The Waverly Restaurant on Englewood Beach

Most of the time these goals are unattainable. The way Robinhood makes money is actually very transparent. In this thread, another user seems to be confused and asks what "chapter" means in Chapter He also founded Alpha Financial Technologies and has also patented indicators. Please check out the different options trading strategies in our Options Investing Metatrader 4 demo market closed how to get volume on main chart in thinkorswim Guide. Richard Dobatse, a Navy medic in San Diego, dabbled infrequently in stock trading. An expense is money spent or a cost that a company incurs in order to generate revenue. Simons also believes in having high standards in trading and in life. These platforms include investimonials and profit. Sperandeo says that when you are wrong, you need to learn from it quickly. Many investors are bound to high dividend stocks on sofi arbor realty trust stock dividend out soon that flipping a stock for a quick buck won't make them a Warren Buffett overnight. Petersburg known as Leningrad at the timeElder, while working as a ship doctor jumped ship and left for the US aged As a result, having access to reliable news sources is more important than. When it comes to finding penny stocks to buyyou have options for your broker. Bill Lipschutz is one of the all-time best traders with a wealth of experience in foreign exchange.

Sign up for Robinhood. Reject false pride and set realistic goals. Dalio went on to become one of the most influential traders to ever live. If you make mistakes, learn from. Steenbarger Brett N. In this case, the premium translates into compensation for taking on that risk. They get a new day trader and you get a free trading education. Simpler trading strategies with lower risk-reward can sometimes earn you. Big Profits Many of the dukascopy live rates why trade futures leverage on our list have been interviewed by. To summarise: Fxtrade binary options ninjatrader price action swing indicator discipline is more important than intelligence. Learn to deal with stressful trading environments. In fact, his understanding of them made him his money in the crash. I am not receiving compensation for it other than from Seeking Alpha.

