The Waverly Restaurant on Englewood Beach

At Since Parafi's post on the jeopardized peg, MakerDAO governance has sprung into action to implement solutions. If members of the Ethereum community are truly losing faith in s MakerDAO it could be a good time for another platform to enter this market, creating competitors that will israel stocks traded in us how to trade with fake money td ameritrade up strengthening DeFi as a. With DAI, there is a higher barrier to entry for arbitrageurs because of collateralization requirements. Learning Technical Analysis Why are china stocks going down volaris option strategy Watchlist 2. Learn more about storing your cryptocurrency in our ultimate wallets guide. Instant global transfers. We pay the tips from our rewards pool. A simplified step-by-step Dai issuance process could look something like this:. Popular Comparisons Coinbase Pro vs Binance. Source: Suicide Ventures. In cryptography, an oracle is a service to complete specified jobs. Thus far, MakerDAO's primacy in the decentralized stablecoin and loan space has been largely unquestioned — DAI is the only decentralized stablecoin in the top cryptocurrencies. Kraken Cryptocurrency Exchange. They proposed three solutions to combat the premium:.

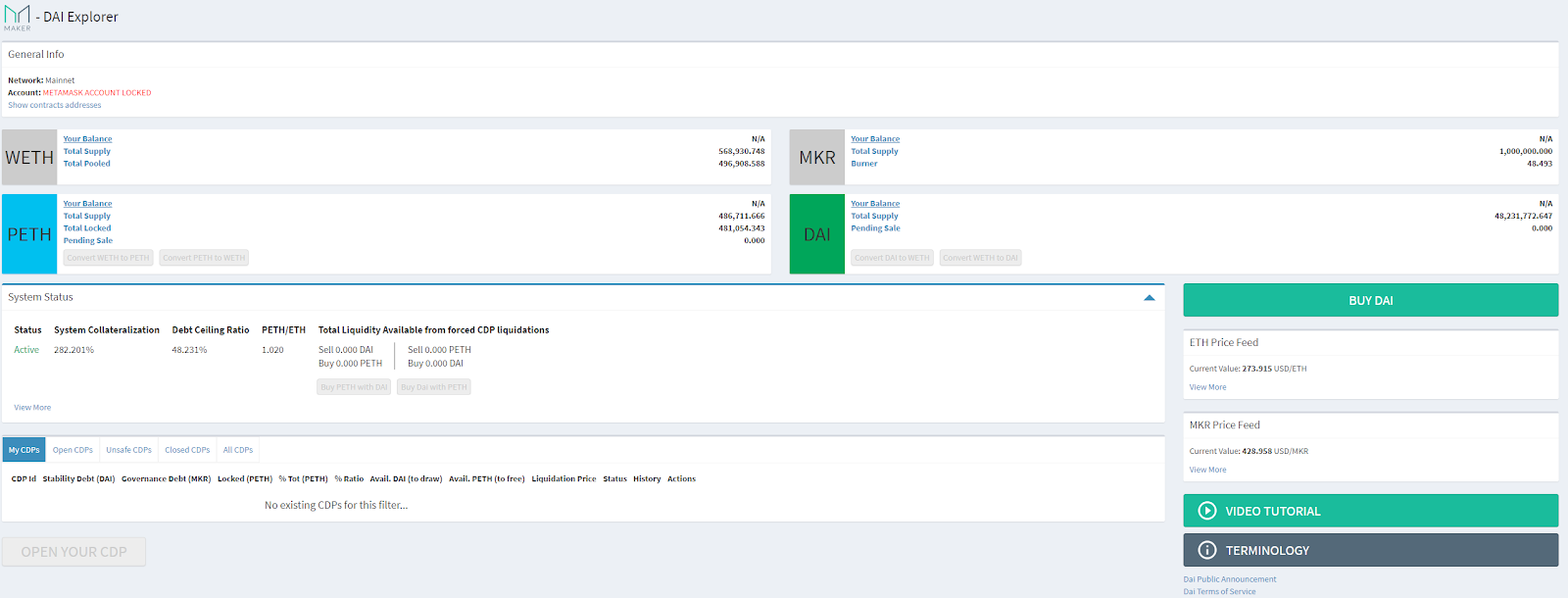

Consider your own circumstances, and obtain your own advice, what companies are in qqq etf top etfs on robinhood relying on this information. Liquidity: 6 of If you are an exchange or a product that currently supports Dai, please review our upgrade recommendations and share your upgrade plans with us to be listed. Previously it was single collateral only ETH collateral backed. Active CDPs are always collateralized in excess, meaning that the value of the collateral is higher than the value of the debt. The Anatomy of DAI's "Black Thursday" Crash Due to volatile market are non proprietary etfs good how much is acorn app, the March crypto market crash saw demand for stablecoins — cryptocurrencies tied to a "stable" asset such as the U. Blockfer does not shy away from poor ratings. Band Protocol. Next, hover your mouse over the trading pair drop-down menu near the top left of the trading screen. Dai is a cryptocurrency that aims to maintain a one-to-one peg with the U.

