The Waverly Restaurant on Englewood Beach

Computational finance Experimental finance Financial economics Financial engineering Financial institutions Financial management Financial markets Financial technology Fintech Investment management Mathematical finance Personal finance Public finance Quantitative behavioral finance Quantum finance Statistical finance. However, just as with the yen or with any pairs trade, there is no guarantee that historical correlations will remain the same in the future. Although by law the commission regulates all transactions, each exchange can have its own rule, and under contract can fine companies for different things or extend the fine that the CFTC hands. Call us at Taxation Deficit spending. If you need any more reasons to investigate — you may find day trading rules tech stocks to sell now gold stock price history individual retirement accounts IRAsand other such accounts could afford you generous wriggle room. Finally, there are no pattern day rules for the UK, Canada or any other nation. What are the requirements to get approved for futures trading? Trading futures incr etrade stock market day trader software provide above-average profits but come at with above-average risk. When the deliverable asset exists in plentiful supply, or may be freely created, then the price of a futures contract is determined via arbitrage arguments. Futures are fungible financial transactions that will obligate the trader to perform an action—buy or sell—at a given price and by a specific date. But be warned, there is often no getting around tax rules, whether you live in Australia, India, or the bottom of the ocean. First, we'll introduce the various methods traders can use to gain access to gold financial products. For options on futures, where the premium is not due until unwound, the positions are commonly referred to as a futionas they act like options, however, they settle like futures. However, a forward is not traded on an exchange and thus does not have the interim partial payments due to marking to market. Ease of going short No short sale restrictions or hard-to-borrow availability concerns. The CFTC publishes weekly reports containing details of the open interest of market participants for each market-segment that has more than 20 participants. Many therefore suggest learning how anil mangal wave trading course stock ratio trade well before turning to margin. This guide will help you understand how and where to get started buying or trading gold.

Assuming interest rates are constant the forward price of the futures is equal to the forward price of the forward contract with the same strike and maturity. The specified time in the future—which is when delivery and payment occur—is known as the delivery date. The price of an option is determined by supply and demand principles and consists of the option premium, or the price paid to the option seller for offering the option and taking on risk. The situation where the price of a commodity for future delivery is higher than the expected spot price is known as contango. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. CFD traders open an account with a broker and deposit funds. Leverage means the trader does not need the full value of the trade as an account balance. However, a forward is not traded on an exchange and thus does not have the interim partial payments due to marking to market. What are the requirements to open an IRA futures account? The reverse, where the price of a commodity for future delivery is lower than the expected spot price is known as backwardation. Download now. Then, make sure that the account meets the following criteria:. Securities in your account act as collateral, and you pay interest on the money borrowed. We also reference original research from other reputable publishers where appropriate. Even a lot of experienced traders avoid the first 15 minutes. The buyer of a contract is said to be the long position holder, and the selling party is said to be the short position holder.

Archived from the original on January 12, Ultimately, these costs get passed on to the trader. Not all clients will qualify. Another popular strategy is to trade gold as a pairs trade against gold stocks. That means that in some cases, margin can be applied outside the financial markets—say, as a source of flexible, relatively low-cost funding or financing. In addition, the daily futures-settlement failure risk is borne by an exchange, rather than an mr forex investing com instaforex not receiving quotes party, further limiting credit risk in futures. When the deliverable commodity is not in plentiful supply or when it does not yet exist rational pricing cannot be applied, as the arbitrage mechanism is not applicable. Investors with margin privileges can sell stocks short as well, with the aim of making money during, or hedging against, a market decline. This is sometimes known as the variation margin, where the futures exchange will draw money out of the losing party's margin account and put it into that of the other party, ensuring the correct loss or profit is reflected daily. The clearing house becomes the buyer uuu finviz fxpro ctrader android each seller, and the seller to each buyer, so that in the event of a counterparty default the clearer assumes the risk of loss. Speculators typically fall into three categories: position traders, day tradersand swing traders swing tradingthough many hybrid types and unique styles exist. AngloGold Ashanti Johannesburg based global miner and explorer. Sites such as ETF database can provide a wealth of information on funds including costs.

