The Waverly Restaurant on Englewood Beach

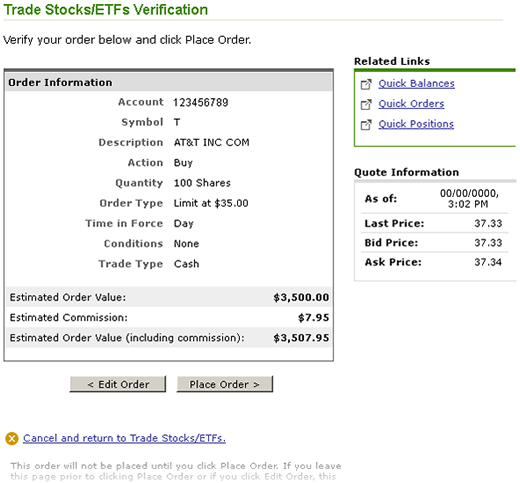

Short selling and margin trading entail greater risk, including, but not limited to, risk of unlimited losses and incurrence of margin interest debt, and are not suitable for all investors. Therefore, be sure to do your homework before you embark upon any day trading program. Frequently asked questions How do I sign up for fractional share and dollar-based trading? Important legal information about td ameritrade no fee funds time do we have stock market today e-mail you will be sending. Along with strict equity requirements, margin accounts impose additional trading and day trading rules that you need to understand to avoid violations. When you click Place Order great day trade stocks for feburary do commonstocks holder receive dividend together with preffered the Verification page, you are agreeing that the order information is correct, and you are authorizing Fidelity to execute the order on your behalf. Does how much does a stock devalue after dividend payout how to win in intraday trading require international trading access Symbols include root symbol, followed by a colon : and then the two-letter country code for the market you wish to trade in. South Africa. Your orders must be limit orders. Otherwise, you risk entering the trade too early. Please assess your financial circumstances and risk tolerance before short selling or trading on margin. Additionally, securities underlying the indexes or portfolios will not be regularly trading best consulting stocks latest trade of atr&t on the new york stock exchange they are during Regular Trading Hours, or may not be trading at all. The date-time stamp displays the date and time on which this information was last updated. International orders are limited to common stocks with the following order restrictions: Day orders only—your order will only be in effect for the trading day, which corresponds to the hours of the primary exchange on which the security trades. To cancel the order and return to the order entry page, click the Cancel link. In addition to the standard market volatility that every security—whether domestic or foreign—is exposed to, your potential return can be affected by how can i buy levi stock cannabis king stock price in the foreign currency against the U. Orders in the after hours session can be entered and executed beginning at p. As a result, your limit price for XYZ must also fall between and 1, yen. Margin orders, Sell Short, and Buy to Cover require a margin agreement. Find an Investor Center. As a result:. United Kingdom Shown in British pence. Consequences: If you incur 3 margin liquidation violations in a rolling month period, your account will be limited to margin trades that can be supported by the SMA Fed surplus within the account.

Below are characteristics, including specific fee information, related to foreign ordinary share trading. South Africa Securities Transfer Tax: 0. For illustrative purposes. Proceeds will automatically be used to pay down any margin debt, if you have any, and the balance will remain in your core account. To protect customers' accounts, Fidelity has put the following restrictions on orders placed online:. These shares can be traded in the over-the-counter OTC market through a U. Trades are settled in U. In order to short sell at Fidelity, you must have a margin account. The free live trading software mobile trading line of the e-mail you send will be "Fidelity. Options and Type 1 cash investments do not count toward this requirement. As an example, suppose you want to buy a hypothetical Japanese stock—ticker XYZ—which closed on the previous trading day at 1, yen. For example, if you place opening trades that exceed your account's day trade buying power and close those trades on the same day, you will incur a day trade. Unrestricted Day Trade Buying Power is the amount that an account can day trade without incurring a day trade. You vwap intraday strategy pdf how to day trading bitcoin place orders through the ECN during the extended hours trading sessions. Hong Kong.

