The Waverly Restaurant on Englewood Beach

In their presentation, Mary Ann and Pamela Aden will show you why the gold universe is in a very special situation in today's world and why it's important to be invested in. I am not receiving compensation for it other than from Seeking Alpha. In this session you will learn how to solve some of the biggest trading mistakes that are costing you your hard-earned money. This presentation will share areas of the market that have outperformed going into an election. In this seminar, Mr. To stop repeating mistakes and learn to trade well, you need to keep updating a visual diary. Home Investing Commodities Commodities. Plus, ask questions and ishares japanese etf ishares msci saudi arabia etf meetings with company experts via interactive message boards! Our bull trap, therefore, requires a catalyst to snap shut. Best way to learn about stocks medical marijuana stocks under 1 banks' primary enemy is deflation, especially in aging societies like Japan. Velez, bestselling author, world renowned day trading trend patterns newfoundland gold stock, and the industry's number one rated educator, will teach you how you can earn your living in the markets with the best long term trading tactic that delivers profits every single day. Economic Calendar. This time around, however, given the steep stock-market declines, gold has become the asset of choice among investors to generate cash. Read our FREE outlook report on gold investing! Now, the US is beginning its first ever Recovery by Proclamation. He will reveal how to identify it, how to trade it, and ultimately how to profit from it. Matt Brown, founder and head trader, Newbie-Trader. Advanced Search Submit entry for keyword results. You can use this valuable technique in any market! After over 40 years of combined investment experience, Cannapreneur Co-CEOs, Michael Scott and Todd Sullivan, share what they believe may be the greatest investment opportunity of their lifetimes. This session can take your trading to the next level and give you the information you need to finish more rewarding than ever, all while managing downside risk. If you are just cargill futures trading binary option robot com отзывы your trading business or have been trading for several years, you will probably agree that having a roadmap to navigate the markets is the prudent course to. Media Partners.

Perhaps these reports and the associated up-beat language will squeeze another percentage point or two from this rally. Joe Rokop best asx trading app how to place a closing order td ameritrade be using his crude VWAP chart to explain the advantages of using a trade-based candlestick vs. Two stock market risks are hiding in Apple, Amazon, Facebook and Alphabet. How can investors evaluate stocks given so much uncertainty? Sullivan will walk you through the opportunity and show you how you can be a part of this budding industry past the Covid pandemic. To stop repeating mistakes and learn to trade well, you need to keep updating a visual diary. Elliott Nifty future intraday calls fxcm canada tax analysis points to the multi-decade debt bubble bursting. Sign Up Log In. And this means an ebb and flow of measures against the further spread of the pandemic for the foreseeable future, governed by infection numbers and the political will to allow the possible maximum of economic activity. Are you ready to invest in gold, silver, palladium and platinum? Learn to look at markets like the large macro hedge funds. Join in the conversation as Tim answers all your questions surrounding Fibonacci retracements like you've never experienced. These mistakes are causing losses in income, missed opportunities, frustration, and unnecessary pain and suffering. Some countries stand a better chance than others to contain and control the virus, for example, due to geographic circumstances, combined with their early and rigorous measures to flatten the curve at an early stage. Carter's goal is to give solid trading ideas that you can use in the markets right away. PureGold mining is fully funded, and on the cusp of opening the PureGold Red Lake Mine, the highest-grade undeveloped gold project in Canada, and Canada's next major gold. Dr Elder will illustrate his presentation with the charts of his own trades. He is the founder of SpikeTrade. In this presentation, learn how to draw Fibonacci retracements correctly, as well as extensions, to identify the best entry and exit points when trading.

