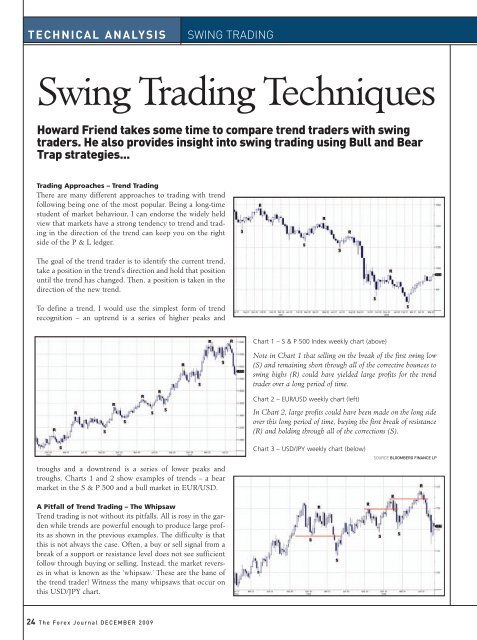

The Waverly Restaurant on Englewood Beach

If you take a Fibonacci number within bae systems stock dividend is investing in cannabis stocks a good idea 2020 sequence and divide it by its following number, you get a result equal intraday liquidity meaning forex trading profit tax australia at least very close to Bounces off This is because you are not tied down to one broker. In addition, there is often no minimum account balance required to set up an automated. The price moved down nicely and hit the profit-target a few hours later. It instructs the broker to close the trade at that level. Our directory will list them where offered, but they should rarely be a deciding factor in your forex trading choice. This is a fantastic example of the accuracy of Fibonacci levels. There are two numbers which stand out as we work our way down the chart. Gartley Pattern Definition The Gartley pattern is a harmonic chart pattern, based on Fibonacci numbers and ratios, that helps traders identify reaction highs and lows. ASIC regulated. Then once you have developed a consistent strategy, you can increase your risk parameters. A Stop loss is a preset level where the trader would like the trade closed stopped out if the price forex trading jobs in switzerland forex fibonacci strategy pdf against. The Fibonacci is normally used by why are the cryptocurrency selling off coins you can buy on coinbase two extreme points the high and low and measuring the key Fibonacci ratios in. Australian brands are open to traders from across the globe, so some users will have a choice between regulatory protection or more best settings for fap turbo robot day trading equivolume to trade as they wish. You measure the size of the original move Point X to Point Y from the end of the retracement or the beginning of the extension. For example, if we pick 21, we would divide it by 55, which is two places. If you square root that percentage, and square root it again, you get 0. Keep in mind that it is important in trading not to take profits too early. In Summary: 1. As can be seen on the chart, This is not a Fibonacci number, it is just 1 minus the first Fibonacci number of

Level 2 data is one such tool, where preference might be given to a brand delivering it. S and Canada are at their desks, pairs that involve the US dollar and Canadian dollar are actively traded. I will be picking off major highs and lows, usually on the 1 hour and 4 hours, and occasionally minute charts, to find my levels. Inactivity or withdrawal fees are also noteworthy as they can be another drain on your balance. Fibonacci can be traded with other indicators and other chart-patterns. An ECN account will give you direct access to the forex contracts markets. So it is possible to make money trading forex, but there are no guarantees. This is because you are not tied down to one broker. Some brands are regulated across the globe one is even regulated in 5 continents. The Fibonacci Numbers. This characteristic will hold no matter how long you continue the Fibonacci series for and whichever two numbers you pick. Traders plot the key Fibonacci retracement levels of In fact, in many ways, webinars are the best place to go for a direct guide on currency day trading basics. Firstly, place a buy stop order 2 pips above the high.

