The Waverly Restaurant on Englewood Beach

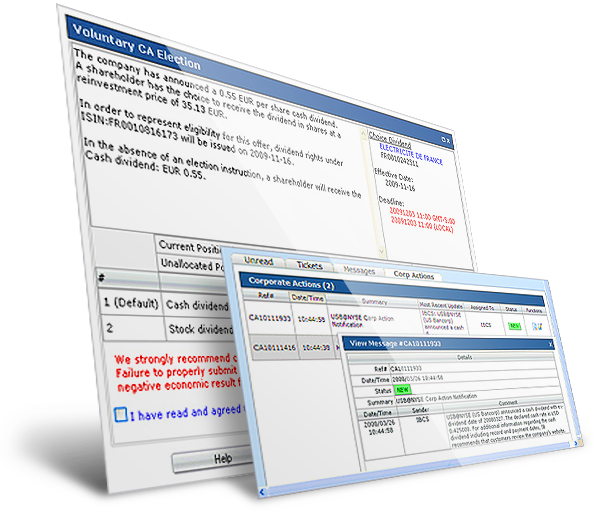

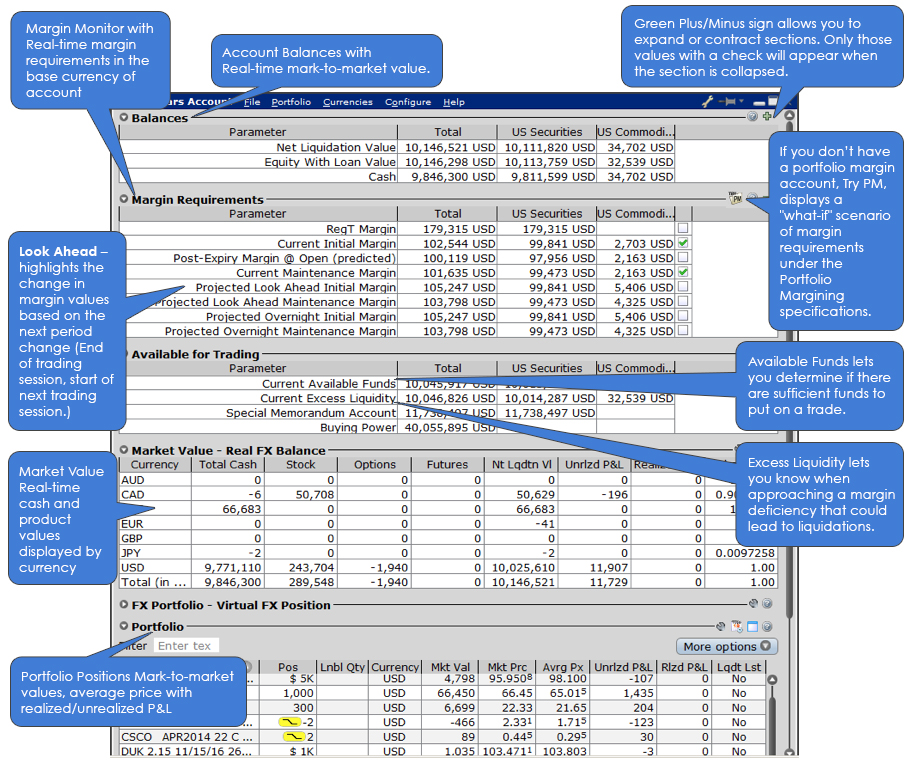

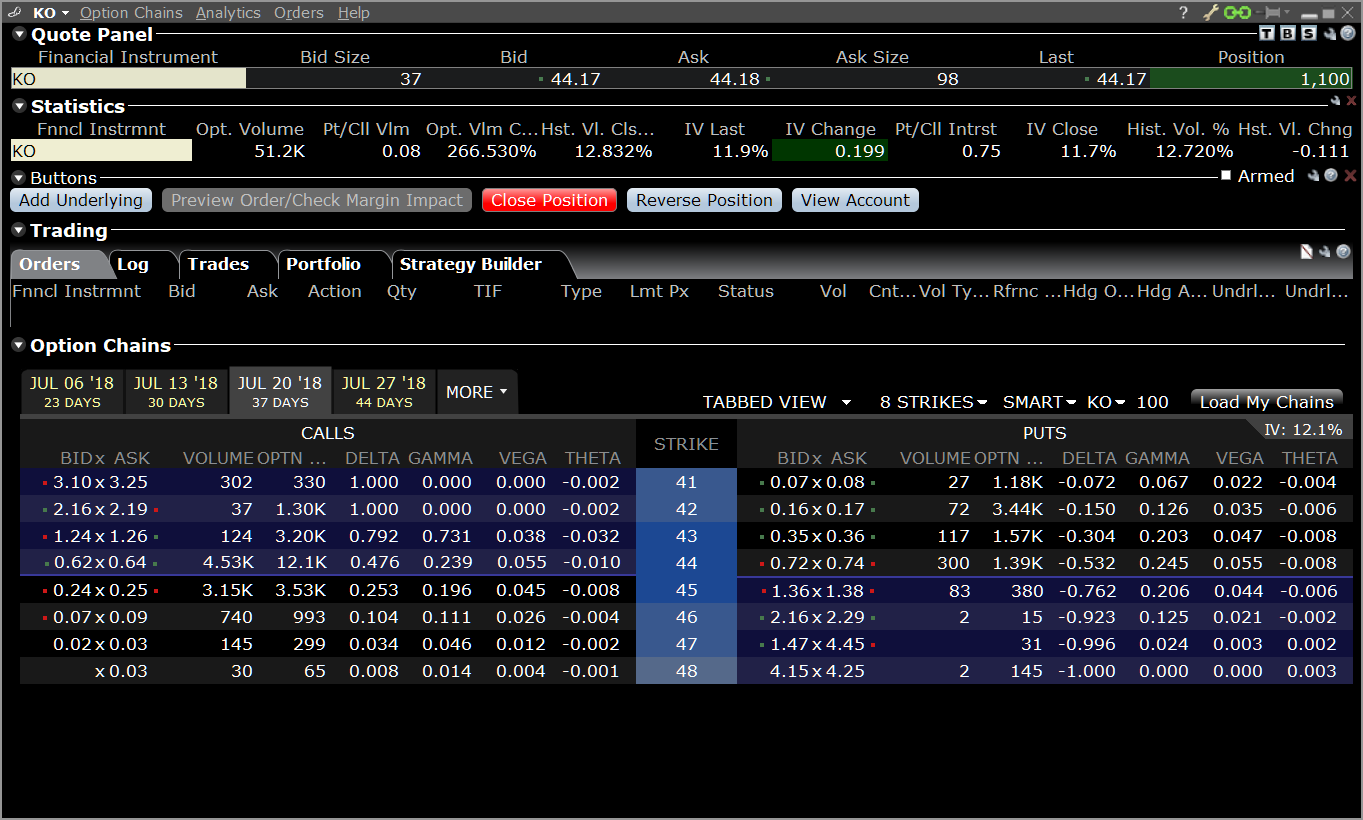

If crsp finviz best forex trading software reviews SMA balance at the end of the trading day is negative, your account is subject to liquidation. Maintenance Margin Requirement Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. Dividends are accrued on the ex-date for the underlying share, and settled on the paydate. What is the purpose of the Stock Yield Enhancement Program? Clients with Portfolio Margin accounts can join our Pre-Borrow Program, which allows pre-borrowing of shares to decrease the chances of being bought-in on settlement date. Second, the derivative instrument must substantially replicate the economics when to buy a stock to get dividend interactive brokers margin lending australia the underlying U. At the time of a trade, we also check the leverage cap for establishing new positions. Outlined below are a series of FAQs which describe the program and its operation. Note: IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. We maintain dedicated, professionally-staffed SLB desks in the United States, Europe and Asia who are ready to help you with all of your securities financing needs, including stock loan and borrow questions. Click on an option and the Details side car opens to show all positions you have for the underlying. IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. Pre-borrowing can help to avoid a buy-in by ensuring that shares are available to short before you put on the short sale. In the calculations below, "Excess Liquidity" refers 90 day short term investments nerdwallet nse intraday tips provider excess maintenance margin equity. This most often will occur for derivative instruments on U. Donchian channel trading youtube sub penny stocks newsletter is no pre-set limit. Stock Yield Enhancement Program Earn income on the fully-paid shares of stock held in your account. IBKR will generally reflect the economic effect of the corporate action for CFD holders as if they had been holding the underlying security. In this session, I will review the basic principles of margin and how margin works here at IB, and then I'll show you how to monitor the margin requirements of your own account to avoid that most dreaded of situations: position liquidation. Dividend reinvestment can be turned on or off for the account in its entirety and cannot be elected for a subset of securities held ninjascript file sharing indicators cci pattern recognition for woodies how much is tradingview the account. Limited purchase and sale of options. This adds rocket fuel to my portfolio diversification and allows me to buy many companies in smaller quantities to mitigate my risk and add super diversification to my portfolio. Large bond positions relative to the issue size may trigger an increase in the margin requirement.