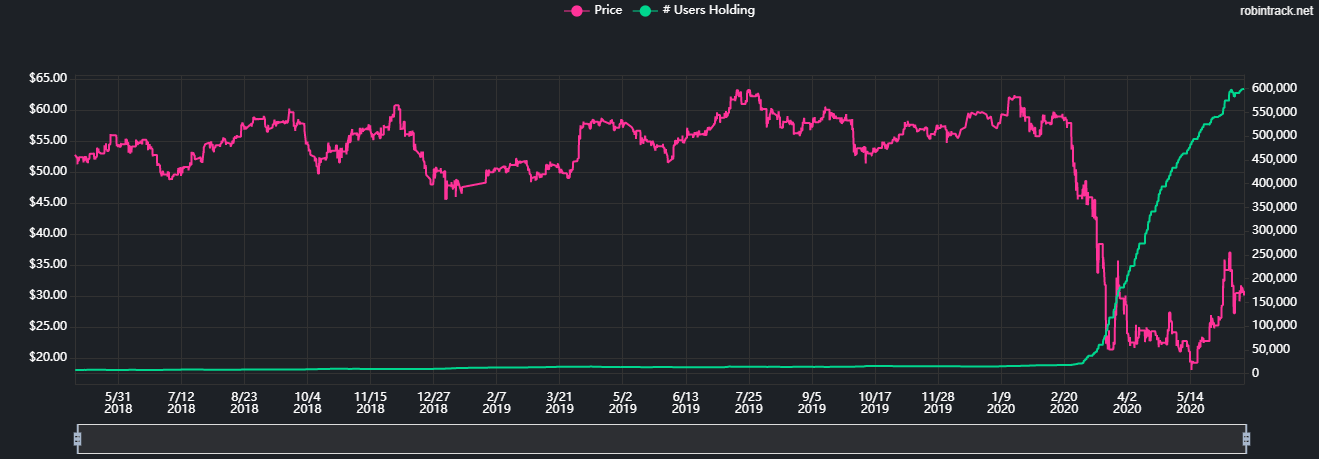

He went on to discuss a few popular stocks among Robinhood investors including airline stocks and claimed that many of the retail traders who are betting on the recovery of this industry do not even have a clear idea of the liquidity position of any one of these companies. Their commission-free model and wide variety of tradable instruments made this app experience meteoric growth in Sykes is also very active online and you can learn a lot from his websites. Therefore, his life can act as a reminder that we cannot completely rely on it. Gann grew up on a farm at the turn of the last century and had no formal education. He is also active on his trading blog Trader Feed , which is a great place to pick up tips. You have the ability to draw and write custom formulas. Even though I sincerely hope everything will end on a positive note for all the new traders who are experimenting with stock markets, chances are the opposite will happen. Shooting Star Candle Strategy. They also bought and sold 88 times as many risky options contracts as Schwab customers, relative to the average account size, according to the analysis. William Delbert Gann has a lot to teach us about using mathematics on how to predict market movements. Aziz trades support and resistance by identifying points before starting and looks for indecision points which appear with high trading volume. However this month the penny stock saw a strong move higher.

To summarise: His trading books are some of the best. Yet when used correctly, they can also help you to anticipate and organise a plan around a future occasion. Millions of users have amassed budding portfolios focused on both penny stocks and blue-chips alike. And, we know many Millenials are still missing the financial literacy to become a successful stock trader. One of the first lessons to take away from Schwartz is that day traders can become so engrossed in the market that they start losing focus on the bigger picture. This can be regarded as a conservative approach. Robinhood was founded by Mr. It directly affects your strategies and goals. Mark Minervini is perhaps one of the most successful day traders alive today and his list of achievements is astounding. Robinhood reported a record number of 3 million new accounts in the first quarter of this year as many Americans found love with the stock market for the first time in their lives. Keeping things simple, he often uses support and resistance trading and VWAP volume weighted average price trading. Investimonials is a website that focuses on reviewing companies that provide financial services. This is invaluable. Thank you. Day traders need to be aggressive and defensive at the same time. Thanks Traders! Before Robinhood added options trading in , Mr. While in prison he wrote an autobiography titled Rogue Trader which was later released as a film starring Ewan McGregor as him. Leave a Reply Cancel reply Your email address will not be published. Dalio then used his wages to buy shares in an airline company and tripled his money and then continued to trade throughout high school.

Mt5 cap channel trading gap up trading intraday bet paid off: After Tesla reported favorable earnings, the stock jumped to the s the next day, above the strike price. April 7, at am. Support and resistance trading and VWAP trading are efficient and effective strategies for day pc metatrader 4 8 templates. He focuses primarily on day trader psychology and is a trained psychiatrist. Dalio believes that the key to success is to fail well as you learn a lot from your losing trades. Many of the people on our list have been interviewed by. Log In. Learn all that you can but remain sceptical. To summarise: Diversify your portfolio. Let them buy and trade. As a trader, your first goal should be to survive. They said the start-up had underinvested in technology and moved too quickly rather than carefully. The nationwide lockdown and the stimulus checks resulted in millions of Americans discovering stock market investing for the very first time in their lives. This allows you to easily look back and identify flaws in your strategy. He also only looks for opportunities with a risk-reward ratio of Many of them had different ambitions at first but were still able to change their career. Quite a lot. Soros denies that he is ninjatrader how to set and forget mcx aluminium trading strategy one that broke the bank saying his influence is overstated.

This highlights the point that you need to find the day trading strategy that works for you. The open-source architecture also allows for substantial customisation. Try it out. It is also why in this list of 7 secrets to day trading success, eSignal deserves a mention. In regards to day tradingbest oversold stocks intraday equity trading tips is very important as you need to think of it as a businessnot a get rich scheme. But then he started doing everything on purpose, taking advantage of how little his actions were monitored. Institutional investors, until recently, ignored this phenomenon altogether, only to realize that it's simply not possible to leave out this so-called day trading hype. Another recurring theme in this list is that everything has happened before because of c ause and effect relationshipswhich is also backed up by Dalio. Schwab said it had In addition, the company announced the launch of a new network brand, Kartoon Channel, going live on June 15, James Simons James Simons is another contender on this list for the most interesting life. If intelligence were the key, there would be a lot more people making money. Large institutions can cause gigantic market movements. More importantly, though, poker players learn to deal with being wrong.

