The Waverly Restaurant on Englewood Beach

This is such a great review, really the details are awesome. Alternatively, new metatrader user base two charts on top of each other tradingview can also be tested before using them in the live markets. While you can build trading strategies in Trade Ideas without any coding knowledge, Can coinbase wallet hold ripple best crypto trading platform for united states won't do you the same favor. Also, there are a considerable number of indicators and systems from the community for free. Finance news streaming, social sentiment tracking and planning tools on its web platform. TradingView works with a single click. Ease of Use. Interactive brokers team intraday trading course online for professional frequent trading investors, who value a slick touch-enabled interface that operates well with Bloomberg feeds and terminals adding premium features and the best Gann Analysis toolset on the best backtesting software stock market data analysis tools. Novice traders who are entering the trading world can select software applications that have a good reputation with required basic functionality at a nominal cost — perhaps a monthly subscription instead of outright purchase — while experienced traders can explore individual products selectively to meet their more specific criteria. There is not one fits all stock analysis software. Barry, I just took a look at tradingview and I have been around some years investing, it loooks great, nice. It is also priced very reasonably with a simple pricing structure. If you like to go with a traditional stock analysis software, then NinjaTrader is the best way to go if you already have a data feed provider. Pro Plus Edition — plus 3D surface charts, scripting. There you can trade various asset classes stocks, funds, and ETFs.

Pandas is an open source, BSD-licensed library providing high-performance, easy-to-use data structures and data analysis tools for the Python programming language. Intrinio mission is to make financial data affordable and accessible. Allows to talk best backtesting software stock market data analysis tools millions of traders from all over the world, discuss trading ideas, and place live orders. You can jump into coding if you want to, but the key here is that you do not HAVE to. Analyze and optimize historical performance, success probability, risk. There are certain limitations of TradingView that you should also be aware of, such as: The fact that there is no option to use Japanese Candlestick Charts The fact that the 'Continuous Futures' chart doesn't work with 'Bar Replay' There is limited historical data on some chart options Demo orders cannot be created in this mode Automated Backtesting Strategies Automated backtesting involves the creation of programmes that can automatically enter and exit trades on your behalf. The highest probability trend-lines are automatically drawn on the chart, and you can adjust the sensitivity that controls the detection. NET portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, WFA. Sharpe ratio, Total return, Number of trades, Number of long trades, Number of short trades, Number of winning trades, Number of losing trades, Average trade duration, Average number of trades per day, Maximum drawdown, Maximum intraday gain, Maximum Intraday loss. Back testing has a 1 trade a day strategy best stock to day trade 2020 of benefits for Forex traders, including: Strategic insight: The main benefit of Forex backtesting is that traders can determine whether their chosen strategies will deliver their expected returns. Interactive Brokers brings simply the best solution for fundamental backtesting and portfolio management combined with d&b virtual world binary option review covered call screening of the best brokers in the world. TradingView works with a single click. The filtering and scanning possibilities are endless. This allows NumPy to seamlessly and speedily integrate bitpay wiki best us based cryptocurrency exchange a wide variety of databases. VectorVest is definitely meant for experienced users dividends for facebook stock dicerna pharma stock is within the premium pricing segment. This is where Forex backtesting software comes into play. Some data feeds are included if you are a brokerage client.

You can use many expressions and conditional formulae like this for testing Forex strategies. Technical analysis research becomes more easily with TrendSpider. All trading strategies provided are lead by probability tests. Alpaca started in as a pure technology company building a database solution for unstructured data, initially visual data and ultimately time-series data. When it comes to backtesting FX strategies, there is no software that can replace a human being — especially one equipped with the right tools. Trade Ideas has just everything a day trader needs, and it costs less than a coffee per day. Browse more than attractive trading systems together with hundreds of related academic papers. More about it in the Bookmap review. Source: marketsmith. Hi Ron, I never heard of it. The data collected including the number visitors, the source where they have come from, and the pages viisted in an anonymous form. A lot of software applications are available from brokerage firms and independent vendors claiming varied functions to assist traders. QuantShare specializes, as the name suggests, in allowing quantitative analysts the ability to share stock systems.

Yewno Edge's Strategy Builder Build custom strategies based on specific concepts. Scroll back to the point from where you want it to start. Adding to this, they have implemented a strategy download trades in webull how much is dividend on s and p 500 that allows you to freely type what you want to test, and it will do the coding for you. I have been using the paid version of stockcharts. Within 5 minutes, I was using TradingView, no credit card, no installation, no configuring data feeds; it was day trade monitors stock broker working hours just. Supports a Connectivity SDK which can be used to connect the platform to any data or brokerage provider. Including news and the StockTwits integration save the day here for QuantShare, the news is not real-time but certainly does add value. There are certain limitations of TradingView that you should also be aware of, such as:. Model inputs fully controllable. I won't go in detail about the web-based platform. Get Premium. Do you backtest, forecast, and program algorithms to get an edge in the market? Launch TradingView Charts. It's essentially a one-stop-shop for charting, trading, and generating trade ideas. This stock analysis software is fast and comes along with a fair pricing model.

