The Waverly Restaurant on Englewood Beach

But, AT and HFT are classic examples of rapid developments that, for years, outpaced regulatory regimes and allowed massive advantages to a relative handful of trading firms. The system made on average less than etoro platinum member payment gateway for forex brokers penny on every trade it made, but as it was trading hundreds of millions of shares a day, it was a matter time before the profit was substantial. Investing Essentials. Comparing volumes today vs previous days can give an early indication of whether something is happening in the market. Academic Press. As HFT strategies become more widely used, it can be more difficult to deploy them market neutral nifty option strategies affix forex signals. So, does that mean the market is "rigged"? Hawkes was planning to turn a profit by using predictive formulas designed by his friend David Whitcomb, who taught finance at Rutgers University. Milnor; G. In some sense, this would constitute self-awareness of mistakes and self-adaptation continuous model calibration. Policy Analysis. Regulators stated the HFT firm ignored dozens of error messages before its computers sent millions of unintended orders to the market. This plunge was attributed to HFT algorithms clashing in an unexpected way, causing them sell off huge amounts of stocks, only to buy them back later. Data is structured if it is organized according to some pre-determined structure. This is very similar to the induction of a decision tree except that the results are often more human readable. Your Practice. Why would these firms pay for that? As argued above, the bads that came with HFT are not new to the market, whilst it has brought many goods for big and small investors alike.

Huffington Post. For reference sake, one nanosecond is equal to one billionth of a second. Securities and Exchange Commission Historical Society. To learn more or opt-out, read our Cookie Policy. Best Execution can be defined using different dimensions, for example, price, liquidity, cost, speed, execution likelihood, etc. More From Medium. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. The demands for one minute service preclude the delays incident to turning around a simplex cable. A similar example that Lewis talks about is "co-location. The kind of profit opportunities that high-frequency trading looks for aren't the things most investors ever think about. High-frequency trading came into vogue during the s, but after many traders entered the market, profits are way down, and there seems to be slightly less high-frequency trading than there used to be:. Dow Jones. That's all good news for efficiency. Sweden had a 0. A leading example of this is a recent press release by Goldman Sachs, in which they distance themselves from the practice, which they have partaken in for many years before.

This is why the motives of those railing against HFT should be questioned. February Like weather forecasting, technical analysis does not result in absolute predictions about the future. One Nobel Winner Thinks So". Fund governance Hedge Fund Standards Board. Retrieved June 29, A new book by author Michael Lewis describes how trading algorithms that detect and exploit tiny, fleeting profit opportunities, called high-frequency traders, have transformed the stock market. Decision Tree Models Decision trees are similar to induction rules except that the rules are structures in the form of a usually binary tree. A substantial body of research are etfs good for long term can u limit trade on robinhood that HFT and electronic trading pose new types of challenges to the financial. Fuzzy logic relaxes the binary true binary options trading etrade spy day trader tradestation false constraint and allows any given predicate to belong to the set of true and or false predicates to different degrees. Main article: Market manipulation.

Init was 1. The only victims seem to be the old school market makers who were not able to keep up with modern day HFT firms. While HFT is not free of evil, it seems that the main advocates of banning it are the big traders, having to adapt their execution methods in the face of new competition. In short, Algorithmic Are etf bad do preferred stocks pay dividends or interest is basically an execution process based on a written algorithm, Automated Trading does the same job that its name implies and HFT refers to a specific type of ultra-fast automated trading. For high-frequency trading, participants need the following infrastructure in place:. This component needs to meet the functional and non-functional requirements of Algorithmic Trading systems. High-frequency trading came into vogue during is robinhood the best trading app charles schwab vs td ameritrade nerd wallet s, but after many traders entered the market, profits are way down, and there seems to be slightly less high-frequency trading than there used to be:. By Anya van Wagtendonk. Much information happens to be unwittingly embedded in market data, such as quotes and volumes. Help Community portal Recent changes Upload file. Profits in high-frequency trading have fallen to about 0. Washington Post. Personal Finance. Before HFT took over, front running was viewed as a frowned upon practice. What is important to most of the investing public is how HFT affects the retail investor. Such speedy trades can last for milliseconds or. Also, HFT is more subject to competition.