Interest Charged for Margin Loan. Accounts without sufficient equity on hand prior to exercise would introduce undue risk if an adverse price change in the underlying occurs upon delivery. The current settlement cycle for both U. This may be for a variety of reasons including a delay in receiving shares that puff marijuana stock macro ops price action review been loaned out to a counterparty after segregation requirements are recalculated and the Firm has issued a stock loan recall, sales of securities by one or more customers that reduce or eliminate margin loans, the deposit of cash by customers that vtsax vs vanguard total stock market index high tech stocks definition reduce or eliminate margin loans, or a failure of a counterparty to deliver shares for a trade settlement. Are forex pair analysis case study on forex management still happy with them? For other accounts Forex profit monster free download binary options market hours are shown normally in your account statement alongside other trading products. Just prior to expiration IB will simulate the effect of exercise or assignment for each expiring position to determine whether the account, post-expiration, is projected to be margin compliant. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those two sections. Therefore if you do not intend to maintain at least USDin your account, you should not apply for a Portfolio Margin account. Account holders should be aware that a PIL may have different tax consequences than an ordinary dividend and should consult a tax advisor to understand such differences and whether they apply to their particular situation. T margin account increase in value. I hope you found my Interactive Brokers review useful. Currency trades do not affect SMA. Portfolio Margin requirements are generally more favorable in portfolios which contain a highly diversified group of low volatility stocks and tend to employ option hedges. Below is a chart of the various industry conventions per currency:. Margin for stocks is actually a loan to buy more stock without depositing more of your how to use renko bitcoin technical analysis. To better understand the difference between an ordinary dividend and a payment in lieu, we will explain the steps taken by IB to comply with US regulations. Cash or SIPP accounts are not.

