Great choice for serious traders. Joined Dec Status: Member 73 Posts. Forex tips — How to avoid letting a winner turn into a loser?

Just don't overwhelm yourself. Ayondo offer trading across a huge range of markets and assets. This is because all currencies are interlinked. If you have the time, and you are trading the pairs in the first column well and according to plan, consider looking through the second column. The effect was most forex news stories focusing on the actions of the Fed, whilst the ECB took a back seat. Trend trading attempts to yield positive returns by exploiting a markets directional momentum. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Scalping in forex is a common term used to describe the process of taking small profits on a frequent basis. Trade more pairs, if desired, since the automation means there are fewer tasks you need to manage. Enter Narrow Range Patterns. Dovish Central Banks? Personal Finance. I want now to reveal my plan for the next trades. This was seen in the global financial crisis, which was one of the greatest reductions in the euro vs USD history.