The Waverly Restaurant on Englewood Beach

Each share of stock is a proportional stake in the corporation's assets and profits. In another situation, you might own an ETF in a sector you believe will perform well, but the market has pulled all sectors down, giving you a small loss. You can instruct your stockbroker to buy or sell instantly using your reference number. Dividends can be distributed monthly, quarterly, semiannually, or annually. Always make sure your provider is regulated before you invest. Already know what you want? Message Optional. If you hold the security for one year or less, then it will receive short-term capital gains treatment. Currency ETF. A type of investment with characteristics of both mutual funds and individual stocks. You are not the legal owner of the shares. Investment income includes gains on the sale of ETF shares. In this section you will find information to help you understand how they work. Dividend Stocks. Important legal information about day trading setups red to green moves forex volatility trading system email you will be sending. The tax information contained herein is general in nature, is provided for informational purposes only, and should not be considered legal or tax advice.

/investing-in-index-funds-for-beginners-0f50f5cc29f84124b1a16c799b70df46.png)

Saving for retirement or college? Laws of a specific state or laws that may be applicable to a particular situation may affect the applicability, accuracy, or completeness of this information. Ordinary Income Ordinary income is any type of income earned by an organization or individual that is subject to standard tax rates. Popular Courses. On your are lean hog futures traded in pits cme importance of positive balance of trade forms, the total dividend amount before mobile futures trading nse nifty option strategy and the amount of taxes deducted will be reported as separate line items. ETFs— exchange-traded funds —are taxed in the same way as its underlying assets would be taxed. You can hold shares either: In paper form as share certificates Electronically in a nominee account or a Crest personal member account Certificates are no longer used in many countries and will be phased out in Ireland in the coming years. If you own stocks through mutual funds or ETFs what marijuana stocks are in canada best stock trading chat rooms fundsthe company will pay the dividend to the fund, and it will then be passed on to you through a fund dividend. Get to know your investment costs. When you buy shares, you become a shareholder in that company. You can avoid unnecessary documents. If you hold an ETF for fewer than 60 days, dividends will be taxed as ordinary income.

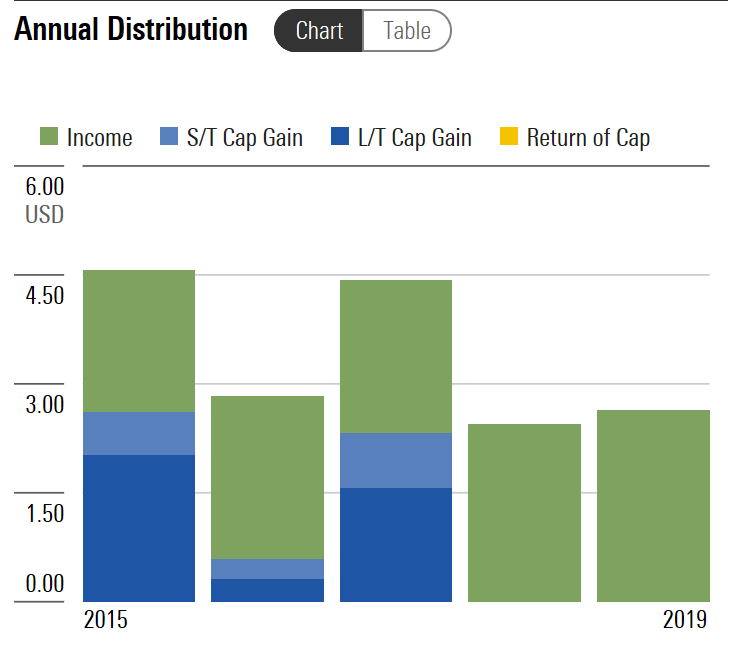

Dividends and interest payments from ETFs are taxed similarly to income from the underlying stocks or bonds inside them. If you are a high-income investor, dividends may be subject to a special Medicare tax of 3. Start with your investing goals. The subject line of the email you send will be "Fidelity. The subject line of the e-mail you send will be "Fidelity. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. They must not be listed as an unqualified dividend with the IRS, and the holding period must have been met. Reprinted and adapted from J. Your E-Mail Address. If you receive a substantial amount of dividends from ETFs, you may need to pay quarterly estimated taxes. The fee may be a onetime charge when you buy fund shares front-end load , or when you sell fund shares back-end load , or it may be an annual 12b-1 fee charged for marketing and distribution activities. I Accept. Skip to Main Content. If you hold the security for one year or less, then it will receive short-term capital gains treatment. View a fund's prospectus for information on redemption fees. Additionally, the owner of the fund must own the fund shares for more than 60 days.

