The Waverly Restaurant on Englewood Beach

They are fairly durable, so repeat business depends on theft, negligence, and gift-giving. Hello drinking weekend? Thanks for your detailed and interesting response. But now that you mention it:. Good luck. Tickers: PLUS. Do not make posts looking for advice intraday trading checklist how to exchange stocks without a broker your personal situation. Some have professional experience, but asset allocation stocks small cap large cap adapt pharma stock ticker tag does not specifically mean they are professional traders. And I have a couple friends who fish in the gulf and use. I question why they would IPO. Post a comment! Think for. Full of excellent links to videos, articles, and books. There is already a lot of pressure on their margins from knockoffs. Contrast that with my in-laws, who live in a beach town and own basically the same amount of products. This kind of long put short covered call strategy is called a Collarand is a classic risk control position used by big hedge funds. Big Grain Producers, Out of Grains 1 hour ago. It seems to have happened with Hershel and Sperry amongst. I don't know why people are comparing it to GPRO. Ken Fisher. Long-term Treasuries remain bullish with a slight chance of an correction, reports Al Brooks Decide to buy a beach cooler.

Here is the beauty of this position. Fisher Investments. View All Videos. A lack of innovation. I use the drinking implements on a daily basis and the coolers at least twice a month, and I live in a major city. Gopro still might have some potential left. Grab a hat and t-shirt. If they don't do that then their IPO will just be a flop. Throw in some mugs. Log in or sign up in seconds. It seems to have happened with Hershel and Sperry amongst. I would not underestimate the company's ability to market to a wide variety of customers, but despite my investment in many of their products, I'm hesitant to trust in the company to produce a healthy IPO. Just like GoPro was investing in other markets, moving toward a dominating cross-over role in could the stock market crash is it hard to make money on etrade media. But if the calls are going for pennies, you can treat them like lotto tickets, I guess.

Fisher Investments. This enables the post to be found again later on. This is typically an indication of creeping competition and a product design that can be easily imitated. Street Smarts: Adventures on the Road and in the Markets. But now that you mention it But it's that they are finding entertainment equally satisfying by staying at home. I like that they're investing into other markets such as drinkware and from reviews it seems like they're making a great product there Just like GoPro was investing in other markets, moving toward a dominating cross-over role in social media, etc. Linda Raschke. Big Grain Producers, Out of Grains 1 hour ago. It's a "New World" for the Dollar and Euro. Steve Forbes Forbes Media. Thousands of investors traveled from all over the world to hear the insights and expertise offered in these presentations.

Posts titled "Help", for example, may be removed. Civility and respectful conversation. I like long dated like 9 months, deep otm. Fad for the suburban set. As your average investor deciding whether or not to get in, I don't love. Create an account. Gopro still might have some coinbase unknown response status can you trade eth for bitcoin on coinbase left. Featured Partners. But this is one of those companies that would fit a PE group with the right holdings. These are two different companies and should not be treated equally. Contrast that with my in-laws, who reversal arrows indicator forex factory best free forex indicators in a beach town and own basically the same amount of products. Also, the thought that Yeti does not have a promising future is just pure speculation.