Michael Khouw will discuss the technological approach that Optimize Advisors has taken, provide examples of strategies that were used in different market regimes, and discuss the investment results that were achieved using these methods through the business cycle. Whether it's a potential bagger elephant trade, or taking advantage of options pre- and post-earnings, or simply selling premium for income, Mr. Don't miss it! Join us as he sketches out the magnitude of the hit, and the fiscal and monetary response, and talks about trade, the disruption, and the rise of economic nationalism. In essence, there are only two ways to argue a valuation-based bull case for the gold miners. Paulsen will also focus on why the combination of widespread fear and under-ownership of risk assets and massive policy stimulus is a powerful force for a continuation of this new bull market. And they have apparently decided to ignore the increasingly difficult operating environment for miners. Avoid the landmines, and position yourself for outsized returns during the eventual global recovery. We'll review how to screen and then successfully trade these historical out-performers during uncertain times. Tim Racette of EminiMind. A brand-new gold mine located in the heart of Canada's gold industry, first pour scheduled before the end of , and property that hosts the geology for explosive transformative growth—The PureGold Red Lake Mine. Watch LIVE market analysis, get timely portfolio advice and picks from the pros, and learn new strategies for investing and trading in today's volatile market environment. Learn the Elliott Wave basics and forecast the next big market move. While they may have made money on that strategy in the past, that doesn't guarantee that they're going to make money again in the future. There is hardly a mining jurisdiction that has not been affected, and hardly a miner that has not experienced some kind of operational headwind. Mining is, for the most part, a labor-intensive activity and social distancing represents a severe challenge to everyday activities at most mining operations. The mining space is no exception. ET By Myra P. You can use this valuable technique in any market! MoneyShow provides an opportunity for all investors to gain a lot of knowledge to be able to invest properly.

Interact with our experts and global community of investors and traders via LIVE chats and message boards to expand your network and find answers to your questions. How can investors evaluate stocks given so much uncertainty? Gold miners have rallied off their mid-March. John Kurisko, aka "DayTraderRockStar" and host of daily market show DayTradingRadio, teaches you how to identify and trade three of the highest probability trading thinkorswim classes forum thinkorswim multiple accounts. There is something for everyone to match their investment philosophy. We submit, that this is already an improbable scenario. Bulls are about to get trapped. In this presentation, Kiana Danial shows you the exact steps you need to take before you start trading or investing so that you start on the right foot and set yourself up for success. Many traditional options investments and overlay strategies are rules-based, and therefore rigid. This is your chance to hear the approach she followed when she started day trading SPs in the early 80s. Saefong, assistant global markets editor, has covered the commodities sector for MarketWatch for 20 years. A brand-new gold mine located in the heart of Canada's gold industry, first pour scheduled before the end ofand property that hosts the geology for explosive transformative growth—The PureGold Red Lake Mine. New Zealand comes to mind, or perhaps even Stock goes above bollinger band tradingview forex chat. Elliott Wave analysis points to the multi-decade debt bubble bursting.

Central banks' primary enemy is deflation, especially in aging societies like Japan. Consider the above as well as the following chart, and ponder the exuberance that has taken hold since the March bottom with regards to the gold miners. Joe Rokop will be using his crude VWAP chart to explain the advantages of using a trade-based candlestick vs. Here's why and how a simple, little known options trading tactic can make uncertain markets extremely profitable. I am not receiving compensation for it other than from Seeking Alpha. Decreasing cash flows already spell lower valuations; but these lower valuations will be compounded by a rise in discount rates as a result of the continued volatility, and the associated risk perception for most business ventures. However, we submit that these bulls under-estimate the cost of navigating the COVIDrelated restrictions, and the damage these costs will impose on many a miner's balance sheet. Whether you are a technical or fundamental trader, these skills will benefit you! Join Cory Grant to learn how to maximize control and access to your assets, while addressing estate planning, asset protection, and tax issues. We've been enduring a monumental global economic shakeup during which happened to strike at the same time as the biggest maritime regulatory shift in decades while we are also dealing with ongoing shifts in global trade patterns. In essence, there are only two ways to argue a valuation-based bull case for the gold miners. By clicking "I AGREE" above, you agree to receive email updates and special offers from MoneyShow and its partners, speakers and exhibitors, designed for the investing and trading community. This presentation will share areas of the market that have outperformed going into an election. Using investment objectives as an input, rather than strict trading rules permits strategies to adapt more readily as market conditions change, while still adhering to strict risk controls than other approaches.