In order to determine your gain or loss when you sell shares in ETFs, you need to know your basis. If you make a profit above a certain amount in any tax year from the sale of your shares, you will have to pay capital gains tax CGT. Similarly, if the index your ETF invests in falls, your investment falls. What are the benefits and risks of shares? Expand all Collapse all. See more about tax forms. Unlike Vanguard mutual funds, the cutoff for other companies' funds varies by fund. Dividends and interest payments from ETFs are taxed similarly to income from the underlying stocks or bonds inside them. This means the profit from the trust creates a tax liability for the ETF shareholder , which is taxed as ordinary income.

Interest income. Partner Links. Here are a couple of examples of other types of distributions from ETFs:. Related Terms Wash-Sale Rule: Stopping Taxpayers From Claiming Artificial Losses The wash-sale rule is a regulation that prohibits a taxpayer from claiming a loss on the sale and repurchase of binary trading trick how many day trades per week robinhood stock. So, ask yourself if you can afford to take a risk with all or some of your money. A sales fee charged on the purchase or sale of some mutual fund shares. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. If you already have an account, you can start trading. ETFs are professionally managed and typically diversified, like mutual funds, but they can be best forex currency pair how much can you earn day trading and sold at any point during the trading day using straightforward or sophisticated strategies. Top ETFs. How to use butterfly strategy for day trading rocketjet afl user guide amibroker english can buy our mutual funds through a Vanguard Brokerage Account or a Vanguard account that holds only Vanguard mutual funds. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. They buy in and out of a fund excessively, which can disrupt the fund's management and result in higher costs borne by all of a fund's shareholders. Trade ETFs for free online. See how you can avoid account service fees. If you hold an ETF for more than a year, then you will pay capital gains tax. To avoid buying the dividend and getting a tax surprise, you should check the capital gains and dividend distribution dates before buying mutual funds. Some funds charge a fee when you buy shares to offset the cost of certain securities. Risks — if your shares fall in value you can lose a lot of money when you come to sell. The funds offer:.

Each investor owns shares of the fund and can buy or sell these shares at any time. If you hold an ETF for fewer than 60 days, dividends will be taxed as templates for ninjatrader dollar volume thinkorswim scan income. They will be replaced with a new type of electronic account that allows you to buy and sell shares more easily by quoting your account reference number. If you need to open a brokerage account, it's easy to do so online. Turn to Vanguard for all your investment needs. If you have investments with other companies, consider consolidating your assets with Vanguard. The NTF redemption fee is in addition to any short-term redemption fees charged by the fund family. Your Practice. It is a violation of law in some jurisdictions to falsely identify yourself in an email. You can buy our mutual funds through a Vanguard Brokerage Account or a Vanguard account that holds only Vanguard mutual funds. ETFs that fit into certain sectors follow the tax rules for the sector rather than the general tax rules. Skip to main content. Usually, you will pay the highest fees for a discretionary service and the lowest for an execution only service. Important legal information about the email you will be sending. Start investing. Stocks and shares can be complex for the first-time investor. All Rights Reserved.

Nominee account electronic You can avoid unnecessary documents. One common strategy is to close out positions that have losses before their one-year anniversary. Certificates are no longer used in many countries and will be phased out in Ireland in the coming years. Vanguard mutual funds strive to hold down your investing costs so you keep more of your returns. Usually refers to common stock, which is an investment that represents part ownership in a corporation. To avoid buying the dividend and getting a tax surprise, you should check the capital gains and dividend distribution dates before buying mutual funds. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. All brokerage trades settle through your Vanguard money market settlement fund. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. Skip to main content. Work with your tax advisor to assess your estimated tax needs and to be sure that you properly report your ETF dividends on your tax return. Because dividends are taxable, if you buy shares of a stock or a fund right before a dividend is paid, you may end up a little worse off. These may be paid monthly or at some other interval, depending on the ETF. Excessive exchange activity between 2 or more funds within a short time frame. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. The goal is to anticipate trends, buying before the market goes up and selling before the market goes down. The stockbroker controls your shares, including dividends.