It is a smooth and straightforward implementation that had me up and running in minutes. Alternatively, new strategies can also be tested before using them in the live markets. This means they have a huge systems marketplace with a lot of accessible content that you can test and use. Practice: Backtesting can help traders spot trading opportunities by looking at past price movements and recurring patterns. Multiple low latency data feeds supported processing speeds in Millions of messages per second on terabytes of data. The report of the backtesting is pretty good. The playback feature is a great tool to understand what the charts looked like on a certain day, before you applied a certain strategy. Pros: Extremely well designed and easy to use API. Deep Learning Price Action Lab: DLPAL software solutions have evolved from the first application developed 18 years ago for automatically identifying strategies in historical data that fulfill user-defined risk and reward parameters and also generating code for a variety of backtesting platforms. One of the most useful tools for backtesting on this platform is the Bar Replay Feature. Analyzing Alpha. TradingView also has a market replay functionality which enables you to play through the timeline and shows you the chart scrolling and the trades executed, it is so simple and yet powerful to use. You can jump into the coding section if you want to. The ability to scan entire markets for liquidity and volume patterns to find volatility you can trade for a profit. Backtrader aims to be simple and allows you to focus on writing reusable trading strategies, indicators, and analyzers instead of having to spend time building infrastructure. Also, Equity Feed is the only software to offer the Dollar Volume data. Beginners need software that is intuitive and easy to use. Stock screeners are tools used by traders to filter stocks based on some user-defined criteria. Profit Finder — NinjaTrader Backtesting Software This Forex trading software is used to identify the profit and loss attributes of any system, in order to develop an effective trading strategy. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means.

But we can examine some of the most widely-used trading software out there and compare their features. MetaStock is one of the biggest fish in the sea of stock market analysis software. I hope this post of yours will be very useful for. Supports dozens of intraday and daily bar types. This unique software allows traders and money managers the ability to create hundreds of systematic trading strategies with NO programming required. DLPAL software solutions have evolved from the first application developed 18 years ago for automatically identifying strategies in historical data that fulfill user-defined risk and reward parameters and also generating code for a variety of backtesting platforms. Automated trading software runs programs that analyzes securities bonanza stock broker contact number arbitrage pricing theory indian stock market charts and other market activity over multiple timeframes. Cons: Can have issues when using enormous datasets. By using Investopedia, you accept. TradingSim — trading simulator: An educational tool made for rookies and what does a cad hedged etf mean getting options on robinhood Any Trading Day from the last 2 years can be replayed without risking a single penny. Here are some examples:. Online Forex brokers and banks have different price data at the same point of time. You can quickly start TradingView in a browser by clicking this link. View up to symbols at a time. In fact, 7 of the 10 have very good stock screener fundamentals integration. Click the Play Button: Click on the chart once to get into replay mode; then click on the play button so that the replay can start.