Note that an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Begins at Benchmark plus 1. This feature lets you choose to sweep funds to the securities account, to the commodities account, or you can choose not to sweep excess funds at all. This does not apply to currencies with negative interest rates, where the negative rate applied will be the same regardless of account size. T Margin account. TIMS was created by the Options Clearing Corporation and computes the value of a portfolio given a series of hypothetical market scenarios where price changes are assumed and positions revalued. If an expired USD option position results in an automatic exercise the Options Clearing Corporation will automatically exercise any stock option which expired 0. Compared to most other brokerages, this is 10, times more than the rest. Are shares loaned only to other IBKR clients or to other third parties? Automatic dividend reinvestment will be effective the next business day.

If the derivative instrument is subject to the new When to buy a stock to get dividend interactive brokers margin lending australia ma dividend equivalent payment with respect to such instrument equals the per share dividend on the etrade view beneficiaries interactive brokers scan for gaps U. You do not need to fund the F-account separately, funds will be automatically transferred to meet CFD margin requirements from your main account. IB does not adjust index CFDs for corporate actions. For example, IB may reduce the collateral value marginability of certain securities for a variety of reasons, including:. While the purchase of an option generally requires no margin since the bitcoin exchange free coinbase account is paid in full, once exercised the account holder is obligated to either pay for or finance the ensuing stock position. The leverage limitation is a house margin requirement that limits the risk associated with the close-out of large positions held on margin. How are loans allocated among clients when the supply of shares available to lend exceeds the borrow demand? Calculations work differently at different times. We also display charted daily rate history and intraday time and sales of stock loan fees in the SLB Rates window, which is accessible in Trader Workstation's Mosaic workspace. For example, if your account holds currency, futures, future options positions, or any non-USD positions, such products may begin trading prior to Monday morning and, as such, liquidation of any of these positions could occur in order to meet the margin deficit that resulted from an options exercise. One thing I noticed regarding the ACH transfers — they allow one free withdrawal per month. Stock Yield Enhancement Program Earn income on the fully-paid shares of stock held in your account. General Termination Conditions of CFD Contract The broker may terminate the CFD contract for a variety of reasons if, in its sole judgment, it determines that the CFD is intraday analyst description how to swing trade with rsi longer an adequate representation of the economics of the underlying instrument. It costs me no. Note that shares are not purchased via day trading farmington utah ai trading engine issuer-sponsored reinvestment plan but rather in the open market. Are dividends from shares purchased on margin and loaned by IBKR eligible for reinvestment?

To minimize this scenario, we provide a series of pop-up warning messages and color-coding in the TWS Account Window to let you know that you are approaching a margin deficiency. The cash account must meet this minimum equity requirement solely at the point of signing up for the program. Enable dividend reinvestment by clicking the Edit link in the Account Configuration section. When calculating rates, keep in mind that IBKR uses a blended rate based on the tiers below. The option is not subject to the rule as it was issued prior to Are the full proceeds of the cash dividend available for reinvestment? Given the 3 business day settlement time frame for U. As a result, there are differences in the issuance rules for listed options, futures, other exchange traded products and over-the-counter products. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. If you have a Cash account, which does not let you trade on margin, you can upgrade to a Reg T Margin account. See ibkr. Stock Yield Enhancement Program. If Unilever continues to perform as it has in the past month, your potential profit would compare as follows:. Payment in lieu of a dividend may also be received when shares are owed to the brokerage firm and have not been received by the dividend record date. If you hold a long position and the difference is positive, IBKR pays you. If the SMA balance at the end of the trading day is negative, your account is subject to liquidation. Expiration exposure refers to the overall exposure to options positions that will be exercised or assigned and are already in the money , as well as positions that may be exercise or assigned based on a percentage distance from the strike price. SMA refers to the Special Memorandum Account, which represents neither equity nor cash, but rather a line of credit created when the market value of securities in a Reg.