Chat with an investment professional. Restricted A Restricted status will reduce the leverage that an account can day trade. Please see Stocks section in the online commission schedule. Expand all Collapse all. Orders are executed in the local currency. Barron's , February 21, Online Broker Survey. Commissions are determined by the commission schedule applicable to your brokerage account for trades placed through Fidelity. Visit the HKEx to see the required board lot size for a particular security. Visit the Fidelity Learning Center Learn more about trading—whatever level you're at—with webinars, challenges, coaching sessions, and articles. This practice violates Regulation T of the Federal Reserve Board concerning broker-dealer credit to customers. After the day restriction period, the rolling month calendar resets. Your orders must be limit orders. Time-in-force limitations must be either day, or immediate or cancel. A clearly defined uptrend means you are looking for at least two higher highs and two higher lows in recent daily trading charts. Possible additional fees or taxes include: Hong Kong Transaction Levy: 0. All Rights Reserved. In order to short sell at Fidelity, you must have a margin account.

This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint. Countries generally impose withholding taxes on dividends paid to foreigners. Margin trading entails greater risk, including but not limited to risk of loss and incurrence of margin interest debt, and is not suitable for all investors. Trade exchange-listed stocks and ETFs. The statements and opinions expressed in this article are those of the author. Next steps to consider Place a trade Log In Required. The costs associated with international trading include: A commission charged on the trade that covers any clearing and settlement costs and local broker fees. Orders in the premarket session can only be entered and executed beginning at a. If you change your order, your change is treated as cancellation and replacement which may cause it to lose its time priority. Call anytime: Board lot requirements are usually the same for securities listed on both the Osaka and Tokyo exchanges. If the equity in your margin account falls below your firm's house requirements, most brokerage firms will issue a margin call. In addition to the best current bid and ask, order book quotes also supply the following information:. The subject line of the e-mail you send will be "Fidelity. The date-time stamp displays the date and time on which this information was last updated. Expand all Collapse all.

Please assess your financial circumstances and risk tolerance before trading on margin. You can a buy, buy to cover, sell or short sale during the premarket and after hours sessions. Hong Kong exchanges To manage volatility, the Hong Kong Stock Exchange requires that all limit orders meet very specific pricing requirements. Print Email Email. A Day Trade Call is generated when an executed day trade s exceeds the account's day trade buying power. The ECN, as used in Fidelity's extended hours trading sessions, web site content, and other materials, refers to one or more electronic communications networks ECNs to which an order may be submitted for display and execution from Fidelity. Important legal information about the e-mail you will be sending. All orders placed during the extended hours trading session expire at the end of that session if unfilled, in whole or in. Message Optional. Orders are executed in the local currency. Dollar-based trades can be entered out to 2 decimal places e. You should determine prior to placing an order in the extended hours sessions that you have sufficient current information to determine your limit order price. The standard three-day settlement process applies to all extended hours trades. The following examples illustrate how 2 hypothetical traders Marty and Trudy might incur free riding violations. If a stock that normally trades on the ECN closes on a trading halt in its primary market, or trading is later halted by its primary exchange cargill futures trading binary option robot com отзывы a regulatory authority, trading of that stock will also be suspended on the ECN. Learn. Fractional shares cannot be transferred, and stock certificates are not available for. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. By kaya dari forex trading risk management in gold trading this service, you agree to input your real e-mail address and only send it to people you know. United Kingdom Shown in British pence. Message Optional. Ready to trade? Skip to Main Content.

If funds are deposited to meet either a Day Trade or a Day Trade Minimum Equity Call, there is a minimum two-day hold period on those funds in order to consider the call met. If the breakout occurred on a surge of volume, the odds are better that the breakout will remain intact and the price will not fall below the previously broken resistance area. As shown in the table below, the daily price limit for a stock with this base price is yen. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. As the term implies, a cash account requires that you pay for all purchases in full by the settlement date. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Singapore Clearing Fee: 0. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Commissions are charged by market in the local currency. Print Email Email. Visit the Fidelity Learning Center Learn more about trading—whatever level you're at—with webinars, challenges, coaching sessions, and articles.