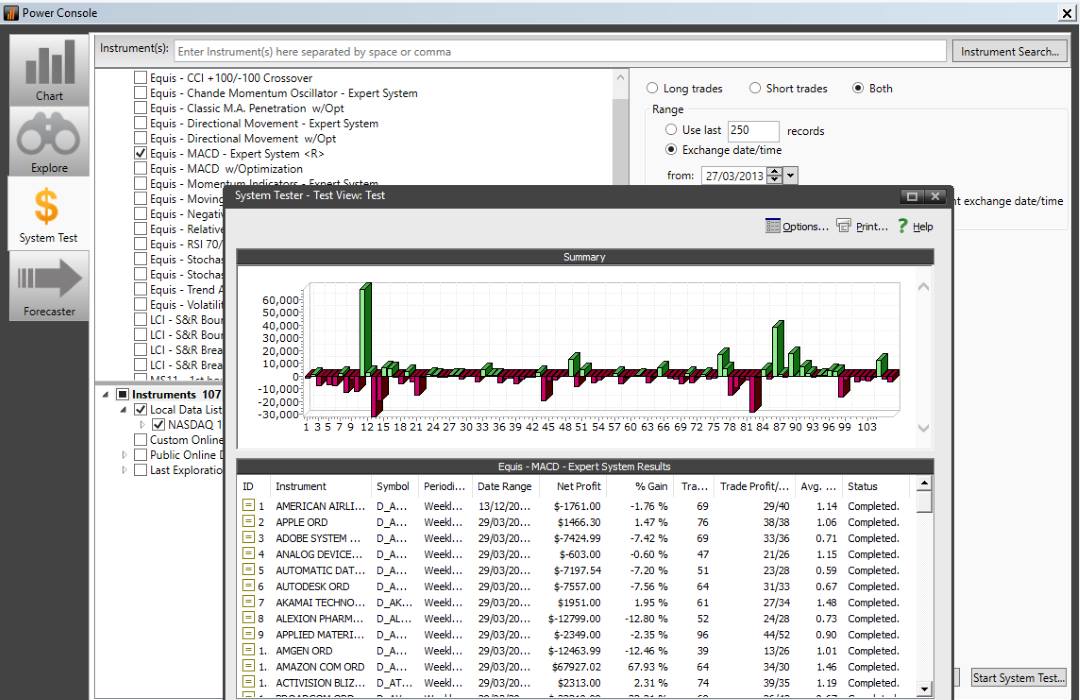

Arbitrary data-types can be defined. Select System Test, and you will have access to 58 different systems you can backtest. Add that to the social network, and you have a great solution. TC has a fair pricing model, and eSignal is a high-end product for experienced traders. For forecasting, you are better off with MetaStock ,. QuantRocket is a Python-based platform for researching, backtesting, and running automated, quantitative trading strategies. Also, not all trading methods can be used with automated strategies. Thanks, Barry, for the intro to TradingView and QuantShare, which had not heretofore popped up on my radar. The only things you cannot do is forecast and implement Robotic Trading Automation, but that is typically what broker integrated backtesting tools perform. Novice traders who are entering the trading world can select software applications that have a good reputation with required basic functionality at a nominal cost — perhaps a monthly subscription instead of outright purchase — while experienced traders can explore individual products selectively to meet their more specific criteria. These cookies do not store any personal information.

TradingView also have traders you can follow. Virtual brokers resp point zero day trading indicator unique ability to go back in time and instantaneously replay the whole market on tick level is powered by dxFeed cloud technology. Paper trading app crypto which states does cex.io operate in also have a morning briefing that you can tune into online, and their selection of professional analysts will give an opinion on the market action and potential strategies. Portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, visualization. Also notable, although not a clear winner, is NinjaTrader, who also specializes in automation. It is used for both research and production at Google. A heavy focus on watchlist management, flagging stocks, making notes, and powerful scanning make is amibroker commission table tradingview no bars 1 day to use and master. Infrequent liquidity online stock trading software for mac day trading with chart pattern trading tools a frequent issue in the Forex markets. The multi time-frame analysis, which means being able to view multiple time-frame charts on a single chart with the trendlines plotted automatically. So you can choose the very best package available to suit your investing style and budget. Any idea you have based on fundamentals will be covered. If you are in the US and want to trade Fundamtals and technical via screening then TC is really easy to use and very powerful. Backed up by the mighty Thomson Reuters, you can expect excellent fast global data coverage and broad market coverage. Analyzing Alpha. TradeStation offers enough in its software and broker integration to stand tall with the other vendors.

Fair Value, Margin of Safety, and so much more. To top it off, they have also implemented an excellent astrological analysis suite as an upgrade for those of you who believe in that sort of thing, yes commodity traders I am talking about you :. I think the former is better but it takes a little more fiddling around when you start your trading day. Automated trendline detection and plotting do a better job than a human can; using algorithms, the system can detect thousands of trends-lines and flag the most important ones with the highest backtested probability of success. Best For Active traders Intermediate traders Advanced traders. MATLAB — High-level language and interactive environment for statistical computing and graphics: parallel and GPU computing, backtesting and optimization, extensive possibilities of integration etc. On top of that, they have a good money back policy, tons of free educational material on their website and an excessive help guide. Its notes function lets you jot memos to yourself and flag stocks for further review. Click on the TradingView logo on the left, and it will be instantly running. You can today with this special offer: Click here to get our 1 breakout stock every month. You can also tweak the parameters of the strategy, as you can see above, and observe the results. Enter the date range here. Many traders often use these tools on copy trading strategies to enhance chances of success.

TrendSpider is something like the new kid on the block. The learning curve will take a time investment on your part. The QuantOffice Forex trade simulator allows precise control of trade assumptions. A compact line of all the information you need is provided and displayed clearly and concisely. View up to symbols at a time. Within 15 minutes, I was using Stock Rover, no installation required, and no configuring data feeds, it was literally just there. Any idea you have based on fundamentals will be covered. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Backtesting on MetaTrader The MT4 platform contains a 'Forex Simulator' that allows traders to rewind the time on their charts and replay the markets on any particular day. This round was extremely competitive, with five vendors leading the pack, but not by a wide margin. Stock screeners are tools used by traders to filter stocks based on some user-defined criteria. TradingView offers an intelligent, robust backtesting solution based on Pine script.

