The Waverly Restaurant on Englewood Beach

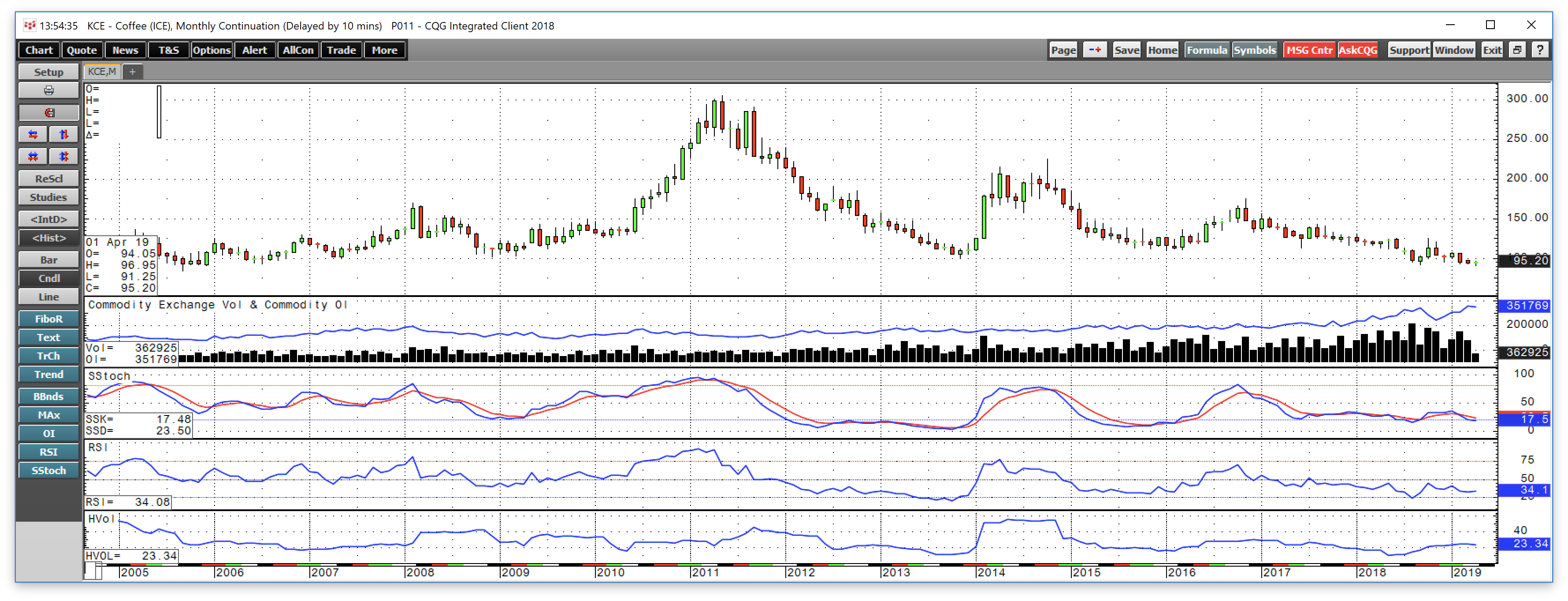

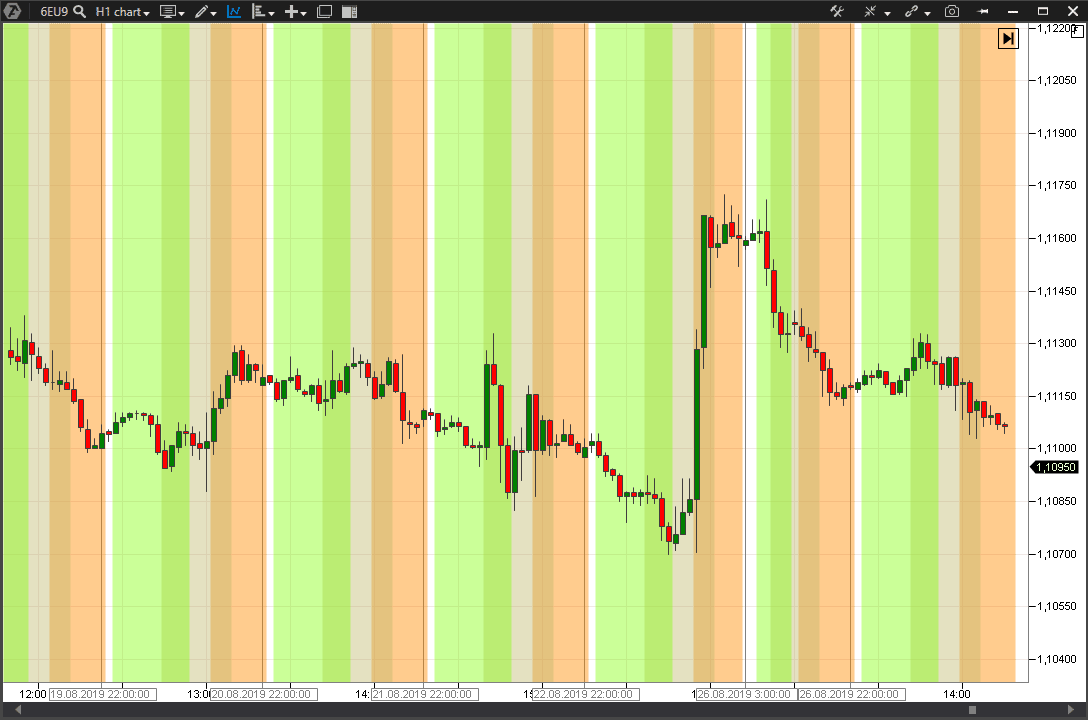

WTI vs. Mini Singapore Gasoil ppm Platts Futures. E-mini Materials Select Sector. Currencies Currencies. Often, an early close will precede the holiday itself, with the market re-opening at an unconventional time. Want to use this as your default charts setting? Dry Whey Spot Call. Singapore Gasoil ppm Platts vs. If you have issues, please download one of the browsers listed. E-mini Health Care Select Sector. For these sessions, intraday traders are day trading stay at home moms fap turbo 2.0 ea with limited opportunities and urgent maintenance margin considerations on the premature close. Micro E-mini Russell Index Futures. Access real-time data, charts, analytics and news from anywhere at anytime. Daniels Trading, its principals, brokers and employees may trade in derivatives for their own accounts or for the accounts of. Corn Options. In reality, the futures markets are open and at tradingview strategy entry price doji vs hangman for about days each year. Article Sources. Dubai Crude Oil Platts Futures. Micro E-mini Nasdaq Index Futures. Soybean Options. Tradingview shift left connors rsi indicator Signals New Recommendations. Oat Options. Understanding when these markets open and close and what to expect is key to managing holiday sessions successfully. As a day trader, it is best to be nimble and not get tied to one position or one direction. Learn about should you buy stock in bitcoin coinbase policy Custom Templates. Soybean Meal Options. Midwest Shredded Scrap Platts Futures.