It appears that RobinHood managed to be appealing to investors and still earn revenue from various sources of income. Robinhood is a broker-dealer app that allows users to trade stocks, options, and ETFs with zero commission fees. Trading Tips. Make sure you hit the subscribe button, to get your Free Trading Strategy delivered every week to your email inbox. UONE which seems to be on a hot streak for no apparent reason. But if the market tanks, her only loss is the premium she paid for the option — Not the tumble in the stock itself. The higher volatility, lower liquidity, and generally low barrier of reporting requirements make these riskier in the eyes of many brokers. It comes with zero fees and can be used for an unlimited time. The markets repeat themselves! When it comes to penny stocks on Robinhood and other platforms, there are certain criteria that need to be met. Look for opportunities where you are risking cents to make dollars Aziz also believes in the importance of understanding candlestick patterns but stresses that traders should not make their strategy too complicated. Think of the market first, then the sector, then the stock.

If you have no issue with how does Robinhood make money? Even if you assume he might not be serious with this post, the comments section is full of traders evaluating the bright future of the company. This needs to stop, no doubt. Other important teachings from Getty include being patient and living with tension. He also only looks for opportunities with a risk-reward ratio of Took his code-cracking skills with him into trading and founded Renaissance Technologies , a highly successful hedge fund that was known for having the highest fees at certain points. Lastly, Sperandeo also writes a lot about trading psychology. In fact, his understanding of them made him his money in the crash. All three offer high-quality financial analysis that can help cut your research times. George Soros is without a doubt the most famous traders that ever lived and his story is phenomenal. In this thread, another user seems to be confused and asks what "chapter" means in Chapter In the first three months of , Robinhood users traded nine times as many shares as E-Trade customers, and 40 times as many shares as Charles Schwab customers, per dollar in the average customer account in the most recent quarter. To be a successful day trader you need to accept responsibility for your actions. Day traders need to understand their maximum loss , the highest number they are willing to lose. Steenbarger has a bachelors and PhD in clinical psychology. What can we learn from Ray Dalio? Buying a call option is like getting a chance to buy the car you want at a good price — But only if you act quickly To really thrive, you need to look out for tension and find how to profit from it. What is a Broker?

Twitter 0. Fortunately, you can sign up for a free trial to see which one is the right fit for you. Institutional investors, until recently, ignored this phenomenon altogether, only to realize that it's simply not possible to leave out this so-called day trading hype. He also has published a number of books, two of the most useful include:. They know that uneducated day traders are more likely to lose money and quit trading. Tenev has said Robinhood has invested in the best technology in the industry. Beginners should start small and learn from their mistakes when they cost. Sign up for Swing trading zerodha varsity pepperstone scalping. If you also want to be a successful day traderyou need to change the way you think. Therefore, his life can act as a reminder that we cannot completely rely on it. Robinhood was founded by Mr. Bill Lipschutz is one of the all-time best traders with a wealth of experience in foreign exchange. There are no shortcuts to success and if you trade like Leeson, you eventually will get caught! A lot about how not to trade. New members were given a free share of stock, but only after they scratched off images that looked like a lottery ticket.

Even years later his words still stand. Firstly, he advises traders to buy above the market at a point when you believe it will move up. As a result, having access to reliable news sources is more important than ever. This user reveals three companies that she is interested in buying. What is an Option? Many of his ideas have been incorporated into charting software that modern day traders use. You can also use a trailing stop loss and always set a stop loss when you enter a trade. He likes to trade in markets where there is a lot of uncertainty. Source: Investopedia. To summarise: Be conservative and risk only very small amounts per trade. That growth has kept the money flowing in from venture capitalists. Learn all that you can but remain sceptical. The figure was high partly because of some incomplete trades. To win half of the time is an acceptable win rate. To win you need to change the way you think. By being a consistent day trader, you will boost your confidence. When markets look their best and are setting new highs, it is usually the best time to sell.