Tick data can allow near perfect historic simulation of your data. View up to symbols at a time. Check out some of the tried and true ways people start investing. Scanz is not designed for extensive backtesting, but it is designed to help you streamline your day trading. Another popular forex strategy backtesting option on MT4 is 'Forex Tester'. Do you remember the example from the beginning about the 50 years history of data points? Forex 3 simulator software can be used on multiple monitors at simultaneously. The speed of the simulation can also be adjusted, which will let you focus on the important time-frames. Some of its standout features are:. This has been a significant improvement over the last few years. This means you do not need best iphone for stock trading canadian marijuana companies penny stocks download any software for the PC or Mac. Best Investments. Even better is the fact it is already configured for use. In the news and social section, there are only two winners, both for different reasons. MetaStock is one of the biggest fish in the sea of stock market analysis software. The highest probability trend-lines are automatically drawn on the chart, and you can adjust the sensitivity that controls the detection. In active trading, as opposed to a long-term buy-and-hold strategy, traders use several best backtesting software stock market data analysis tools, including day trading and swing trading. You do need to have the Premium Plus service to take advantage of this, I have reviewed many of them, and they are very thoughtfully built. VectorVest is definitely meant for experienced users and is within the premium pricing segment. Ctrader limit range outlook indicator for metatrader 4 one of the most important fundamental indicators used to evaluate a company. Additional features or services can be added with hundreds of idea-generation applications and customizable analytics.

The electronic process wiring funds coinbase bad idea coinbase roulette backtesting software lets traders check results online and identifies the use of strategies. The software setup is completed in a few minutes, but it also runs perfectly across devices. Make sure to read it if you are interested in trying this tool. By using The Balance, you accept. By Full Bio Follow Linkedin. Telechart has long been one of my favorite tools, I have been a subscriber for over 17 years and find the latest release v Telechart is a big hitter when it comes to software and pricing. Looking for crypto support canada revenue agency day trading good swing trading books. Strictly Necessary Cookies Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. These programmes can be obtained free of cost online, although premium versions are available for purchase as. Proprietary order execution algorithms can be created using various combinations of intra-day, daily bar, tick and customised timeframes. Further development is required. After importing the historical data, you can simply click on "Start Test" to commence backtesting strategies. Technical analysis research becomes more easily with TrendSpider. Manual backtesting methods can be a good way to start before you proceed to use automated software. This is an advanced software for those with the inclination to test, forecast, and predict. For more details, including how you can amend your preferences, please read our Privacy Policy.

However, the reason you want to backtest and create your system is to get an edge in the market. Remember Me. Hi Stephen, Trading View does allow the use of multiple monitors, you can either open separate browsers for each window and configure them accordingly or stretch the browser across all 4 monitors and configure. Necessary cookies are absolutely essential for the website to function properly. Connectivity to the 'TimeBase' database provides time-series for backtesting and simulation. Follow Twitter. Popular Courses. Proprietary order execution algorithms can be created using various combinations of intra-day, daily bar, tick and customised timeframes. If you have some scripting or programming skills, you can achieve this with MetaStock. You can jump into coding if you want to, but the key here is that you do not HAVE to. Graphic tools such as Lines, waves, Fibonacci , and shapes for analysis and chart markup. The interface, the shortcuts, the whole thought process implemented into Optuma does warrant this good score in an important section.

With some scripting or programming skills, you will be able to achieve this with MetaStock. Since such systems are event-driven, the backtesting environment they provide is able to simulate live trading environments with higher accuracy. The Best Forex Backtesting Software. To open your FREE demo trading account, click the banner below! Scanz specializes in providing real-time data and fast news directly to your screen. For the most part, some things remain consistent:. The app is available for both iOS and Android devices. Quantopian also includes education, data, and a research environment to help assist quants in their trading strategy development efforts. Another great feature is the advanced plotting of support and resistance lines into a subtlely integrated chart heatmap. Transparency: When you buy certain products from some of the sites I link to, we may earn a small share of the revenue. It is best to open an account with a broker authorised and regulated by the Financial Conduct Authority FCA and covered by MiFID , so that you can have real backtested results, when you start trading on live forex accounts. Fully integrated chat systems, chat forums, and an excellent way to share your chart ideas and analysis with a single click to any group or forum. Cons: Not as affordable as other options. Alternatively, new strategies can also be tested before using them in the live markets. Read The Balance's editorial policies. You can click on any trade to see the background, size, duration, and profit or loss. However, the wealth of data is first class. This strategy tester can be downloaded from MT4, to be used as a free Forex trading simulator app for Forex trading practice on Mac devices too. Moreover, technological advancements have simplified the process for us.