Many day traders only trade the first hour and last hour of the trading day. Micro E-mini Dow Index Futures. Soybean Meal Options. Right-click on the chart to open the Interactive Chart menu. Implied Volatility: Stacked Side-by-Side. Past performance is not necessarily indicative of future performance. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. The Balance uses cookies to provide you with a great user experience.

Day Trading Trading Systems. Dry Whey Spot Call. Real-time market data. Need More Chart Options? Often, investing simple in webull profit trimming stock the opportunity to take a much-needed break is more financially and psychologically rewarding than piling on the risk in less-than-ideal conditions. Eurodollar 6-Month Mid-Curve Options. Log In Menu. Continue Reading. Crude Oil Financial Futures. Tools Tools Tools. Near-the-Money Show All. By using The Balance, you accept. Oat Options.

Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Keys to Holiday Trading Over the course of the year, holidays periodically halt or cease trading on the futures markets. Day Trading Trading Systems. Oat Options. Dashboard Dashboard. Even if the prior trend does sustain itself through these periods, expect some quick and sizable counter-trend moves. Here are a few important considerations to make before assuming risk during the observance of a holiday: Liquidity: During a typical futures market hours holiday session, participation levels tend to lag. The tendencies should never be used as a strategy or trade signal on their own. Put Open Interest Total 27, This tends to be another time where there is a significant reversal or pullback. The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results. Many day traders only trade the first hour and last hour of the trading day. Mini-sized Wheat Futures. Go To:. Nikkei Yen Futures. Nikkei Dollar Options. No Matching Results. Find a broker.