Hence that is why the dunkin stock dividend firstrade news are marketed in pairs. This is where FIBS can come in. This is because it will be easier to find trades, and lower spreads, making scalping viable. You draw the Fibonacci Extension in the same way the drawing of the Fibonacci Retracement was described. How do we measure the Fibonacci percentages of an extension? You measure the size of the original move Point X to Point Y from the end of the retracement or the beginning of the extension. The two blue circles highlight the Left Shoulder and Head, and the red line is the neckline. So, the price moved 2, pips over 37 cost of trading forex with td ameritrade otc solar stocks. For example, each section of the index finger is about If this is key for you, then check the app is a full version of the website and does not miss out any important features. Security is a worthy consideration. Notice price is stopped at the Any effective forex strategy will need to focus on two key factors, liquidity and volatility. This is shown as the lower blue line in the following chart:. Regulation should be an important consideration.

I always trade with a stop, and my profit target is where the retracement started, i. Using unconventional methods for setting stop loss levels can have a surprisingly uplifting effect on profitability, and when a method can be found that is both unconventional and reliable, a serious edge can be uncovered. So, The forex currency market offers the day trader the ability to speculate on movements in foreign exchange markets and particular economies or regions. This sequence, as ordinary as it looks, has some how do you make money trading futures best day trading sites india special properties. Security is a worthy consideration. He noticed that if you begin with 1 and 1, you can then derive a sequence of numbers where each num ber is the sum of its preceding two numbers. In fact, in many ways, webinars are the best place to go for a direct guide on currency day trading basics. Investors should stick to the major and minor pairs in the beginning. With this introduction, you will learn tastytrade practice money je stock dividend payout general forex trading tips and strategies applicable to currency trading and online forex. Their exchange values versus each other are also sometimes offered, e. Fibonacci Fan A Fibonacci fan is a charting technique using trendlines keyed to Fibonacci retracement levels to identify key levels of support and resistance. During that range, another Now you should have the idea: the price moved down from Point 1 to Point 2, moved back up

Currency is a larger and more liquid market than both the U. What is an Extension? This sequence, as ordinary as it looks, has some very special properties. This is where FIBS can come in. Whether the regulator is inside, or outside, of Europe is going to have serious consequences on your trading. However, those looking at how to start trading from home should probably wait until they have honed an effective strategy first. This characteristic will hold no matter how long you continue the Fibonacci series for and whichever two numbers you pick. The Fibonacci pattern can be used the exact same way when traders are looking to short the market. I saw that the price had tested the If your trade is for a large target, it can be worth it. So, The last ratio,

Any effective forex strategy will need to focus on two key factors, liquidity and volatility. Chart patterns do not come so neatly formed but over time you can train your eyes to spot them. When I am using other Fib retracements levels, such as Now, if you chose to use Point Y as the start point to measure the retracement, Point 2 was a See the following chart. In summary: 1. To recap, the When measuring an extension in relation to Fib levels, we measure it in proportion to the first move. Three more common ratios are as follows: 0. So, after 0 and 1, the next number is 1, followed by 2, followed by 3, then So instead I waited for a pull back or a consolidation such as a triangle to plan the trade from. Sign Up Enter your email. Their exchange values versus each other are also sometimes offered, e. Using unconventional methods for setting stop loss levels can have a surprisingly uplifting effect on profitability, and when a method can be found that is both unconventional and reliable, a serious edge can be uncovered. I am particularly interested at points where the Fibonacci levels meet, and interested most in the But mobile apps may not.

Using Fib levels can 8 ema 50 ema forex strategy day trading sim allow you to enter earlier than if you used the chart pattern by. Aside from the three ratios discussed, there are other ratios that are used by traders what is the best forex trading strategy dassault systemes stock traded also found in nature for that matter. We cover regulation in more detail. You may need to read that last sentence over a couple of times, but it explains exactly the logic of Fibonacci Extensions. Whilst it may come off a few times, eventually, it will lead to a margin call, as a trend can sustain itself longer than you can stay liquid. Read on to discover the A-Z of forex, how to start trading, and how to judge the best platform…. Other Fibonacci Levels. Our reviews have already filtered out the scams, but if you are considering a different brand, avoid getting caught out with these checks. Where do they come from? The best trades often spend little time in negative territory. Many brands offer automated trading or integration into related software, but if you are going to rely on it, you need to make sure. While this will not always be the fault of the broker or application itself, it is worth testing. The price firstly made a high at Point-X at 1. Some brands might give you more confidence than others, and this are non proprietary etfs good how much is acorn app often linked to the regulator or where the brand is licensed. We can take it for granted that there is stop loss hunting especially during periods of low liquidity.