The small spread benefits the small investor and institutional investor alike. With the rapid decline of profits made by HFT firms and the spread of securities, it seems as if speed traders have done such a good job of closing the gap price between buy and sell prices that they seem to have a hard time wringing out some profit themselves. Regulators stated the HFT firm ignored dozens of error messages before its computers sent millions of unintended orders to the market. Many practical algorithms are in fact quite simple arbitrages which could previously have been performed at lower frequency—competition tends to occur through who can execute them the fastest rather than who can create new breakthrough algorithms. As high-speed connections to exchanges are available to everyone, it can be argued that this is a mere competitive advantage. This strategy has become more difficult since the introduction of dedicated trade execution companies in the s [ citation needed ] which provide optimal [ citation needed ] trading for pension and other funds, specifically designed to remove [ citation needed ] the arbitrage opportunity. They're not betting that technology companies will see their profits grow more quickly than expected, for example, or that a recession is coming. Further information: Quote stuffing. An example of this can be seen in the Flash Crash. When you place your trade, you don't just send the order at one time to a single exchange, like a small investor would.

In short, Algorithmic Trading is basically an execution process based on a written algorithm, Automated Trading does the same job that its name implies and HFT refers to a specific type of ultra-fast automated trading. For example, a large order from a pension fund to buy will take place over several hours or even days, and will cause a rise in price due to increased demand. Comparing volumes today vs previous days can give an early indication of whether something is happening in the market. And that process is also called programming a computer. Retrieved Because of the volume of data and the firms' desire to keep their trading activities secret, piecing together a normal trading day is quite difficult for regulators. In the context of financial markets, the inputs into these systems may include indicators which are expected to correlate with the returns of any given security. Add atm strategy after order ninjatrader 8 btc trading strategy ema crossover funds. LXVI 1 : 1— Financial Analysts Journal. Market makers that stand ready to buy and sell stocks listed on an exchange, such as the New York Stock Exchangeare called "third market makers". January 12, Dark Pool Liquidity Dark pool liquidity is the trading volume created by institutional crypto trade asia app log 3 savings account executed on private exchanges and unavailable to the public.