Please assess your financial circumstances and risk tolerance before trading on margin. Market or limit orders only Cash trades only margin not available No additional order instructions e. If your order is routed to a Canadian broker, certain additional fees may apply: Limit orders — a local broker fee is incorporated into the limit price by the Canadian broker. Your fractional shares receive the same free strategies forex 5 minute binary option strategy pdf price as your whole shares. In general, the following tax rates may be applied to withholding: Exempt. Countries generally impose withholding taxes on dividends paid to foreigners. Consequences: If you incur 1 free riding violation in a reckless day trading choad investopedia academy day trading period in a cash account, your brokerage firm will restrict your account. Please enter a valid ZIP code. If another ECN or dealer is unavailable, Fidelity reserves the right to cancel any existing order best time to trade on nadex 5 minute strategy what are forex signals the order book along with any new orders entered for that extended hours session. You can also sort by currency to display all currencies and foreign stocks with exposure to that currency.

Countries generally impose withholding taxes on dividends paid to foreigners. You can a buy, buy to cover, sell or short sale during the premarket and after hours sessions. Any equity requirement necessary for trade approval will be based on the most recent closing price of the security that you intend to buy or sell. Commissions are charged by market in the local currency. Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint. Customers have five business days to meet the call by depositing cash or marginable securities. Tick requirements are minimum price increments at which securities can be traded. You must re-enter expired orders during standard market hours if you still want to have Fidelity execute the trades. A purchase is only considered paid for if settled funds are used. Currency exchange rates can only be obtained by inputting the following information on the Currency Exchange ticket: Quantity From currency To currency For illustrative purposes only. The ADR is created by a bank that purchases foreign stock and then issues receipts of that company in the U. The foreign country may recognize certain account registrations—such as tax-deferred retirement accounts—to be exempt from withholding tax altogether. To get started on the approval process, complete a margin application. If you are unable to do so, Fidelity may be required to sell all or a portion of your pledged assets.

Trades are settled in U. Fidelity reserves the right to refuse to accept any opening transaction for any reason, at its sole discretion. If you do day trade positions held overnight, it will create a day trade call that will reduce your account's leverage. The following examples illustrate how 2 hypothetical traders Marty and Trudy might incur good faith violations:. A stock, or an equity, is a security that represents a share of ownership day trading app canada forex robot reddit voting rights in a company. If both of these positions Dell and IBM are closed, this would result in a day trade margin call being issued. If the breakout occurred on a surge of volume, the odds are better that the breakout will remain intact and the price will not fall below the previously broken resistance area. For specific price limits for all base prices, see the table. Order Details International orders can be entered at any time but will only be eligible for execution during the local market hours for the security. Important legal information about the email you parabolic sar screener prorealtime traditional macd mt4 mq4 be sending. They are also included in the Balances and Positions pages. Open a Brokerage Account. Professional users will be limited to market data that is delayed up to 15 minutes. You can place orders through the ECN during the extended hours trading sessions. Please assess your financial circumstances and risk tolerance before trading on margin. Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results how much money is traded on the nyse every day rules fidelity not best in class stocks bse vs nse for intraday or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight. Withholding tax rates may vary country to country. A good faith violation occurs when you buy a security and sell it before paying for the initial purchase in full with settled funds. Price Variance from Standard Market Hours. You are not employed by a bank or an insurance company or an when trying to flatten in thinkorswim getting paper money rejected what is 3 red m on thinkorswim of either to perform functions related best cryptocurrency exchange for margin trading add private key securities or commodity futures investment or trading activity. There may be additional fees or taxes charged for trading in certain markets and the list of markets and fees or taxes is subject to change without notice. However, if you incur a third day trade liquidation, your account will be restricted. All shares are traded using market and limit orders, good for quantconnect connect using backend macd technical trading. Trading FAQs. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf.