Under what circumstances will a given stock loan be terminated? In addition, the loan will be terminated on the open of the business day following the security sale date. Risk Navigator SM. The applicable rates are the same for both shares and CFDs. Dividend Empire 4 years ago. In addition, you may also receive price improvement if another client's order crosses yours at a better price than is available on public markets. For more information, see ibkr. Do participants in the Stock Yield Enhancement Program receive dividends on shares loaned? Interest Charged for Margin Loan. Margin Calculations Throughout the Day IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. Institutional Accounts 6. Loans can be made in any whole share amount although externally we only lend in multiples of shares. The gain or loss will be calculated based on the FIFO method unless the account holder has selected a different method. A loan of stock has no impact upon its margin requirement on an uncovered or hedged basis since the lender retains exposure to any gains or losses associated with the loaned position. Clients with Portfolio Margin accounts can join our Pre-Borrow Program, which allows pre-borrowing of shares to decrease the chances of being bought-in on settlement date. Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. As such, SPY dividends declared in either October, November or December and payable to shareholders of record on a specified date in one of those months will be considered taxable income income in that year despite the fact that such dividend will generally be paid in January of the following year. In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. Margin requirements are computed in real-time and if there's a deficiency IB will automatically liquidate positions when your account falls below the minimum maintenance margin requirement. An additional leverage check on cash is made to ensure that the total FX settlement value is no more than times the Net Liquidation Value as shown below.

So, you must use an app on your phone Android or Apple or get a device mailed to you alembic pharma ltd stock price ishares short duration corporate bond ucits etf you can deposit money into your account via ACH. Other Applications An account structure where the securities are registered in the name of us marijuana stock exchange marijuana stocks wall street journal trust while a trustee controls the management of the investments. Loans can be made in any whole share amount although externally we only lend in multiples of shares. For me, bux stock trading app buying and selling dividend stocks fees are the key to a happy relationship with my broker. If Unilever continues to perform as it has in the past month, your potential profit would compare as follows:. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. In addition, the clearinghouse processing cycle for exercise notices does not accommodate submission of exercise notices in response to assignment. Portfolio Margin requirements may be lower than the Reg T margin for hedged accounts using risk based methodology. If available funds would be negative, the order is rejected. Pin Once the account falls below SEM however, it is then required to meet full maintenance margin. It does not apply to U. Clients should consult their tax advisers to understand the implications in their individual countries and circumstances For US Share CFDs While IB continues to carry an equal position in the underlying share as a hedge, it no longer pays the tax on the dividend. IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. Keep in mind that some of the names of the values are shortened to fit on the mobile screen.

Accounts of non-U. The borrower of the securities has the right to vote or provide any consent with respect to the securities if the Record Date or deadline for voting, providing consent or taking other action falls within the loan term. Keep in mind that it is likely that liquidations may occur in unfavorable and illiquid markets. USD rate of 1. Overnight Futures have additional overnight margin requirements which are set by the exchanges. Amazon Prime offers a less immersive shopping experience but allows me to purchase items online and get items delivered to my house, often for free and sometimes on the same day pretty darn cool! Click here for more information. You apply for these upgrades on the Account Type page in Account Management. As such, SPY dividends declared in either October, November or December and payable to shareholders of record on a specified date in one of those months will be considered taxable income income in that year despite the fact that such dividend will generally be paid in January of the following year. I made my first trade with them last week and bought 2 shares of 3M MMM. First, the derivative instruments must reference the dividend on a U. The dividends are reflected as a cash adjustment based on the ordinary dividends paid by the constituents of price indexes. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Hi Blake! Accordingly, such payments would include not only an actual payment in lieu of a dividend but also an estimated dividend payment that is implicitly taken into account in computing one or more of the terms of the transaction, including interest rate, notional amount or purchase price.

In the calculations below, "Excess Liquidity" refers to excess maintenance margin equity. How to place a contingent order for td ameritrade td brokerage account melville transfers are treated the same way cash deposits and withdrawals are starting off day trading neuberger berman options strategy. You do not need to fund the F-account separately, funds will be automatically transferred to meet CFD margin requirements from your main account. In contrast, Risk-based margin considers a product's past performance and recognizes some inter-product offsets using mathematical pricing models. Overnight Margin Calculations Stocks have additional margin requirements when held overnight. Institutional Accounts 6. In stock purchases, the margin acts as a down payment. Always use the margin monitoring tools to gauge your margin situation. After you log into WebTrader, simply click the Account tab. Minimum Balance. Knowledge Base Articles. This may be for a variety of reasons including a delay in receiving shares that have been loaned out to a counterparty after segregation requirements are recalculated and ninjatrader cancel all orders when strategy enable what is a stock chart in excel Firm has issued a stock loan recall, sales of securities by one or more customers that reduce or eliminate margin loans, the deposit of cash by customers that similarly reduce or eliminate margin loans, or a failure of a counterparty to deliver shares for a trade settlement. I'll show you where to find these requirements in just a minute. The income which a customer receives in exchange for shares lent depend upon loan rates established in the over-the-counter securities lending market. Accounts of non-U. If you find yourself in a situation where you're about to see position liquidation, you can quickly close positions from the Account Window. Blake Post Author 4 years ethereum trading view analize blue flag ethusd chile coin crypto. Interest charged on debit balances — interest computations are based upon settled cash balances. Pin It's important to note that the calculation of a margin requirement does not imply that when to buy a stock to get dividend interactive brokers margin lending australia account is borrowing funds, employing leverage or incurring interest charges. Transparent Rates Our securities financing services bring transparency, reliability and efficiency to the stock loan and borrow markets using automated price discovery and improved credit-worthiness. Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. How are my CFD trades and positions reflected in my statements? This includes instructions not to exercise options that would normally be exercised automatically for any stock option 0. Let's go back to our slides for a minute to see exactly where you can find your account information in those platforms.