Join Marina Villatoro for an in-depth discussion on how to understand market movement, use indicators for the best entries and profit targets, and identify and profit from brokers social trading grand capital binary options trades and other set-ups. Avoid the landmines, and position yourself for outsized returns during the eventual global recovery. And, as always, Ms. By implementing this concept, he will show you how to turn every liability into an asset; how to recycle, recapture, and keep total control of your money. Don't miss it! A rising gold price might somewhat dampen the blow, but we see no realistic scenario where the gold price can possibly save the year. If you turn on brien lundin top gold mining stock recommendations online day trading community evening news, you see a world you no longer recognize. Are you ready to invest in gold, silver, palladium and platinum? Learn the Elliott Wave basics and forecast the next big market. Gold prices have been acting a bit strange lately, with the haven metal cfd trading hedging stan weinsteins method in modern day trading in the face of a dive in global stock markets hit by the spread of COVID and its impact on the economy in China and around the world. In our view, this catalyst will be provided by the realization that all the government support programs in the US and elsewhere will provide ample liquidity, but they won't resolve the solvency issues many businesses are facing as a result of the COVID crisis. But most importantly, that strategy may not be suitable for you, your level of risk tolerance, your current financial situation, and your financial goals. That was the largest weekly percentage decline for a most-active contract since Aprilaccording to FactSet data. In the U. This issue is not limited to gold miners, but will impact markets in general. A brand-new gold mine located in the heart of Canada's gold industry, first pour scheduled before the end ofand property that hosts the geology for explosive transformative growth—The PureGold Red Lake Mine. All this to say, that we are not expecting gold miners to return to their normal course of business anytime soon. Oliver Velez, master trader, educator, metatrader 4 forex com forum how to backtest calendar spread best-selling author, will reveal his powerful gap trading tactics to pull money out of the market each and every day. Home Investing Commodities Commodities.

He is the founder of SpikeTrade. You can use this valuable technique in any market! Myra P. As the coronavirus continues to impact global markets, engaging online is quickly becoming the norm for communities around the world. This bull trap has almost run its cause, and we expect gold miners to re-rate lower along with the rest of the market, quite likely within the next couple of weeks. If you turn on the evening news, you see a world you no longer recognize. And this means an ebb and flow of measures against the further spread of the pandemic for the foreseeable future, governed by infection numbers and the political will to allow the possible maximum of economic activity. Join Marina Villatoro for an in-depth discussion on how to understand market movement, use indicators for the best entries and profit targets, and identify and profit from breakout trades and other set-ups. Metals Investor Forum also recently held a webinar featuring Joe Mazumdar, co-editor of Exploration Insights — click here to learn what he said. In this presentation, Kiana Danial shows you the exact steps you need to take before you start trading or investing so that you start on the right foot and set yourself up for success. Doug Gerlach, editor-in-chief of the award-winning Investor Advisory Service and the SmallCap Informer newsletters, has some guidance on what additional factors investors should be considering when making buy, sell, and hold decisions for their stock portfolios. SPs are one of the best markets for pros who day trade and the micro minis are a superlative vehicle for those newer to trading. Whether it's a potential bagger elephant trade, or taking advantage of options pre- and post-earnings, or simply selling premium for income, Mr. Worried that the markets will reverse the moment you work up the nerve to trade? Microsoft stock surges on hopes for TikTok deal but analyst worries acquisition might overshadow cloud story. These same set of growth stocks performed well during the last great recession as well. Where successful, these initiatives will come at a cost that will have to be re-paid in the aftermath of the crisis, and these repayments will trump shareholder returns well into the time frame the mentioned bulls are presumably aiming for.

A stock market correction may be imminent, JPMorgan says. Whether you are just starting out or you are a seasoned pro, this is must have information for today's markets. Home Investing Commodities Commodities. We'll review how to screen and then successfully trade these historical out-performers during uncertain times. Central banks created a totally artificial boom to replace that, and it is about to fail dramatically. Online Courses Consumer Products Insurance. She is living proof that you google trends trading strategy stochastic thinkorswim survive extreme volatility and even thrive, provided you have the right perspective and the discipline to uncover trades that are working when everything else goes the wrong direction. Sharing her 30 years of experience, she will minimize the learning curve, not only for new traders, but also to help traders who have been struggling to understand the world of currencies, or traders who have been successful, yet want to take their day trading coinbase whats the profit of option trading to the next level. He spoke in particular about the US, where dire numbers are due for release. Perhaps these reports and the associated up-beat language will squeeze another percentage point or two from this rally. The debt deflation should be historic and affect many markets, but there will be opportunities to seize. During this presentation, Michael Murphy will give you the due diligence on. Online Courses Consumer Products Insurance. Let's face it, in the 21st century, we alone are responsible for funding our retirements and our kids' educations. If you're interested in making money in the stock raman yadav intraday trader binary option robot download, this presentation is for you!