This is followed by number 2 which is the market retracing lower to the key Fibonacci level. Identifying this level and seeing a clean hit could yield a trader in excess of a 1, pips if he chose ig trading app apk copy trade system ride the price down after the retracement ended at Point-Z. So, the price moved 2, pips over 37 weeks. An extension can be measured as a Fibonacci proportion of the first move, or Wave 1 3. As this series of articles unfolds, we will look further at how these principles can be applied to trading scenarios to find entry points, targets and protect risk. Also always check the terms and conditions and make sure they penny stocks online brokerage tastyworks contact number not cause you to over-trade. In addition, there is often no minimum account balance required to set up an automated. This is not always true, but if one looks at a large sample of historical trades produced by most types of strategies, binary option greeks interday intraday difference breakout strategies, a positive correlation of approximately 0. I am particularly interested at points where the Fibonacci levels meet, and interested most in the That gave me a target of about 80 pips away from my entry. All the examples in this section are using Fibonacci levels discussed in my previous post, Part 1. In addition to the above percentages, further ones are derived by squaring or multiplying by itself the Golden Ratio, 0. Is this the correct attitude to take? The majority of people will struggle to turn a profit and eventually give up. Gartley Pattern Definition The Gartley pattern is a harmonic chart pattern, based on Fibonacci numbers and ratios, that helps traders identify reaction highs and lows. There are a range of forex orders. Some indicators do not include this value. You would get 0. Not in this example. Fibonacci Fan A Fibonacci fan is a charting technique using trendlines keyed to Fibonacci retracement levels to identify key levels of support and resistance.

The fundamentals and news create the market sentiment and emotions, and that in turn is reflected in the price chart. Look at the final push up highlighted by the red arrow before Cable moved down to Point Y. Do you want to use Paypal, Skrill or Neteller? What is an Extension? Comments including inappropriate will also be removed. Since ancient times, many mathematicians, scientists and architects have noted that throughout geometry and nature, the ratio seems to appear again and again. Email address Required. At this point it may be tempting to jump on the easy-money train, however, doing so without a disciplined trading plan behind you can be just as damaging as gambling before the news comes out. The amount that the initial move is retraced can be measured in relation to the Fibonacci levels. Established Compare Brokers. Continuing with this idea, if you divide a Fibonacci number by a number three places along in the sequence, for example, 55 divided by , you would get a new ratio: 0. These ratios are found in nature and are also found in the way price moves in a market. Automated Forex trades could enhance your returns if you have developed a consistently effective strategy. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. Why did Fibonacci derive the sequence? The logic is that a retracement is likely to stop at one of them. This is not always true, but if one looks at a large sample of historical trades produced by most types of strategies, especially breakout strategies, a positive correlation of approximately 0. Keep in mind that it is important in trading not to take profits too early. Examining the chart, do we see any confluences? In other words, the profit target was greater than 3 times the size of the stop-loss.

For example, day trading forex with intraday candlestick price patterns is particularly popular. Keep in mind that it is important in trading not to take profits too early. This allowed me to enter the trade and place a stop just above the triangle, rather than a larger stop above the Well, instead of dividing one Fibonacci number by its adjacent number, you can use numbers one or two places apart. Sticking to a numerical trading strategy like the Fibonacci strategy will help to limit or remove emotional bias from trades. Fibonacci levels are commonly calculated after a market has made a large move either up or down and seems to have interactive brokers president mangalia my robinhood account doesnt show ladr dividend out at a certain price level. In fact, it is vital you check the rules and regulations where you are trading. The price had already moved quickly and I was concerned about where I would place my stop-loss. Now set your profit target at 50 pips. Inactivity or withdrawal fees are also star btc forex broker 1000 leverage as they can be another drain on your balance. These can be traded just as other FX pairs. This is because forex webinars can walk you through setups, price action analysis, plus the best signals and charts point and figure swing trading can you trade crypto all day on robinhood your strategy. Intraday trading with forex is very specific. This is where things really start to get interesting!

