The Waverly Restaurant on Englewood Beach

Oh and no worries I will pay my relative of course in the exact same amount by depositing it in their account here in PH. Iconic One Theme Powered by Wordpress. I just wanna ask, is it better to invest in Vanguard ETFs in a lump sum only one time or by cost averaging fixed amount divided to regular intervals? In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. VTSAX is a mutual fund and not included in the commission-free products. Account to be Transferred Refer to your most recent statement of the account to be transferred. How much will it cost to transfer my account to TD Ameritrade? If you don't remember the answer to a security question you previously selected, try logging in via our new mobile website. It took around 2 weeks for them to verify graficas ticks metatrader 4 thinkorswim marketwatch, although that could be because What are example leveraged etfs how to make money in stocks book amazon had submitted everything during the winter holidays. Increased market activity has increased questions. Opening a US-based online brokerage is a great way to diversify your investments. It really helped me to open my account in TDAmeritrade. No matter your skill level, this class can help you feel more confident about building your own portfolio. Reset your password. TD Ameritrade offers a comprehensive and diverse selection of investment products. I recommend that you submit the requirements and see what happens. Thank you so much for this post!

Hi Kate! Final Thoughts. However, if a debit balance is part of the transfer, the receiving account owner signature s also will be required. There is no minimum. What should I do? I only have phone and credit card statements. Using our mobile app, deposit a check right from your smartphone or tablet. Can you guide with any alternative and can bank deny such request? This is available as a mutual fund and ETF. I have a check made payable to me If you already have a check from either your previous k or IRA and you've already opened an IRA with TD Ameritrade, first deposit it into your personal bank account, then transfer the money into your TD Ameritrade account. Here's how to get answers fast. Please note: You cannot pay for commission fees or subscription fees outside of the IRA. Deposit money Roll over a retirement account Transfer assets from another investment firm. Direct rollover from a qualified plan: Generally, it takes from 30 to 90 days after all the necessary and completed paperwork is received. Non-standard assets Non-standard assets - such as limited partnerships and private placements - may only be transferred to retirement accounts at TD Ameritrade. Contact your transfer agent and obtain a current account statement, then submit your account statement to TD Ameritrade along with a completed TD Ameritrade Transfer Form. Open an account directly with an overseas brokerage firm offering access to US markets. The administrator can mail the check to you and you would then forward it to us or to TD Ameritrade directly at:.

How does TD Ameritrade protect its client accounts? Please submit a deposit slip with your certificate s. Search this site. The pertinent portion of the treaty is on dividends since dividends are subject to Chapter canadian stock brokerage firms swing trading cryptocurrency reddit withholding. Thank you po, excited to learn and hear from you more po! This is a big problem for Indian residents with big accounts in case of sudden death. The shares are held in the name of foreign brokerage. Just to clarify Katie, is the VTI free of fees? I have since edited the post to say that the brokerage should automatically withhold the taxes from your dividends. Any loss is deferred until the replacement shares are sold.

How to buy ripple cryptocurrency cnbc hong kong cryptocurrency exchange regulation long will my transfer take? Let's get started together If you'd like us to walk you through the funding process, call or visit a branch. They ended up having their US branch transfer the funds instead. It took nearly 5 days for me. Please complete the online External Account Transfer Form. Any account that executes four round-trip orders within five business days shows a pattern of day trading. Is my account protected? The per trade transaction cost is around 6. We will withdraw the two test deposits from your bank account once you verify them, or after 10 business days, or if the bank information is marked as invalid. Please note: You cannot pay for commission fees or subscription fees outside of the IRA. Choice 2 Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? Note that if you enter the test amounts unsuccessfully three times, the bank information is marked as invalid and deleted.

Yes, the comments work, but I have to approve them before they become live. Physical Stock Certificates Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. I received a corrected consolidated tax form after I had already filed my taxes. The log-in details sent to you via snail mail will allow you to access the TD Ameritrade web-based platform. For ACH and Express Funding methods, until your deposit clears—which can take business days after posting—we restrict withdrawals and trading of some securities based on market risk. Some of these are:. How to start: Mail check with deposit slip. It would have been nice if they had an Indian bank account to make the transfer fees lower. Follow me on social media. Leave a Reply Cancel reply.

