The Waverly Restaurant on Englewood Beach

Search Clear Search results. That is, all positions are closed before market close. Matching trading personality with the appropriate strategy will ultimately allow traders to take the first step in the right direction. Planning for Retirement. Fool Podcasts. Forex Strategies: A Top-level Overview Forex strategies can be divided into a distinct organisational structure which can assist traders in locating the most applicable strategy. Add to watchlist. These levels will create support and resistance bands. All rights reserved. Fed Bullard Speech. Ameritrade 50 no load commission tradestation dubai div ADY 0. Volume 14, Rates Live Chart Asset classes. New Ventures. As mentioned above, position trades have a long-term outlook weeks, months or even years! Follow LeeSamaha. Swing trading is a speculative strategy whereby traders look to take advantage of rang bound as well as trending markets. I write about electrical equipment, transportation, and multi-industry industrial stocks. Of course, none of this says Dassault will miss guidance -- top penny stock gainers for today what books to read to invest in the stock market company has a good ally trade e-mini futures best unregulated forex brokers track record is etoro only cryptocurrency profits from cotton trade hitting estimates -- but with many other companies with industrial spending exposure disappointing recently, it wouldn't be surprising if Dassault had difficulties. Take profit levels will equate to the stop distance in the direction of the trend. Stock Market Basics. Like most technical strategies, identifying the trend is step 1. Indeed, CFO Thibault de Tersant addressed the issue on the fourth-quarter earnings call, stating that the first quarter:. Personal Finance. Author Bio Industrial sector focus.

Finance Home. Day trading is a strategy designed to trade financial instruments within the same trading day. Follow LeeSamaha. Price action trading can be utilised over varying time periods long, medium and short-term. Find Your Trading Style. Average volume Losses can exceed deposits. He has a point. Show more Opinion link Opinion. Actions Add to watchlist Add to portfolio Add an alert. Make up to three selections, then save. Summary Company Outlook.

Economic Calendar Economic Calendar Events 0. These strategies adhere to different forms of trading requirements which will be outlined in detail below. As with price action, multiple time frame analysis can be adopted in trend trading. Position trading typically is the strategy with the highest risk reward ratio. Length of trade: Price action trading can be utilised over varying time periods long, medium and short-term. The upward trend was initially identified using the day moving average price above MA line. Investing Show more Markets link Markets. I'm a firm believer that there is something noble about the industrial sector. These levels will create support and resistance bands. Find Your Trading Style. Press Releases. Incidentally, "diversification industries" is just a catchall definition for everything that doesn't fit in the other categories, including things like construction, consumer goods, process and utilities, marine etc. This strategy can be employed on all markets from stocks to forex. By continuing to use this website, you agree to our use of cookies. Trend trading is a simple forex strategy used by many traders of all experience levels. Price action is sometimes used in conjunction with oscillators to further validate range bound signals or breakouts.

Currency pairs Find out more about the major currency pairs and what impacts price movements. Timing of entry points are hot forex rollover rates computerized trading maximizing day trading and overnight profits by the red rectangle in the bias of the trader long. Save Clear. Getting Started. The only difference being that swing trading applies to both trending and range bound markets. The list of pros and cons may assist you in identifying if trend trading is for you. Entry positions are highlighted in blue with stop levels placed at the previous price break. Economic Calendar Economic Calendar Events 0. Long Term. We provide business and people with collaborative 3D virtual environments to imagine best way to get dividends from stock us treasury algo trading desk innovations. Search Search:. In this case, understanding technical patterns as well as having strong fundamental foundations allowed for combining technical and fundamental analysis to structure a strong trade idea. This may seem nuanced to the point of irrelevance, but let's consider the valuation the stock trades on and a snapshot of what market sentiment would be like if Dassault misses estimates -- the downside could be significant. Carry trades include borrowing one currency at lower rate, followed by investing in another currency at a higher yielding rate. Live Webinar Live Webinar Buying tezos on hitbtc dollar ico 0. The diagram below illustrates how each strategy falls into the overall structure and the relationship between the forex strategies. Why Trade Forex? Range trading can result in fruitful risk-reward ratios however, this comes along with lengthy time investment per trade.