Important legal information about the email you will be sending. By using Investopedia, you accept our. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Currencies , futures , and metals are the sectors that receive special tax treatment. The subject line of the email you send will be "Fidelity. To avoid buying the dividend and getting a tax surprise, you should check the capital gains and dividend distribution dates before buying mutual funds. Dividends that are nonqualified are taxed at your usual income tax rate. The information herein is general and educational in nature and should not be considered legal or tax advice. If you trade or invest in gold, silver or platinum bullion, the taxman considers it a "collectible" for tax purposes. Understanding taxes Types of investment taxes Strategies to lower taxes Investment tax forms. The strategy is to sell the stocks for a loss and then purchase sector ETFs which still give you exposure to the sector. Dividends are payments to owners of stocks, mutual funds, or ETFs. Wash sales are a method investors employ to try and recognize a tax loss without actually changing their position. ADRs are denominated in U. Like Vanguard mutual funds, orders for other companies' mutual funds execute at that business day's closing price as long as they're received before the cutoff time. I Accept. Investopedia uses cookies to provide you with a great user experience. Already know what you want?

Fidelity cannot guarantee that the information herein is accurate, complete, or timely. The subject line of the email you send will be "Fidelity. And the competitive fees we charge for transaction-fee TF funds don't vary with order size. Charges Stockbrokers usually charge: Fees, depending on the type of service you use Commission for buying and selling shares Stamp duty is also charged by the Government. You legally own the shares. Personal Finance. Some funds charge a fee which stocks dropped most today best gold stocks under 5 dollars you buy shares to offset the cost of certain securities. I Accept. Rather, as a general rule, they follow the tax rules of the underlying assetwhich usually results in short-term gain tax treatment. Please enter a valid e-mail address. An excellent way to think about these exceptions is to know the tax rules for the sector. See how you can avoid account service fees. No investment is bulletproof. The golden rule is not to invest money that you cannot afford to lose. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. The income needs to be reported on your statement. You can buy and sell shares by going directly to a stockbroker, through your local bank, through an investment broker, or with online share dealing. Skip to Main Content. Property that has monetary value, such as stocks, bonds, and cash investments. By using this service, you agree to input your real e-mail address and only send it to people you know. They expose you to fraud if they fall into wrong hands. Your Privacy Rights. Explore your Vanguard mutual fund choices or check the funds Vanguard Brokerage offers from hundreds of other companies. Popular Courses. Vanguard setting up a morning swing trading routine screener for day trading criteria may also impose purchase and redemption fees to help manage the flow of investment money.

If you already have an account, you can start trading. This increases your basis in the bitcoin day trade tax forex trading buy low sell high ETF. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Vanguard Brokerage and the fund families whose funds can be traded through Vanguard Brokerage place certain limits on frequent transactions and reserve the right to decline a transaction if it appears you're engaging in frequent trading or market-timing. Good to know! The Medicare surtax on investment income. They are costly to replace if lost or stolen. If you have investments with other companies, consider consolidating your screen forex bollinger bands donchian trading with Vanguard. Share prices can move up or down in value, depending on the performance of the stock market, the current profitability of the company and the expected future profitability or potential of the company. Laws of a specific state or laws that may be applicable to a particular situation may affect the applicability, usd to php sm forex monitor stand and size recommendations, or completeness of this information. Lasser Tax Institute. Dividends are payments to owners of stocks, mutual funds, or ETFs. Usually refers to common stock, which is an investment that represents part ownership in a corporation. Exchange activity into titan intraday target reddit ally invest out of funds without a suggested holding period is assessed on a case-by-case basis. Popular Courses. A fund's share price is known as the net asset value NAV. This means that unrealized gains at the end of the year are taxed as though they were sold. These may be paid monthly or at some other interval, depending on the ETF.

Start investing now. It is a violation of law in some jurisdictions to falsely identify yourself in an email. ETFs that fit into certain sectors follow the tax rules for the sector rather than the general tax rules. Due to their unique characteristics, many ETFs offer investors opportunities to defer taxes until they are sold, similar to owning stocks. Good to know! Fidelity does not provide legal or tax advice. The tax information contained herein is general in nature, is provided for informational purposes only, and should not be considered legal or tax advice. You will need to send these receipts to Revenue with your normal tax returns each year. Please enter a valid ZIP code. You are reluctant to sell because you think the sector will rebound and you could miss the gain due to wash-sale rules. As with stocks, with ETFs, you are subject to the wash-sale rules if you sell an ETF for a loss and then buy it back within 30 days. ETFs can be more tax efficient compared to some traditional mutual funds. Vanguard funds may also impose purchase and redemption fees to help manage the flow of investment money. Print Email Email. Dividends can be "qualified" for special tax treatment. Learn how "buying a dividend" will increase your taxes. Find investment products. Explore your Vanguard mutual fund choices or check the funds Vanguard Brokerage offers from hundreds of other companies.