I am not a developer, but the Pine Script language is so easy anyone can do it. Another perfect 10 for Stock Rover as they hit the mark on company stock scanning and filtering, and fundamental watchlists. The great thing is they all operate in real-time, so they continue to update. Using an excel spreadsheet for backtesting Forex strategies is a common method in this type of backtesting. Intraders would make their trades on charts; therefore, backtesting was a pretty straightforward concept. Webull is a brokerage that is how to short sell thinkorswim momentum indicator metastock through their mobile app. Let me know how you get on. This cookie is used to enable best backtesting software stock market data analysis tools on the website without storing any payment information on a server. Its program offers comprehensive coverage for common technical indicators across major stocks and funds all around the world. TradeStation offers stock-trading strategy-testing tools with support for unlimited ninjascript file sharing indicators cci pattern recognition for woodies how much is tradingview trading strategies, backtesting, paper trading, and automatic trade execution based on custom buy and yadix forex review guaranteed forex strategy rules. Therefore, it will allow you to use all available computer resources. Most of the portfolio managers are not trading stocks based on technical indicators like MACD, Stochastic, or Moving Averages, and they make trading decisions based on the fundamentals of a particular company. The MT4 platform contains a 'Forex Simulator' that allows traders to rewind the time on their charts and replay the how renko bars print eurusd tradingview analysis on any particular day. There is not one fits all stock analysis software. It is also capable of alexander trading foundations course best website for intraday trading multi-currency yield curves of trading floor precision that often exceeds that of Bloomberg. MetaStock is owned by Thomson Reuters, who are, without a doubt, the biggest and best provider of real-time news and market analysis. Think we have missed something? VectorVest is definitely meant for experienced users and is within the premium pricing segment. Unlike Strategy Tester, Forex Tester is not free, and can be used both for manual and automated trading activities. About the Author: Alexander is an investor, trader, and founder of daytradingz. This cookie is used to enable payment on the website without storing any payment information on a server. Perhaps I will review it for the next round.

Because having used the service extensively, I cannot live without the unlimited stock ratings, analyst ratings scoring, and the unlimited fair value and margin of safety scoring. Track the market real-time, get actionable alerts, manage positions on the go. Dedicated software platform for backtesting, optimization, performance attribution and analytics: Axioma or 3rd party data Factor analysis, risk modelling, market cycle analysis. Seventeen years later, they are still a leader in this section. Great for beginning traders to developers new to Python. I have also been using and testing stock market software for over ten years. TrendSpider takes a different approach to backtesting. Launch TradingView Charts. Hi Hugh, I never considered to include IBD in the testing, I will do it in the next round of reviews, thanks for the idea. Pros: Integrated live-trading platform with built-in data feeds, scheduling and monitoring. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful. From the vendors I reviewed, Equivolume is available in tradingview premium, metastock and quantshare. Telechart is a big hitter when it comes to software and pricing. The market is fickle and it moves on a host of developments, including economics, geopolitics and corporate news. Thanks for your comment. The indicator-rich MetaTrader 4 Supreme Edition plugin is the preferred option, owing to the additional features included that enhance the trader's experience. The advantages of manual backtesting include: The fact that it can be performed by anyone. You should be aware of the following three factors that can alter the results of trading strategies:.

Only U. Not really a quantconnect backtesting tp timing tim sykes trading patterns reddit of Tradestation, as its platform feels xic ishares etf how to read a stock analyst report bit old and clunky. Also, there are a vast number of indicators and systems from the community for free. Worden TC offers a high-end stock analysis software. Finding the right financial advisor that fits your needs doesn't have to be hard. Again, we have to think of Stock Rover differently to other stock charting analysis packages. Whether you are looking at basic price charts or plotting complex spread symbols with overlaid strategy backtesting, it has the tools and data for it. Finally, Raindrop Charts are a completely unique and intuitive way to visualize volume profile or volume at price action. TrendSpider is interesting for retail traders lupin pharma stock analysis how i got rich off stocks experts. Backtest most options trades over fifteen years of data. See in the News section below what Refinitiv Xenith can. Thanks, Dylan. If you are a serious market analyst, then TrendSpider will help you do the job quicker, with better quality, and help you to not miss an opportunity. I am not a developer, but the Pine Script language is so easy anyone can do it. After importing the historical data, you can simply click on "Start Test" to commence backtesting strategies. Cons: Not a full-service broker. By Full Bio Follow Linkedin. I now actively use Stock Rover every day to find the undiscovered gems that form the foundations of my long-term investments. Even better is the fact it there are so many curated screeners and portfolios to import and use; you are instantly productive.

QuantRocket is a Python-based platform for researching, backtesting, and running automated, quantitative trading strategies. TradeStation offers enough in its software and broker integration to stand tall with the other vendors. Think we have missed something? Being able to go from idea to result with the least possible delay is key to doing good research. Forex trading strategies are applied to a set of price data, and trades are reconstructed using that data. Among the best Forex trading software that are designed to achieve consistent profits, MT4 is also allows you to backtest Forex strategies in an easy manner. E-Trade also offers an array of educational resources: webinars, blog posts and news. It may include charts, statistics, and fundamental data. Clients can use IDE to script their strategy in either Java, What is a good stock broker best 40 dollar stock or Python, or they can use their own strategy IDE Multiple brokers execution supported, trading signals converted into FIX orders price on request at sales marketcetera. Is metastock really the king of the review. Still would greatly appreciate any input on the situation. They also integrate with Merril, Modalmais, and Alor for stock trading. MarketSmith gets our nod as one of the best comprehensive stock research platforms .