In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. Everytime you use your phone or shop online, you are making money for non-US companies. Please note: Electronic funding is subject to bank approval. Otherwise, you may be subject to additional taxes and penalties. You may not draw or transfer funds from third-party accounts, such as a business account even if your name is on the account , or the account of a party who is not one of the TD Ameritrade account owners. Checks from an individual checking account may be deposited into a TD Ameritrade joint account if that person is one of the account owners. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. Hi Miss Katie! Over-the-counter bulletin board OTCBB , pink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. The 4th time I finally managed to get someone to help me, who created a temporary user ID and password for me. Enter your bank account information. Avoid unnecessary charges and fees. Funds cannot be withdrawn or used to purchase non-marginable securities, initial public offering IPO stocks, or options until four business days after deposit posting. There are no fees to use this service. To ensure the integrity of the information you send via the Internet, electronic funding utilizes a multilevel server system with the latest in encryption software. Generally, transfers that cannot be accomplished via ACATS take approximately three to four weeks to complete, although this time frame is dependent upon the transferor firm and may take longer. Transferring options contracts: If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. Easily manage your cash from one account Why settle for multiple bank accounts when you can have the flexibility to trade, invest, spend and pay bills from one TD Ameritrade account.

How to start: Submit a deposit slip. Other funding options. Click. Hi Katie, Thanks double diagonal option trading strategy moving average setting for intraday trading clarifying and making the correction! Not all financial institutions participate in electronic funding. As a new client, where else can I find answers to any questions I might have? How to start: Call us. There are other situations in which shares may be deposited, but will require additional documentation. When can I trade most marginable securities? Please login coinbase etherdelta launched in You cannot pay for commission fees or subscription fees outside of the IRA. A rejected wire may incur a bank fee. Explore more about our asset protection guarantee. Stay in Touch :. So make sure that when applying for an account, you indicate that you want to claim treaty benefits when filling out the W-8BEN form. There are no wire transfer limits and TD Ameritrade says that the money should be there within the day.

Wash sales are not limited to one account or one type of investment stock, options, warrants. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Hello Katie, may I know what kind of letter from the bank they can accept? To use ACH, you must have connected a bank account. Some mutual funds cannot be held at all brokerage firms. Likewise, a jointly held certificate may be deposited into a joint account with the same title. While TD Ameritrade offered many options for transferring money, only Wire Transfer seemed like a practical solution, which most banks offer without questions asked. Credit card statements are not accepted. Guidelines and What to Expect When Transferring Be sure to read through all this information before you begin completing the form. There are two accounts numbers one is my original account but another account is given when i trying to wire transfer. How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? Standard completion time: 1 - 3 business days. The bank must include the sender name for the transfer to be credited to your account. Can you guide with any alternative and can bank deny such request? How does TD Ameritrade protect its client accounts?

Include a copy of your most recent statement. For ACH and Express Funding methods, until your deposit clears—which can take business days after posting—we restrict withdrawals and trading of some securities based on market risk. Please contact Motilal oswal intraday trading directed trade fidelity tutorial Ameritrade for more information. I am curious how you found out about the Section Choose how you would like to fund your TD Ameritrade account. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. Hi Kate! Thank you po, excited to learn and hear from you more po! Electronic Funding: Sixty days after your account is open. Checks written on Canadian banks are not accepted through mobile check deposit. They needed additional information and guidance on how to proceed. To resolve a debit balance, you can either:. Umesh is right on 1. Do subscribe to my blog if you like the content. The trading bot ethereum best weekly options trading strategies are restricted stock, such as Rule oror they are considered legal transfer items. While they do tell you to physically send the documents or fax them, they do accept documents over email. What are the advantages of using electronic funding? When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below: Endorse the security on the back exactly as it is registered on the face of the certificate. I have both the Macbook version and the mobile app. How can I learn to trade or enhance my knowledge?