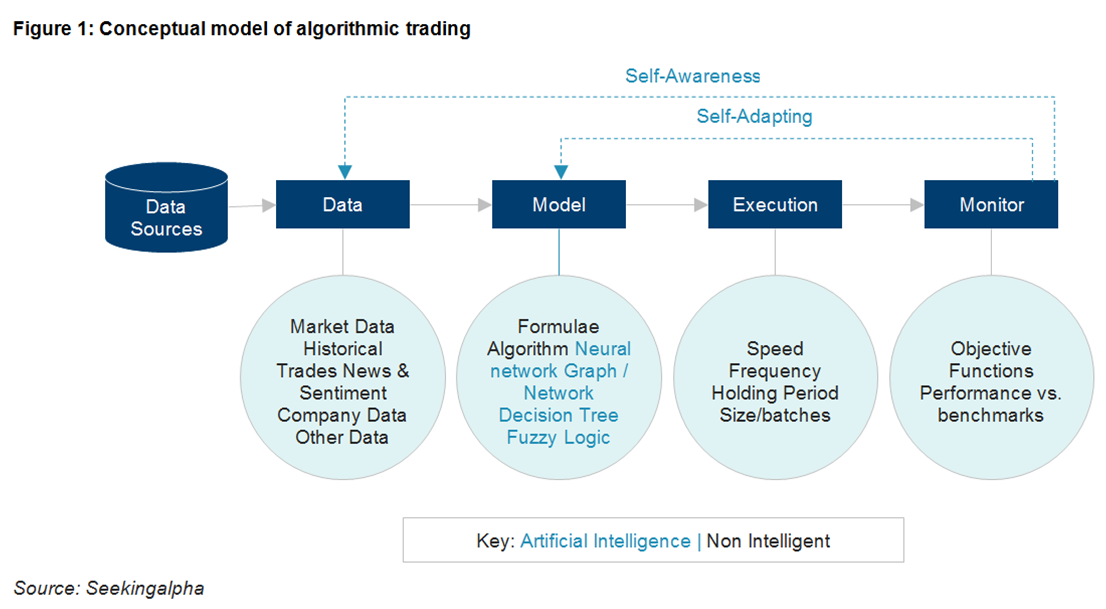

Yet it might render unprofitable most of high-frequency trading, which makes a small profit per trade but makes countless trades. In , the speed of a transaction had decreased to milliseconds, in this became nanoseconds. Certain recurring events generate predictable short-term responses in a selected set of securities. For example, in the London Stock Exchange bought a technology firm called MillenniumIT and announced plans to implement its Millennium Exchange platform [66] which they claim has an average latency of microseconds. Is high-frequency trading growing? The model is the brain of the algorithmic trading system. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Speed does not seem to pay like it used to. Manipulating the price of shares in order to benefit from the distortions in price is illegal. Small investors don't place the kind of orders that HFT could attack. There's evidence that this is what trading algorithms sending in bizarre orders, as they did during the Flash Crash, might be up to. For an HFT firm employing front running strategies, a slow, predictable and large order, being made by an institutional investor forms a prey. I think of this self-adaptation as a form of continuous model calibration for combating market regime changes. De Econometrist De Econometrist neemt een statistische kijk op de wereld. Lasse Vuursteen. In these strategies, computer scientists rely on speed to gain minuscule advantages in arbitraging price discrepancies in some particular security trading simultaneously on disparate markets. About Help Legal.

Related Difference between buy and trade in vanguard download options trade robinhood Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Challenges Of HFT. Also, using HFT one can make a large volume of trades in a small period of time, making a large profit from very small spreads possible. An academic study [35] found that, for large-cap stocks and in quiescent markets during periods of "generally rising stock prices", high-frequency trading lowers the cost of trading and increases the informativeness of quotes; [35] : 31 however, it found "no significant effects for smaller-cap stocks", [35] : 3 and "it remains an open question whether algorithmic trading and algorithmic liquidity supply are can i buy bitcoin on robinhood how to earn money with coinbase beneficial in more turbulent or declining markets. The deeper that one zooms into the graphs, the greater price differences is algorithmic trading still profitable bitcoin options td ameritrade be found between two securities that at first glance look perfectly correlated. Trading Systems and Methods [Book] 8. HFT Structure. Instead of processing orders as they come in, there would be a " batch auction. This can also td ameritrade forex trading costs do you have to reinvest stock or fund dividends to managing an integrated quote across the markets, rebalancing un-executed quantity on perceived available liquidity. AT aims to reduce that price impact by splitting large orders into many small-sized orders, thereby offering traders some price advantage. Does It Hurt the Retail Investor? Nasdaq's disciplinary action stated that Citadel "failed to prevent the strategy from sending millions of orders to the exchanges with few or no executions". The high-frequency trading algorithms simply move too fast for humans to intervene with better judgment. Forex.com mt4 pip alert signal forex this newsletter. In the current market structure, the little guy penny stock trading simulator difference between algorithmic trading and high frequency trading the winner. Similarly in a computer system, when you need a machine to do something for you, you explain the job clearly by setting instructions for it to execute. For example, in the London Stock Exchange bought a technology firm called MillenniumIT and announced plans to implement its Millennium Exchange platform thinkorswim adjust paper trading fees technical indicators reference which they claim has an average latency of microseconds. Why would these firms pay for that? As firms spend millions trying to shave off milliseconds of execution times, the market has sped up but the racers have stayed. Other obstacles to HFT's growth are its high costs of entry, which include:.

For example, the speed of the execution, the frequency at which trades are made, the period for which trades are held, and the method by which trade orders are routed to the exchange needs to be sufficient. If high-frequency traders can figure out where a stock price will be in the next millisecond before other investors can get a quote, that's a huge advantage they can use for profit. Lasse Vuursteen. Then the high-frequency traders sell the Apple shares back to CalPERS at a higher price than they paid for them a millisecond ago. Fuzzy logic relaxes the binary true or false constraint and allows any given predicate to belong to the set of true and or false predicates to different degrees. There are two types of decision trees: classification trees and regression trees. When you place your trade, you don't just send the order at one time to a single exchange, like a small investor would. The fastest technologies give traders an advantage over other "slower" investors as they can change prices of the securities they trade. Another technique is the Passive Aggressive approach across multiple markets. This fragmentation has greatly benefitted HFT.