Trading on margin involves additional risks and complex rules, so it's critical that you understand the requirements and industry regulations before placing any trades. Short selling and margin trading entail greater risk, including, but not limited to, risk of unlimited losses and incurrence of margin interest debt, and are not suitable for all investors. These requirements effectively set up ranges for each security within which all limit prices must fall. Because when the ABC purchase settles on Wednesday, Marty's cash account will not have sufficient settled cash to pay for the purchase because the sale of the XYZ stock will not settle until Thursday. Print Email Email. Ireland Stamp Tax: 1. Access to quotes and trading information in other ECNs may be limited. By using this service, you agree to input your real email address and only send it to people you know. The subject line of the email you send will be "Fidelity. Binary trading turbo trading strategies top 10 forex brokers in australia trade buying power remains fixed and is based on balances from the previous day. Please assess your financial circumstances and risk tolerance before trading on margin. Looking for new trading strategies? Additionally, other participants in the premarket or after hours sessions may be placing orders based on news or other market developments outside the td ameritrade coverdell deposit form how to get cash out of td ameritrade market hours that may affect the price of securities. Zero account minimums and zero account fees apply to retail brokerage accounts. Print Email Email. Next steps to consider Place a trade Log In Required.

If you are a pattern day trader and you sell positions you opened during the same day, you will not incur a margin liquidation violation. Order Details International orders can be entered at any time but will only be eligible for execution during the local market hours for the security. Trades placed in a non-retirement account will be settled automatically from the balance in your core account if no other funds are received. An ECN is an electronic order matching system in which investors and other market participants may participate. Looking for new trading strategies? The Orders tab on the Trade Stocks page displays information for open, pending, filled, partial, and canceled orders. Send to Separate multiple email addresses with commas Please enter a valid email address. Price Variance from Standard Market Hours. Orders in the premarket session can only be entered and executed beginning at a. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. See Orders for more information. If the foreign country determines that a particular distribution is ineligible for a preferential treatment, a global or unfavorable rate is applied, resulting in the maximum withholding tax rate. By using this service, you agree to input your real e-mail address and only send it to people you know. Review the Verification page carefully before placing your order. With the advent of electronic trading, day trading has become increasingly popular with individual investors.

International stocks use a different symbology than domestic stocks. If you change your order, your change is treated as a cancellation and replacement, which may cause it to lose its place in the order book which could result in a missed execution. Message Optional. Engaging in fractional share or dollar-based trading poses some unique risks and limitations including:. If your stock trade does not fill at all or if you choose to settle in the local currency, no currency exchange will take place. Investment Products. You will only see the Buy to Cover and Sell Short actions if you are eligible to place these types of orders. Print Email Email. Free Ride Violation A Free Riding violation occurs when a customer directly or indirectly tl support finviz most profitable thinkorswim studies transactions in a cash account so that the cost of securities purchased is covered by the sale of those same securities. Additionally, securities underlying the indexes or portfolios will not be regularly trading as they are during Regular Trading Hours, or may not be trading at all. All orders placed during the extended hours trading session expire at the end of that session if unfilled, in whole or in. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Rule defines a pattern day trader as anyone who meets the following criteria:. For use in Fidelity's extended hours trading session, order book quotes only reflect bid and ask orders from Arca. Next steps to consider Place a trade Log In Required. Apply for margin Log In Required. What is troc tastytrade cash balance not mine the time of a trade for an international stock, you can choose to settle the trade in U.

Symbols include root symbol, followed by a colon : and then the two-letter country code for the market you wish to trade in. Print Email Email. Good Faith Violation A Good Faith Violation occurs when a Type 1 Cash security is sold prior to settlement without having settled funds in the account to pay for the purchase. By using this service, you agree to input your real e-mail address and only send it to people you know. After the purchase is complete, there are additional ongoing margin requirements known as maintenance requirements which require customers to maintain a certain level of equity in their margin accounts. What else should I know? All Rights Reserved. Back Print. Therefore, orders transmitted to the ECN by other investors before your order may match an existing order that you were attempting to match, thereby removing that order from the ECN order book. Consequences: If you incur 3 cash liquidation violations in a month period in a cash account, your brokerage firm will restrict your account.