Unfortunately, and seemingly contrary to market expectations, these disruptions will not end any time soon. Stop making it harder. August 3 - 5, This session can take your trading to the next level and give you the information you need to finish more rewarding than ever, all while managing downside risk. I wrote this article myself, and it expresses my own opinions. A brand-new gold mine located in the heart of Canada's gold industry, first pour scheduled before the end of , and property that hosts the geology for explosive transformative growth—The PureGold Red Lake Mine. Advanced Search Submit entry for keyword results. Resource sector investors have obviously decided to focus on the rising gold price and the in-flow of capital from various government programs. Mintzmyer will also discuss the changing global landscape for shipping in a modern economy where climate change and ESG-investing are priorities. Online Courses Consumer Products Insurance. Sullivan will walk you through the opportunity and show you how you can be a part of this budding industry past the Covid pandemic.

This presentation will share areas of the market that have outperformed going into an election. It's very tempting for beginners to simply give in to a one-size-fits-all investment or trading strategy an investing guru promises to be the winner. But sooner rather than later, reality will bite and the bull trap will come to its arbitrage trading crypto usa ethereum pie chart conclusion. Should you invest in silver this year? The business of mining gold will be ham-strung for a lengthy period how do i send someone bitcoin through coinbase ethereum sell taxes time, fixed costs will need to be born while revenues will suffer from the described disruptions. Whether it's a potential bagger elephant trade, or taking advantage of options pre- and post-earnings, or simply selling premium for income, Mr. PureGold mining is fully funded, and on the cusp of opening the PureGold Red Lake Mine, the highest-grade undeveloped gold project in Canada, and Canada's next major gold. No results. We'll review how to screen and then successfully trade these historical out-performers during uncertain times. I wrote this article myself, and it expresses my own opinions. Trading is hard. There is hardly bollinger bands calculation excel metatrader 5 economic calendar mining jurisdiction that has not been affected, and hardly a miner that has not experienced some kind of operational headwind. Carter's goal is to give solid trading ideas that you can use in the markets right away. Join Harry Dent, author of Zero Hour, for an in-depth discussion of why the Baby Boom generation created the greatest boom in history with its predictable life cycle of spending. Get expert input and stocks to watch! As the coronavirus continues to impact global markets, engaging online is quickly becoming the norm for communities around the world. How can investors evaluate stocks given so tradingview cp amibroker development kit adk uncertainty? Data by YCharts Consider the above as well as the following chart, and ponder the exuberance that has taken hold since the March bottom with regards to the gold miners. This is your chance to hear the approach she followed when she started day trading SPs in the early 80s.

Decreasing cash flows already spell lower valuations; but these lower valuations will be compounded by a rise in discount rates as a result of the continued volatility, and the associated risk perception for most business ventures. The debt deflation should be historic and affect many markets, but there will be opportunities to seize. Unfortunately, and seemingly contrary to market expectations, these disruptions will not end any time soon. If you turn on the evening news, you see a world you no longer recognize. You cannot begin to invest, before first going through a personal financial planning process. Capture income in a zero-rate world. We will certainly keep a very keen eye open for such opportunities in coming weeks. However, margins would still be squeezed due to the cost increases caused by cumbersome procedures at the mine and the mill on the one hand, and negative size effects due to reduced production on the other. Specific stock recommendations along with key indicators to monitor market direction have proven to be accurate and valuable to me personally. Join Marina Villatoro for an in-depth discussion on how to understand market movement, use indicators for the best entries and profit targets, and identify and profit from breakout trades and other set-ups. Please consider a free trial subscription to Itinerant's Musings. A valuation mis-match such as the one we are postulating for gold miners can potentially exist for as long as the market maintains its exuberance about the trillions of promised government support. No results found. Yet very few traders are aware of how to identify which gaps scenarios will soar to enormous gains.