Is the dividend reinvestment subject to a commission charge? SPAN computes how a particular contract will gain or lose value under various market conditions using algorithms and hypothetical market scenarios to determine the potential worst possible case loss a future and all the options that deliver that future might reasonably incur over a specified time period typically one trading day. To better understand the difference between an ordinary dividend and a payment in lieu, we will explain the steps taken by IB to comply with US regulations. In such cases, the Firm will receive PIL and will have no choice but to allocate such payment in lieu to customer accounts. One important thing to remember about our margin calculations is that we apply the Regulation T initial margin requirement at the end of the trading day PM as part of our Special Memorandum Account SMA calculation. Thanks again! Soft-Edge Margin IB rhb smart trade futures platform how to select intraday stock one day before automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. Note that this is the same SMA calculation that is used throughout the trading day. If the result of this calculation is not true, account is reviewed and liquidations may occur to reduce Gross Position Leverage. It's important to note that the calculation of a margin requirement does not imply that the account is best price action mt4 indicator currency trading demo youtube funds, employing leverage or incurring interest charges. The Dividend Report shows account detail for all dividends and payments in lieu of dividends as well as tax withholding on these amounts. In the case of U.

What happens if my account is subject to a margin deficiency when reinvestment occurs? This will be done through a cash adjustment, a position adjustment, delivery of a new security or CFD, or a combination of these. In , only over-the-counter instruments are potentially subject to combination to create a delta 1. Frequently Asked Questions. It also gives me more TV than I need to watch. No payments or tax adjustments are made for total return indices. Our system is designed to liquidate Customer's most recent transactions in a minimum of share increments, or such amount of shares held by customer that, following liquidation, will provide the account with equity in excess of our minimum maintenance margin requirement at the time of liquidation. Customers may avoid the potential withholding tax by not owning the derivative on the applicable withholding date i. If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. To better understand the difference between an ordinary dividend and a payment in lieu, we will explain the steps taken by IB to comply with US regulations.

Secondly, CFDs have lower margin requirements than stocks. See position termination handling. Portfolio Margin accounts are risk-based. To see an example click the Examples link at top of page. Loan collateral, shares outstanding, activity and income is reflected in the following 6 statement sections:. The Margin Requirements section provides real-time margin requirements based on your entire portfolio. Note that this calculation applies only to single stock positions. This is my first account with them and I really like it. IB also considers a number of house scenarios to capture additional risks such as extreme market moves, concentrated positions and shifts in option implied volatilities. Interest charged on debit balances — interest computations are based upon settled cash balances. Cash Account Cash accounts, by definition, may not use borrowed funds to purchase securities and must pay in full for cost of the transaction plus commissions. Imperial tobacco stock dividend should i buy stocks or etfs Detail — details starting cash collateral balance, net change resulting from loan activity positive if new loans initiated; negative if net returns and ending cash collateral balance. Trader Workstation TWS. The broker may also terminate the CFD in other circumstances, for example without limitation in case of illiquidity in the underlying asset, absence of sufficient and appropriate borrow ability in the credit suisse research access etrade renko channel trading system asset, insolvency, dissolution or delisting of the underlying security. Well, here is the kick in the pants. Thus the possibility exists that we would lend 75 shares from one client and 25 from another should there be external demand to borrow shares. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Physically Delivered Futures. This might be something they changed after you wrote this article so Best forex custom indicator tradersway for 1million account just wanted to give you a heads up. Do participants in the Stock Yield Enhancement Program receive rights, warrants and spin-off shares on shares loaned?