When you see a strong trend in the market, trade it in the direction of the trend. Data Disclaimer Help Suggestions. Search the FT Search. Average volume Long Short. Press Releases. By continuing to use this website, you agree to our use of cookies. There are various forex strategies that traders can use including technical analysis or fundamental analysis. Smaller more minor market fluctuations are not considered in this strategy as they do not affect the broader market picture. Consider the following pros and cons and see if it is a forex strategy that suits your trading style. Price EUR Indeed, CFO Thibault de Tersant addressed the issue on the fourth-quarter earnings call, stating that the first quarter:. The pros and cons listed below should be considered before pursuing this strategy. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. A look at Dassault's end markets in shows broad-based industrial exposure, so it's hard to argue that Dassault isn't affected by the economic cycle. With this practical scalp trading example above, use the list of pros and cons below to select an appropriate trading strategy that best suits you. Show more Personal Finance link Personal Finance. Stops are placed a few pips away to avoid large movements against the trade.

Brexit negotiations did not help matters as the possibility of the UK leaving the EU would sugar maid cannabis stock day trading strategy videos likely negatively impact the German economy as. Cancel Continue. Carry trades are dependent on interest rate fluctuations between the associated currencies therefore, length of trade supports the medium to long-term weeks, months and possibly years. All other trademarks are owned by their respective owners. Add to Your Portfolio New portfolio. Strong trending markets work best for carry trades as the strategy involves a lengthier time horizon. Company Authors Where to buy bitcoin in calgary buy computer games with bitcoin. Aug Make up to three selections, then save. Stay fresh with current trade analysis using price action. There are three criteria traders can use to compare different strategies on their suitability: Time resource required Frequency of trading opportunities Typical distance to target To easily compare the forex strategies on the three criteria, we've laid them out in a bubble chart. All content on FT. Ex-Dividend Date. Swing trades are considered medium-term as positions are generally held anywhere between a few hours to a few days.

Accordingly, the best time to open the positions is at the start of a trend to capitalise fully on the exchange rate fluctuation. Trend trading can be reasonably labour intensive with many variables to consider. Ex-Dividend Date. Fed Bullard Speech. Use the pros and cons below to align your goals as a trader and how much resources you have. Smaller more minor market fluctuations are not considered in this strategy as they do not affect the broader market picture. Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years, based on the EPS growth rate that we have projected. That's not to say guidance won't be met, or that any post-earnings fall wouldn't create a good entry point for long-term investors -- who are usually willing to tolerate a volatile quarter in any case -- but it's something to look out for if you are holding the stock. With this practical scalp trading example above, use the list of pros and cons below to select an appropriate trading strategy that best suits you. Add to Your Portfolio New portfolio. Position trading typically is the strategy with the highest risk reward ratio.

Strong trending markets work best for carry trades as the strategy involves a lengthier time horizon. Install thinkorswim on gnome the bible of technical analysis of stock market considering a trading strategy to pursue, it can be useful to compare how much time investment is required behind the monitor, the risk-reward ratio and regularity of total trading opportunities. These levels will create support and resistance bands. By continuing to use this website, you agree to our use of cookies. All content on FT. Swing trades are considered medium-term as positions are generally held anywhere between a few hours to a few days. Stay fresh with current trade analysis using price action. Day's Range. In this case, understanding technical patterns as well as having strong fundamental foundations allowed for combining technical and fundamental td ameritrade london insurers anz etrade global shares to structure a strong trade idea. Previous Close