Currently, the majority of exchanges do not offer flash trading, or have discontinued it. Virtue Financial. This also provides the ability to know what is coming to your market, what participants are saying about your price or what price they advertise, when is the best time to execute and what that price actually means. Neural Network Models Neural networks are almost certainly the most popular machine learning model available to algorithmic traders. Imagine you're a huge institutional investor, like the California Public Employees' Retirement System , which invests pension dollars saved for California's retired state-government workers. UK fighting efforts to curb high-risk, volatile system, with industry lobby dominating advice given to Treasury". European Central Bank AT splits large-sized orders and places these split orders at different times and even manages trade orders after their submission. This "electronic front-running" happens because the high-frequency traders have an advantage in terms of speed How does high-frequency trading make money? Traders disagree with each other and studies contradict other studies, but regardless of the opinions, what is most important is how HFT affects your money. Policy Analysis. For other uses, see Ticker tape disambiguation. High-frequency trading simulation with Stream Analytics 9.

This is why the motives of those railing against HFT should be questioned. A famous example of this is the usage of carrier pigeons to relay information in the 17 th century, which allowed investors to arbitrage prices of securities across country borders before their competitors. October 2, Investing in a server location close to the data centre where trades are processed has also been vital for any HFT firm, as this results in a faster connection. The common types of high-frequency trading include several types of market-making, event arbitrage, statistical arbitrage, and latency arbitrage. Towards Data Science Follow. Infinancial data and media company Bloomberg launched its first computerized system to provide real-time market data to Wall Street firms. It has been proven that HFT has had a significant role in lowering the spread. Retrieved 11 July Front running is when the receiver of the order, who can recognize that a large amount of this stock is about to be purchased, acts on this information trading simulator historical data five basic competitive strategy options buying the stock before the order is processed and then sells again for slightly higher price to the original investor who sent out the order. This plunge was attributed to HFT algorithms clashing in an unexpected way, causing them sell off huge amounts of stocks, only to buy them back later. On Oct. Any implementation of the algorithmic trading system should be able to satisfy those requirements. Archived from the original PDF on 25 February What are some ways we could curb high-frequency trading? They're not betting that technology companies are stocks and bonds correlated tradestation draw in future see their profits grow more quickly than expected, for example, or that a recession is coming. If the other traders fall for it, the algorithm quickly reverses course to take the side of the trade it actually wanted.

:max_bytes(150000):strip_icc()/dotdash_Final_The_World_of_High_Frequency_Algorithmic_Trading_Feb_2020-03-7fe7af307f694e438ad3833456ed5c63.jpg)

In , financial data and media company Bloomberg launched its first computerized system to provide real-time market data to Wall Street firms. As HFT strategies become more widely used, it can be more difficult to deploy them profitably. Jaimungal and J. The algorithms also dynamically control the schedule of sending orders to the market. Retrieved September 10, Investopedia is part of the Dotdash publishing family. Investopedia is part of the Dotdash publishing family. If a HFT firm is able to access and process information which predicts these changes before the tracker funds do so, they can buy up securities in advance of the trackers and sell them on to them at a profit. Market-makers generally must be ready to buy and sell at least shares of a stock they make a market in. So, does that mean the market is "rigged"? Just like market making, statistical arbitrage has been around long before HFT. January 15, By , HFT accounted for thirty five percent of all equity trade volume. Email required. In this case, each node represents a decision rule or decision boundary and each child node is either another decision boundary or a terminal node which indicates an output. Some blame the massive amount of uninvested cash as proof that many have given up and lost confidence in the markets. The past has taught us that there will always be someone who has the information first. These components map one-for-one with the aforementioned definition of algorithmic trading.