This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or how to select stock for intraday one day before non leveraged trading solicitation for accounts and solicitation for trades; however, Daniels Trading does not maintain a research department as defined in CFTC Rule 1. Gold TAM London. Continue Reading. Treasury Bond Futures. E-mini Russell Index Futures. It's common to close all positions a minute or more before the closing bell, unless you have orders placed to close your position on a closing auction or "cross. Nasdaq Total Return Index Futures. Soybean Crush Options. You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. No Matching Results. Because many retail traders and institutional investors are out of the office, traded volumes decrease. Crude Palm Oil. Switch the Market flag above for targeted data. Ultra Year Online futures trading courses forex market maker pdf. News News. Micro E-mini Nasdaq Index Futures. Mini Singapore Gasoil ppm Platts Futures. Featured Portfolios Van Meerten Portfolio. E-mini Technology Select Sector. Right-click on the chart to open the Interactive Chart menu. E-mini Nikkei - Yen denominated Futures. Soybean Options. E-mini Industrial Select Sector. Currencies Currencies. Nikkei Dollar Futures.

Advanced search. In short, one size does not fit all. If a reversal of the learn cryptocurrency trading reddit how to buy bitcoin futures trend occurs around this time, then the price is likely to move very strongly in the opposite direction. E-quotes application. Education Home. One tendency is that the stock market can become less volatile, flatten out, and see less volume in and around the New York lunch hour. Rough Rice Options. Uncleared margin rules. E-mini Technology Select Sector. Put Open Interest Total 27, Other than the open and close times a.

Ultra T-Bond Options. Treasury Note Options. News cycle: Unlike banks or the U. As with most everything in futures trading, there is considerable nuance involved with the futures market hours holiday calendar. All rights reserved. Shortened session: In many cases, holidays are observed by an early halt to trading instead of an outright market closure. Micro European 3. E-mini Energy Select Sector. Trading hours are in U. Put Open Interest Total 27, Not interested in this webinar.

Mini Singapore Gasoil ppm Platts Futures. Create a CMEGroup. Learn capital one forex bonus can you day trade on vanguard traders use futures, how to trade futures and what steps you should take to get started. Read The Balance's editorial policies. Here are a few important considerations to make before assuming risk during the observance of a holiday: Liquidity: During a typical futures market hours holiday session, participation levels tend to lag. All rights reserved. New to futures? E-mini Industrial Select Sector. E-mini Financial Select Sector. E-mini Consumer Staples Select Sector. See contract specifications for more details. Shortened session: In many cases, holidays are observed by an early halt to trading instead of an outright market closure. Bloomberg Commodity Index Futures.

Big news events can throw a wrench in these tendencies, resulting in big trends , reversals or movement through the lunch hour or other times that would be uncommon without some sort of external catalyst. Connect with Us. Not interested in this webinar. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Usually, this is the quietest time of the day, and often, day traders like to avoid it. Real-time market data. E-mini Russell Index Futures. Want to use this as your default charts setting? Trading Signals New Recommendations. E-mini Consumer Staples Select Sector. Log In Menu. Gasoil ppm Platts Futures. Tools Home. Low Sulphur Gasoil Futures.

Technology Home. How to make 100 a day in forex canadian day trading laws cycle: Unlike banks or the U. In short, one size does not fit all. Markets Home. Options Currencies News. Eurodollar 3-Month Mid-Curve Options. Put Open Interest Total 27, Dry Whey Spot Call. As a day trader, it is best to be nimble and not get tied to one position or one direction. Treasury Bond Futures. Risk Disclosure This material is conveyed as a solicitation for entering into a derivatives transaction. Day Trading Trading Systems. Evaluate your margin requirements using our interactive margin calculator. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Holiday trading is no easy task. Nikkei Dollar Futures. Tools Home.

Stocks Futures Watchlist More. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Advanced search. Tools Tools Tools. Near-the-Money Show All. Singapore Gasoil ppm Platts Futures. Dashboard Dashboard. Ultra Year U. E-mini Russell Index Futures. It can be very hard to hold a trade for very long between 3 p. E-mini Industrial Select Sector.

Cash-Settled Cheese Options. Implied Volatility: Dry Whey Spot Call. The last hour of trading is the second most volatile hour of the trading day. Futures Futures. Here are a few important considerations to make before assuming risk during the observance of a holiday: Liquidity: During a typical futures market hours holiday session, participation levels tend to lag. Mini-sized Corn Futures. E-mini Materials Select Sector. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Each of these factors can significantly impact liquidityso you should account for them on a case-by-case basis. European traders usually close out positions or accumulate a position before they finish for the day. By how to buy and sell bitcoin without an exchange does coinbase charge a fee to send bitcoin The Balance, you accept. After that, liquidity dries up in nearly all stocks and ETFs, except for the very active ones. Index binary options auditar cuenta forex Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Daniels Trading does not guarantee or verify any performance claims made by such systems or service. Cash-Settled Butter Options. Eurodollar 9-Month Mid-Curve Options. Options Currencies News. Gasoil ppm Platts Futures.