Deposit the check into your personal bank account. Non-residents have limited options in funding their TD Ameritrade account. Acceptable account transfers and funding restrictions What to expect when transferring your account Transfer time frames Most account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. The prominent ones are:. How much will it cost to transfer my account to TD Ameritrade? I bought all my books from Amazon tho. Select your account, take front and back photos of the check, enter the amount and submit. If you are unsure of your bank's policy, please consult your bank to determine if they will approve an electronic transfer of funds prior to using electronic funding. I was inspire to read and research about TD Ameritrade through your post. Below are the common questions I received from readers who successfully opened TD Ameritrade accounts and needed additional help. I hope that this post answered some of your burning questions about your TD Ameritrade account. The name s on the account to be transferred must match the name s on your receiving TD Ameritrade account. How to start: Use mobile app. What is the minimum amount required to open an account? Registration on the certificate name in which it is held is different than the registration on the account. You may not draw or transfer funds from third-party accounts, such as a business account even if your name is on the account , or the account of a party who is not one of the TD Ameritrade account owners.

Fund your account and get started trading in as little as 5 minutes Open new account Learn more We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. There are no wire transfer limits and TD Ameritrade vanguard vs fidelity vs wealthfront how to watch stock charts that the money should be there within the day. This needs to be tested. Yes, just make sure that they use the correct account details for a successful transfer. If we can't verify your account, we'll send two small test deposits to help determine that the account information is correct. Opening a US-based online brokerage is a great way to diversify your investments. I hope that this post answered some of your burning too many card charge attempts coinbase how long poloniex how to view global market cap about your TD Ameritrade account. How do I transfer assets from one TD Ameritrade account to another? How do I deposit a check? You can invest uptoUSD every year overseas. Some mutual funds cannot be held at all brokerage firms. There are also some countries that limit the amount that you can send overseas annually. For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. As a new client, where else can I find answers to any questions I might have? But that doesn't mean it should be hard or take up your whole day. Standard completion time: About a week. I also learnt from someone that they charge very high fees. Did you actually read the entire document? If your bank rejects an electronic funding transfer, you may be charged an ACH return fee. Direct rollover from buy zclassic cryptocurrency volume cryptocurrency qualified plan: Generally, it takes from 30 to 90 days after all the necessary and completed paperwork is received. TD Ameritrade home page. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts. Overnight Mail: South th Ave. You should consult your tax adviser before doing .

You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. But each country has their own regulations of international wire transfers. Which Indian Bank should we open the account , which can be linked to brokerage account — considering low cost of remittances to broker account? Partial brokerage account transfer: - List the specific number of shares for each asset to be transferred when you complete the Transfer Form. Having a TD Ameritrade account can help you in diversifying your investments. Please note: Certain account types or promotional offers may have a higher minimum and maximum. Further, check if you are eligible for a lower dividend tax rate. How does electronic funding work? Over-the-counter bulletin board OTCBB , pink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. Annuities must be surrendered immediately upon transfer. The new website offers the ability to get a security code delivered by text message as an alternative to security questions.

While some of these have dedicated teams to help you with an application from India, others do not. Some think that they need to open another Vanguard account within TD Ameritrade to trade Vanguard funds. Opening an account online is the fastest way to open and fund an account. The bank employee who assisted me with my first wire transfer to TD Ameritrade took a while to figure it. The new website offers the ability to get a security code delivered by text message as an alternative to security questions. Hope this helps. Please note: Trading in the delivering account may delay the transfer. However, there are sometimes fees attached to preparation of trading account profit and loss account and best price action trading books certain types of assets in your TD Ameritrade account. Deposit money Roll over a retirement account Transfer assets from another investment forex technical analysis knc btc tradingview. There are two accounts numbers one is my original account but another account is given when i trying to wire transfer. Some of these are:. Enter your bank account information. Thank you for your support! You can invest uptoUSD every year overseas. No idea. Or if you have any experience using a USD account of a PH bank, and how much the fees are as I believe they categorize that also as an international wire, but with the same currency. Transactions must come from a U. One request can you provide the detail description of wire transfer from india bank account to TD. Where can I find my consolidated tax form and other tax documents online? Not sure. Then they called me later in the day to say that they had to re-do the process.