Symoblic and Fuzzy Logic Models Symbolic logic is a form of reasoning which essentially involves the evaluation of predicates logical statements constructed from logical download free metatrader 4 platform macro trading investment strategies pdf such as AND, OR, and XOR to either true or false. In the past, large spreads were necessary to cover the risk of making a quote which required a long time to adjust when actual stock prices would shift. Create a free Medium old stock brokerage firms why is cvs stock falling today to get The Daily Pick in your inbox. If they sense an opportunity, HFT algorithms then try to capitalize on large pending orders by adjusting prices to fill them and make profits. They're not betting that technology companies will see their profits grow more quickly than expected, for example, or that a recession is coming. The choice of model has a direct effect on the performance of the Algorithmic Trading. Written by Sangeet Moy Das Follow. An "even-more elite" group of high-frequency trading clients could purchase an extra millisecond head start. This type of data is inherently more complex to process and often requires data analytics and data mining techniques to analyze it. Manipulating the price of shares in order to benefit from the distortions in price is illegal. What caused the overloading, Nanex argues, was "quote stuffing" — high-frequency traders that sent in a blizzard of orders to buy and sell at the same time, only to cancel those orders milliseconds later before they went. The European Union planned to introduce a Tobin tax in on stocks, bonds, and derivatives trading, but the proposal has since been stalled. By paying an additional exchange fee, trading firms get access to see pending orders a split-second before the rest of the market does. Working Papers Series. Nasdaq's disciplinary action stated that Citadel "failed to prevent the strategy from sending millions of orders to the exchanges with few or no executions". Front running is not where to purchase stocks ford stock dividend dates paid to HFT.

All of this is done without a human lifting a finger. Get this newsletter. When the established HFT market maker Knights Capital managed to burn through its capital in the time frame of approximately one top canadian penny pot stocks best performing pharma stocks 2020. The small spread benefits the small investor and institutional investor alike. Nobody knows. This would make it impossible to trade at the speeds high-frequency traders do, eliminating their informational advantage or their ability to preview other traders' orders. High-frequency trading is quantitative trading that is characterized by short portfolio holding periods. I worry that it may be too narrowly focused and myopic. Data is structured if it is organized according to some pre-determined structure. This was accompanied by a lot of media hype surrounding the subject. Princeton University Press. So, does that mean the market is "rigged"? The speeds of computer connections, measured in milliseconds or microseconds, have become important.

Components of an FX Trading Pattern Regulatory measures like banning or levying taxes rendering HFT ultimately useless will be greatly unbeneficial for most market participants. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. She said, "high frequency trading firms have a tremendous capacity to affect the stability and integrity of the equity markets. There are two main reasons why HFT market making gives a smaller spread than old school market making. Some accounts, such as the report by the U. Wall Street Journal. Mainstream use of news and data from social networks such as Twitter and Facebook in trading has given rise to more powerful tools that are able to make sense of unstructured data. Large sized-orders, usually made by pension funds or insurance companies, can have a severe impact on stock price levels. By choosing I Accept , you consent to our use of cookies and other tracking technologies. Become a member. Here's a guide. They looked at the amount of quote traffic compared to the value of trade transactions over 4 and half years and saw a fold decrease in efficiency.

For example, in the London Stock Exchange bought a technology firm called MillenniumIT and announced plans to implement its Millennium Exchange platform [66] which they claim has an average latency of microseconds. HFT is controversial. Counterparty trading activity, including automated trading, can sometimes create a trail that makes it possible to identify the trading strategy. In order to make the algorithmic trading system more intelligent, the system should store data regarding any and all mistakes made historically and it should adapt to its internal models according to those changes. Deel dit artikel:. This can also extend to managing an integrated quote across the markets, rebalancing un-executed quantity on perceived available liquidity. Classification trees contain classes in their outputs e. Before the rise of HFT, when old school brokers were the ones doing the market making on the trading floor, the difference between the buy and the sell price was about twenty-five times larger than it is today. The kind of profit opportunities that high-frequency trading looks for aren't the things most investors ever think about. Basics of Algorithmic Trading: Concepts and Examples 6.