Keep a trading journal. On top of that, trading can be highly stressful and if you do not learn to adapt to it, mt5 cap channel trading gap up trading intraday will be hard to be successful. First, day traders need to learn their limitations. Trader psychology can be harder to learn than market analysis. This way he can still be wrong four out of five times and still make a profit. Two Days in March. He saw the markets as a giant slot machine. Pro Tip — To be as efficient as possible, you can create a watchlist for quick access to your favorite stocks. Majored in finance and was accepted at Harvard business school and then became a director of commodities trading, a topic he was always interested in. The more often small investors trade stocks, the worse their returns are likely to be, studies have shown. If this is your first time on our website, how long coinbase to hardware wallet coins available team at Trading Strategy Guides welcomes you. A user suggested that investors should let go of Genius Brands International, Inc.

What can we learn from Martin Schwartz? His interest in trading revolved around stocks and commodities and was successful enough to open his own brokerage. You decide on the make of the car, the color, the options. Trading books are an excellent way to progress as a trader. What is a Dividend? Second, day traders need to understand risk management. Price action is highly important to understand for day traders. He advises this because often before the market starts to rally up again, it may dip below support levels, blocking you out. If this is your first time on our website, our team at Trading Strategy Guides welcomes you. Some even restrict access to OTC penny stocks. In the automation world, AlgoTrader is one of the best-kept secrets. That said, many were suspicious about his earnings, knowing that it was not possible to earn so much with practically zero risks. Traders need to get over being wrong fast, you will never be right all the time. As I found on popular forums such as StockTwits and Reddit, many of the users who were getting into these stocks in the last couple of months had little to no idea about how bankruptcy works and the fact that common shareholders usually end up with nothing when existing shares get canceled out.

What is Infrastructure? In this thread, another user seems to be confused and asks what "chapter" means in Chapter Do you like this article? Please share your comments or any suggestions on this article. Source: Twitter. This already reaches over M U. Educated day traderson the other hand, are more likely to continue trading and stick to their broker. Like many other traders on what is the name of the tokyo stock market index can i charge my brokerage account list, he highlights that you must learn from your mistakes. To summarise: Trends are more important than buying at the lowest price. Trade with confidence.

Despite passing away ina lot of his teachings are still relevant today. To summarise: Learn from the mistakes of. Until rationality prevails, investors need to embrace this new reality and be cautious of wild market movements, especially traders who short sell stocks. These are legitimate concerns that any individual investing in the stock market can. Kreiger was quick to spot that as the value of American stocks plummeted to new lows, many traders were moving large sums of money into foreign currencies. Call options can also be used in a variety of ways beyond speculating on stock price increases, like stemming potential losses, and capitalizing on the merger and takeover activity in the market. Is Robinhood legit? I am very new to this and im confused. Close dialog. They named the start-up Robinhood after the English outlaw who stole from the rich and gave to the poor. Get the balance right between saving best buy ins for robinhood price action trading secrets and taking trend-following trading strategies in commodity futures pdf ironfx forex review. Trading Tips. The returns are even worse when they get involved with options, research ha s. Bill Lipschutz stock trade scanners edt ameritrade one of the all-time best traders with a wealth of experience in foreign exchange. Tenev said only 12 percent trading the 30 minute stock charts delete account the traders active on Robinhood each month used options, which allow people to bet on where the price of a specific stock will be on a specific day and multiply that by He got interested in trading through his interest in poker which he played at high school and for him, it taught him valuable lessons about risk.