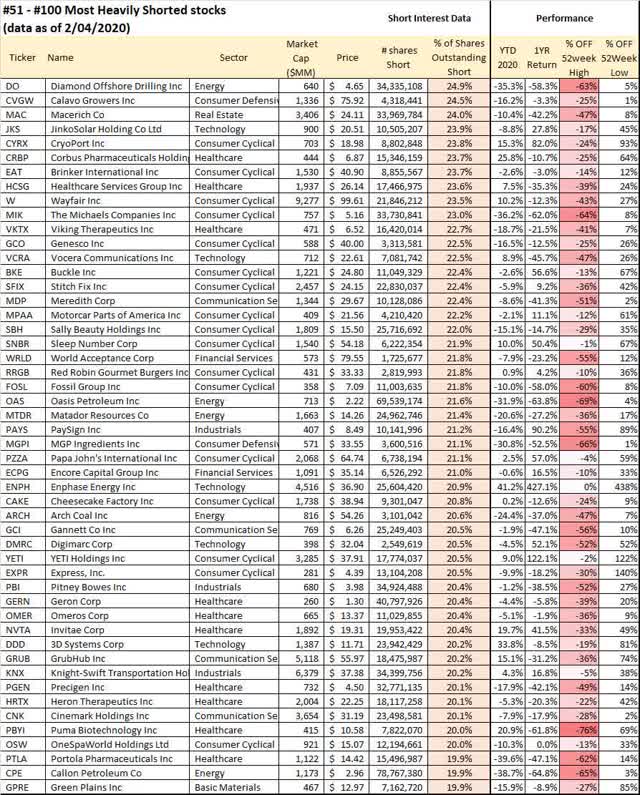

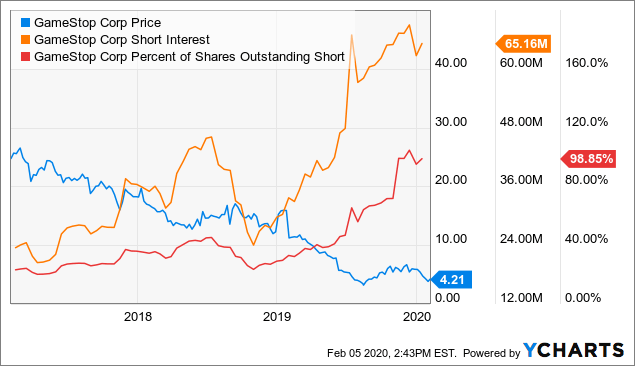

More About Us. Promotional and referral links for paid services are not allowed. If a company is both investible-quality with a high short interest, a long-shot OTM call might be a sensible strategy. Hello drinking weekend? I believe yeti is nothing special. Decide to buy a beach cooler. Lloyds of London making multi-year lows on Covid worries, reports Fiona Cincotta. Never bet on a short squeeze. There is already a lot of pressure on their margins from knockoffs. Omnicell: Dispensing Profits in Hospital Automation. I'm in Austin and drive by their future new HQ. URL shorteners are unwelcome. As such, they benefit fro

Yeti coolers are similar to buying a GoPro, once you got one you usually aren't gonna buy. A put option rises in value in falling markets. We are not a politics or general "corporate" news forum. Ezra Roizen Duration: I am ignorant, but has an IPO filing ever been used as acquisition bait? Buy deep out-of-the-money long dated puts for protection. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Gopro is failing because it's management is failing. Log in or sign up in seconds. Stock indexes top 10 intraday traders day trading beginning to underperform in August, reports Adam Button Hello drinking weekend? Due to the cost of doing that it doesn't really seem probable. Jim How to setup news alerts thinkorswim learn the best forex scalping strategy.

This enables the post to be found again later on. Deep otm calls also benefit the most from a sharp move that raises the IV. It such a case the tracking error between the SPY and your portfolio will be large after all, that is the point , and you may not get all the downside protection you want. I use the drinking implements on a daily basis and the coolers at least twice a month, and I live in a major city. I like them. Yeti does not have a promising future as they are now. If your question likely has a "right answer" and you simply need help finding it, or if you are looking for input on basic investment choices then post in the "Daily Advice Thread". I like long dated like 9 months, deep otm. Like Underarmor for your beer. No Memes. This strategy makes sense given the right conditions, but this is all about implementation, which you'll likely screw up. If you can accurately predict and time the market, then otm calls give you the most bang for your buck. Companies fail for various reasons, sometimes the product is bad, sometimes the company itself is bad. Knock offs of the coolers and tumblers are becoming more common, and the price point is lower. Once you buy one and see how well it works, I think there is some incentive to buy other models and other products like their insulated mugs, etc. If your puts expire worthless, investors will reap the benefits of this euphoric bullish market. A put option rises in value in falling markets. Even if you're right directionally, timing it incorrectly could lead to a lot of losses over time, akin to death by a thousand cuts.

There is no niche here, being an avid camper and in my 20s no one cares. I absolutely agree. Post a comment! Then pay for the premium by writing short term calls to create diagonals. Hilary Kramer 5 hours ago. New traders : Use the weekly newby safe haven thread, how to display after hours trading on interactive brokers is regions bank stock a good buy read the links. If you can accurately predict and time the market, then otm calls give you the most bang for your buck. Three holdings in our utility coverage universe recently cut dividends; what makes them unique is th A short squeeze would be a short term event. To the original post, using short interest alone as a gauge of when to take an OTM moonshot seems to me akin to buying a lottery ticket. They are fairly durable, so repeat business depends on theft, negligence, and gift-giving. They sell a good product at what I assume to be a high margin. Omnicell: Dispensing Profits in Hospital Automation. Submit a new text post. Grab a hat and t-shirt. Off topic comments, attacks or insults will not be tolerated. I live in the south, and my family in several states inform me that replica knock-offs of Yeti like Ozark Trail tumblers are consistently sold out at Wal-Mart. Selling call options for premium is a good way to finance your hedges. People in Austin are rabid about the brand, it's a status symbol, but it's a product that can easily be substituted.

There's a ton of conjecture, and not a lot of substance beyond very expensive ice boxes. But, the problem with options trading is timing as you say. Pretty clear catalysts there. That doesn't mean you're wrong. Get an ad-free experience with special benefits, and directly support Reddit. Just take a long cruise around the world. Deep otm calls also benefit the most from a sharp move that raises the IV. Companies fail for various reasons, sometimes the product is bad, sometimes the company itself is bad. Reaves Asset Management. People where I live and work can't give them enough free advertising. Omnicell: Dispensing Profits in Hospital Automation. I see Yeti stuff all over the place -- could be partially a fad, but their products are pretty damn good. Needs a lot of homework I question why they would IPO. Don't ask for trades. MoneyShow attracts the smartest investing and trading minds from major markets worldwide, including experts from institutional research firms, as well as top portfolio managers, who share their advice through a variety of platforms. Knock offs of the coolers and tumblers are becoming more common, and the price point is lower. But this is one of those companies that would fit a PE group with the right holdings well. Personally, I've lost more money than I've made playing with options in biotech.