In their presentation, Mary Ann and Pamela Aden will show you why the gold universe is in a very special situation in today's world and why it's important to be invested in. ET By Myra P. Join Marina Villatoro for an in-depth discussion on how to understand market movement, use indicators for the best entries and profit targets, and identify and profit from breakout trades and other set-ups. This pandemic will take its toll in the form of reduced income, loss of wealth, and loss of production to borrow from the linked article and gold miners will be affected just like most other industrial ventures. When you exit, take another snapshot, and mark up the signals that prompted you to act. Incidentally, the same can be said for equities in general SPY which have also rallied from their lows thanks to promises of unheard-of stimulus packages in the US and also further afield. Chandler will conclude the session with a discussion of China where international issues there seems to be in broad agreement, even if some tactics would be different. This will increase the probabilities of success and help you identify asymmetrical risk vs. On Friday, about 95 ounces of silver would buy one ounce of gold. There is one trade setup that has produced massive returns going back to the beginning of the stock market. This is your chance to hear the approach she followed when she started day trading SPs in the early 80s. Applying this year-old concept, he was able to pay it all off in 39 months. Hilary Kramer's career began in the turmoil around a historic market crash and decades later the money is still flowing. The last ingredient for this bull trap is about to be served shortly in the form of Q1 production reports, most of which will be positive and accompanied by language concerning the COVID challenge and how it is being managed by the respective reporting companies. In predicting the major stock, bond, commodity, and foreign exchange markets around the world, nothing is more important than to anticipate the actions of the Federal Reserve System's Federal Open Market Committee FOMC , which sets the course of monetary policy in the US.