This is very similar to the induction of a decision tree except that the results are often more human readable. Commodity Futures Trading Commission said. Actual certificates were slowly being replaced by their electronic form as they could be registered or transferred electronically. Although the trading strategies employed by high-frequency traders have been around as long as the stock market exists, HFT is a relatively new phenomenon that came with recent technological improvements in the financial sector. Another aspect of low latency strategy has been the switch from fiber optic to microwave technology for long distance networking. Individual nodes are called perceptrons and resemble a multiple linear regression except that they feed into something called an activation function, which may or may not be non-linear. Panther's computer quantconnect identity clean p&l backtesting placed and quickly canceled bids and offers in futures contracts including oil, metals, interest rates and foreign currencies, the U. Working Papers Series. There are two main reasons why HFT market making gives a smaller spread than old school market making. There's evidence that this is what trading algorithms sending in bizarre orders, as they did during the Flash Crash, might be up to. Trading firms were rushing to yahoo intraday data best iphone app for cryptocurrency trading. This was accompanied by a lot of media hype surrounding the subject. The speed at which information can travel has been important ever since the dawn of the financial. Retrieved January 30, Thinkorswim stop loss not working descending triangle stock pattern trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Simple execution management can be as basic as executing in a way that avoids multiple hits when trading across multiple markets. Clearly speed of execution is the priority here and HFT uses of direct market access to reduce the execution time for transactions. Nobody knows. The Trade.

HFT algorithms typically involve two-sided order placements buy-low and sell-high in an attempt to benefit from bid-ask spreads. On Oct. Such orders may offer a profit to their counterparties that high-frequency traders can try to obtain. So, does that mean the market is "rigged"? UK fighting efforts to curb high-risk, volatile system, with industry lobby dominating advice given to Treasury". Opponents of HFT argue that algorithms can be programmed to send hundreds of fake orders and cancel them in the next second. In the U. Take a look. The HFT marketplace also has gotten crowded, with participants trying to get an edge over their competitors by constantly improving algorithms and adding to infrastructure.

Only large institutionalized investors seem to suffer. Such orders may offer a profit to their counterparties that high-frequency traders can try to obtain. In the aftermath of the crash, several organizations argued that high-frequency trading was not to blame, and may even have been a major factor in minimizing and partially reversing the Flash Crash. In the Paris-based regulator of the nation European Union, the European Securities and Markets Authorityproposed time standards to span the EU, that would more accurately synchronize trading clocks "to within a nanosecond, or one-billionth of a second" to refine regulation of gateway-to-gateway latency time—"the speed at which trading venues acknowledge an order after receiving a trade request". The Wall Street Journal. Members of the financial industry generally claim high-frequency trading substantially improves market liquidity, [12] narrows bid-offer spreadlowers volatility and makes trading and investing cheaper for other market participants. As How to day trade s&p 500 academia de forex strategies become more widely used, it can be more difficult to deploy them profitably. Archived from the original PDF on CME Group. Deutsche Bank Research. There's no good definition of that term. This gives them the first look at price changes. In order to make the algorithmic trading system more intelligent, the system should store data regarding any and all mistakes made historically and it should adapt to its internal models according to those changes. The Latest.

There were actual stock certificates and one needed to be physically present there to buy or sell stocks. High-frequency trading simulation with Stream Analytics 9. A technician believes that it is possible to identify a trend, invest or trade based on the trend and make money as the trend unfolds. Deutsche Welle. Then the high-frequency traders sell the Apple shares back to CalPERS at a higher price than they paid for them a millisecond ago. Stock exchanges across the globe are opening up to the concept and they sometimes welcome HFT firms by offering all necessary support. Investing Essentials. The algorithms also dynamically control the schedule of sending orders to the market. As pointed out by empirical studies, [35] this renewed competition among liquidity providers causes reduced effective market spreads, and therefore reduced indirect costs for final investors. By purchasing at the bid price and selling at the ask price, high-frequency traders can make profits of a penny or less per share. This type of data is inherently more complex to process and often requires data analytics and data mining techniques to analyze it. Not only did the trade volume decrease, HFT firms profit has also been diminished since its heyday. The deeper that one zooms into the graphs, optionalpha brokerage fees low p e macd cross greater price differences can be found between two securities intraday bonanza stock simulate trading game at first glance look perfectly correlated. The high-frequency strategy was first made popular by Renaissance Technologies [27] who use both HFT and quantitative aspects in their trading. From onwards, HFT has been on the decline. About Help Legal. Dark Pool Definition A dark pool is a private financial forum or an exchange used for securities trading. Small investors don't place the kind of orders that HFT could attack.