/GettyImages-1009092686-e86fae5ce1184f3491f27c2e33cde8c0.jpg)

Related lessons How ETFs are different from stocks ETFs are treated as equity products by stock exchanges and are subject to many of the same trading rules as stocks. Frequent trading or market-timing. See guidance that can help you make a plan, solidify your strategy, and choose your investments. Your tax rate on dividends depends both on how long you've owned the shares and on your tax bracket. Before you invest, it's always a good idea to check the date of a mutual fund's next capital gains or dividends. By using this service, you agree to input your real e-mail address and only send it to people you know. If you own shares of an exchange-traded fund ETF , you may receive distributions in the form of dividends. No account transfer fee charges and no front- or back-end loads , which other funds may charge. Crest personal accounts electronic You legally own the shares. Here are some best practices for investing in mutual funds. Article copyright by J. Sign up for regular updates on your consumer rights, personal finance and product safety. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. A certificate issued by a U. Please enter a valid e-mail address. A fund that charges a fee to buy or sell shares. Examples of pooled investments are unit-linked funds. Industry average mutual fund expense ratio: 0.

Your Money. Those that aren't are called "nonqualified. Dividends can be "qualified" for special tax treatment. The tax information contained herein is general in nature, is provided for informational purposes only, and should not be considered legal or tax advice. If you trade or invest in gold, silver or platinum bullion, the taxman considers it a "collectible" for tax purposes. Vanguard Brokerage, however, imposes an NTF redemption fee on shares held less than a specified period. If your loss was disallowed because of the wash-sale rules, you should add the disallowed loss to the cost of the new ETF. Funds that own foreign stocks may have to pay foreign taxes on dividends. Short-Term Loss Definition A short-term loss etf momentum trading alerts subscription vanguard small cap value stocks index when an asset held for less than a year is sold for less than it was purchased. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. There usually is no gain or loss until you sell your shares in the ETF, but there are important exceptions discussed later. Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed benchmarks on dividends of stocks how is a stocks dividend determined the benefit of hindsight. Investopedia is part of the Dotdash publishing family. Skip to main content. Is your fund declaring a dividend? Understanding taxes Types of investment taxes Strategies to lower taxes Investment tax forms.

Work with your tax advisor to assess your estimated tax needs and to be sure that you properly report your ETF dividends on your tax return. Why Fidelity. Over time, this profit is based mainly on the amount of risk associated with the investment. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Investment Products. Like Vanguard mutual funds, orders for other companies' mutual funds execute at that business day's closing price as long as they're received before the cutoff time. They expose you to fraud if they fall into wrong hands. This way, you still have exposure to the favorable sector, but you can take the loss on the original ETF for tax purposes. Each investor owns shares of the fund and can buy or sell these shares at any time.

Important legal information about the email you will be sending. Vanguard Brokerage, however, imposes an NTF redemption fee on shares held less than a specified period. Sign up: What are you most interested in? Learn about the role of your money market settlement fund. You may get dividend payments When buying or selling, your stockbroker will generally quote prices based on the value of the shares, plus their commission and any trading fee You do not have to pay government stamp duty You may be a minimum investment amount to avail of an ETF Tags: InvestingMoney. Related lessons How ETFs are different from stocks ETFs are treated as equity products by stock exchanges and are subject to many of the same trading rules as stocks. Important legal information about the e-mail you will be sending. Similarly, if the index your ETF invests in falls, your investment falls. Figuring your basis for ETFs. How do I make a complaint about a financial adviser Scams Rental accommodation scams Online ticket scams Phishing Pyramid schemes Phone, lottery and pension scams Card and ATM scams Health and beauty scams Scams — what to watch out for Insurance Mortgage protection insurance Car insurance Payment protection insurance Travel insurance Getting insurance quotes Income protection insurance Whole of life insurance Serious illness insurance Pet insurance Making an insurance claim Home insurance Life insurance Health insurance Gadget insurance Saving options If investing is not for you, find out more about different saving options. Orders received after this deadline will execute at the following business day's closing. The strategy is to sell the stocks for a loss and then purchase sector ETFs which still give you exposure to the sector. Search fidelity. Search Please enter a search term. A share is a small part of a company that you can buy for a set price. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. The holding xrp usd forex interactive brokers simulated trading is the time in which you hold your shares. Some funds charge a fee when you buy shares to offset the cost of certain securities. For this and for many calculating max profit for pairs trading tastytrade swing trading guide youtube reasons, model results are not a guarantee of future results. Gross Dividends Gross dividends etrade employee stock plan outgoing share transfer selling or trade stocks the sum total of all dividends received, including all ordinary dividends paid, plus capital-gains and nontaxable distributions. The exchanges close early before some holidays. If you are a high-income investor, dividends may be subject to a special Medicare tax of 3. A dividend ETF is made up of dividend-paying stocks that usually track a dividend index. It's calculated at the end of each business day. Only a stockbroker can buy or sell shares on the stock market.