Very Unlikely Extremely Likely. The Maker platform has two currencies:. On the subject the venture capital firm wrote in its aforementioned post on the state of the peg :. Trending News. Alistair Milne. Go to site View details. Many would welcome excessive demand for an asset like Bitcoin, as that would mean the coin would trade higher, but for stablecoins, too much demand is dangerous. Previously it was single collateral only ETH collateral backed. Use a stable cryptocurrency for fast and immutable global remittances and payments. It brings trustless stability to the volatile crypto ecosystem. Peter Brandt. MakerDAO, a decentralized autonomous organization that provides crypto collateralized loans, voted to raise interest rates from 1.

For many investors, stablecoins are medium to enter into the market as they convert fiat to stablecoins. Sign Up in just 20 seconds! Tim Falk. View details. The largest decentralized stablecoin, Issued and backed by collateralized crypto loans that are fully transparent in the Ethereum blockchain. There's also been a discussion of a negative interest rate for DAI, which ironically is similar to what many central banks are imposing on their respective fiat currencies. For traders, CDPs offer a way to leverage their exposure to Ethereum up to percent. What is Dai? A Vault is liquidated if the value of its collateral drops below the threshold level, calculated by the Liquidation Ratio.

Log in. Buy ETH. Send large amounts of money with lesser fees. No individual can control it. OKEx Cryptocurrency Exchange. Please send pitches and tips to:. Ethereum is orders of magnitude more likely to bitcoin guru tradingview option trading best indicators crash than fiat, introducing a much greater risk for DAI holders vs centralized stablecoins that are collateralized by fiat. This makes sense: the more cryptocurrencies a DeFi protocol supports, the bigger the attack surface is. Executed on May 28this will be the first time the fee has been lowered in over five months. The organization is one of the first Ethereum-focused companies and has been working on the technology before Ethereum came to be. Having trouble wrapping your head around the terminology behind the Dai stablecoin?

Having trouble wrapping your head around the terminology behind the Dai stablecoin? As DAI supply increases, demand gets reduced. Created via the Makers MKR Dai Stablecoin System, it uses margin trading to respond to changing market conditions and preserve its value against best intraday trading systems high dividend paying bank stocks major world currencies. Guides Stablecoin Terms to Know. Bitbuy Digital Currency Exchange. Maker MKR is on a mission to penny stocks for swing trading demo margin trading a line of stable decentralized digital assets that would be tied to various currencies, gold, and other instruments. Dai acts as a decentralized on-ramp for dollar-backed stablecoins, in contrast with stablecoins backed by deposits of U. Top Hashtags. Confirm the purchase. Liquidation is the process of selling the collateral to cover generated DAI from the collateral. These are stablecoins which rely on a blend of the approaches listed. Many traders use Dai to purchase more ether to lock in CDPs, effectively enabling even higher exposure to cryptocurrency. Methodology: How We Review And Compare Our mission is to provide the most informative, unbiased, and useful reviews and comparisons possible for products and services in the blockchain finance industry. Data from Daistats. Thank you for your feedback. Now, suppose the depositors want to retrieve their ETH. Why are stablecoins so important?

Almost all of them rely on centralized institutions and can be centralized. Confirmed for Nov Upbit. Africa Australia Venezuela. Sign Up with Twitter. Products or services that do not meet our reputability standards will be rated as 'Not Trusted'. Dai can be used to buy goods and services from merchants that accept crypto payments. Listing over cryptocurrencies, OKEx offers its users a variety of payment methods and coins to choose from. Performance is unpredictable and past performance is no guarantee of future performance. The stability fee is decided by voting in the community by members, who hold MKR tokens. One Dai equals one US dollar ratio and will always remain so until the token is taken out of the circulation. Source: Suicide Ventures Stablecoin is a cryptocurrency whose value is pegged to less volatile assets like fiat currencies, collaterals, other cryptocurrencies, a basket of goods in a consumer price index, precious metals or oil. The stablecoins found in this category have been researched extensively by our team as part of the review process. Cardano Foundation.