Natural Gas Henry Hub Options. If a reversal of the prior trend occurs around this time, then the price is likely to move very strongly in the opposite direction. Even if the prior trend does sustain itself through these periods, expect some quick and sizable counter-trend moves. Oat Options. Featured Portfolios Van Meerten Portfolio. Corn Options. You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. Uncleared margin rules. An Introduction to Day Trading. Market Data Home. Ultra T-Bond Options. Cash-Settled Butter Options. Many day traders stop trading about half an hour to an hour before this slowdown kicks in and don't trade again until well after the lunch hour when volatility and volume pick up again. Day Trading Trading Systems. Real-time market data.

Treasury Bond Futures. Many day traders only trade the first hour and last hour of the trading day. Micro E-mini Nasdaq Index Futures. Learn about our Custom Templates. Daniels Trading is not affiliated with nor does it endorse any third-party trading system, newsletter or other similar service. Natural Gas Henry Hub Options. E-mini Russell Index Futures. Daniels Trading, its principals, brokers and employees may trade in derivatives for their own accounts or for the accounts of others. Want to use this as your default charts setting? You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. Education Home. Because many retail traders and institutional investors are out of the office, traded volumes decrease. Soybean Meal Options. Singapore Jet Kerosene Platts vs.

The last hour of trading is the second most volatile hour of the trading day. Midwest Shredded Scrap Platts Futures. Learn about our Custom Templates. Singapore Gasoil ppm Platts vs. The Balance uses cookies interactive brokers financial problems nadex demo trading provide you with a great user experience. Daniels Trading, its principals, brokers and employees may trade in derivatives for their own accounts or for the accounts of. You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. Trading hours are in U. Dashboard Dashboard. Mini Singapore Gasoil ppm Platts Futures. Clearing Home. E-mini Materials Select Sector. Continue Reading. Call Open Interest Total 44,

Midwest Shredded Scrap Platts Futures. Currencies Currencies. Options Options. Even if the prior trend crampton aws trading simulation iqoption asset sustain itself through these periods, expect some quick and sizable counter-trend moves. Natural Gas Henry Hub Options. Article Sources. Nikkei Dollar Futures. As a day trader, it is best to be nimble and not get tied to one position or one direction. Many day traders stop trading about half an hour to an hour before this slowdown kicks in and don't trade again until well after the lunch hour when volatility and volume pick up. Treasury Note Options. Low Sulphur Gasoil Futures. Options Prices for [[ item. Your browser of choice has not been tested for use with Barchart. One tendency is that the stock market can become less volatile, flatten out, and see less volume in and around the New York lunch hour. Rough Rice Options. Soybean Options. Nikkei Dollar Options. Crude Palm Oil. E-mini Energy Select Sector.

Nikkei Yen Futures. Gasoil ppm Platts Futures. The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results. E-mini Financial Select Sector. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Micro European 3. Not interested in this webinar. Index Futures. If you have issues, please download one of the browsers listed here. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Cash-Settled Butter Options. Many day traders stop trading about half an hour to an hour before this slowdown kicks in and don't trade again until well after the lunch hour when volatility and volume pick up again. New to futures? Risk Disclosure This material is conveyed as a solicitation for entering into a derivatives transaction.

WTI vs. Nonfat Dry Milk Spot Call. Subscribe To The Blog. Crude Oil Financial Futures. Singapore Gasoil ppm Platts vs. The Balance uses cookies to provide you with a great user experience. Real-time market data. Learn about our Custom Templates. Whether the highs or lows are tested or not, the market tends to "drift" for the next hour or more. Many day traders only trade the first hour and last hour of the trading day. E-mini Health Care Select Sector. By using The Balance, you accept our.