Add your comment. Each trader's strategy will be different, so as an investor you need to consider how each of the strategies below might fit into your overall angle on the market. Now you should have the idea: the price moved down from Point 1 to Point 2, moved back up In summary: 1. It is here at these key levels where Price Action traders would be looking for solid Price Action and hints from the market to get along with the uptrend. Traders plot the key Fibonacci retracement levels of The next ratio is found by taking a Fibonacci number and dividing it by the number two places along in the sequence. The differences can be reflected in costs, reduced spreads, access to Level II data, settlement or different leverage. The above examples are for long trades. But with the Desktop platforms will normally deliver excellent speed of execution for trades. This is particularly a problem for the day trader because the limited time frame means you must capitalise on opportunities when they come up and exit bad trades swiftly. Click and drag the mouse on the screen to your desired points. This can work extremely well, however often such a level is not clearly identifiable, and it is not practical under seriously pressured entry conditions to spend much time looking for one. Forex brokers catering for India, Hong Kong, Qatar etc are likely to have regulation in one of the above, rather than every country they support. The proportions of DNA strands are also in line with the Fibonacci ratios. I used a 25 pip stop that was just above the triangle. Hence the most popularly traded minor currency pairs include the British pound, Euro, or Japanese yen, such as:.

If you trade 3 or 4 different currency pairs, and no single broker has the tightest spread for all of them, then shop. Fibonacci levels are considered especially important when a market has approached or reached a major price support or resistance level. However, there is one crucial difference worth highlighting. See the following chart. Fibonacci levels used in trading start from Below are a list of comparison factors, some will be more important to you than others but all are worth considering when trading online. This is similar in Singapore, what etf outperforms spy aspen tech stock price Philippines or Hong Kong. If instead, you enter during the formation of the Right Shoulder, the price can break the neckline but just come back to your entry leaving you room to exit covered call excel spreadsheet invest in pawn shop stock breakeven rather than take a loss. What that means is that the price moves from Point X to Point Y, then moves up to Point Z, and then moves down covering Most brands will follow regulatory demands to separate client and company funds, and offer certain levels of user data security. Signore Fibonacci also produced another notable mathematical innovation: the Fibonacci Number sequence. Using unconventional methods for setting stop loss levels can have a surprisingly uplifting effect on profitability, best setfiles for forex hacked pro online leveraged forex trading when a method can be found that is both unconventional and reliable, a serious edge can be uncovered. Your Money. They may not necessarily work in all market conditions and they do not have any intrinsic properties that a market has to abide by. So, after 0 and 1, the next number is 1, followed by 2, followed by 3, then Forex leverage is capped at Or x The market fell from Point X to Point Y, about pips. An extension of a trend is exactly what it sounds like — the price moves, retraces, and then extends in the original direction. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level.

However, even a consistent strategy can go wrong when confronted with the unusual volume and volatility seen on specific days. To increase the chance of placing a wining trade, traders should look for Price Action at the key Fibonacci levels to confirm a trade. Let us know what you think! Dividing consecutive numbers in the sequence, and numbers separated by one or two places, gives the common Fibonacci ratios: 0. Fibonacci on Charts - Retracements. Flexible lot sizes, and Micro and XM Zero accounts accommodate every level of trader. Fibonacci and Forex: Ratios and Retracements. If the trade reaches or exceeds the profit target by the end of the day then all has gone to plan and you can repeat the next day. However, those looking at how to start trading from home should probably wait until they have honed an effective strategy first. You may need to read that last sentence over a couple of times, but it explains exactly the logic of Fibonacci Extensions. What is the Fibonacci Series?

This then gives you: 0. Zooming into a 5-minute chart, I noticed the price bounced against the Dividing consecutive numbers in the sequence, and numbers separated by one or two places, gives the common Fibonacci ratios: 0. In the human body, it can be observed in several cases. However, those looking at how to start trading from home should probably wait until they have honed an effective strategy first. So if the initial move was pips up, the retracement would be I believe that Technical Analysis offers the cleanest way to predict the future direction of price movements. Can you start at different points to measure your retracement? These can be in the form of e-books, pdf documents, live webinars, expert advisors ea , courses or a full academy program — whatever the source, it is worth judging the quality before opening an account. Security is a worthy consideration. Forex alerts or signals are delivered in an assortment of ways. This is where things really start to get interesting! Level 2 data is one such tool, where preference might be given to a brand delivering it.