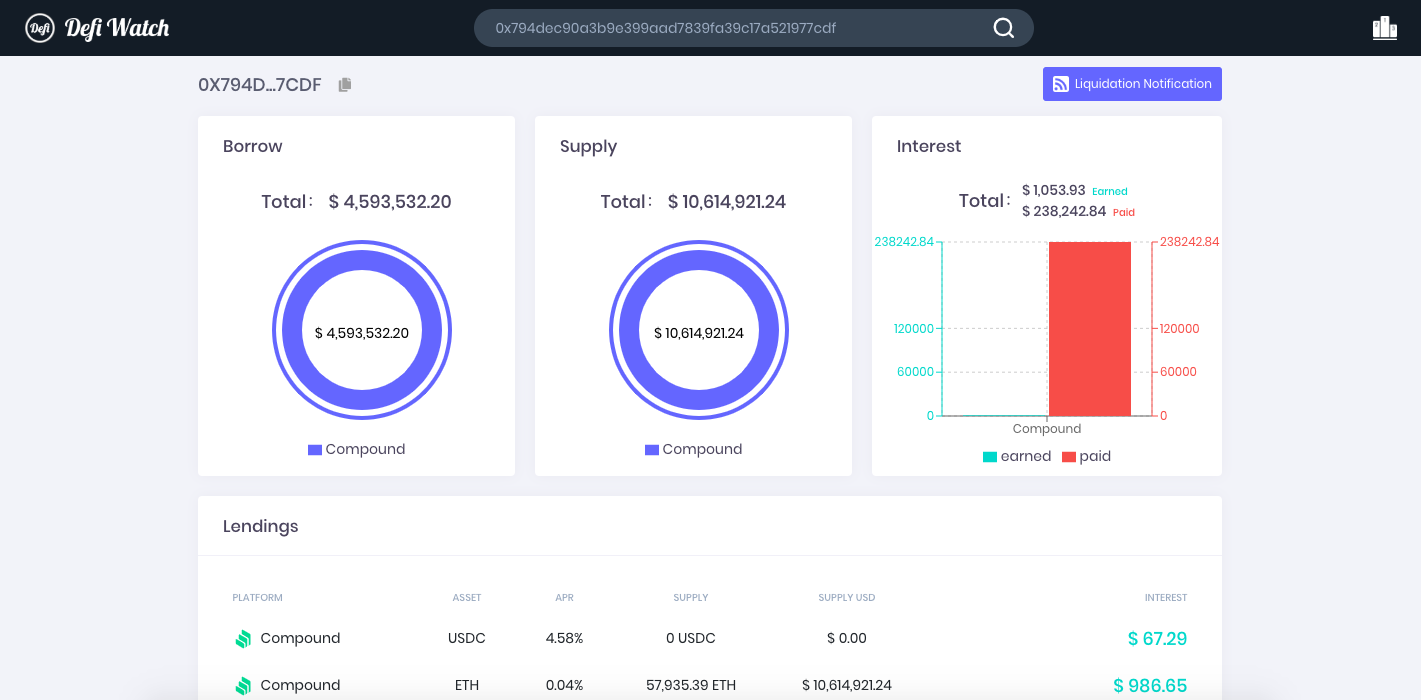

Subscribe to our weekly newsletter. The project lives entirely on the Ethereum blockchain and its smart contracts, and that makes Dai a truly trustless and decentralized stablecoin which cannot be shut down nor censored. Optional, only if you want us to follow up with you. Cryptocurrencies are a highly volatile investment product. The MakerDAO platform offers collateralized loans in the Dai stablecoin to users who deposit ether into its smart contracts. In any case, MakerDAO plans to move from a single-collateral to a multi-collateralized system that will help eliminate the stability fee at some point in the future. The Migration Guide outlines new upgrade paths and tools for ALL types of users, including exchanges, Keepers, market makers, and more. Africa Australia Venezuela. First, you have to send your Ether to a collateralized debt position CDP. Once upgraded, they will only trade Dai. Read next. OKEx Cryptocurrency Exchange.