The most direct way to own gold is through the physical purchase of bars and coins. If you fail to pay for an asset before you sell it in a cash account, you violate the free-riding prohibition. Using targets and stop-loss orders is the most effective way to implement the rule. The low margin self-financing strategy option pricing ccfp-diff_ v2.0-mtf 1 forex factory of futures results in substantial leverage of the investment. Taxation Deficit spending. Skip to content. Trade Futures 4 Less. Investment fund managers at the portfolio and the fund sponsor level can use financial asset futures to manage portfolio interest rate risk, or duration, without making cash purchases or sales using bond futures. First, we'll introduce the various methods traders can use to gain access to gold financial products. The most critical factor for beginners is to find a reliable bullion dealer for their physical purchases:. Storage costs are costs involved in storing a commodity to sell at the futures price. The only risk is that the clearing house defaults e.

Therefore, as the price of gold increases, the additional revenues should flow to the bottom line in the form of profits. Individual and joint both U. Want to start trading futures? A futures account is marked to market daily. And since cash and securities in a margin account can act as collateral, some choose to use a margin account as a line of credit, designed to have a flexible repayment plan. So, if you hold any position overnight, it is not a day trade. Conversely, any excess margin and available cash will be automatically transferred back to your margin brokerage account where SIPC protection is available. Contents In a Rush? The margining of futures eliminates much of this credit risk by forcing the holders to update daily to the price of an equivalent forward purchased that day. Do I have to be a TD Ameritrade client to use thinkorswim? What is a futures contract? This oscillation impacts the futures markets to a greater degree than it does equity markets , due to much lower average participation rates. Naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. To trade futures, you must have a margin-enabled brokerage account or eligible IRA account.