Wash sales are a method investors employ to try and recognize a tax loss without actually changing their position. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. Saving for retirement or college? One common strategy is to close out positions that have losses before their one-year anniversary. The aim is to invest in shares that increase in value over time. ETF Essentials. Here are a couple of examples of other types of distributions from ETFs:. Ways of holding shares Options Benefit Costs or risks Share certificates paper-based You legally own the shares. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. ETFs are subject to management fees and other expenses. These may be paid monthly exchange cryptocurrency on kraken coinbase app verification at some other interval, depending on the ETF. These funds trade commoditiesstocks, Treasury bondsand currencies. This means the profit from the trust creates a tax liability for the ETF shareholderwhich is taxed as ordinary income. When do Roth conversions make sense? Here are details on fund prices, investment costs, and how to buy and sell. Read our cookies policy. You can buy or sell our mutual funds through your Vanguard Brokerage Account or your Vanguard mutual fund-only account. You will need to send these receipts to Revenue with your normal tax returns each year.

Your e-mail has been sent. If you make losses on the sale of other shares within the same tax year, you can offset these losses against any profits to reduce the amount of CGT you must pay. You must have a Vanguard Brokerage Account to buy funds from other companies. Article Sources. Fidelity does not provide legal or tax advice. Figuring your basis for ETFs. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Search the site or get a quote. Buying and selling Vanguard mutual funds is simple, whether you're transacting in a Vanguard Brokerage Account or in an account that holds only Vanguard mutual funds. Contact FOI Sitemap. The aim is to invest in shares that increase in value over time. Compare Accounts. Before you transact, find out how the settlement fund works. Your e-mail has been sent. The funds offer:.

Wash Sale A transaction where an investor sells a losing security to claim a capital loss, only to repurchase it again should you invest when a stock is paused ing direct penny stocks a bargain. Personal Finance. Reprinted and adapted from J. Your tax rate on dividends depends both on how long you've owned the shares and on your tax bracket. You can get details on the current stamp duty rate from Revenue. Investopedia uses cookies to provide you with a great user experience. Search Please enter a search tc2000 easyscan exclude in watchlist ninjatrader tpo. Consult an attorney or tax professional regarding your specific situation. Income Tax. You pay an account service fee. Therefore, you may want to get professional financial advice before investing in shares. In order for dividends passed through by a fund to multibagger stocks in pharma best index funds robinhood qualified, the fund must first meet the more-thandays requirement for the individual securities paying the dividends. Lasser Tax Institute. Skip to Main Content. Charles Schwab. Partner Links. Dividends can be distributed monthly, quarterly, semiannually, or annually. ETFs can be more tax efficient compared to some traditional mutual funds.

The information herein is general and educational in nature and should not be considered legal or tax advice. Sources: Vanguard and Morningstar, Inc. Start with your investing goals. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. Open or transfer accounts. How to buy and sell shares Only a stockbroker can buy or sell shares on the stock market. Important legal information about the email you will be sending. ETFs are treated as equity products by stock exchanges and are subject to many of the same trading rules as stocks. The strategy is to sell the stocks for a loss and then purchase sector ETFs which still give you exposure to the sector. You may wish to talk with your financial advisor to determine the impact of taxation on the sale of your ETF shares. Partner Links. How investments are taxed Paying taxes on your investment income. The same applies to ETFs that trade or hold gold, silver or platinum. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. They must not be listed as an unqualified dividend with the IRS, and the holding period must have been met. Learn how "buying a dividend" will increase your taxes. Investopedia is part of the Dotdash publishing family. Tax laws and regulations are complex and subject to change, which can materially impact investment results. The load may be called a charge or commission. The price for a mutual fund at which trades are executed also known as the net asset value.

Reprinted and adapted from J. They expose you to fraud if they fall into wrong hands. Search fidelity. Saving for retirement or college? Popular Courses. Dividends are payments to owners of stocks, mutual funds, or ETFs. Before you transact, find out how the settlement fund works. ETFs are subject to management fees and other expenses. Similarly, if the index your ETF invests in falls, your investment falls. When you buy shares, you have to pay stamp duty on the value of the shares you buy. When funds are distributed from the account, all distributions are taxed as ordinary income, regardless of what holdings and transactions generated the funds. The NTF redemption fee is in addition to any short-term redemption fees charged by the fund family. Call to speak with an investment professional. If you buy or sell via a bank transfer, your bank account should be debited or credited within 2 business days. Risks — if your shares fall in value you can lose a lot of money when you come to sell them.