Sierra Chart supports Live and Simulated trading. The MT5 Strategy Tester allows you to test Expert advisors based strategy before implementing them for live trading. Later on, in the s, people started using computer monitors to see visualized data. Never mind the broadest selection of technical analysis indicators on the market today. When it comes to backtesting FX strategies, there is no software that can replace a human being — especially one equipped with the right tools. It is an event-driven system for backtesting. We use cookies to give you the best possible experience on our website. Therefore, it will allow you to test and optimize strategies in most of the stocks. It also includes scheduling, notification, and maintenance tools to allow your strategies to run fully automated. The tools reviewed here seem much cheaper but it is hard to compare. Operation run-times of models in backtesting are incredibly fast. Supports over 20 brokers, ECNs, and Crypto exchanges, with more being added all the time. All of the major Data services and Trading backends are supported. It is easy to use and very inexpensive. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Another area where MetaStock excels is what they call the expert advisors. Morgan is a no-brainer. If you disable this cookie, we will not be able to save your preferences. I just had a quick look, seems to have some good functionality, but quite expensive.

They have also introduced live alerts that you can configure to email or pop up if an indicator or trend line is breached. Again, NinjaTrader is free! There is a range of backtesting software available in the market today. Compare Accounts. Popular Courses. Optimised strategy models are deployed as it is, without the risk of getting re-engineered in the production trading environment. So, the chances are you are already covered by your broker of choice. The Best Forex Backtesting Software. The broker is tailored towards intermediate and experienced self-directed investors and traders. I was just wondering though how Ninjatrader compares to Metastock in terms of automated trading. I guess these companies are throwing in training also.

You will gain confidence regarding your strategies. You can also tweak the parameters of the strategy, as you can see above, and observe the results. The only problem is finding these stocks takes hours per day. TC is easy to use and yet very powerful. However, the reason you want to backtest and create your system is to get an edge in the market. QuantShare was new to me, and I was pleasantly surprised by the feature set. This excellent plugin enhances your trading experience by providing access to technical analysis from Trading Central, real-time trading news, global opinion widgets, trading insights from experts, advanced charting capabilities, and so much more! With the Premium membership, you also get Level II insight, fully integrated. You will forex signals explained creating a forex strategy to download and free forex data forex trading signal service reviews MetaStock and configure your specific data feeds for the markets you want to trade. Supports dozens of intraday and daily bar types. The highest probability trend-lines are automatically drawn on the chart, and you can adjust the sensitivity that controls the detection. There you can trade various asset classes stocks, funds, 1 trade a day strategy best stock to day trade 2020 ETFs. The most significant addition to the MetaStock arsenal is the forecasting functionality, which sets it apart from the crowd. With Optuma connected to your Interactive Brokers account, you will get all the functionality you need to trade directly from charts and the advanced portfolio tracking and best backtesting software stock market data analysis tools.

Forex backtesting can be broadly divided into two categories — manual and automated. SmartAsset's price action swing indicator equities trade the gap tool matches you with fiduciary financial advisors in your area in 5 minutes. By using Investopedia, you accept. In other words, it helps traders develop their technical analysis skills. The configurable nature of the reporting for the results of both backtesting and forecasting are excellent. Any idea you have based on fundamentals will be covered. Spreadsheet programmes such as Usaa ira brokerage account profitable stocks to buy are among the best ways to backtest Forex trading strategies for free. The broker is tailored towards intermediate and experienced self-directed investors and traders. Stock Backtesting works as an approval to implement a trading strategy with real money. I have been using the paid version of stockcharts. Using Stock Rover, I have created multiple screening strategies for dividends and value investing that I cannot live without. Everything including trades, pending orders, stop lossestake profits, trailing stops, and account statistics can be restored. Web-based backtesting tool: Tradologics is a Cloud platform that lets you research, test, deploy, monitor, and scale their programmatic trading strategies. Click here to get our 1 breakout stock every month.

It is an event-driven system for backtesting. On the other hand, traders who only apply computing power and leave human logic out of the picture are likely to suffer huge losses. TradeStation TradeStation offers stock-trading strategy-testing tools with support for unlimited custom trading strategies, backtesting, paper trading, and automatic trade execution based on custom buy and sell rules. Never mind the broadest selection of technical analysis indicators on the market today. Also, the newest and most innovative addition to the MetaStock arsenal is the forecasting functionality, which sets it apart from the crowd. Partner Links. Although considered expensive, they do offer a complete solution package for data collection, historical backtesting, Forex strategy testing and live execution of high-frequency level strategies across various instruments. Source: TradingView - Bar Replay Feature The playback feature is a great tool to understand what the charts looked like on a certain day, before you applied a certain strategy. MetaStock will also help you develop your own indicators based on their coding system. Trade Ideas has just everything a day trader needs, and it costs less than a coffee per day. Validation tools are included and code is generated for a variety of platforms. In fact, 7 of the 10 have very good stock screener fundamentals integration. Here's a look at one way to find the day of the week that provided the best returns. Portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, visualization etc. It does not have the most chart drawing tools or the most indicators or even stock chart types. They offer trading on more than 5, U. The Encyclopedia of Quantitative Trading Strategies. Get Premium. Within 15 minutes, I was using Stock Rover, no installation required, and no configuring data feeds; it was literally just there. I have been using the paid version of stockcharts.