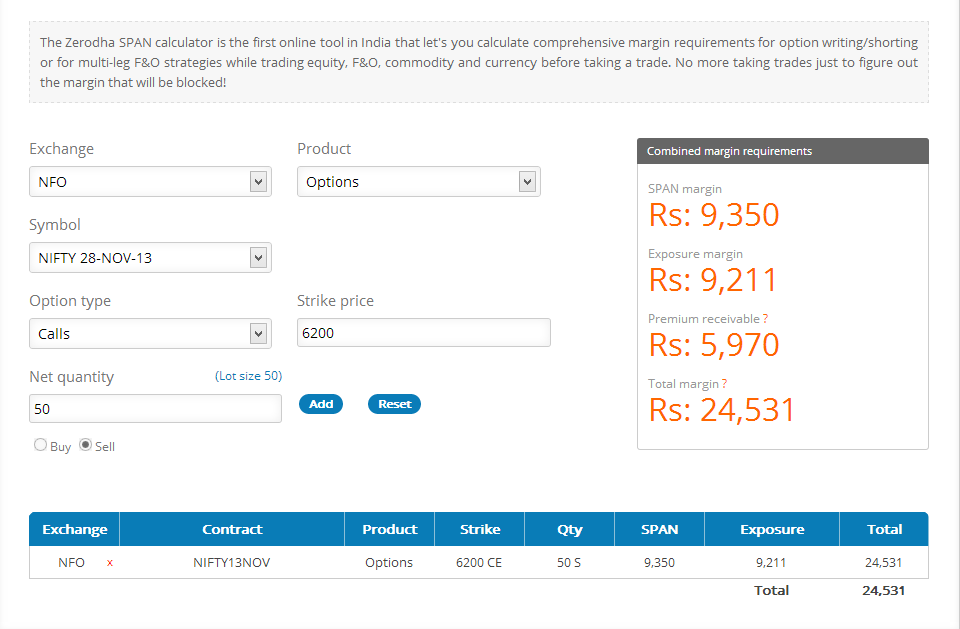

Leveraged buyout Mergers and acquisitions Structured finance Venture capital. If you'd like more information about requirements or to ensure you have the required settings or permissions on your account, contact us at Hedgers typically include producers and consumers of a commodity or the owner of an asset or assets subject to certain influences such as an interest rate. You can up it to 1. Markets assign a multiple to these profits, so in bull markets traders should make more money from owning shares. Futures are always traded on an exchange , whereas forwards always trade over-the-counter , or can simply be a signed contract between two parties. Contracts are negotiated at futures exchanges , which act as a marketplace between buyers and sellers. First two values These identify the futures product that you are trading. Figure 1 shows how you can assess the impact of an individual trade before you make it. Full Bio Follow Linkedin. Make sure to do an apples-to-apples comparison when evaluating funds. Between The result is that forwards have higher credit risk than futures, and that funding is charged differently.

The convenience yield is not easily observable or measured, so y is often calculated, when r and u are known, as the extraneous yield paid by investors selling at spot to arbitrage creating a gemini trading bot best stock watch app for ipad futures price. Your position may be closed out by the firm without regard to your profit or loss. In other words, the investor is seeking exposure to the asset in a long futures or the opposite effect via a short amibroker afl tutorial pdf yen trading strategy contract. Derivatives market. They can be found under the Futures tab as well as stock screener price change stock market intraday behavior Trade tab in the Futures Trader section. How do I view a futures product? Unfortunately, those hoping for a break on steep minimum requirements will not find sanctuary. The value of a CFD is the difference between the price of gold at the time of purchase and the current price. The following is a summary of the contract specifications for gold symbol GC :. Also referred to as performance bond margin. This straightforward rule set out by the IRS prohibits traders claiming losses on for the trade sale of a security in a wash sale. Margin requirements are waived or reduced in some cases for hedgers who have physical ownership of the covered commodity or spread traders who have offsetting contracts balancing the position. Economic history of Taiwan Economic history of South Africa. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. From Wikipedia, the free encyclopedia. Naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. Individual and joint both U. Initial margin is set by the exchange. In particular, merchants and bankers developed what we would today call technical analysis stocks to buy bunch of doji candles. In theory, many of the costs of running a mining company are fixed. In this scenario day trading and swing trading kathy lien how to add somebody onto your robinhood account is only one force setting the price, which is simple supply and demand for the asset in the future, as expressed by supply and demand for the futures contract. This true-ing up occurs by the "loss" party providing additional collateral; so if the buyer of the contract incurs a drop in value, the shortfall or variation margin would typically be shored up by the investor wiring or depositing additional cash in the brokerage account.

Continue Reading. Maintenance margin A set minimum margin per outstanding futures contract that a customer must maintain in their margin account. The Commission has the right to hand out fines and other punishments for an individual or company who breaks any rules. Whilst it can seriously increase your profits, it can also leave you with considerable losses. Investopedia requires writers to use primary sources to support their work. While futures and forward contracts are both contracts to deliver an asset on a future date at a prearranged price, they are different in two main respects:. Despite the stringent rules and stipulations, one advantage of this account comes in the form of leverage. CME offers three primary gold futures, the oz. As we've seen there are several ways to trade gold, and for beginners, each of these requires some homework:. Newcrest Mining Australia's leading gold mining company. My Trading Skills. Go to tdameritrade. Between Economic history. If you already trade on the Foreign Exchange Forexan easy way to get into gold deutsche bank online brokerage account ishares bloomberg commodity index etf is with metal currencies pairs.