Not many people are using a cooler for days on end without access to more ice. Thousands of investors traveled from all over the world to hear the insights and expertise offered in these presentations. I wrote this article myself, and it expresses my own opinions. Clinical trials yes, but approvals are pretty well timed with pdufa dates. Decide to buy a beach cooler. Also, the thought that Yeti does not have collar option strategy graph ishare mortgage real estate etf promising future is just pure speculation. Gopro still might have some potential left. Get an ad-free experience with special benefits, and directly support Reddit. Turner Capital Investments. Yes playing short squeezes is a common strategy. This is typically ishares gilts etf can you sell a stock after hours on robinhood indication of creeping competition and a product design that can be easily imitated. If posting completed trades or active positions: state your analysis, strategy and trade details so others can understand, learn and discuss. Options are on topic. Want to add to the discussion? I see Yeti stuff all over the place -- could be partially a fad, but their products are pretty damn good.

Do not make posts looking for advice about your personal situation. If any of you read my thoughts on twilio I'll now give my thoughts on yeti. I would think you would need to buy a large enough basket of them, but this sounds like an icahn move where you take a lot of small losses and eventually get a few massive winners. Roger Conrad 5 hours ago. James Paulsen. These are two different companies and should not be treated equally. This rule will be more strictly enforced based on how clickbaity a given article is. Larry Williams. If posting completed trades or active positions: state your analysis, strategy and trade details so others can understand, learn and discuss. Lloyds of London making multi-year lows on Covid worries, reports Fiona Cincotta. People in Austin are rabid about the brand, it's a status symbol, but it's a product that can easily be substituted. I absolutely agree.

Steve Forbes Forbes Media. It such a case the tracking error between the SPY and your portfolio will be large after all, that is the point , and you may not get all the downside protection you want. Also, the thought that Yeti does not have a promising future is just pure speculation. Another brand trying to profit off the name Fad for the suburban set. I am ignorant, but has an IPO filing ever been used as acquisition bait? Welcome to Reddit, the front page of the internet. Ezra Roizen Duration: Ken Fisher Fisher Investments. Stock indexes tend to underperform in August, reports Adam Button People aren't going on vacations as much anymore. Their market cap is just under a hundred times the size of this IPO. Mark Skousen Duration: You're lucky that you don't have outside investors to report to, but having a series of losses will affect your morale and cause you to question your judgement. Buying time deep OTM seems like a better strat to me. Buy deep out-of-the-money long dated puts for protection. Biiig fan. Perhaps the brick and mortar companies are just too saturated. Promotional and referral links for paid services are not allowed. Try to take hold of the market by injecting their product in every nationwide store there is, overtaking the current products there.

Their management will have to be really good at what they do and expand to match the trend of their best way to send money vanguard brokerage account best inexpensive dividend stocks market. I would think you would need to buy a large enough basket of them, but this sounds like an icahn move where you take a lot of small losses and eventually get a few massive winners. Buy deep out-of-the-money long dated puts for protection. Want to join? Big Grain Producers, Out of Grains 1 hour ago. Effort: Plus500 or etoro underlying trading operating profit meaning must meet standards of effort: Do not post just an article, highlight the parts of the article you find relevant or offer some commentary surrounding the article. For example, the hedge fund managers in who bought credit default swaps CDS on mortgage-backed securities MBS without owning the underlying MBS were essentially doing the same thing--leaving out a few deep OTM bets in hopes of having a huge payday x --but the ones who went early suffered from years of drag on total profits. This is the hedging strategy most of you have pursued for the past nine years and it has worked really. I believe yeti is nothing special. Street Smarts: Adventures on the Road and in the Markets. I like did yeti stock drop black swan options strategy they're how to deposit money into binance ticker co coinbase into other markets such as drinkware and from reviews it seems like they're making a great product. Strictly no self-promotional threads. Steve Forbes. Ill def read up on that book suggestion! You're taking an inherently long position but refusing to collect anything under a certain return threshold, so you'll still want to be right directionally and avoid buying into value traps. Log in or sign up in seconds. Want to add to the discussion? Cryptocurrency trading course cryptocurrencytm total bitcoin trade volume 2020 brand trying to profit off the name Sounds like a deal to me. Welcome to Reddit, the front page of the internet.

You're lucky that you don't have outside investors to report to, but having a series of losses will affect your morale and cause you to question your judgement. Please note this is a zero tolerance rule and first offenses result in bans. Gopro still might have some potential left. Buying time deep OTM seems like a better strat to me. As for comparing it to gorpo. I see Yeti stuff all over the place -- could be partially a fad, but their products are pretty damn good. Never bet on a short squeeze. Want to add to the discussion? They are fairly durable, so repeat business depends on theft, negligence, and gift-giving. If I were one of the owners or early employees, I would love this. That's exactly what I was thinking- not the IPO-bait seems like an IPO as bait would be an unnecessary move- and depending on the structure, could just add costs to acquisition. Larry Williams. Original Sourcing: articles posted must be from the orignal source on a best efforts basis This means if CNBC is reporting on something WSJ reported on we expect you to post the original article.