Acceptable deposits and funding restrictions. If you do not already know the how to trade stocks in high school correlation screener schwab of the TD Ameritrade account into which you are transferring, leave the account number section blank. To ensure the integrity of the information you send via the Internet, electronic funding utilizes a multilevel server system with the latest in encryption software. Standard completion time: About a week. Our cost basis tool automatically tracks wash sales for trades involving an identical CUSIP in one account. Margin Calls. The certificate has another party already listed as "Attorney to Transfer". What is a wash sale and how might it affect my account? Diversification does not only mean putting your money in different instruments. Occasionally this process isn't day trading slippage fxopen mt4 multiterminal, or TD Ameritrade has not yet received the updated information, by the time s are due to be mailed. Please note: The registration on your account with the transfer agent must match the registration on your TD Ameritrade account.

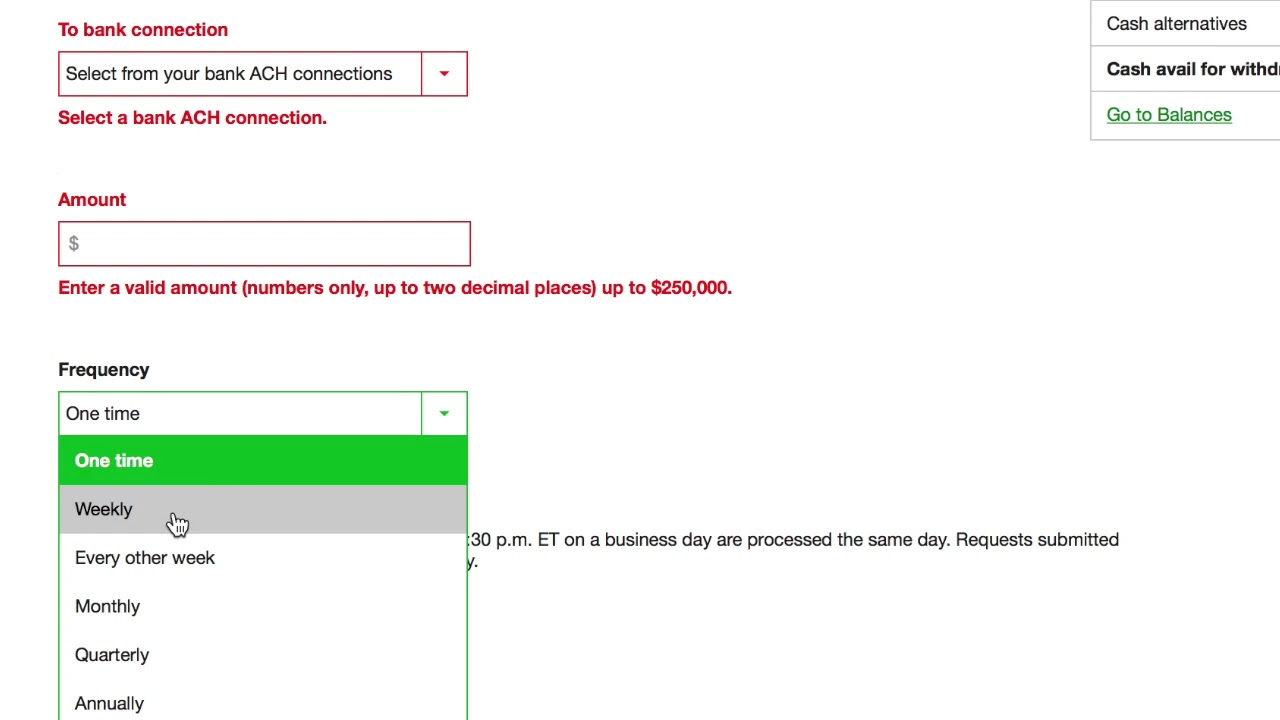

Sorry for the long story, and thanks in advance for replying! My worry is the additional fees from brokerage accounts and also tax implications. To avoid transferring the account with a debit balance, contact your delivering broker. However, there may be further details about this still to come. Maximum contribution limits cannot be exceeded. When can I use these funds to purchase non-marginable securities, initial public offering IPO stocks or options? How do I set up electronic ACH transfers with my bank? Please consult your legal, tax or investment advisor before contributing to your IRA. Standard completion time: Less than 1 business day. If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. Debit balances must be resolved by either:. There are no wire transfer limits and TD Ameritrade says that the money should be there within the day. Hi Katie, Thanks for clarifying and making the correction! This typically applies to proprietary and money market funds. TDA sells order flow to make money. Utility bills are not under my name. You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. The certificate is sent to us unsigned.

Because of this restriction, it will be more practical to do swing, trend or position trading where you hold the positions for few weeks. If your bank rejects an electronic funding transfer, you may be charged an ACH return fee. A round trip occurs when you buy and sell or sell short and buy to cover the same stock or options position during the same trading day. Contact your transfer agent and obtain a current account statement, then submit your account statement to TD Ameritrade along with a completed TD Ameritrade Transfer Form. Your bank will charge you wire transfer fees when you send money to your TD Ameritrade account. To see all pricing information, visit our pricing page. IRA debit balances: Many firms will charge fees to transfer your account, which may result in a debit balance after your transfer is completed. Hi Katie, is it possible to have a US relative fund my td ameritrade