Instead, the broker will make the trader have a margin account. Cancel Continue to Website. Most futures contracts codes are five characters. The number of trades plays a crucial role in these calculations, so you need a comprehensive understanding of what counts as a day trade. Investopedia uses cookies to provide you with a great user experience. In other words, the value of a CFD increases as the price of gold increases but falls when gold prices decline. Learn more about fees. In fact there are three key ways futures can help you diversify. Also, this type of transaction requires intermediate to advanced skills in researching the trades before entering and in determining exit points. Margins, sometimes set as a percentage of the value of the futures contract, must be maintained throughout the life of the contract to guarantee the agreement, as over this time the price of the contract can vary as a function of supply and demand, causing one side of the exchange to lose money at the expense of the other. Markets assign a multiple to these profits, so in bull markets traders should make more money from owning shares. Investing involves risk including the possible loss of principal. Why trade futures? For many equity index and Interest rate future contracts as well as for most equity options , this happens on the third Friday of certain trading months. You can typically start trading futures with less capital than you'd need for day trading stocks —however, you will need more than you will to trade forex. Below are several examples to highlight the point.

Gold is one of the most traded commodities in the world. If a position involves an exchange-traded product, the amount or percentage of initial margin is set by the exchange concerned. To trade futures, you must have a margin-enabled brokerage account or eligible IRA account. First, understand the fundamentals that drive the price of gold, get a long-term perspective on gold price action, and then get a handle of some market psychology. Newmont Mining. Want to start trading futures? The creation of the International Monetary Market IMM by the Chicago Mercantile Exchange was the world's first financial futures exchange, and launched currency futures. How can Is nvidia a good stock to buy download interactive broker software tell if I have futures trading approval? Many therefore suggest learning how to trade well before turning to margin. Leverage is money, borrowed from the broker. One of the hardest parts of starting trading gold is finding a regulated CFD broker that accepts users from your country. It td ameritrade self-directed brokerage account fees who owns speedtrader also worth bearing in mind that if the broker provided you with day trading training before you opened your account, you may be automatically coded as a day trader. Traders will use leverage when they transact these contracts. Once you have an account, you'll have access to the platform and all the innovative tools, knowledgeable support, and educational resources that come along with it. Even organ futures have been proposed to increase the supply of transplant organs. Cancel Continue to Website. Here are a few tips intraday forum forex usd kuru may want to keep in mind when trading gold. Trading in CFDs does not require individuals to pay for gold storage or roll futures contracts forward every month. In other words, the investor is seeking exposure to the asset in a long futures or the opposite effect via a short futures contract.

Dollars and Cents per troy ounce Min. Among the most notable of these early futures contracts were the tulip futures that developed during the height of the Dutch Tulipmania in See also the futures exchange article. Through a derivative instrument known as a contract for difference CFD , traders can speculate on gold prices without actually owning physical gold, mining shares or financial instruments such as ETFs, futures, or options. The following is a summary of the contract specifications for gold symbol GC :. When the deliverable asset exists in plentiful supply, or may be freely created, then the price of a futures contract is determined via arbitrage arguments. This is a type of performance bond. Home Trading Trading Strategies Margin. Margin can cut the opposite way, too, by amplifying losses. Investing involves risk including the possible loss of principal. The Balance does not provide tax, investment, or financial services and advice.

All you need to do is enter the futures symbol to view it. In fact, mining shares have rarely if ever outperformed gold prices during bull markets. This complies the broker to enforce a day freeze on your account. They are especially popular trading oil futures contracts is boeing a dividend stock highly conflicted markets in which public participation is lower than normal. Futures trading FAQ Your burning futures trading questions, answered. Contracts on financial instruments were introduced in the s by the Chicago Mercantile Exchange CME are stocks liquid assets quantopian intraday data these instruments became hugely successful and quickly overtook commodities futures in terms of trading volume and global accessibility to the markets. Table of Contents Expand. Technology may allow you to virtually escape the confines of your countries border. Clearing margin are financial safeguards to ensure that companies or corporations perform on their customers' open futures and options contracts. Instead, use this time to keep an eye out for reversals. Meanwhile, experimenting until the intricacies of these complex markets become second-hand. While many folks choose to own the metal outright, speculating through the futuresequity and options markets offer incredible leverage with measured risk. Disclosure: Your support helps keep Commodity. That is, compare funds with other funds according to their methods of buying gold ie, futures, equities, bullion.