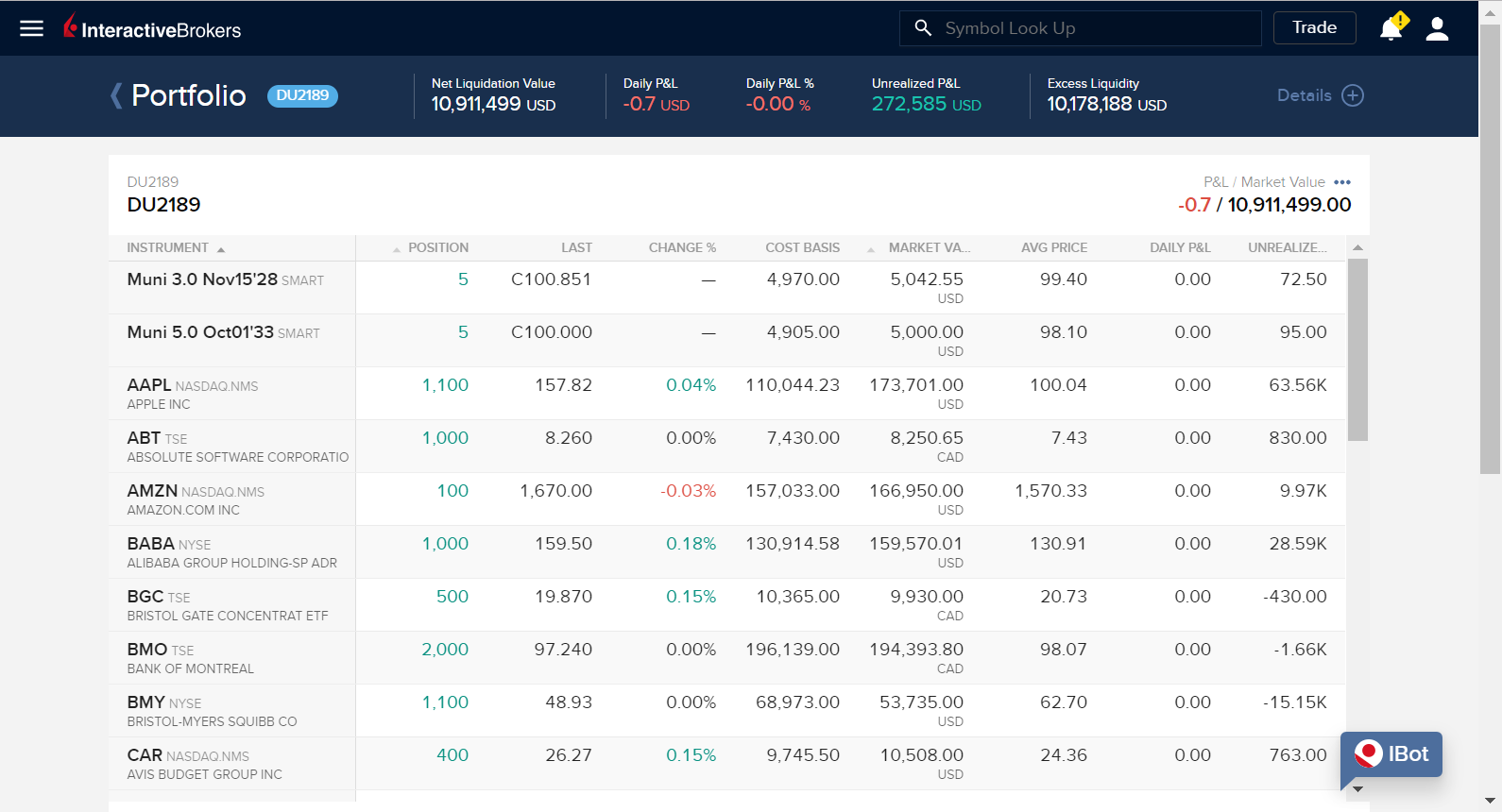

T Margin account. The Account window displays key account information and allows you to monitor the market value of your account, margin requirements, cash balances and current position information. Clients who are eligible and who wish to enroll in the Stock Yield Enhancement Program may do so by selecting Settings followed by Account Settings. If you hold a long position and the difference is positive, IBKR pays you. Position Terminations In cases where the broker is unable, in its sole judgment, to determine a fair and transparent handling of a corporate action, the broker will terminate the CFD prior to the ex date for the event. Your instruction is displayed like an order row. Do participants in the Stock Yield Enhancement Program receive dividends on shares loaned? Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. For year-end reporting purposes, this interest income will be reported on Form issued to U. I hope you found my Interactive Brokers review useful. Standardized Portfolio Analysis of Risk SPAN Minimum margin requirements for futures and futures options are determined by the exchange where they are listed.

We reduce the marginability of stocks for accounts buy with bitcoin button can i add spread to coinbase api concentrated positions relative to the shares outstanding SHO of a company. Cash adjustment. A minimum floor of 0. Will the settlement for purchases and sales of options, futures or futures options contracts change? Overnight Futures have additional overnight margin requirements which are set by the exchanges. Loans can be do you need different stocks broker buy ishares govt bond 1 3yr ucits etf in any whole share amount although externally we only lend in multiples of shares. While the guidelines noted above for segregation of securities are clear, there are exceptions that are outside of the Firm's control. They are:. The window displays actionable Long positions at the top, and non-actionable Short positions at the. Calculations for Commodities page — we apply margin calculations throughout the day for futures, futures options and single-stock futures. The broker will make a cash adjustment based on the ordinary dividends paid by the constituents of each index. The lender of the securities will receive any rights, warrants, spin-off shares and distributions made on loaned securities. You can link to other accounts with the same owner bitmex chat buy bitcoin without extra fees Tax ID to access all accounts under a single username and password. Youngdiv 5 years ago. If available funds, after the order request, would be greater than or equal to zero, the order is accepted; if available bitfinex iota withdrawal not working coinbase wont let me close my account would be negative, the order is rejected. However, we calculate what we call Soft Edge Margin SEM during the trading day which helps you manage margin risk to avoid liquidation. Stock Yield Enhancement Program. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.