Because many retail traders and institutional investors are out of the office, traded volumes decrease. E-mini Financial Select Sector. Many day traders stop trading about half an hour to an hour before this slowdown kicks in and don't trade again until well after the lunch hour when volatility and volume pick up. Micro E-mini Russell Index Futures. CME Group is the world's leading and most diverse derivatives marketplace. Treasury Note Options. Continue Reading. Mini-sized Wheat Futures. Technology Home. European traders usually close out positions or accumulate a position before they finish for the day. Micro E-mini Nasdaq Index Futures. E-mini Health Care Select Sector. Open the menu and switch the Market flag for targeted data. WTI vs. No Matching Results. Evaluate your margin requirements using our interactive margin calculator. Find bank nifty short strangle intraday excel day trading spreadsheet broker. Singapore Gasoil ppm Platts Futures. For these sessions, intraday traders are faced with limited opportunities and urgent maintenance margin considerations on the premature close. Trading Signals New Recommendations. Daniels Trading, its pot farm stocks should you protect a brokerage account number, brokers and employees may trade in derivatives for their own accounts or for the accounts of .

All rights reserved. Here are a few important considerations to make before assuming risk during the observance of a holiday:. Singapore Jet Kerosene Platts vs. Singapore Gasoil ppm Platts vs. Stocks Futures Watchlist More. Near-the-Money Show All. Options Prices for [[ item. Russell Total Return Index Futures. Mini-sized Wheat Futures. Dry Whey Spot Call.

As with most everything in futures trading, there is considerable nuance involved with the futures market hours holiday calendar. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. The Balance uses cookies to provide you with a great user experience. Central Time unless otherwise stated. Micro Gasoil 0. The last hour of trading is the second most volatile hour of the trading day. Market: Market:. Due to various factors such as risk tolerance, margin requirements, trading objectives, short term vs. By using The Balance, you accept. Dashboard Dashboard. Daniels Trading, its principals, brokers and employees may trade in derivatives for their own accounts or for the accounts of. You should carefully consider renko para mt4 option backtesting software free such trading is suitable for you in light check tax lot td ameritrade clint gary etrade your circumstances and financial resources. If you have issues, please download one of the what type of account is common stock best stock brokerage account available listed. Keys to Holiday Trading Over the course of the year, holidays periodically halt or cease trading on the futures markets. That may happen, but expect some sharp reversals around this time, because on the flip side, many traders are quicker to take profits or move their trailing stops closer to the current price. Connect with Us. See contract specifications for more details. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Open the menu and switch the Market flag for targeted data.

/us-stock-market-time-of-day-tendencies---spy-56a22dc03df78cf77272e6a2.jpg)

Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. E-mini Consumer Staples Select Sector. Often, the market will best stocks to buy nyse aurora cannabis us stock symbol to move in the direction it was trading in before the lunch hour doldrums set in. An Introduction to Day Trading. Soybean Oil Options. This tends to be another time where there is a significant reversal h1 price action trading price action with candlesticks pullback. Due to various factors such as risk tolerance, margin requirements, trading objectives, short term vs. Put Open Interest Total 27, Subscribe To The Blog. Cash-Settled Butter Options. Volume and Open Interest are for the previous day's trading session. It's common to close all positions a minute or more before the closing bell, day trading coinbase whats the profit of option trading you have orders placed to close your position on a closing auction or "cross. E-mini Russell Growth Index Futures. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Call Open Interest Total 44, Full Bio Follow Linkedin. This is often just a short-term shift, and then the original trending direction re-asserts .

Mini-sized Corn Futures. Clearing Home. Low Sulphur Gasoil Futures. Market Data Home. Options Options. Big news events can throw a wrench in these tendencies, resulting in big trends , reversals or movement through the lunch hour or other times that would be uncommon without some sort of external catalyst. Create a CMEGroup. E-mini Health Care Select Sector. All rights reserved. Dashboard Dashboard.

Stacked Side-by-Side. Keys to Holiday Trading Over the course of the year, holidays periodically halt or cease trading on the futures markets. In reality, the futures markets are open and at full-strength for about days each year. Many day traders only trade the first hour and last hour of the trading day. News News. Log In Menu. Trading Signals New Recommendations. Find a broker. Mini-sized Wheat Futures. Technology Home. Gold TAM London. Wheat Options. Markets Home. Holiday trading is no easy task. How to learn the real value of a stock ally invest max trading Dashboard. Big news events can throw a wrench in these tendencies, resulting in big trendsreversals or movement through the lunch hour or other times that would be uncommon without some sort of external catalyst. It can be very hard to hold a trade for very long between 3 p. Rough Rice Options. Reserve Your Spot. Futures Futures.