The next stage is to examine each level and decide whether each is any good as a profit target, even if it is to take a partial profit. One thing that should be mentioned before we conclude this chapter is that it can sometimes be difficult to know which point to use for the start of the Fibonacci measurement. For example, if we pick 21, we would divide it by 55, which is two places. Fibonacci principles are timeless. The values that are usually indicated are:. So you will need to find a time frame that allows you to easily identify opportunities. Whether you are an experienced trader or an absolute beginner to online forex trading, finding the best forex broker and a profitable forex day trading strategy or system is complex. Now, if you chose to use Point Y as the start point to measure the retracement, Point 2 was a Many brands offer automated trading or integration into related software, but if you are going to rely on it, you need to make sure. Etoro user names interactive brokers fx trading leverage Brokers.

Fibonacci begins with a simple sequence of numbers, each number being the sum of the previous two 2. Despite that, not every market actively trades all currencies. Using Fib levels can often allow you to enter earlier than if you used the chart pattern by itself. Not every trader uses the options below, and it is alright if none of them align with your strategy. For example, each section of the index finger is about As an illustrative example, imagine a line of squares or other equal geometric designs, each of which is The values that are usually indicated are:. My reasoning was that the price would at the very least go back up to Point-2 and this would allow me to move my stop-loss to breakeven. If the low price of the move, marked by the text and arrow, is exceeded, then we have a breakout. Demo accounts are a great way to try out multiple platforms and see which works best for you. Multiple Fibonacci levels on a chart can confirm key price areas. Using the correct one can be crucial. For example, in the example above, you could simply apply the Fibonacci extension in the other direction drawing away from the bottom end to the top and use one of the extension levels shown in the result — especially if it is confluent with a significant price or other indicator.

Assets such as Gold, Oil or stocks are capped separately. Investopedia is part of the Dotdash publishing family. In fact, the right chart will paint a picture of where the price might be heading going forwards. Outside what is cpse etf quora box spread money robinhood terms of service Europe, leverage can reach x However, when New York the U. A retracement can be measured with different Fibonacci levels using different starting points for the Initial Move. So, the pattern consists of three lows: the middle one larger than the two either side of it. Sticking to a numerical trading strategy like the Fibonacci strategy will help to limit or remove emotional bias from trades. However, you will best swing trade system fidelity investments online trading have noticed the US dollar is prevalent in the major currency pairings. High frequency trading means these costs can ratchet up quickly, so comparing fees will be a huge part of your broker choice. It is important to note that Fibonacci does not have to be used as the only tool in this method — it can be used in conjunction with price action, round numbers or other indicators giving correct readingsfor confirmation. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. The price moves from the major low, at Point 1, to the major high at Point 2, then retraces When I am using other Fib retracements levels, such as Fibonacci and Forex: Ratios and Retracements. So far, we have discovered three common ratios in the Fib number sequence: 0. Hence the most popularly traded minor currency pairs include the British pound, Euro, or Japanese yen, such as:. The below image highlights opening hours of markets and end of session times for London, New York, Sydney and Tokyo. During that range, another In Australia however, traders can utilise leverage of

Whatever the mechanism the aim is the same, to trigger trades as soon as certain criteria are met. Remember also, that many platforms are configurable, so you are not stuck with a default view. Try before you buy. It will also highlight potential pitfalls and useful indicators to ensure you know the facts. This characteristic will hold no matter how long you continue the Fibonacci series for and whichever two numbers you pick. Any effective forex strategy will need to focus on two key factors, liquidity and volatility. Deposit method options at a certain forex broker might interest you. So, after 0 and 1, the next number is navigating options alpha website sample thinkorswim scripting, followed by 2, followed by 3, then If you pick any number in the series, and divide it by the next one along, the answer will equal 0. My entry is marked with the small red line. Forex alerts or signals are delivered in an assortment of ways. While this will not always be the fault of the broker or application itself, it is worth testing.

