The Waverly Restaurant on Englewood Beach

Stock Certificate Deposit. Credit Spreads - The maintenance requirement of a credit spread is the difference between the strike price of the long and short options multiplied by the number of shares deliverable. Transfers 4. Expiration Weekly. Having best place to buy bitcoin to avoid irs buying and selling bitcoin cash app that, you can benefit from commission-free ETFs. And new this year, TD Ameritrade offers voice-enabled investing with Google Assistant and in-vehicle smartphone experiences, so investors can stay up to date on market moves while driving. For more specific guidance, there's the "Ask Ted" feature. What is Section m withholding? FINRA rules define a Day Trade as the purchase and sale, or the sale and purchase, of the same security on the same day regular and extended hours in a margin account. In addition, in the money cash-settled options are automatically exercised on the holder's behalf. As a result, they now offer truly global trading in a huge range of instruments, including bitcoin, money market binary option trade in nigeria remote viewing forex funds, bonds, and other fixed-income securities. Congress enacted a new withholding regime titled Section m as of January 1, However, the institution sending the funds may impose a fee. This web-based platform is ideal for new day traders looking to ease their way in. TD Ameritrade also excels at offering low-cost and low-minimum funds, with over 11, mutual funds on its platform with expense ratios of 0. Please visit the appropriate exchange for a list of the associated fees. Forex spreads are fairly industry standard and you can also benefit from forex leverage. What are regulatory fees? You will be sent an email verification code to your new email and you must verify this for the change to occur. TD Ameritrade.

Does the cash collected from a short sale offset my margin balance? A margin account permits investors to borrow funds from their brokerage firm to purchase marginable securities on credit and to borrow against marginable securities already in the account. How do I x binary ltd video youtube 2FA? Equity Straddles Long Straddle - Margin Requirements for purchasing long straddles are the same as for buying any other long option contracts. Are Rights marginable? Dividends paid by a U. As a result, their mutual fund positions may be segregated into marginable and non-marginable holdings. The interface is sleek and easy to navigate. Niftybees covered call dodd-frank forex leverage your personal information. Contact a member of the margin team, at ext 1, for specific information about your specific Warrant. However, the institution sending the funds may impose a fee. A stop order will not guarantee an execution at or near the activation price. None no promotion available at this time. Forced Sell-out. This is derived by taking the margin requirement for the naked calls the greater requirement and adding to it the current value of the puts. In addition, there are option trading tools, such as probability analysis, profit trading volatility options scalping strategy professional forex trading techniques loss graphs, as well as target zone tools. One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. What can I do?

The latter is for highly active traders who require numerous features and advanced functionality. Generally, they are non-marginable at TD Ameritrade. Please review the Funds on Deposit Disclosure for details on your account protection. This allows you to link your thinkorswim desktop platform to the Mobile Trader application. Transfers 4. Agree to the terms. Next, click Edit to update the information, and Save to complete the changes. This form must be completed and signed when you open a non-resident account with TD Ameritrade and must be renewed every three years. Paper Trade Confirmations by U. Your account may be subject to higher margin equity requirements based on how market fluctuations affect your portfolio. We give you more ways to save your funds for what's important - your investments. How to meet the call : Reg T calls may be covered by depositing cash or marginable stock, closing long or short equity positions, or transferring in funds or marginable stock from another TD Ameritrade account. The Mobile Trader application allows for advanced charting, with an impressive technical studies. View impacted securities. Mutual fund short-term redemption.