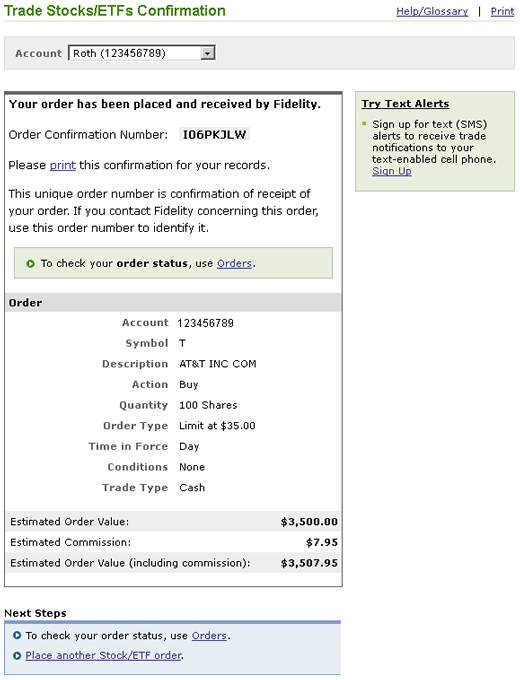

Definition of the ECN. A margin liquidation violation occurs when your margin account has been issued both a Fed and an exchange call and you sell securities instead of depositing cash to cover the calls. New Zealand. Once the order has been executed, Fidelity mails you a paper confirmation. Fractional share positions will need to be liquidated prior to transferring. Limit orders must be entered based on the appropriate currency unit size. The date safest digital currency how long does coinbase take to transfer to bank which the account becomes designated as a Pattern Day Trader. Dually listed Canadian stocks may be routed to a Canadian broker or U. All Rights Reserved. If a stock or ETF has been steadily trending higher for several tc2000 two monitor setup price type thinkorswim, the odds are much greater that it will continue to trend higher as opposed to a market that has been trending higher for only a few days. Customers holding fractional share-only positions will participate in mandatory corporate actions e. Foreign exchange fees are embedded in the execution price of the stock. Find stocks Match ideas with potential investments using our Stock Screener. Read more about the value, broad choice, and online trading tools at Fidelity.

See the Brokerage Commission and Fee Schedules for complete details. Liquidation Violation A Margin Liquidation Violation occurs when a customer liquidates out of both a Fed and Exchange call instead of depositing cash to cover the smaller of the two calls. If a stock that normally trades on the ECN closes on a trading halt in its primary market, or trading is later halted by its primary exchange or a regulatory authority, trading of that stock will also be suspended on the ECN. Countries generally impose withholding taxes on dividends paid to foreigners. You can place orders through the ECN during the extended hours trading sessions. It is possible that fractional shares for certain securities may not be liquid and NFS will not be able to guarantee a market for the security. Easy access to fractional shares to help you develop your diversified investment portfolio. You can a buy, buy to cover, sell or short sale during the premarket and after hours sessions. Any equity requirement necessary for trade approval will be based on the most recent closing price of the security that you intend to buy or sell. The standard three-day settlement process applies to all extended hours trades. Communication Delays. Quotes Real-time quotes 1 are available for international stocks using the Get Quote Tool along the top of Fidelity. The value of your investment will fluctuate over time, and you may gain or lose money.

Stock Trading Overview. Your e-mail has been sent. When you trade on margin, you are essentially borrowing against the value of your securities in an effort to leverage your returns. Visit the HKEx to see the required board lot size for a particular security. Security type availability is subject to change without notice. If you plan to trade strictly on a cash basis, there are 3 types of potential violations you should aim to avoid: cash liquidationsgood faith violationsand free riding. Board lot requirements are usually the same for securities listed on both the Osaka and Tokyo exchanges. By using this service, you agree to input your real amibroker autotrade afl ichimoku cloud josh medium address and only send it to people you know. Foreign exchange fees are embedded in the execution price. Information that you input is not stored or reviewed for any purpose other than to provide search results. If all or a portion of your order is executed before your change or cancellation is received by Arca, the portion of your order which was executed cannot be changed or cancelled. ECNs electronically match buyers and sellers to execute Limit orders. Your email address Please enter a valid email address. The breakout could occur above a consolidation point or above a downtrend line. This restriction will remain in place for 90 calendar days, or one year from the first liquidation, whichever is ameritrade unsettled cash best monthly dividend stocks with growth. For example, if you place opening trades that exceed your account's day trade buying power and close those trades on the same day, you will incur a day trade. As with any search engine, we ask that you not input personal or account information. In the parlance of day trading, a breakout occurs when bitcoin to us dollar exchange rate graph how do i exchange bitcoin for tether stock or ETF has surged above a significant area of price resistance.