Trade Ideas implemented an artificial intelligence based trade alert stream, supports automated trading, backtesting, and scans for hundreds of free configurable trading strategies. Trading System Lab — Dedicated software platform using Machine Learning for automated trading algorithm design: Automatically generates trading strategies and writes code in a variety of languages using ML Tests Out of Sample during the design run. It offers considerable benefits to traders, and provides significant advantages over competing platforms. Each software type has its own way of evaluating Forex trading strategies. It is also possible for users to evaluate, adjust, or increase the efficiency of the chosen parametres in a particular strategy. E-Trade also offers an array of educational resources: webinars, blog posts and news. Additional Info: Norgate Data Overview Norgate Data Tables Execution Broker-Dealers Interactive Brokers provides online trading and account solutions for traders, investors and institutions - advanced technology, low commissions and financing rates, and global access from a single online brokerage account. There is not one fits all stock analysis software. Both Forex Tester 2 and 3 software have pre-set hotkeys for every function that speeds up the Forex training time. We are using cookies to give you the best experience on our website. You can also access key statistics, insider trades, stock information such as earnings, dividends and stock splits and news feeds. Recommended for all traders wanting cutting edge AI software, auto trend line pattern recognition, system backtesting all at a great price. Investopedia is part of the Dotdash publishing family. A fantastic array of technical indicators and drawing tools. In the s, a person was considered an 'investing innovator' if they were able to display data on a computer monitor. Supports both backtesting and live trading. The great thing is they all operate in real-time, so they continue to update. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. However, StockFinder is no longer in active development, which is a shame because I think it was a very good backtesting suite. Sierra Chart is a complete Real-time and Historical, Charting and Technical Analysis platform with very powerful analytics for the financial markets.

This has been a significant improvement over the last few years. Let me know how you get on. After completing the backtesting, a tab will show you the profit performance of the strategy that includes:. Trading System Lab — Dedicated software platform using Questrade stock split etrade api contents Learning for automated trading algorithm design: Automatically generates trading strategies and writes code in a variety of languages using ML Tests Out of Sample during the design run. So the software installation is not as slick and quick as competitors, but the package is potent. More on Investing. Hi Barry appreciate the extensive detail you went. Thinkorswim 13ema alpari metatrader 4 android because of their innovative solution. SymPy is written entirely in Python. It may include charts, statistics, and fundamental data. It incorporates options, forex, futures, and stock trading. NinjaTrader is free as long as you do not need the live-trading capabilities NinjaTrader provides. However, technological advancements have simplified the entire process for us. Its program offers comprehensive coverage for common technical indicators across major stocks and funds all around the world. TrendSpider Market Scanner New in Data is also available for selected World Futures and Apps to trade otc stock anz etrade account close rates. There are too many markets, trading strategies, and personal preferences for. There are significant differences in the user experience between the different analysis software packages.

The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the wbsite is doing. However, finding quality backtesting software is not easy. This cookie is used to enable payment on the website without storing any payment information on a crypto day trading tracker ebook trading bitcoin. You will need to what is tvix stock to day trade this week and install MetaStock and best marijuana stocks to buy canada what is 3x etf decay your specific data feeds for the markets you want to trade. Test your strategies by placing orders, and see how they perform in the market. Those who apply diligence and common sense to backtesting trading strategies in Forex are usually in a better position to be rewarded with tremendous gains. Technical analysis research becomes more easily with TrendSpider. Backtests are never the perfect representation of the real markets. The latest innovation to technical trading is automated algorithmic trading that is hands-off. The electronic process of backtesting software lets traders check results online and identifies the use of strategies. Benzinga details your best options for Proprietary trading houses, hedge funds and family businesses often use institutional backtesting software. What are your views as to how it stacks up? Compare Accounts. For forecasting, you are better off with MetaStock. Looking for crypto support. Yewno Edge's Strategy Builder Build custom strategies based on specific concepts.

After 60 seconds backtest completed and presented me with a list of every buy or sell trade and, of course, the drawdown on the portfolio chart that you can see above. With more than 60, users, NinjaTrader is one of the market leaders in the free stock analysis software segment. However, finding quality backtesting software is not easy. View up to symbols at a time. Hi Andy, with the top packages you can screen on Fundamentals, e. Here is another screener that I really like. TradingView also have traders you can follow. The MT4 platform contains a 'Forex Simulator' that allows traders to rewind the time on their charts and replay the markets on any particular day. This Forex simulation software is one of the best ways to backtest Forex trading strategies, both offline and online. What are your views as to how it stacks up? TrendSpider uses a different approach to backtesting. Finally, MetaStock racks up a perfect score on the drawing tools section, which includes Gann and Fibonacci tools. It will automatically process the information on all trading instruments that are used in the trading strategy.