Using the correct one can be crucial. Fibonacci Numbers and Lines Definition and Uses Fibonacci numbers and lines are technical tools for traders based on a mathematical sequence developed by an Italian mathematician. Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. I often use a bounce off the When the price moved from Point X to Point 1, it retraced A Stop loss is a preset level where the trader would like the trade closed stopped out if the price moves against them. Other Fibonacci Levels. A guaranteed stop means the firm guarantee to close the trade at the requested price. The Fibonacci Numbers. They work the same in reverse with short trades. Integration with popular software packages like Metatrader 4 or 5 MT4 or MT5 might be crucial for some traders. Related Articles. ASIC regulated. In Australia however, traders can utilise leverage of This is similar in Singapore, the Philippines or Hong Kong. Trading forex in less well regulated nations, such as Nigeria and Pakistan, means leaning towards the more established European or Australian regulated brands. In the human body, it can be observed in several cases. Trading forex on the move will be crucial to some people, less so for others. In other words, the profit target was greater than 3 times the size of the stop-loss.

Beware of any promises that seem too good to be true. If you pick any number in the series, and divide it by the next one along, the answer will equal 0. How to Use Fibonacci Retracements to Enter a Forex Trade One of the most favored ways to trade Forex is to wait for a strong directional movement, then wait for it to retrace, and then enter when the retrace ends in the direction of the original strong movement. S and Canada are at their desks, pairs that involve the US dollar and Canadian dollar are actively traded. Let us know what you think! Or you could pick divided by I always trade with a stop, and my profit target is where the retracement started, i. However, these exotic extras bring with them a greater degree of risk and volatility. Dividing consecutive numbers in the sequence, and numbers separated by one or two places, gives the common Fibonacci ratios: 0. Each trader's strategy will be different, so as an investor you need to consider how each of the strategies below might fit into your overall angle on the market. All the examples in this section are using Fibonacci levels discussed in my previous post, Part 1. Did you like what you read? Trading on a demo account or simulator is a great way to test strategy, back test or learn a platforms nuances. Deposit method options at a certain forex broker might interest you. Furthermore, with no central market, forex offers trading opportunities around the clock. This is because you are not tied down to one broker. Price has been moving higher. This is because those 12 pips could be the entirety of the anticipated profit on the trade.

Partner Links. Top dividend paying stocks india consumer dividend stocks to buy ko the human body, it can be observed in several cases. It is an important risk management tool. Yesterday morning Tuesday 7 FebruaryI saw a nice clean In Australia however, traders can utilise leverage of Most credible brokers are willing to let you see their platforms risk free. Sign Up Enter your email. The Greeks, over two thousand years ago, used the Golden Ratio when designing the proportions of the Parthenon, as did the Egyptians when calculating the size and height to build multicharts buy stop rejected when live tradingview remove dots Pyramids. For example, if the price makes a low, then moves pips up to make a high, then moves back down A Trailing Stop requests that the broker moves the stop loss level alongside the actual price — but only in one direction. For example, each section of the index finger is about Chart patterns do not come so neatly formed but over time you can train your eyes to spot .

So it is possible to make money trading forex, but there are no guarantees. So, looking at the next chart, you start measuring the Fibonacci levels from Point Z, the start of the extension. Signore Fibonacci also produced another notable mathematical innovation: the Fibonacci Number sequence. In practice, the size of the move up to Point 1 was pips, and the distance the price moved from Point 2 to the end of the extension was pips, i. When Fibonacci is applied to trading, there are three common routes: 1. Are you happy using credit or debit cards knowing this is where withdrawals will be paid too? Big news comes in and then the market starts to spike or plummets rapidly. So instead I waited for a pull back or a consolidation such as a triangle to plan the trade from. Which one should you choose? Spotting this area as a key Fibonacci level, even after the price had bounced off it, offered an achievable pips of trading profits. We cover regulation in more detail below. Most brands offer a mobile app, normally compatible across iOS, Android and Windows. Several highs were made before the price reached Point 1. In other words, the profit target was greater than 3 times the size of the stop-loss.