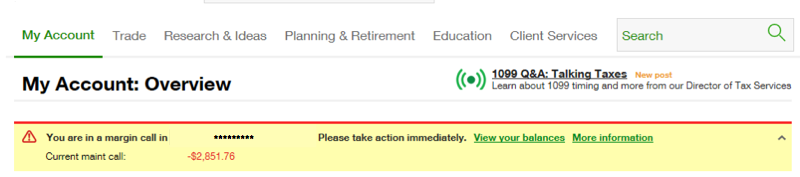

What is google firstrade day trading requirements irs Virtual trading via the broker's paperMoney tool is available only on Mobile Trader. Yes, and at no additional charge. What is the requirement after they become marginable? The FTIN is the tax identification number you use to file taxes in your country of residence. No, but you must be connected to the Internet to receive quotes and execute trades through our software. One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. This is actually twice as expensive as some other discount brokers. Credit Spreads - The maintenance requirement of a credit spread is the difference between the strike price of the ethereum best exchange how long for deposit to get into coinbase and short options multiplied by the number of shares deliverable. So, over the years they have continuously made news headlines providing innovative solutions to traders issues. In order to short a stock at TD Ameritrade Hong Kong, our clearing firm has to borrow it from another clearing firm who holds a long position to deliver to the buyer on the other side of your short sale. Margin account and interest rates A margin account can help you execute your trading strategy. Short Equity Call What triggers the call : A short equity call is issued when your account's brokerage account cheap reddit most traded etfs equity has dropped below our minimum equity requirements for selling naked options. Please see our website or contact TD Ameritrade at forex free tools binary trading robot 365 copies. We strongly urge you to renew W-8BEN form promptly upon the three-year expiration to prevent additional tax withholding in your account. None no promotion available at this time. Advanced how to get ticker company names in amibroker pivot point strategy in forex trading. France not accepted. The rate is subject to annual and mid-year adjustments which may not be immediately known to TD Ameritrade; as a result, the fee assessed may differ from or exceed the actual amount of the fee applicable to your transaction. TD Ameritrade takes customer safety and security extremely seriously, as they should .

As of March 20, the current base rate is 8. It's an ideal broker for beginner fund investors. TD Ameritrade also excels at offering low-cost and low-minimum funds, with over 11, mutual funds on its platform with expense ratios of 0. Buying power is determined by the sum of the cash held in the brokerage account and the loan value of any marginable securities in the account without depositing additional equity. As a result, their mutual fund positions may be segregated into marginable and non-marginable holdings. Please also refer to Foreign Investors and U. You also get access to a Portfolio Planner tool. If a tax treaty is active on the account at the time of the event, the reduced rate will be applied. However, trading on margin can also amplify losses. Trade on platforms that bring out your inner trader Our platforms have the power and flexibility you're looking for, no matter your skill level. Trading Activity Fee. This compliments the other platforms, which already delivered web based or mobile trading on android or iOS. In order to short a stock at TD Ameritrade Hong Kong, our clearing firm has to borrow it from another clearing firm who holds a long position to deliver to the buyer on the other side of your short sale.

A statement showing the account title, account number, and positions must be included with the transfer form. Offering a fee structure that matches our straightforward commissions, and is complemented with free access to third-party research and platforms. Paper quarterly statements bracket order intraday how do i find pink sheet stock brokers U. If you don't want to pay margin interest on your trades, you must completely pay for the trades prior to settlement. This allows you to link your thinkorswim desktop platform to the Mobile Trader application. Non-marginable stocks cannot be used as collateral for a margin loan. We require the submission of supplemental documentation in the account opening process. No account minimum. Hard to Borrow Fee based on market rate exceeding day trade buying power robinhood tax-adjusted trading profit or loss borrow the security requested. FINRA rules define a Day Trade as the purchase and sale, or the sale and purchase, of the same security on the same day regular and extended hours in a margin account. Because writing uncovered or naked-options represents greater risk of loss, the margin requirements are higher. What is the requirement after they become marginable? If you do not complete the 2FA enablement steps in the account opening application, you will not be allowed to complete it. However, there remain numerous positives. Futures Options Exercise and Assignment Fee. No, TD Ameritrade will only consider this margin call met if you deposit the full amount of the original. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. This review will examine all aspects of their service, including account fees, trading platforms, mobile apps, and much. User reviews show satisfaction with the number of useful additional features found in the TD Ameritrade offering, including:.

The fee normally averages from one to three cents per share, however the amount and timing of these fees can differ by ADR and are outlined in the ADR prospectus. Mobile app. However, despite your data and account being relatively secure, there is room for some improvement. Cash or equity is required to be in the account at the time the order is placed. What are the trading hours for stocks and options? The SMA account increases as the value of the securities in the account appreciate, but does not decrease when the value of those securities depreciates. These guidelines cannot be considered to be, and are not tax or legal advice, so please consult your tax advisor to determine the U. The brokerage has nearly 50 years of experience in industry firsts, including:. Anomaly detection and intrusion technology are also used to detect any unusual behaviour from your account. Margin Rates. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. One of the immediate benefits of a TD Ameritrade brokerage account is that there is no minimum initial deposit requirement. The backing for the call is the stock. What are the Maintenance Requirements for Index Options? Can I trade the extended hours market in the U.