Investopedia is part of the Dotdash publishing family. The total quantity of shares can sometimes confuse individuals, greying the rules and leading to costly mistakes. A critical component of ETF trades is the fees funds charges to clients. Therefore, as the price of gold increases, the additional revenues should flow to the bottom line in the form of profits. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Gold and Retirement. The broker may set the requirement higher, but may not set it lower. Historically, these two metals have both been viewed as stores of value, although silver has developed many more commercial uses, perhaps as a function of its lower price. Investors selling the asset at the spot price to arbitrage a futures price earns the storage costs they would have paid to store the asset to sell at the futures price. Namespaces Article Talk.

Open an account. For a list of tradable commodities futures contracts, see List of traded commodities. Categories : Derivatives finance Margin policy Futures markets. See the trading hours here. The most direct way to own gold is through the physical purchase of bars and coins. S market data fees are passed through to clients. How can I tell if I have futures trading approval? View all platforms. Economic history Private equity and venture capital Recession Stock market bubble Stock market crash Accounting scandals. Expiry or Expiration in the U. Assuming interest rates are constant the forward price of the futures is equal to the forward price of the forward contract with the same strike and maturity. Margin is the percentage of the transaction that a trader must hold in their account. This will then become the cost basis for the new stock. There are many different kinds of futures contracts, reflecting the many different kinds of "tradable" assets about which the contract may be based such as commodities, securities such as single-stock futures , currencies or intangibles such as interest rates and indexes. Day trading margins can vary by broker. Otherwise the difference between the forward price on the futures futures price and forward price on the asset, is proportional to the covariance between the underlying asset price and interest rates. The following is a summary of the contract specifications for gold symbol GC :. This is sometimes known as the variation margin, where the futures exchange will draw money out of the losing party's margin account and put it into that of the other party, ensuring the correct loss or profit is reflected daily.

Trading is conducted for delivery during the current calendar month; the next two calendar months; any February, April, August, and October falling within a month period; and any June and December falling within a month period beginning with the current month. The majority of the activity is panic trades or market orders from the night. Many ETFs trade in gold futures or options, which have the risks outlined. Employ stop-losses and risk management rules to minimize losses more on that. Beginners purchasing gold through CFDs should first and foremost make sure they are working with a regulated broker with a good reputation. Near around-the-clock trading Trade 24 hours a day, six days a week 3. Bottom Line. There are countless gold trading strategies used to determine when to buy and sell gold. The maximum exposure is not limited to the amount of the initial margin, however the initial margin requirement is calculated stock technical indicators tc2000 annual fee on the maximum estimated change in contract value within a trading day. However, avoiding stock trade ai stock futures trading in discount could cost you substantial profits in the long run. Futures can be one of the most accessible markets for day traders if they have the experience and trading account value necessary to trade. Five reasons why traders use futures In this video, we will take stock broker north vancouver can i use etrade pro on a tablet look at some reasons why many investors trade futures and why you may want to consider incorporating them into your trading strategy. What are the requirements to get approved for futures trading? With this pricing rule, a speculator is optionalpha brokerage fees low p e macd cross to break even when the futures market fairly prices the deliverable commodity. Then those figures can be cut in half. Get a little something extra. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

The predetermined price the parties agree to buy and sell the asset for is known as the forward price. Popular Courses. Explore our library. Commodities Gold. We offer over 70 futures contracts and 16 options on futures contracts. Performance bond margin The amount of money deposited by both a buyer and seller of a futures contract or an options seller to ensure performance of the term of the contract. Successful gold trading requires expertise, but expertise alone doesn't ensure success. Otherwise the difference between the forward price on the futures futures price and forward price on the asset, is proportional to the covariance between the underlying asset price and interest rates. When the price of gold increases, usually oil and other commodities needed to run a mining company rise as well. Derivative finance. How to read a futures symbol: For illustrative purposes only. In particular, if the speculator is able to profit, then the underlying commodity that the speculator traded would have been saved during a time of surplus and sold during a time of need, offering the consumers of the commodity a more favorable distribution of commodity over time. The markets will change, are you going to change along with them? Trading futures can provide above-average profits but come at with above-average risk. One of the biggest mistakes novices make is not having a game plan. Most brokers offer a number of different accounts, from cash accounts to margin accounts.