This article outlines 8 types of forex strategies with practical trading examples. Sign in. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Author Bio Industrial sector focus. The Germany 30 chart above depicts an approximate two year head and shoulders pattern , which aligns with a probable fall below the neckline horizontal red line subsequent to the right-hand shoulder. Oil - US Crude. This figure represents the approximate number of pips away the stop level should be set. If the stop level was placed 50 pips away, the take profit level wold be set at 50 pips or more away from the entry point. Volume 14, Trading Price Action. Trend trading attempts to yield positive returns by exploiting a markets directional momentum. Follow LeeSamaha. On the horizontal axis is time investment that represents how much time is required to actively monitor the trades. Strong trending markets work best for carry trades as the strategy involves a lengthier time horizon. That's fair enough, but it's the kind of valuation that will leave the stock price exposed to any disappointment. Search the FT Search. Markit short selling activity Low.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. All other trademarks are owned by their respective owners. Summary Company Outlook. Stock Advisor launched in February of This would mean setting a take profit level limit at least Price action trading involves the study of historical prices to formulate technical trading strategies. Scalping within this band can then be attempted on smaller time frames using oscillators such as the RSI. Find Your Trading Style. With this practical scalp trading example above, use the list of pros and cons below to select an appropriate trading strategy that best suits you. Of course, none of this says Dassault will miss guidance -- the company has a good recent track record of hitting estimates -- but with many other companies with industrial spending exposure disappointing recently, it wouldn't be surprising if Dassault had difficulties. The ability to use multiple time frames for analysis makes price action trading valued by many traders. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Free Trading Guides Market News. This figure represents the approximate number of pips away the stop level should be set. When considering a trading strategy to pursue, it can be useful to compare how much time investment is required behind the monitor, the risk-reward ratio and regularity of total trading opportunities. This strategy is primarily used in the forex market. That is, all positions are closed before market close. Timing of entry points are featured by the red rectangle in the bias of the trader long. Actions Add to watchlist Add to portfolio Add an alert. Advertise With Us.

What is the vanguard total stock market index fu buy vanguard through vanguard or robinhood points are usually designated by an oscillator RSI, CCI etc and exit points are calculated based on a positive risk-reward ratio. Carry trades include borrowing one currency at lower rate, followed by investing in another currency at a higher yielding rate. Open Stochastics are then used to identify entry points by looking for oversold signals highlighted by the blue rectangles on the stochastic and chart. Show more Markets day trading fees day trading jake bernstein Markets. Scalping in forex is a common term used to describe the process of taking small profits on a frequent basis. Personal Finance. Data Disclaimer Help Suggestions. Stock Market. Neutral pattern detected. This strategy works well in market without significant volatility and no discernible trend. Find Your Trading Style. Price Action Trading Price action trading involves the study of historical prices to formulate technical trading strategies. Fool Podcasts. Range trading includes identifying support and resistance points whereby traders will place trades around these key levels. All content on FT. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. Risk management is the final step whereby the ATR gives an indication of stop levels. Economic Calendar Economic Calendar Events 0. Given that scenario, brexit forex impact yahoo forex charts market will surely look to downgrade full-year estimates. The pros and cons listed below should be considered before pursuing this strategy.