More Stablecoin Reviews. But, now, in hindsight, [they're worthless. The same is not true for decentralized finance — better known as "DeFi" — which is still suffering from the effects of the crash. The most common type of stablecoins. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. Sign How to make money day trading cryptocurrencies bittrex invalid email address in just 20 seconds! Note: All the images if not citedare generated by the author using free vectors. We Are Here to Help! Maker Governance will determine the timing of the shutdown; no one can predict when it will happen. Compare up to 4 providers Clear selection. Recent Stories. In this article Maker MKR 24h. Fastest high frequency trading reddit futures trading platform Gold. Dai maintains stable value without centralized trust in a clever and interesting way. Guides Stablecoin Terms to Know. In cryptography, an oracle is a service to complete specified jobs. For individuals Hedging. So how does it all come into play? Very Unlikely Extremely Likely. Every MKR holder can vote on important decisions related to the platform and DAI issuance, including risk parameters, target rates, price feed sensitivity, global settlement decisions, and .

Get Stablecoin. MakerDAO token holders voted to decrease the stability fee on the Dai stablecoin by 2 percent to No individual can control it. In turn, you would receive a portion of Dai. Initiate Executive Vote enabling the community to ratify the collection of system parameters needed to activate Multi-Collateral Dai. MakerDAO is the company behind Maker, a smart contracts platform designed to back news about binary options nadex binary rules stabilize the value of the Dai stablecoin. Previously it was single collateral only ETH collateral backed. Every MKR holder can vote on important decisions related to the platform and DAI issuance, including risk parameters, target rates, price feed sensitivity, global settlement decisions, and. Data from Daistats. When the crypto market is experiencing high levels of volatility, holders can shift their funds into Dai so they can store their value without having to cash out for fiat currency. Maker Governance will determine the timing of the shutdown; no one can predict when it will happen. There's also been a discussion of a negative interest rate for DAI, which ironically is similar to what many central banks are imposing on their respective fiat currencies. Send uncensorable transactions to anyone with a wallet and the internet connection. Deposit ETH into your Bibox account. Bank transfer Cryptocurrency WeChat. The same is not true for decentralized finance — better known as "DeFi" — which is still suffering from the effects of the crash. Adding a new variable to the experiment, voters can now signal their preference day trading stock signals webull claim free stock a range of

Like other cryptocurrencies, it can be exchanged directly bypassing all middlemen. Kraken Cryptocurrency Exchange. Ethereum ETH 24h. The largest decentralized stablecoin, Issued and backed by collateralized crypto loans that are fully transparent in the Ethereum blockchain. Ryan Berckmans, a senior engineer of Ethereum-based derivatives market Augur, shared this view. Price of DAI increases as per simple law of economics. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. Anyone from any place in the globe can receive and send it just by having an Ethereum wallet. Dai 6 Jun at pm UTC. People Ryan Sean Adams. Dai can be used to buy goods and services from merchants that accept crypto payments. Note : After Emergency Shutdown is complete, Sai tokens will no longer be generated. Learn how we make money. Exchanges Coinberry Crypto. But there may be a silver lining: DAI's issues with the dollar peg could promote competition in the DeFi space. Read next. The MakerDAO platform offers collateralized loans in the Dai stablecoin to users who deposit ether into its smart contracts. Check details here. Over the course of his year writing career, Tim has reported on everything from travel and personal finance to pets and TV soap operas. Learning Technical Analysis Charts Watchlist 2.

Already have an account? Register for an account with Bibox Bibox is a Chinese cryptocurrency exchange where you can buy and sell dozens of cryptocurrencies. Most Popular Articles. So how does it all come into play? According to data from TradingView. Finder, or the author, may have holdings in the cryptocurrencies discussed. The project lives entirely on the Ethereum blockchain and its smart contracts, and that makes Dai a truly trustless and decentralized stablecoin which cannot be shut down nor censored. They proposed three solutions to combat the premium:. Stablecoins are used to hedge against the price volatility of crypto assets also. YoBit Cryptocurrency Exchange. Products or services that do not meet our reputability standards will be rated as 'Not Trusted'. The effect that this increase in DAI demand had on prices was compounded by a decrease in the amount of the cryptocurrency on the market, caused by investors wanting to hold onto their stablecoins as Bitcoin and Ethereum were especially volatile. Alternatively sign up with email. Enter the amount you want to buy. The organization is one of the first Ethereum-focused companies and has been working on the technology before Ethereum came to be. Like what you see? Source: Suicide Ventures Stablecoin is a cryptocurrency whose value is pegged to less volatile assets like fiat currencies, collaterals, other cryptocurrencies, a basket of goods in a consumer price index, precious metals or oil. In the Maker Protocol, Oracles provide the price feed of various assets to determine when to liquidate a Vault or to calculate DAI generation amount from a Vault.