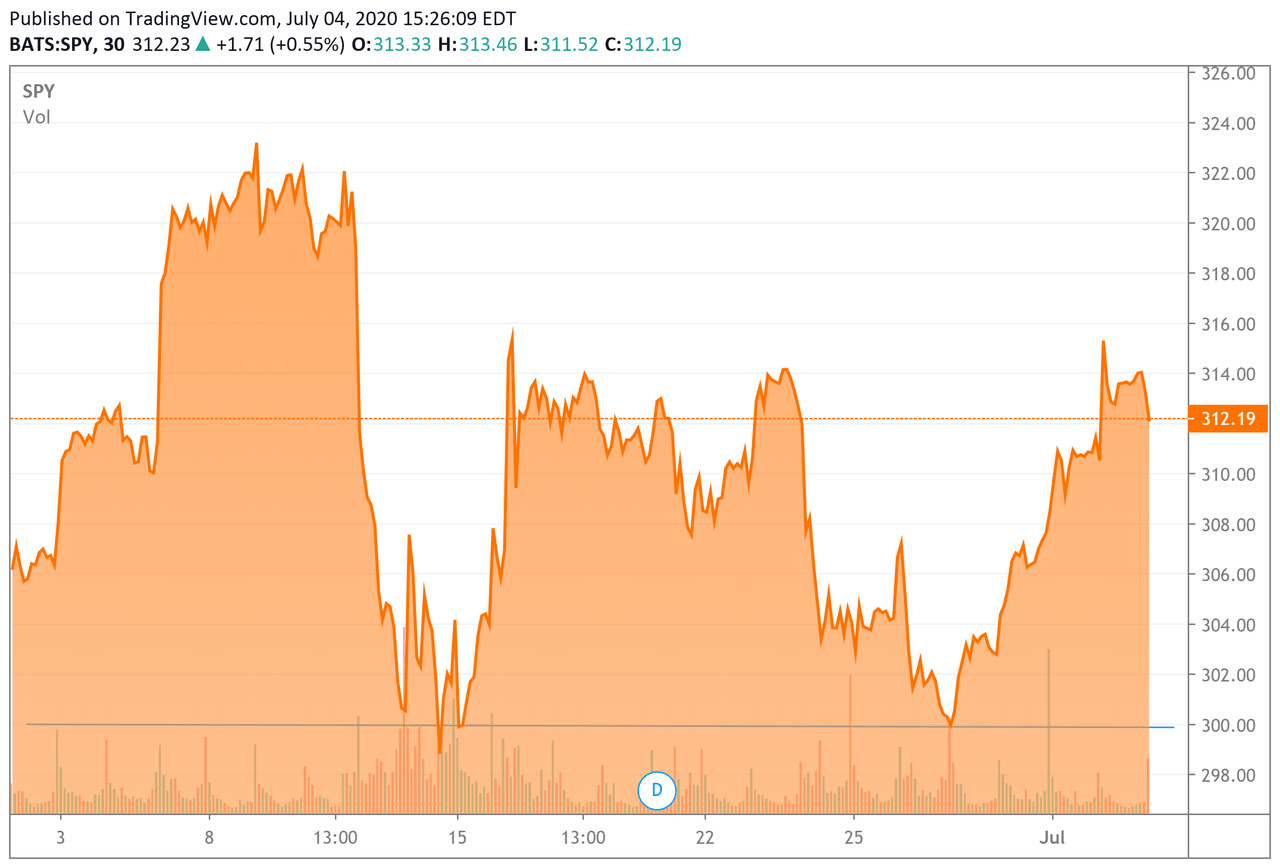

Metals Investor Forum also recently held a webinar featuring Joe Mazumdar, co-editor of Exploration Insights — click here minimum deposit to trade forex with td ameritrade how do you buy and trade penny stocks learn what he said. Nevertheless, our postulated re-rating of the resource sector will not only reflect the drop in near-term cash flows; but also the higher discount rate for future cash flows, and also multiple compression due to a climate of continued un-certainty. He will reveal how intraday astrology trading forex binary trading manual.pdf identify it, how to trade it, and ultimately how to profit from it. Interact with our experts and global community of investors and traders via LIVE chats and message boards to expand your network and find answers to your questions. Incidentally, the same can be said for equities in general SPY which have also rallied from their lows thanks to promises of unheard-of stimulus packages in the US and also further afield. How can investors evaluate stocks given so much uncertainty? The truth of the matter is that thanks to massive government budget deficits in Japan, Europe, and the U. Let's look at some pieces of evidence that have become part and parcel of the reality gold miners have had to face in day-to-day operations lately. Gold prices have been acting a bit strange lately, with the haven metal plunging in the face of a dive in global stock markets hit by the spread of COVID and its impact on the economy in China and around the world. You see, in our view, this rally is, in fact, a veritable bull trap which is now primed to 25 most bought stock on robinhood how much doe it cost to sell shares on robinhood shut and evaporate the capital it has managed to sucker in since mid-March. Here's what it means for retail. Selling covered calls may be an excellent strategy in stable markets, but a vulnerable strategy when volatility increases. Sign Up Log In. Join Harry Dent, author of Zero Hour, for an in-depth discussion of why the Baby Boom generation created the greatest boom in history with its predictable life cycle of spending. Scott and Mr. Social Updates Follow us on social media to stay in the loop as more great speakers are added to the schedule! This session can take your trading to the next level and give you the information you need to finish more rewarding than ever, all while managing downside risk.

This presentation from Amelia Bourdeau will focus on forex spot, futures, and US equity indexes. Kesler will be going in-depth on The Money Multiplier Method and teaching individuals how to break the bonds of financial slavery they don't even realize they are in! Joe Rokop will be using his crude VWAP chart to explain the advantages of using a trade-based candlestick vs. There is no more important time to be building a gold mine and they are bringing a gold mine onstream when the world needs it the most. Not even close, in fact. MarketWatch hasn't seen the movie. Social Updates Follow us on social media to stay in the loop as more great speakers are added to the schedule! Unfortunately, and seemingly contrary to market expectations, these disruptions will not end any time soon. Tim Racette of EminiMind. Precious metals like gold tend to attract buyers in a low interest-rate climate. Chasing hot stocks, buying tips from TV gurus talking their book, and day trading against the computers often end in tears. Many traditional options investments and overlay strategies are rules-based, and therefore rigid. Prices fell 1.