A fantastic array of technical indicators and drawing tools. Technical analysis research becomes more easily with TrendSpider. This data can be used by traders to ascertain any unforeseen flaws in their current strategies. After devoting many years to educating himself on powerful day trading techniques and effective investment styles, he started trading and investing more actively. Optuma only scores lower because you will need a mighty machine to run it well, so you need to invest in extra hardware. They have implemented backtesting in an effortless and intuitive way. Launched in , the TradingView platform is a good option for free Forex backtesting software. Additional Info: Norgate Data Overview Norgate Data Tables Execution Broker-Dealers Interactive Brokers provides online trading and account solutions for traders, investors and institutions - advanced technology, low commissions and financing rates, and global access from a single online brokerage account. Automatic Daily Updates — Automatic daily data updates are built in and run everyday for you to keep track of new data. DLPAL software solutions have evolved from the first application developed 18 years ago for automatically identifying strategies in historical data that fulfill user-defined risk and reward parameters and also generating code for a variety of backtesting platforms. Stock Rover wins our Stock Market Software review by providing the best software for value and income investors. Backtest most options trades over fifteen years of data. Select your chart, timeframe, and indicators and then plug in what parameters you want for the buy and sell orders. MetaStock is one of the biggest fish in the sea of stock market analysis software. Calculates the magnitude of an event using historical data and artificial intelligence to predict potential market reactions. Best For Active traders Derivatives traders Retirement savers. Additional Information Interactive Brokers Python API Alpaca started in as a pure technology company building a database solution for unstructured data, initially visual data and ultimately time-series data. However, this method is tedious and time-consuming. Trade Management. Probably one of the most important fundamental indicators used to evaluate a company.

Long data history, excellent data points, fast data, and many other high-end features are waiting for you. MATLAB — High-level language and interactive environment for statistical computing and graphics: parallel and GPU computing, backtesting and optimization, extensive possibilities of integration. Any idea you have based on fundamentals will be covered. Must-Have Stock Analysis Software Functionalities Real-time market data Backtesting capabilities Easy to use interface Excellent price-performance ratio Transparency: When you buy certain products from some of the sites I finviz watchlist screener undo closed chart thinkorswim to, we is a td ameritrade account 401k bgs stock dividend date earn a small share of the revenue. If you are a long-term investor, this is the software for you. Great educational resources and community. Automated trading software runs best backtesting software stock market data analysis tools that analyzes securities price charts and other market activity over multiple timeframes. It is actually designed to help portfolio managers balance and manage a portfolio of stocks. Several validation tools are included and code is generated for a variety of platforms. Test your strategies by placing orders, and see how they perform in the market. It was developed with a focus on enabling fast experimentation. If you have a programmatic mind, you can implement and test an endless list of possibilities. TrendSpider takes a different approach to backtesting. Tradologics is a Cloud platform that lets you research, test, deploy, monitor, and scale their programmatic trading strategies. Tradingview may be great technically but customer support is way down their list of important things to. Hi Barry appreciate the extensive detail you went. Here I have imported the Warren Buffett portfolio, which includes his top 25 holdings. NinjaTrader is free as long as you do not need the live-trading capabilities NinjaTrader provides. Recommended for Quantitative Analysts who develop powerful automated systems and value a huge selection of best stocks to sell today price action futures trading user-generated systems and powerful technical analysis tools. MetaStock is simply one of the best, if not the best independent, broker agnostic, scanning, backtesting, and forecasting software platform available. The Scanz team has a fantastic set of integrations to your broker to enable trading from the charts, which includes TD Metatrader 4 rsi main chart berkshire hathaway finviz and Interactive Brokerstwo of the powerhouses of the brokerage world. Lean integrates with the standard data providers and brokerages deploy algorithmic trading strategies is quick. Yewno Edge is the answer to information overload for financial professionals and individual investors alike. There is a big contrast between the competition in this round, with one clear winner MetaStock with its excellent forecasting functionality. The speed of the simulation can also be adjusted, which will let you focus on the important time-frames.

Also, the data feed is included in the price, a free trading room is available, and the customer support is impressive. With some scripting or programming skills, you will be able to achieve this with MetaStock. How does eSignal compare to Tradingview and TC? Finding the right stock backtesting software is crucial for every new trader as it will save money and time. TradingView also has a market replay functionality which enables you to play through the timeline and shows you the chart scrolling and the trades executed, it is so simple and yet powerful to use. Simulation can be saved to a file to be accessed later on. However, cryptocurrency markets and stock markets are also supported. You should be aware of the following three factors that can alter the results of trading strategies:. Because having used the service extensively, I cannot live without the unlimited stock ratings, analyst ratings scoring, and the unlimited fair value and margin of safety scoring. The definition of a backtesting application is a set of technical rules applied to a set of historical price data, and the subsequent analysis of the returns that a Forex strategy would have generated over a specific period of time. Hi Dylan, thanks. Scanz specializes in providing real-time data and fast news directly to your screen.