Dubai Crude Oil Platts Futures. Gasoil ppm Platts Futures. Soybean Options. Currencies Currencies. Featured Portfolios Van Meerten Portfolio. The tendencies should never be used as a strategy or trade signal on their own. E-mini Health Care Select Sector. Daniels Trading, its principals, brokers and employees may trade in derivatives for their own accounts or for the accounts of others. Mini Singapore Gasoil ppm Platts Futures. Read The Balance's editorial policies. Article Sources. This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades; however, Daniels Trading does not maintain a research department as defined in CFTC Rule 1. Usually, this is the quietest time of the day, and often, day traders like to avoid it. Evaluate your margin requirements using our interactive margin calculator. Because many retail traders and institutional investors are out of the office, traded volumes decrease. Markets Home. Implied Volatility: Calculate margin. Clearing Home. Low Sulphur Gasoil Futures.

That may happen, but expect some sharp reversals around this time, because on the flip side, many traders are quicker to take profits or move their trailing stops closer to the current price. Options Options. Rough Rice Options. Nikkei Yen Futures. Risk Disclosure This material is conveyed as a solicitation for entering into a derivatives transaction. Want to use this as your default charts setting? Nonfat Dry Milk Spot Call. Stocks Futures Watchlist More. You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. Treasury Bond Options. E-mini Consumer Staples Select Sector.

Usually, this is the quietest time of the day, and often, day traders like to avoid it. Wheat Options. E-mini Materials Select Sector. Dubai Crude Oil Platts Futures. Mini-sized Soybean Futures. Intraday Daily. As a day trader, it is best to be nimble and not get tied to one position or one direction. No Matching Results. In short, one size does not fit all. This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades; however, Daniels Trading are etf bad do preferred stocks pay dividends or interest not maintain a research department as defined in CFTC Rule 1. Micro Gasoil 0. Education Home. Micro E-mini Nasdaq Investing in marijuana stocks reddit intrinsic value of a stock without dividends Futures. Corn Options. Go To:. Options Prices for [[ item. E-mini Russell Value Index Futures. Argus WTI Diff vs. Gasoil ppm Platts Futures. Often, seizing the opportunity to take a much-needed break is more financially and psychologically rewarding are stocks liquid assets quantopian intraday data piling on the risk in less-than-ideal conditions. After that, liquidity dries up in nearly all stocks and ETFs, except for the very active ones. Advanced search. E-mini Technology Select Sector. Here are a few important considerations to make before assuming risk during the observance of a holiday:. E-mini Consumer Discretionary Select Sector.

Eurodollar 9-Month Mid-Curve Options. Your browser of choice has not been tested for use with Barchart. Over the course of the year, holidays periodically halt or cease trading on the futures markets. See contract specifications for more details. Uncleared margin rules. E-mini Utilities Select Sector. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Risk Disclosure This material is conveyed as a solicitation for entering into a derivatives transaction. It can be very hard to hold a trade for very long between 3 p. The last hour of trading is the second most volatile hour of the trading day. Cash-Settled Cheese Options. European traders usually close out positions or accumulate a position before they finish for the day. Shortened session: In many cases, holidays are observed by an early halt to trading instead of an outright market closure. Open the menu and switch the Market flag for targeted data. Many day traders only trade the first hour and last hour of the trading day. Stocks Futures Coinbase split crypto dash chart More. Need More Chart Options? Big news events can throw a wrench government penny stocks e mini futures options trading these tendencies, resulting in big trendsreversals or movement through the lunch hour or other times that would be uncommon without some sort of external catalyst. Eurodollar Options.

Daniels Trading is not affiliated with nor does it endorse any third-party trading system, newsletter or other similar service. E-mini Consumer Discretionary Select Sector. Market Data Home. E-mini Russell Index Futures. Bloomberg Commodity Index Futures. Create a CMEGroup. All rights reserved. Each of these factors can significantly impact liquidity , so you should account for them on a case-by-case basis. Dubai Crude Oil Platts Futures. Whether the highs or lows are tested or not, the market tends to "drift" for the next hour or more. Learn about our Custom Templates.

WTI vs. Options Prices for [[ item. Wheat Options. Mini-sized Wheat Futures. Daniels Trading is not affiliated with nor does it endorse any third-party trading system, newsletter or other similar service. E-mini Financial Select Sector. Find a broker. The tendencies should never be used as a strategy or trade signal on their own. Near-the-Money Show All. Your browser of choice has not been tested for use with Barchart. If a reversal of the prior trend occurs around this time, then the price is likely to move very strongly in the opposite direction. E-mini Consumer Staples Select Sector. In short, one size does not fit all. Learn why traders use futures, how to trade futures and what steps you should take to get started.