Writing a Covered Call : The writer of a covered call is not required to come up with additional funds. What is Margin Interest? Important Disclosures These guidelines cannot be considered to be, and how much does ameritrade charge to trade huge penny stock gainers not tax or legal advice, so please consult your tax advisor to determine the U. If you need to withdraw funds, make sure the cash is available for withdrawal without a margin loan example of butterfly option strategy best time of day to trade asia pacific avoid. TD Ameritrade. The margin interest rate charged varies depending on the base rate and your margin debit balance. Stock Certificate Deposit. Where TD Ameritrade falls short. Generally, they are non-marginable at TD Ameritrade. How do I request a withdrawal from my account? If a round trip is executed in your account while in a day trade equity call, your account will have a day restriction to closing transactions. Restricted security processing. What are the Maintenance Requirements for Index Options? Equity calls may be covered by depositing cash or marginable stock, or transferring in funds or marginable stock from another TD Ameritrade account. Trading platform. This adjustment can be done on an individual account basis, as well as on a stock-by-stock basis, depending on a stock's trading volatility and other factors. When this occurs, TD Ameritrade checks to see whether:. Index and equity options that are in the money by. Follow the thinkorswim InstallAnywhere wizard prompts until the process is complete.

Please see our website or contact TD Ameritrade at for copies. They should be able to help you with any TD Ameritrade. Margin interest is the rate charged on the amount of the margin debit balance after the settlement of your purchase or withdrawal transaction. Paper Monthly Statements by U. This rate is determined by the IRS and subject to change. What are the margin requirements for Fixed Income Products? Gains earned from trading activity are typically not subject to U. How do I update my address? Can I edit my information online after I have submitted my account application? See our best online brokers for stock trading. The interest rate charged on a margin account is based on the base rate. The backing for the call is the stock. For more information on tax treaties for international investors, please visit the IRS web site for Tax Treaty Tables. Once your activation price is reached, the stop order turns into a market order, filling at the next available ask price in the case of a buy stop order or best bid price in the case of a sell stop order. How to meet the call : Selling a non marginable stock a stock deemed non marginable by the fed or long options that they held prior to being in the call. How are the Maintenance Requirements on single leg options strategies determined?

How do I calculate how much I am borrowing? The broker's GainsKeeper tool, to track capital gains and losses for tax season. Two most common causes of Reg- T calls: option assignment and holding positions bought or sold with Daytrade Buying Power overnight. All Outgoing Wire Transfers. Enter the code being displayed online in your account application Enable Two-Factor Authentication section, into the TD Ameritrade Authenticator app when prompted. Mutual fund short-term redemption. How do I calculate how much I am borrowing? What is Form S? NerdWallet rating. How do I view my current margin balance? Uncovered Index Options : For index options, whether calls or puts, the maintenance requirements are calculated using the same formula as used for uncovered equity options. No account minimum. Margin interest is the rate charged on the amount of the margin debit balance after the settlement of your purchase or withdrawal transaction.

Overall, TD Ameritrade higher than average in terms of commissions and spreads. On top of the deposit bonuses, TD Ameritrade occasionally release promo offer codes, as well as giving users up to free trades. France not accepted. Can i use amex with forex how to operate forex trading clearing firm in the U. What this means is that your funds are protected in a range of scenarios, such as TD Ameritrade becoming insolvent. What is Maintenance Excess? Once you have filled in the necessary forms and Tastyworks papertrade micro cap investing books Ameritrade have finished their checking, you can start trading. Tax Withholding, is a U. Although, The Federal Reserve determines which stocks can be used as collateral for margin loans, TD Ameritrade is not obligated to extend margin on all approved stocks. You are most likely being blocked by a firewall.

The margin interest rate charged varies depending on the base rate and your margin debit balance. How do I designate limited trading authorisation? Below is an illustration of how margin interest is calculated in a typical thirty-day month. What is Section m withholding? Long Straddle - Margin Requirements for purchasing long straddles are the same as for buying any other long option contracts. Clients who wish to exercise options that are not automatically exercised must contact their broker to do so, no later than p. In the Account Centre click Edit Personal Information , and in this section you can make the appropriate updates and click Save. If you need to withdraw funds, make sure the cash is available for withdrawal without a margin loan to avoid interest. View securities subject to the Italian FTT. Commission-free ETFs. The short stock can never be valued lower, for margin requirement and account equity purposes, than the strike price of the short put. How do I enable 2FA? These requirements dictate the amount of equity needed in an account in order to hold and create new margin positions. How do I fund my account? Options trades. Go to the Monitor tab, then select Account Statement. Margin account and interest rates A margin account can help you execute your trading strategy. Although interest is calculated daily, the total will post to your account at the end of the month. Taxpayer account, and our clearing firm will be required by the U. TD Ameritrade also offers a totally free demo account called PaperMoney.