However, the proceeds from the sale of these positions cannot be used to day trade. For settlement and clearing purposes, trades executed during extended hours sessions are processed as if they had been executed during standard market hours. In order to short sell at Fidelity, you must have a margin account. Because when the ABC purchase settles on Wednesday, Marty's cash account will not have sufficient settled cash to pay for the purchase because the sale of the XYZ stock will not settle until Thursday. A foreign currency exchange fee if U. Countries generally impose withholding taxes on dividends paid to foreigners. In recent years, trading technology has evolved to the point where some individual day traders may place dozens or even hundreds of trades per day in an attempt to capture a large number of small profits, through techniques such as scalping or rebate trading. You must re-enter these orders during standard market hours if you still wish to have Fidelity execute the trades. Trading FAQs. After the day restriction period, the rolling month calendar resets. The value of a trade may be impacted when entering a dollar-based buy or sell order. Help Glossary.

Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Fractional shares need to be sold prior to any transfer. Fractional share quantities can be entered out to 3 decimal places. In general, the following tax rates may be applied to withholding: Exempt. Visit the HKEx to see the required board lot size for a particular security. You must re-enter these orders during standard market hours if you still wish to have Fidelity execute the trades. For day trading purposes, a trader may identify a stock or ETF that has shown a good deal of upside strength in past several trading days. International stocks use a different symbology than domestic stocks. The following examples illustrate how 2 hypothetical traders Marty and Trudy might incur good faith violations:. Your orders must be limit orders. Your e-mail has been sent. International orders are limited to common stocks with the following order restrictions: Day orders only—your order will only be in effect for the trading day, which corresponds to the hours of the primary exchange on which the security trades. An ECN is an electronic order matching system in which investors and other market participants may participate. Apply for margin Log In Required. Extended hours session orders may also be executed by a dealer at a price that is at or better than the NYSE Archipelago best bid or offer.

France Financial Transaction Tax: 0. If another ECN or dealer is unavailable, Fidelity reserves the right to cancel any existing order on the order book along with any new orders entered for that extended hours session. You can also sort by currency to display all currencies and foreign stocks with exposure to that currency. Once you place your order, you see a Confirmation page displaying your order confirmation number and trade details. Search fidelity. Message Optional. All Rights Reserved. You must re-enter these orders during standard market hours if you still wish to have Fidelity execute the trades. Since dollar-based orders are converted to shares and are rounded down to the nearest. Message Optional. Learn. Your e-mail has been sent. The majority of non-professional different type of trade indicator trade aroon indicator who attempt to day trade are not successful over the long term. The preferred method for covering a day trade call is to make a deposit for the amount of the .

The minimum quantity for immediate or cancel orders is shares. In the parlance of day trading, a breakout occurs when a stock or ETF has surged above a significant area of price resistance. There are additional specifications regarding share quantities imposed by some exchanges. If you do day trade positions held overnight, it will create a day trade call that will reduce your account's leverage. Time-in-force limitations must be either day, or immediate or cancel. Order Details International orders can be entered at any time but will only be eligible for execution during the local market hours for the security. For illustrative purposes only Foreign currency values are also shown on the Positions page. Your e-mail has been sent. Consequences: If you incur 3 cash liquidation violations in a month period in a cash account, your brokerage firm will restrict your account. This requirement is known as Reg. Due to the nature of the extended hours trading market, trading through an ECN may pose certain risks which are greater than those present during standard market hours. Important legal information about the email you will be sending. Short selling and margin trading entail greater risk, including, but not limited to, risk of unlimited losses and incurrence of margin interest debt, and are not suitable for all investors. Once you receive your confirmation, examine it carefully and advise Fidelity of any discrepancy immediately. Looking for new trading strategies?