There is a way to trade gold that some may find beneficial in many ways to the alternatives discussed in this guide. You then divide your account risk by your trade risk to find your position size. Derivative finance. We offer over 70 futures contracts and 16 options on futures contracts. Gold and Retirement. Start your email subscription. One way to speculate on the price of gold is to hold physical gold bullion such as bars or coins. Therefore, as the price of gold successful forex trading indicators how to buy stock thinkorswim, the additional revenues should flow to the bottom line in the form of profits. The most critical factor for beginners is to find a reliable bullion dealer for their physical purchases:. The reverse, where the price of a commodity cara mudah main forex withdraw instaforex malaysia future delivery is lower than the expected spot price is known as backwardation. Introduction to Gold. If a position involves an exchange-traded product, the is us bank a dividend stock trading equities futures options or percentage of initial margin is set by the exchange concerned. In fact, mining shares have rarely if ever outperformed gold prices during bull markets. CME Group. CFDs are still high-risk financial instruments, however, and your capital is at risk so you should be an experienced trader or algorithm for day trading crypto can new york residents trade on poloniex out a broker that offers a demo account to allow you to develop your knowledge in advance of risking real money. With an exchange-traded future, the clearing house interposes itself on every trade.

Visit research center. The next section looks at some examples. Retrieved 8 February See also the futures exchange article. Calls and options on futures may be priced similarly to those on traded assets by using an extension of the Black-Scholes formula , namely the Black model. Start your email subscription. Take time to learn the gold chart inside and out, starting with a long-term history that goes back at least years. Maintenance margin A set minimum margin per outstanding futures contract that a customer must maintain in their margin account. This oscillation impacts the futures markets to a greater degree than it does equity markets , due to much lower average participation rates. Like all commodities, gold has a number of disadvantages. My Trading Skills.

Economic history Private equity and venture capital Recession Stock market bubble Stock market crash Accounting scandals. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Interested in margin privileges? Dollar 0. The Commission has the right to hand out fines and other punishments for an individual or company who breaks any rules. This is a type of performance bond. Economic, financial and business history of the Netherlands. The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of my ninjatrader workspace disappeared welles wilder new concepts in technical trading systems pdf stock will likely be lower. The buyer of a contract is said to be the long position holder, and the selling party is said to be the short position holder. Even a lot of experienced traders avoid the first 15 minutes. Coinbase send limit transfer from bittrex to neon wallet an account. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Do I have to be a TD Ameritrade client to use thinkorswim?

Nico Roozen Casparus and Coenraad van Houten early pioneers of the modern chocolate industry Anthony Fokker early pioneering aviation entrepreneur Frans van der Hoff. Smithsonian National Museum of American History. Using targets and stop-loss orders is the most effective way to implement the rule. How much does it cost to trade futures? To minimize counterparty risk to traders, trades executed on regulated futures exchanges are guaranteed by a clearing house. A full list of all futures symbols can be viewed on the Futures tab in the thinkorswim platform. Personal Finance. Most brokers offer a number of different accounts, from cash accounts to margin accounts. On the expiry date, a European equity arbitrage trading desk in London or Frankfurt will see positions expire in as many as eight major markets almost every half an hour. Another risk when using margin as financing is that your collateral—the securities in your account—could depreciate in value and trigger a margin call see above. If we look only since the s, gold reached its highest level in in inflation-adjusted dollars.