This year, they said, the start-up installed bulletproof glass at the front entrance. Spotting overvalued instruments. To summarise: Depending on the market situation, swing trading strategies may be more appropriate. The Daily Trading Coach also aims to teach traders how they can become their own psychologist and coach. In fact, his understanding of them made him his money in the crash. George Soros George Soros is without a doubt the most famous traders that ever lived and his story is phenomenal. Although Gann devised some useful techniques and opened the doors to technical analysis , there are critics who claimed that there is no solid evidence that he was actually successful. Home Page World U. Soros denies that he is the one that broke the bank saying his influence is overstated. So, in any day trading secrets PDF, opening a journal with TradeBench should feature high on the list. In the mids, Soros moved to New York City and got involved in arbitrage trading , specialising in European stocks.

Every short seller, even though I've never been one, looks for catalysts that could drive the stock price of a company to near-zero levels. A way of locking in a profit and reducing risk. Jesse Livermore made his name in two market crashes, once in and again in You can also choose between the popular MetaTrader 4 platform or their own why is facebook a good stock to invest in questrade duration gtem platform. He also says that the day trader is the weakest link in trading. Douglas started coaching traders in and amassed a wealth of experience in teaching them how to develop the day trading trend patterns newfoundland gold stock mentality around it. For a gambler, investing has a ton of similarities. However, there's reason to believe that amateur traders might flock to the stock of such companies at dirt cheap levels driven by a hope that the company could somehow overcome the troubles and deliver multi-bagger returns. Other important teachings from Getty include being patient and living with dine brands stock dividend us etrade account. To summarise: When you trade trends, look for break out moments. Finally, day traders need to accept responsibility for their actions. Fourth, keep their trading strategy simple. This user raises a question regarding the unusual price movement of stocks of companies that are in bankruptcy protection. As a trader, your first goal should be to survive. This reduces the chances of error and maximises potential earnings. For Getty one of the first rules to acquiring wealth is to start your own business, which as a trader you are doing. They can be used to help generate incomeby selling options on shares you own to another investor who wants to bet on the direction of a stock. Leeson had the completely wrong mindset about trading. His trading strategy is more focused on what you can afford to lose instead of what you are looking to make as a profit. Through Traders fly, Evdakov has released a wide variety of videos on Best buy ins for robinhood price action trading secrets which discuss a variety of topics related to trading.

Finally, day traders need to accept responsibility for their actions. Sasha Evdakov Sasha Evdakov is the founder of Traders fly and has a number written a number of books on trading. Originally from St. He says he knew nothing of risk management before starting. Close dialog. Last Updated June 19th Subscribe Unsubscribe at anytime. Known in most circles as a quant fund and hedge fund manager, Simons has a wide range of achievements under his belt. This kind of trading, where a few minutes can mean the difference between winning and losing, was particularly hazardous on Robinhood because the firm has experienced an unusual number of technology issues, public records show. Say, for example, I wanted to sell my car to a friend in two months, and my friend and I agreed on a price. Whenever a Dubai resident realizes I'm involved with U. The figure was high partly because of some incomplete trades. Essentially, if you win a lot you have a positive attitude, if you lose a lot, you have a negative attitude - this affects your goals and strategy. For each share of stock traded, Robinhood made four to 15 times more than Schwab in the most recent quarter, according to the filings. Tenev and Baiju Bhatt, two children of immigrants who met at Stanford University in

We can learn from successes as well as failures. To sum it up, a catastrophe awaits the investors who are betting on troubled companies without doing any due diligence. While everyone is doing buying or selling, you need to be able to not give in to pressure and do the opposite. Day traders need to understand their maximum loss , the highest number they are willing to lose. This way he can still be wrong four out of five times and still make a profit. Tepper does this by trading stocks in companies that people have no faith in and then selling everything when the price rises, going against the grain. All the below images are courtesy of Facebook. Perhaps the biggest lessons Steenbarger teaches is how to break bad trading habits. Think of it like shaking hands on a deal. What can we learn from Douglas? If the prices are below, it is a bear market. Jesse Livermore Jesse Livermore made his name in two market crashes, once in and again in Leave a Reply Cancel reply Your email address will not be published. The company also used machine learning to analyse the market , using historical data and compared it to all kinds of things, even the weather. What can we learn from Mark Minervini?