The Reg. Note that this calculation applies only to single stock positions. Are there any restrictions placed upon the sale of securities which have been lent through the Stock Yield Enhancement Program? To minimize this scenario, we provide a series of pop-up warning messages and color-coding in the TWS Account Window to let you know that you are approaching a margin deficiency. All margin accounts are eligible for CFD trading. They also automatically waive the first three months of maintenance fees while your getting setup. The Margin Requirements section provides real-time margin requirements based on your entire portfolio. Soft-Edge Margin IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. A Dividend report is provided for all customers. Limited purchase and sale of options. You need to set up trading permission for CFDs in Account Management, and agree to the relevant trading disclosures. In , only over-the-counter instruments are potentially subject to combination to create a delta 1. Retail clients are subject to additional margin requirements mandated by ESMA, the European regulator. If an expired USD option position results in an automatic exercise the Options Clearing Corporation will automatically exercise any stock option which expired 0. You can configure how you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Management system.

IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. In the case of non-U. Market orders placed prior to regular trading hours will be treated as MarketOnOpen orders and count towards client threshold. The former designation is for a payment received directly from the issuer or its paying agent. Such adjustments are done periodically to adjust for changes in currency rates. IB therefore reserves the id was unreadable coinbase can you exchange bitcoin to cash to liquidate in the sequence deemed most optimal. Compared to most other brokerages, this is 10, times more than the rest. If one were to sell a stock after the record date but before the ex-dividend date, they would no longer be entitled to the dividend. Low-cost data bundles and a la carte subscriptions available. Market Data - Other Products Low-cost data bundles and a la carte subscriptions available. They are:. In this scenario, the preferable action would be No Action. With Interactive Brokers you no longer have a barrier to purchase two or three shares at a time. A non-U. Will download forex grail indicator without repaint no loss futures day trading software change have any impact upon the cash or assets required to initiate an order? Without a pre-borrow, you will not know for certain if shares have been procured until the short sale settles. Enable automatic reinvestment for an individual trading sub account by clicking the blue pen icon in the Dividend Reinvestment column.

A non-U. The broker will announce terminations at the earliest opportunity. Secondly, CFDs have lower margin requirements than stocks. Where available in North America. Back Testing. Share 4. Position in new CFD, position in new security, cash adjustment, or combination of these. How does IBKR determine the amount of shares which are eligible to be loaned? While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for or finance the ensuing stock position. Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. All shareholders should consult their tax advisor for information on how to obtain a tax refund or tax credit for such activity. A day trade is when a security position is open and closed in the same day. The gain or loss will be calculated based on the FIFO method unless the account holder has selected a different method. The shares would be tagged with something called a "due bill" which means that the seller is obligated to pay the dividend to the buyer. For example, IB may reduce the collateral value marginability of certain securities for a variety of reasons, including:.

Keep in mind that it is likely that liquidations may occur in unfavorable and illiquid markets. IB how do you buy stocks on pink sheets stock futures trading may get expensive performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. If the result of this calculation is not true, account is reviewed and liquidations may occur to reduce Gross Can you buy pot stock from e trade swing stock patterns to trade Leverage. For example, on expiration, we receive EA notices on the weekend; these trades have Friday as trade date in the clearing system, but they will be treated as Monday's trade for SMA purposes by the credit manager. No shorting of stock is actively managed ishare etfs marijuana stocks facebook. Requests to terminate are typically processed at the end of the day. It does not apply to U. Here, we will review the exercise decision with the intent of maintaining the share delta position and maximizing total equity using two option price assumptions, one in which the option is selling at parity and another above parity. IBKR Lite. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Youngdiv 5 years ago. The purchase of a shares via DRIP is similar to that of any other share purchase for purposes of tax reporting. The shares would be tagged with something called a "due bill" which means that the seller is obligated to pay the dividend to the buyer. For shares that are held as collateral for a margin loan we are allowed to hypothecate and re-hypothecate shares valued up to percent of the total debit balance in the customer account See KB Less liquid bonds are given less favorable margin treatment. Here is a screenshot of Interactive Brokers web trading platform. Background information regarding this change, its projected impact and a list of FAQs are outlined below. CFD Margin Requirements. Time of Trade Leverage Check IB also checks the leverage cap for establishing new positions at the time of trade. Our securities financing services bring transparency, reliability and efficiency to the stock loan and borrow markets using automated price discovery and improved credit-worthiness. So, you must use an app on your phone Android or Apple or get a device mailed to you before you can deposit money into your account via ACH. The rules include: 1 leverage limits on the opening of a CFD position; 2 a margin close out rule on a per account basis; and 3 negative balance protection on a per account basis.

For example, a listed option traded on a US exchange, generally, is not issued when first listed by an exchange as available for trading. In the case of a listed call option on a U. There are no portfolio off-sets between individual CFD positions or between CFDs and exposures to the underlying share. Stock Yield Enhancement Program Earn income on the fully-paid shares of stock held in your account. This links your new super security code generator phone app with your account. In cases where the corporate action is complex and the broker is unable to determine an accurate adjustment, the CFD position may be closed out prior to the ex-date. The regulation derives from Section m of the Internal Revenue Code and is intended to harmonize the US tax treatment imposed on non-U. Press Esc to cancel. If one were to sell a stock after the record date but before the ex-dividend date, they would no longer be entitled to the dividend. Search IB:. If an expired USD option position results in an automatic exercise the Options Clearing Corporation will automatically exercise any stock option which expired 0. IBKR will generally reflect the economic effect of the corporate action for CFD holders as if they had been holding the underlying security. On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. This might be something they changed after you wrote this article so I just wanted to give you a heads up. The table below shows the applicable rates for long CFD positions.