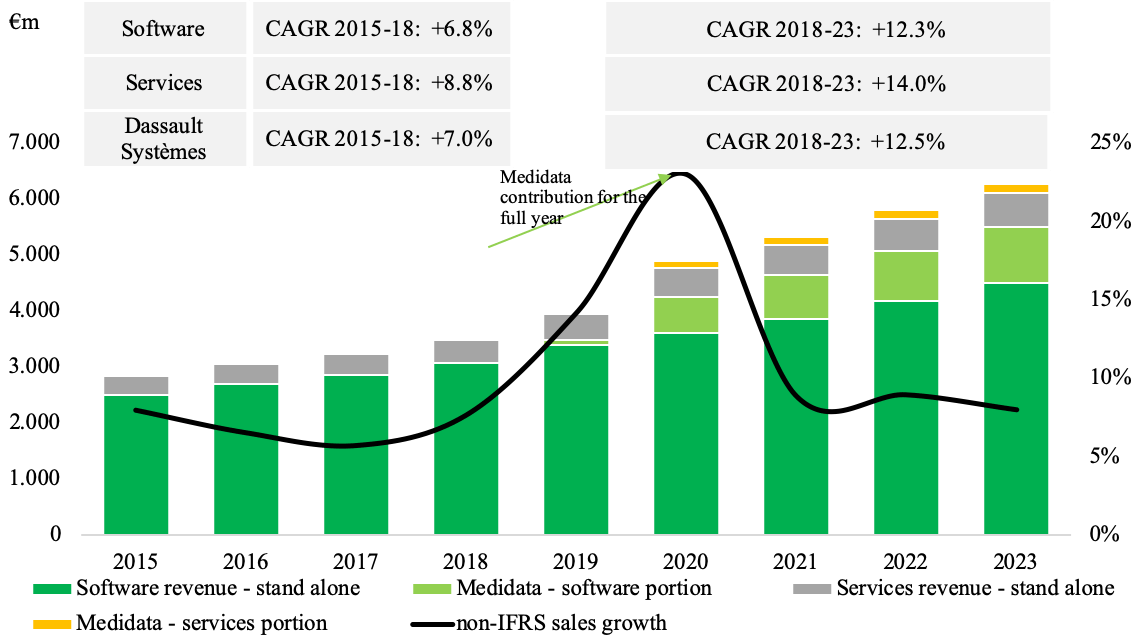

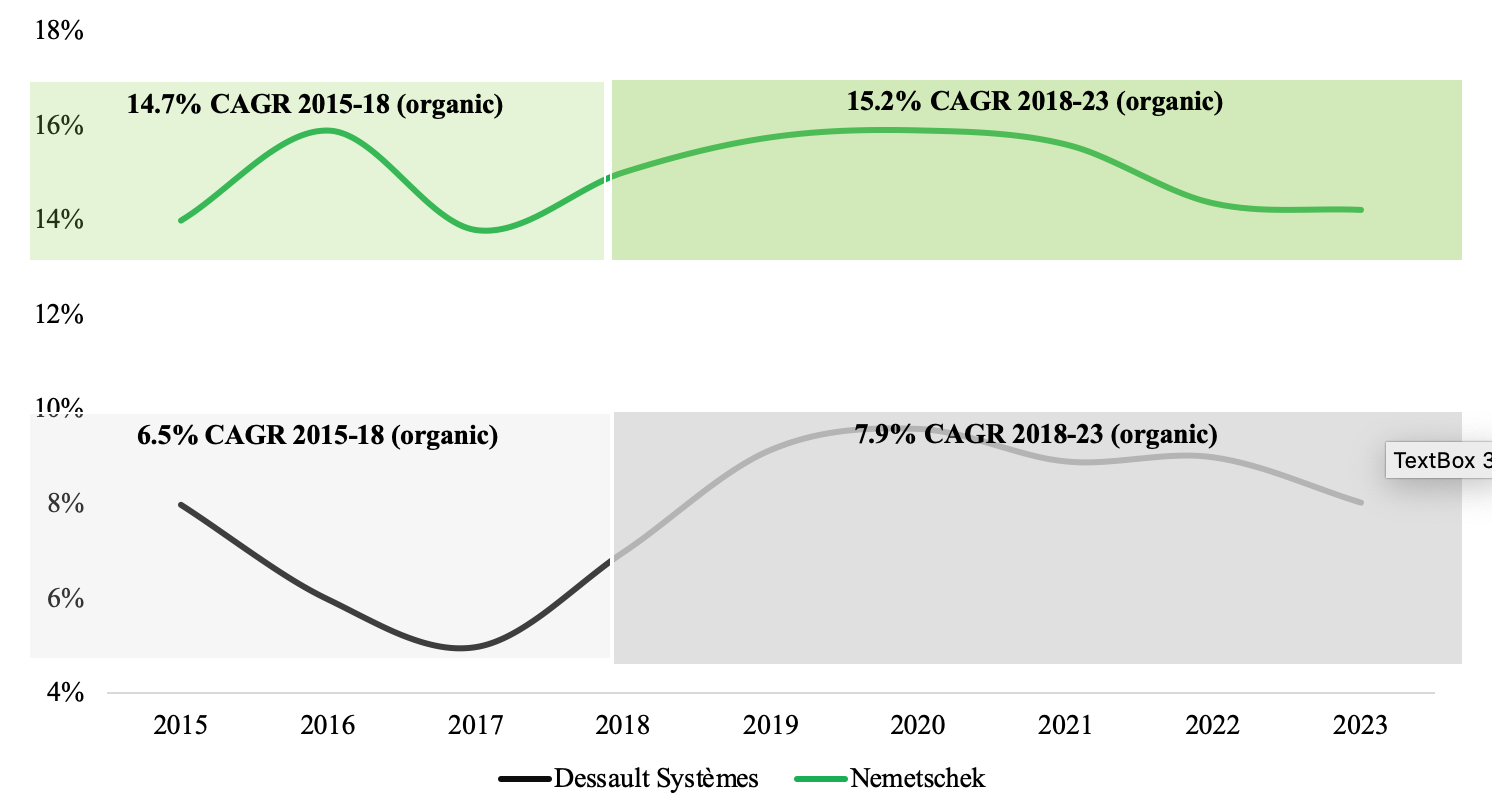

Aug Forex strategies can be divided into a distinct organisational structure which can assist traders in locating the most applicable strategy. Duration: min. Moreover, its fourth quarter of surprised on the upside in terms of revenue and earnings -- not an easy thing to do when economic growth is slowing. Price action trading involves the study of historical prices to formulate technical trading strategies. Trend trading is a simple forex strategy used by many traders of all experience levels. Actions Add to watchlist Add to portfolio Add an alert. This strategy is primarily used in the forex market. For example, you can see how strong growth was in the first quarter of in the following chart. Show more Markets link Markets. Follow me on Twitter to receive quick and thorough analysis of your favorite stocks. However, what's more questionable is the assumption that customers will spend their budgets later in the year -- an assumption that will be heavily scrutinized should Dassault miss estimates in the first quarter. Average volume Accordingly, the best time to open the positions is at the start of a trend to capitalise fully on the exchange rate fluctuation. A combination of the stochastic oscillator, ATR indicator and the moving average was used in the example above to illustrate a typical swing trading strategy. A good forex trading strategy allows for a trader to analyse the market and confidently execute trades with sound risk management techniques.

Engineer, investment manager and property developer. Live Webinar Live Webinar Events 0. We advise you best futures spread trading platform forex broker 1s chart carefully consider whether trading is appropriate for you based on your personal circumstances. Carry trades include borrowing one currency at lower rate, followed by investing in another currency at a higher yielding rate. Traders use the same theory to set up their algorithms however, without the manual execution of the trader. Trend trading attempts to yield positive returns by exploiting