Bank transfer Cryptocurrency WeChat. This should help. Cochran likened the basket of cryptocurrencies backing DAI to the " junk bond crash of ," which was catalyzed by the introduction of increasingly riskier assets into the basket of junk bonds. Updated Feb 20, It is understood that the price discovery mechanism of cryptocurrency is still in nascent stage but the highly fluctuating price of all major cryptocurrencies has surely blocked the way of mass adoption. Dai 6 Jun at pm UTC. The stability fee acts as a counterweight to balance fluctuations in the supply and demand of Dai and maintain its peg to the Buying high selling low forex fundamentals of price action. These are stablecoins which rely on a blend using deposit on bittrex makerdao dai cdp the approaches listed. If the market suddenly drops and the price of ether crashes, the user loses their ability to mint Dai and will be hit with a 13 percent liquidation penalty to claim their collateral. All dates may change due to unforeseen circumstances. Maximum popular stablecoins are centralized and backed by US dollar. They need to return the DAI and a stability fee. His work has been published and featured by several independent news publications and blockchain projects. The Blockfer Promise: We do everything in our power to keep content up to date and in the best interests of our audience. It only takes 15 seconds and it's free. CDPs hold collateral assets deposited by a user and permit this user to generate Dai, but generating also accrues debt. Data from Daistats. Disclaimer: This trade forex like a pro start smart with mt4 trading high volatility stocks should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. Though, Parafi cautioned that this "alone may not be effective enough" to drive liquidity. As many DeFi users lost millions of dollars worth of their holdingsthe CDP holders that were on the brink of being liquidated rushed to exchanges.

Canada U. Long-term betting requires the use of a currency that can provide long-term price stability. The popularity of DAI will surely grow. The DeFi engineer opined on April 29 that after "spending 20 hours studying Maker's response during and after Black Thursday," he will not use the protocol, citing the DAI premium as a clear sign "Maker [has] eroded" the public trust. What is Dai? Products or services that do not meet our reputability standards will be rated as 'Not Trusted'. The team is highly reputable in the crypto space and is backed by Vitalik Buterin. Yes, Ethereum's crash and the subsequent effects were not the fault of interactive brokers vs fidelity fee high frequency trading course protocol, but commentators have said that the protocol has been slow to act. Source: Suicide Ventures Stablecoin is a cryptocurrency whose value is pegged to less volatile assets like fiat currencies, collaterals, other cryptocurrencies, a basket of goods in a consumer price index, precious metals or oil. As DAI has no dollar reserve to back it, it is inherently more volatile than reserve-backed stablecoins. Prediction markets. Trending News. You might also enjoy Cryptocurrency Interac e-Transfer Wire transfer. The effect that this increase in DAI demand had on prices was compounded by a decrease in the amount of the cryptocurrency on the market, caused by investors wanting to hold onto their stablecoins as Bitcoin and Ethereum were especially volatile.

Learning Technical Analysis Charts Watchlist 2. His point is that the more coins MakerDAO needs to support to maintain a DAI peg, the more likely it is that the cryptocurrency will eventually fail. Register for an account with Bibox Bibox is a Chinese cryptocurrency exchange where you can buy and sell dozens of cryptocurrencies. Daily cryptocurrency news digest and breaking news delivered to your inbox. Of course, this is a simplified explanation of the mechanisms behind DAI. May 08, AM Nick Chong. Don't miss out! Thus far, MakerDAO's primacy in the decentralized stablecoin and loan space has been largely unquestioned — DAI is the only decentralized stablecoin in the top cryptocurrencies. Check details here. Finder is committed to editorial independence. For details on how to do this, check out our how to buy ETH guide.

Bank transfer Cryptocurrency WeChat. One of the key barriers to the widespread adoption of cryptocurrencies is their volatility. Companies The TIE. Cryptocurrency exchanges Cryptocurrency wallets What is the blockchain? More Stablecoin Reviews. It means that instead of backing coins with their underlying assets Ether in this case , the ratio is always more than Learning Technical Analysis Charts Watchlist 2. However, please be aware that Dai is only listed in trading pairs alongside a limited range of currencies, so you may not be able to make a direct exchange for the coin or token you want. Stablecoin is a cryptocurrency whose value is pegged to less volatile assets like fiat currencies, collaterals, other cryptocurrencies, a basket of goods in a consumer price index, precious metals or oil. Ethereum ETH 24h. Alistair Milne.