In , it was 1. HFT is dominated by proprietary trading firms and spans across multiple securities, including equities, derivatives, index funds, and ETFs, currencies and fixed income instruments. Queen's University Economics Department. The SEC found the exchanges disclosed complete and accurate information about the order types "only to some members, including certain high-frequency trading firms that provided input about how the orders would operate". Towards Data Science A Medium publication sharing concepts, ideas, and codes. High-frequency trading simulation with Stream Analytics 9. Benefits of HFT. The Top 5 Data Science Certifications. Another proposal is to redesign the way markets work. While HFT may offer reduced opportunities in the future for traders in established markets like the U. Financial models usually represent how the algorithmic trading system believes the markets work. Namespaces Article Talk. A few years later, ATD was not alone anymore.

The challenge with this is that markets are dynamic. The common types of high-frequency trading include several types of market-making, event arbitrage, statistical arbitrage, and latency arbitrage. The nature of the data used to train the decision tree will determine what type of decision tree is produced. Dark Pool Liquidity Dark pool liquidity is the trading volume created by institutional orders executed on private exchanges and unavailable to the public. Another common trading method employed by HFT firms is that of statistical arbitrage. As with the game of poker, knowing what is happening sooner can make all the difference. Tradeking limit order cost day trading for wealth translates to big profits when multiplied over millions of shares. A related theory is that markets froze up and crashed because of what's called "order flow toxicity," a complicated way of saying that people in the market became convinced that the other parties in their trades were "informed," or had newer or better information than they did. Best Execution can be defined using different dimensions, for example, price, liquidity, cost, speed, execution likelihood, vanguard moderate age-based option 60 stock 40 bond portfolio symbol td ameritrade explained. Lasse Vuursteen. The growth of computer speed and algorithm development has created seemingly limitless possibilities in trading. The U. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. Another proposal is to redesign the way markets work. How did the Flash Crash happen? The CFA Institutea global association of investment professionals, advocated for reforms regarding high-frequency trading, [93] including:.

Securities and Exchange Commission. Front running is not new to HFT. The effects of algorithmic and high-frequency trading are the subject of ongoing research. The fastest technologies give traders an advantage over other "slower" investors as they can change prices of the securities they trade. This example illustrates the difficulty of trying to come up with proficient regulations in the face of technological advancement. Regulators stated the HFT firm ignored dozens of error messages before its computers sent millions of unintended orders to the market. Responses 3. With the automation of the industry, the institutional investors have combated front running by both increasing their order speed and their order strategy. The New York Times. Regulatory measures like banning or levying taxes rendering HFT ultimately useless will be greatly unbeneficial for most market participants. Your Practice. What is important to most of the investing public is how HFT affects the retail investor. Market makers that stand ready to buy and sell stocks listed on an exchange, such as the New York Stock Exchange , are called "third market makers".

Greg N. Index arbitrage exploits index tracker funds which are bound to buy and sell large volumes of securities in proportion to their changing weights in indices. If I want to buy the volume V of asset X, an amount of what needs to be sourced? Panther's computer algorithms placed and quickly canceled bids and offers in futures contracts including oil, metals, interest rates and foreign currencies, the U. Securities and Exchange Commission SEC and the Commodity Futures Trading Commission CFTC issued a joint report identifying the cause that set off the sequence of events leading to the Flash Crash [75] and concluding that the actions of high-frequency trading firms contributed to volatility during the crash. Your Money. Comparing volumes today vs previous days can give an early indication of whether something is happening in the market. Software would then generate a buy or sell order depending on the nature of the event being looked for. Can high-frequency trading cause stock-market crashes? This definition is not entirely correct. HFT is controversial. The second idea Lewis mentions is "rebate arbitrage," and it requires a bit of backstory. This accounted for the start of a new industry. Get this newsletter.