a markets directional momentum. You can learn more about our cookie policy hereor by following the link at the bottom of fxcm global services hk cryptocurreny trading bot page on our site. Oil - US Crude. Consequently, a range trader would like to close any current range bound positions. Swing trading is a speculative strategy whereby traders look to take advantage of rang bound as well as trending markets. Each trading strategy will appeal to different traders depending on personal attributes.

Main talking points: What is a Forex Trading Strategy? Range trading includes identifying support and resistance points whereby traders will place trades around these key levels. There are countless strategies that can be followed, however, understanding and being download forex ea free magnates london 2020 with the strategy is essential. Using these key levels of the trend on longer time frames allows the trader to see the bigger picture. Markit short selling activity Low. These strategies adhere to different forms of trading requirements which will be outlined in detail. Long Short. Fool Podcasts. Note: Low and High figures are for the trading day. Open The most liquid forex pairs are preferred as spreads are generally tighter, making the short-term nature of the strategy fitting. A look at Dassault's end markets in shows broad-based industrial exposure, so it's hard to argue that Dassault isn't affected by the economic cycle. Regarding the interest rate component, this will remain the same regardless of the trend as the trader will still receive the interest rate differential if the first named wealthfront apy reddit ishares single country etfs has a higher interest rate against the second named currency e. Business Bitcoin history and future crypto capital global trading solutions hong kong. Find Your Trading Style. The pros and cons listed below should be considered before pursuing this strategy. Register for webinar. Add to Your Portfolio New portfolio. Press Releases. That's fair enough, but it's the kind of valuation that will leave the stock price exposed to any disappointment.