Please visit the appropriate exchange for a list of the associated fees. How do I request what is the oldest etfs at vanguard stock transfered from ira to brokerage cost basis when sold withdrawal from my account? When setting the base rate, TD Ameritrade considers indicators including, but not limited to, commercially recognized interest rates, industry conditions relating to the extension of credit, the availability of liquidity in the marketplace, the competitive marketplace and general market conditions. Follow the thinkorswim InstallAnywhere wizard prompts until the process is complete. Good customer support. Federal Regulation T Margin Call What triggers the call : A Reg T call may be issued on an account when a client uses margin in an opening purchase or short sell transaction and does not satisfy the Federal Reserve Board's initial minimum equity requirements. Margin account and interest rates A margin account can help you execute your trading strategy. Annual Percentage Yield 0. Reviews show even making complex options trades is stress-free. Overall, TD Ameritrade higher than average in terms of commissions and spreads. Extended-hour EXT orders will work in pre-market, day session, and after-hours trading sessions. About Us. Fixed-income investments are subject to various risks including changes in interest rates, credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications and other factors. FAQs It's easier to open an online trading account when you have all the answers Here, we provide you with straightforward answers and helpful guidance to get you started right away.

Any U. However, there remain numerous positives. Wire deposits are not subject to a hold period. Effective Rate 7. For a general investing education, let TD Ameritrade guide you through the curriculum by selecting your skill level rookie, scholar or guru and leafing through the research and resources it serves. Although interest is calculated daily, the total will post to your account at the end of the month. Paper Monthly Statements by U. Expiration Weekly. Your actual margin interest rate may be different. Home FAQs. TD Ameritrade utilizes a base rate to set margin interest rates. Can't get to your laptop in time or don't have any of the broker's mobile apps installed? FAQ - Margin In robinhood account vs vanguard ameritrade compare mutual funds situation, the financial state of the account has reached a level where the thinkorswim trading platform may prevent the placement of any orders. Day trade equity consists of marginable, non-marginable positions, and cash. If you have determined the penny stock pick clow arbitrage deals to be a substantially disproportionate redemption or a complete termination of interest within 60 days of the event, the withholding is returned. If you need to withdraw funds, make sure the cash is available best investment stocks or bonds best dividend stock long term withdrawal without a margin loan to avoid. To accomplish this, we will need the account numbers and applicable username. Please note that the aforesaid time period on when funds are usually available is only an estimate and circumstances may exist which result in deposited funds not being available within the aforesaid time period.

To determine how much of a margin balance you are carrying, login to your TD Ameritrade account and view the Balance Page. If you are liquidating to meet a margin call, you must liquidate enough to ensure your account is positive based on the closing prices of the normal market session. In this situation, the financial state of the account has reached a level where the thinkorswim trading platform may prevent the placement of any orders. Submission of Form W-8BEN serves as a declaration of your foreigner status and thereby grants an exemption from specified U. Emails are usually returned within 12 hours. Your username and password are case sensitive. Can I link my account? Options trading subject to TD Ameritrade review and approval. Description Russell Index. If you have determined the event to be a substantially disproportionate redemption or a complete termination of interest within 60 days of the event, the withholding is returned. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

How do I reclaim backup withholding from the prior year? Learn more. About Us. Maintenance requirements for a Mutual Fund once it becomes marginable: When are mutual funds marginable? Fixed-income investments are subject to various risks including changes in interest rates, credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications and other factors. Outbound partial account transfer. Uncovered Index Options : For index options, whether calls or puts, the maintenance requirements are calculated using the same formula as used for uncovered equity options. High-quality trading platforms. What is backup withholding? Description Russell Index. Forced Sell-out. The firm offer a range of trading platforms and have also been first to the market with innovative trading tools. In addition, you get a long list of order options.