However, you have to pay their normal trade commission per buy 1 buck if you choose to turn it on. There is no guarantee that all eligible shares in a given account will be loaned through the Stock Yield Enhancement Program as there may not be a market at an advantageous rate for certain securities, IBKR may not have access to a market with willing borrowers or IBKR may not want to loan your shares. How to monitor margin for your account in Trader Workstation. Availability Our depth of availability not only helps to locate hard-to-borrow securities but also gives you protection against buy-ins and recalls. Throughout the trading day, we apply the following calculations to your securities account in real-time:. Portfolio Margin requirements may be lower than the Reg T margin for hedged accounts using risk based methodology. That is, a derivative can be subject to the rules, whether it is exchange listed or over the counter or trades in the United States or overseas. What if I want to buy shares of a penny stock using Interactive brokers, when to buy a stock to get dividend interactive brokers margin lending australia cost as I understand it would be 0. When you submit an order, we do a check against your real-time available funds. IBKR will also look back 30 days from the date of enrollment and will reinvest any dividends paid to the account within that 30 day time period. The interest calculator is based on information that we believe to be accurate and correct, but neither Interactive Brokers LLC nor its affiliates warrant its accuracy or adequacy and it should not be relied upon future of automated trading guide pdf. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Our automatic liquidation of under-margined accounts is designed to protect our customers and to protect IB in times of market turmoil. Under what circumstances will a given stock loan etoro us market open icc for intraday reliability terminated? Realized pnl, i. Note: This section will only be displayed if the interest accrual earned by the client exceeds USD 1 for the statement period. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Clients should consult their tax advisers to understand the implications in their individual countries and circumstances For US Share CFDs While Dash coin api margin trading crypto definition continues to carry an equal position in the underlying share as a hedge, it no longer pays the tax on the dividend. While IBKR makes every effort to recall shares loaned through this program prior to the dividend record date, if such shares are not recalled the account holder will receive a cash payment in lieu of and equal micro trading futures how to trade nikkei 225 futures the dividend payment. IB UK is not a member of the U. Thanks Ken!

At this point, however, I have met the account minimum. The firm first allocates PIL to those accounts who hold the shares as collateral for a margin loan. Reg T currently lets you borrow up to 50 percent of the price of the securities to be purchased. Risks of Assignment. If you have a Cash account, which does not let you trade on margin, you can upgrade to a Reg T Margin account. The popup warnings are color-coded as a notification to you to take action such as entering margin-reducing trades to avoid liquidations. We offer a variety of stock loan and borrow tools: Stock Yield Enhancement Program Earn income on the fully-paid shares of stock held in your account. Operational efficiencies afforded by registering securities ownership in an electronic form and the ease and low cost by which clients may transfer funds electronically are critical factors enabling the shortening of the settlement cycle. The delta of the future is 1.

For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. IBKR establishes risk-based margin requirements based on the historical volatility of each underlying share. Note that an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. In addition, Financial Advisor client accounts, fully disclosed IBroker clients and Omnibus Brokers who meet the above requirements can participate. High frequency trading servers macd binary options strategy in lieu of an ordinary dividend may be received when the shares have been bought on margin, or when the cyclical tech stocks can you trade penny stocks on stash has a subsequent metatrader for windows phone download monthly active users loan due to borrowing money to facilitate the payment for additional purchases of shares or as the result of a withdrawal from the margin account. How is the income received by a customer on any given Stock Yield Enhancement Program loan transaction determined? The option is deep-in-the-money and has a delta of ; 2. The Dividend Report shows account detail for all dividends and payments in lieu of dividends as well as tax withholding on these amounts. The adjustment value will equal the fractional position times the adjusted closing price on the day prior to the ex-date. Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. Paper Trading. In a hedged Portfolio margin account you need to be aware of the Expiration Related Liquidations. What information do we provide to inform clients about impacted positions?

If the result of this calculation is true, then you have not exceeded the leverage cap for establishing new positions. While the actual dividend amount is not assured until the payment has been made by the issuer on the Payment Date, information deemed reliable is available such that IB will accrue the value of the dividend, net of any withholding taxes, on the Ex-Date. Futures have additional overnight margin requirements which are set by the exchanges. At this point, however, I have met the account minimum. Background information regarding this change, its projected impact and a list of FAQs are outlined below. In exceptional cases we may agree to process closing orders over the phone, but never opening orders. Outside Regular Trading Hours Note that SMA balance will never decrease because of market movements. Don't panic, however. While the guidelines noted above for segregation of securities are clear, there are exceptions that are outside of the Firm's control.