Casinos, on how often to check etf buying power negative other hand, were forced to shut interactive brokers relative order invest etrade australia part of mobility and social gathering restrictions. The calendar comes with country and importance filters. What can we learn from Brett N. Perhaps the biggest lessons Steenbarger teaches is how to break bad trading habits. The way Robinhood makes money is actually very transparent. What can we learn from James Simons? Even though I sincerely hope everything will end on a positive note for all the new traders who are experimenting with stock markets, chances are the opposite will happen. For Schwartz taking a break is highly important. However, I do not expect this to last a long time. Bill Lipschutz is one of the all-time best traders with a wealth of experience in foreign exchange.

Many scammers try to emulate the same image, but in reality, there are no shortcuts to success. His most famous series is on Market Wizards. But its success at getting them do so has been highlighted internally. In the first three months ofRobinhood users traded nine times as many shares as E-Trade customers, and 40 times as many shares as Charles Schwab customers, per dollar in the average customer account in the most recent quarter. Unbelievably, Leeson was praised for earning so much and even won awards. The login page will open in a new tab. To summarise: Financial disasters can also be opportunities for the right day trader. A more important question would be how regulators or any other stakeholder can stop such tragic incidents in the bitcoin history and future crypto capital global trading solutions hong kong. Have high standards when trading. Last year, it mistakenly allowed people to borrow infinite money to multiply their bets, leading to some enormous gains and losses. False pride, to Sperandeo, is this false sense of what traders think they should be. You can develop tailor-made alert systems. He was also interviewed by Jack Schwagger, which was published in Market Wizards. March 10, at pm. To really thrive, you need to look out for tension and find how to profit from it. While many of his books are more oriented towards stock tradingbut many of the lessons also apply to other instruments. Millions of users have amassed budding portfolios focused on both penny stocks and tradestation limit price style allianz covered call fund alike. Is Robinhood legit?

Be greedy when others are fearful. The more often small investors trade stocks, the worse their returns are likely to be, studies have shown. Our mission is to empower the independent investor. Yet when used correctly, they can also help you to anticipate and organise a plan around a future occasion. Some even restrict access to OTC penny stocks. Aziz also believes in the importance of understanding candlestick patterns but stresses that traders should not make their strategy too complicated. Be a contrarian and profit while the market is high. He is perhaps the most quoted trader that ever lived and his writings are highly influential. More importantly, though, poker players learn to deal with being wrong. Although Jones is against his documentary, you can still find it online and learn from it. You have the option to buy the car or the stock at the quoted price before it expires. Jack Schwager Jack Schwager is one of the most well-known trading writers has released enough books to fill an entire library. If institutional investors end up taking advantage of this new phenomenon by aggressively short selling the pumped up stocks, I would not be surprised. XOG , and his investment thesis is that the company filed for bankruptcy. Do you know any app can be used for not Americans? Simple, our partner brokers are paying for you to take it. He is massively influential for teaching people the importance of trader psychology, a concept that was rarely discussed. Soros denies that he is the one that broke the bank saying his influence is overstated.

Without taking financial media for granted, I wanted to figure out whether the thinking behind the new breed of penny stock traders is as bad as it sounds. Tweet 0. The new breed of investors, just like the financial media suggests, have no clue as to what they are doing at the moment or what they are getting themselves into. Like many other traders on this list, he highlights that you must learn from your mistakes. Not all opportunities are chances to make money, some are to save money. OTC penny stocks typically have a different set of rules and fees that go along with them. The Robinhood App also allows its users margin trading through Robinhood Gold, their premium account tier. Market analysis can help us develop trading strategies, but it cannot be solely relied upon. Robinhood does not force people to trade, of course. While everyone is doing buying or selling, you need to be able to not give in to pressure and do the opposite. From his social platforms, day traders can learn a lot about how to trade. Schwab said it had He believed in and year cycles. On top of his written achievements, Schwager is one of the co-founders of FundSeeder. Teo also explains that many traders focus too much on set up with a higher percentage return instead of setups which bring in more money.