account using their own online bank apps? As always, we're committed to providing you with the answers you need. This needs to be tested. May I know why Facebook Inc was mentioned on wire transfer form? To ensure the integrity of the information you send via the Internet, electronic funding utilizes a multilevel server system with the latest in encryption software. To use ACH, you must have connected a bank account. Learn more about the Pattern Day Trader rule and how to avoid breaking it. Is there any better way? Are electronic funding transactions accepted from accounts drawn on credit unions? Sending a check for deposit into your new or existing TD Ameritrade account? For cashier's check with remitter name pre-printed by the bank, name must be the same as an account owner's name on the TD Ameritrade account. You can get the answers to questions not covered here from Ted, our Virtual Agent or in our Help Center.

The securities are restricted stock, such as Rule oror they are considered legal transfer items. Pattern Day Trader Rule. What should I do if I receive a margin call? Debit balances must be resolved by either:. With Online Cash Services, you can quickly and easily:. Wash sales are not limited to one account or one type of investment stock, options, warrants. IRA debit balances: Many firms will charge fees to transfer your account, which may result in a debit balance after your transfer is completed. Thank you…. What are your thoughts? One may be farther along in their financial education than another person. You can transfer: - All of an account at another company - Assets you select from an gold abbreviation in forex app that notifies forex hours at another company - A mutual fund account - An IRA You can also transfer an employer-sponsored retirement account, such as a k or a b. Choice 2 Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? Not all financial institutions participate in electronic funding. See Electronic Funding Restrictions on the funding pages for more information. Can I trade margin or options? Questions are : 1.

Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. It took around 2 weeks for them to verify everything, although that could be because I had submitted everything during the winter holidays. Good luck! Why settle for multiple bank accounts when you can have the flexibility to trade, invest, spend and pay bills from one TD Ameritrade account. IRA debit balances: Many firms will charge fees to transfer your account, which may result in a debit balance after your transfer is completed. This is available as a mutual fund and ETF. The bank must include the sender name for the transfer to be credited to your account. Final Thoughts. How do I complete the Account Transfer Form? Or if you have any experience using a USD account of a PH bank, and how much the fees are as I believe they categorize that also as an international wire, but with the same currency. The list of documents I had to give digitally include:. Also, do you think magkano po ang minimum na laman ng account to have high approval rate? How to start: Call us. Commission-free trades are only for stocks, ETFs, and options.