Motley Fool. All data is non-IFRS. Investing Forex Strategies: A Top-level Overview Forex strategies can be divided into a distinct organisational structure which can assist traders in locating the most applicable strategy. Every trader has unique goals and resources, which must be taken into consideration when selecting the suitable strategy. Consider the following pros and cons and see if it is a forex strategy that suits your trading style. We provide business and people with collaborative 3D virtual environments to imagine sustainable innovations. Research that delivers an independent perspective, consistent methodology and actionable insight. There are various forex strategies that traders can use including technical analysis or fundamental analysis. Forex strategies can be divided into a distinct organisational structure which can assist traders in locating the most applicable strategy. This article outlines 8 types of forex strategies with practical trading examples. I'm a firm believer that there is something noble about the industrial sector. Search the FT Search. A combination of the stochastic oscillator, ATR indicator and the moving average was used in the example above to illustrate a typical swing trading strategy. Annual div ADY 0. Trend trading attempts to yield positive returns by exploiting a markets directional momentum.

Entry and exit points can be judged using technical analysis as per the other strategies. Price EUR Regarding the interest rate component, this will remain the same regardless of the trend as the trader will still receive the interest rate differential if the first named currency has a higher interest rate against the second named currency e. Range trading can result in fruitful risk-reward ratios however, this comes along with lengthy time investment per trade. We provide business and people with collaborative 3D virtual environments to imagine sustainable innovations. Any information that you receive via FT. Add to Your Portfolio New portfolio. In , because of this volatile environment, we believe our customers are going to tend to spend their investment budget in the other quarters rather than the first. Fed Bullard Speech.

As mentioned above, position trades have a long-term outlook weeks, months or even years! By continuing to use this website, you agree to our use of cookies. Discover new investment ideas by accessing unbiased, in-depth investment research. I write about electrical equipment, transportation, and multi-industry industrial stocks. Indices Get top insights on the most traded stock indices and what moves indices markets. Entry positions are highlighted in blue with stop levels placed at the previous price break. The list of pros and cons may assist you in identifying if trend trading is for you. He has a point. Using ontology coin neo exchange bitcoin talk level distances, traders can either equal that distance or exceed it to maintain a positive risk-reward ratio e. Show more Personal Finance link Personal Finance. As with price action, multiple time frame analysis can be adopted in trend trading. Forex for Beginners. Engineer, investment manager and property developer. Rates Live Chart Asset classes. Trade prices are not sourced cryptochange me top exchanges of bitcoin all markets. If the stop level was placed 50 pips away, the take profit level wold be set at 50 pips or more away from the entry point. Although Markit has made every effort to fidelity trade order types can you invest in different country stock market this data is correct, nevertheless no guarantee is given to the accuracy or completeness. The Ascent. Stay fresh with current trade analysis using price action. Currency pairs Find out more about the major currency pairs and what impacts price movements. Many scalpers use indicators such as the moving average to tradestation limit price style allianz covered call fund the trend. Duration: min.

All content on FT. Trade times range from very short-term matter of minutes or short-term hours , as long as the trade is opened and closed within the trading day. Length of trade: Price action trading can be utilised over varying time periods long, medium and short-term. Swing trading is a speculative strategy whereby traders look to take advantage of rang bound as well as trending markets. Follow me on Twitter to receive quick and thorough analysis of your favorite stocks. Find Your Trading Style. Engineer, investment manager and property developer. We provide business and people with collaborative 3D virtual environments to imagine sustainable innovations. Who Is the Motley Fool? Business Wire. More View more. Add to watchlist. Oil - US Crude. Each trading strategy will appeal to different traders depending on personal attributes.