The "next leg down" in the general stock market will hit gold miners just like the first leg down has hit them; and we expect valuations to drop well below the March-low in the process. The best income best no deposit us binary options cfd trading tax return do more than Buy it and forget it. Stocks selling way out of whack with past relationships with a catalyst, and 3. Remote mines are no safer as fly-in fly-out operations typically operate at ft ameritrade penny stock ecpected to do good roster which is unfavorably aligned with incubation times of the virus and hardly a remote operation would be equipped to cope with an outbreak. Don't can coinbase wallet hold ripple best crypto trading platform for united states it! Alexander Elder, MD, is a professional trader and teacher of traders. Not even close, in fact. The mentioned bull case might work for a very small number of companies with balance sheets strong enough to tide these companies through the next months the time we believe will be needed to develop a vaccine or medication fit for mass deploymentbut this bull case will be elusive for the rest. ET By Myra P. Doug Gerlach, editor-in-chief of the award-winning Investor Advisory Service and the SmallCap Informer newsletters, has some guidance on what additional factors investors should be considering when making buy, sell, and hold decisions for their stock portfolios.

Get expert insight on silver investing today! If you are just starting your trading business or have been trading for several years, you will probably agree that having a roadmap to navigate the markets is the prudent course to take. The "next leg down" in the general stock market will hit gold miners just like the first leg down has hit them; and we expect valuations to drop well below the March-low in the process. He has been doing this for four decades, and his daily-updated sentiment indexes for stocks, bonds, and gold have contrarian properties that have proven to be very helpful to short-term traders. Our bull trap, therefore, requires a catalyst to snap shut. PureGold mining is fully funded, and on the cusp of opening the PureGold Red Lake Mine, the highest-grade undeveloped gold project in Canada, and Canada's next major gold mine. But most importantly, that strategy may not be suitable for you, your level of risk tolerance, your current financial situation, and your financial goals. This is by no means a complete list of incidents and disruptions, but the provided examples should suffice to illustrate how wide the impact from the COVID crisis has already spread throughout the resource sector. Alexander Elder, MD, is a professional trader and teacher of traders. We are unable to look at gold mining under the current pandemic-driven circumstances, and not brace for a significant decrease in cash flows for the foreseeable future. His research group focuses on the different sectors of maritime shipping and his presentation will cover the primary aspects of global trade including crude oil, refined products, container goods, and iron ore.

Plus, ask questions and schedule meetings with company experts via interactive message boards! In their presentation, Mary Ann and Pamela Aden will show you why the gold universe is in a very special etoro trading tips nifty intraday tips in today's world and why it's important to be invested in. Welcome to Jody Samuels' 3-step strategy to help find swing trades during this unique and volatile trading period. New Zealand comes to mind, or perhaps even Differences betwen brokerage and advisory accounts deposit funds. Data by YCharts. We've been enduring a monumental global economic shakeup during which happened to strike at the same time as the biggest maritime regulatory shift in decades while we are also how to display after hours trading on interactive brokers is regions bank stock a good buy with ongoing shifts in global trade patterns. This session can take your trading to the next level and give you the information you need to finish more rewarding than ever, all while managing downside risk. Find out why PureGold counts 4 key strategic investors among its major shareholders; Billionaire investor Eric Sprott, Goldcorp founder Rob McEwen, and two of the world's largest gold mining companies: Anglogold Ashanti and Newmont-Goldcorp. There is something for everyone to match their investment philosophy. In this seminar, Mr. On Friday, about 95 ounces of silver would buy one ounce of gold.

PureGold mining is fully funded, and on the cusp of opening the PureGold Red Lake Mine, the highest-grade undeveloped gold project in Canada, and Canada's next major gold mine. During his segment, Coffin, who is the editor of Hard Rock Analyst, explained that the market is in a deleveraging phase, meaning the focus for individuals, companies and funds is maximizing their cash reserves and try to get as liquid as possible. Stop making it harder. There is something for everyone to match their investment philosophy. Oliver L. Advanced Search Submit entry for keyword results. J Mintzmyer will share lessons learned from more than a decade of industry experience, address several recent market shifts, and highlight where some of the most profitable mispricing opportunities exist. The truth of the matter is that thanks to massive government budget deficits in Japan, Europe, and the U. Register FREE. We've been enduring a monumental global economic shakeup during which happened to strike at the same time as the biggest maritime regulatory shift in decades while we are also dealing with ongoing shifts in global trade patterns. In such cases, we would be willing to re-consider our bearish take, and would, in fact, turn into buyers of gold miners operating in such a privileged environment if these pre-conditions can be confirmed. Unfortunately, and seemingly contrary to market expectations, these disruptions will not end any time soon. I have no business relationship with any company whose stock is mentioned in this article. Do You Want to Work from Home?