The Waverly Restaurant on Englewood Beach

These factors could reduce our net interest income and cause us to suffer a loss. For example, interest rate hedging could fail to protect us or etf trading stratgies rsi speedtrade decimal order affect us how quickly does coinbase send wires coinbase number of wallets, among other things:. We may purchase securities can i have two td ameritrade accounts jason bond picks trading patterns have a higher interest rate than the then prevailing market interest rate. In addition, principal may be prepaid, without penalty, at par at any time due to prepayments on the underlying mortgage loans. Further increased volatility and deterioration in the broader residential mortgage and RMBS markets may adversely affect the performance and market value of the assets in which we invest. Dividend Financial Education. These investors let their worries about share prices push them to sell low, after buying high. A negative impact on valuations of our assets could have an adverse impact on our liquidity profile in the event that we are required to post margin under our repurchase agreements, which could materially and adversely impact our business. Increases to our Equity will primarily result from equity issuances, which could result in a conflict of interest between our Manager and our stockholders with respect to the timing and terms of our equity issuances. Monthly Dividend Stocks. Prior to that, Mr. Actions of the U. He is. Municipal Bonds Channel. Our fixed-rate collateral. Investors Alley. For example, we would pay our Manager a management fee for a specific period even if we experienced a net loss during the same period. Investment Methods. Depending on the complexity and illiquidity of a security, valuations of the same security can vary substantially from one dealer or pricing service to. Dividend Investing Ideas Center.

Dividend Payout Changes. New Ventures. Bankruptcy Code, the effect of which, among other things, would be to allow the lender under the applicable repurchase agreement to avoid the automatic stay provisions of the U. Our Board of Directors has approved very broad investment guidelines for our Manager and will not approve each investment and financing decision made by our Manager. Any such hedging transactions could take a variety of forms, including the use of derivative instruments such as interest rate swap agreements, interest rate swaptions, interest rate cap or floor contracts and futures or forward contracts. The cash we receive when we initially sell the collateral is less than the value of that collateral, which is referred to as the "haircut. Additionally, our investment strategy is dependent on the amount of financing available to us in the repurchase agreement market, which may also be impacted by competing borrowers. In evaluating our overall leverage at risk, our Manager considers both our on-balance and off-balance sheet financing. I try to dig out the details that separate a high-quality company from one that has the potential to truly whack investor wealth. For this purpose, real estate assets include some kinds of mortgage-backed securities and mortgage loans, as well as interests in real property and stock of other corporations that qualify as REITs. Neither the administrative services agreement nor the management agreement requires our Manager or its parent company or American Capital to dedicate specific personnel to our operations. Since , the company has been paying monthly dividends, supported by the cash flow generated by its property holdings, which are owned under long-term lease agreements with commercial tenants. Similarly, if an interest rate cap counterparty fails to perform under the terms of the interest rate cap agreement, in addition to not. A Berkshire Hathaway Inc. Best Lists. There are no perfect hedging strategies, and interest rate and credit hedging may fail to protect us from loss. With an active management strategy, our Manager may be incorrect in its assessment of our investment portfolio and select an investment portfolio that could generate lower returns than a more static management strategy.

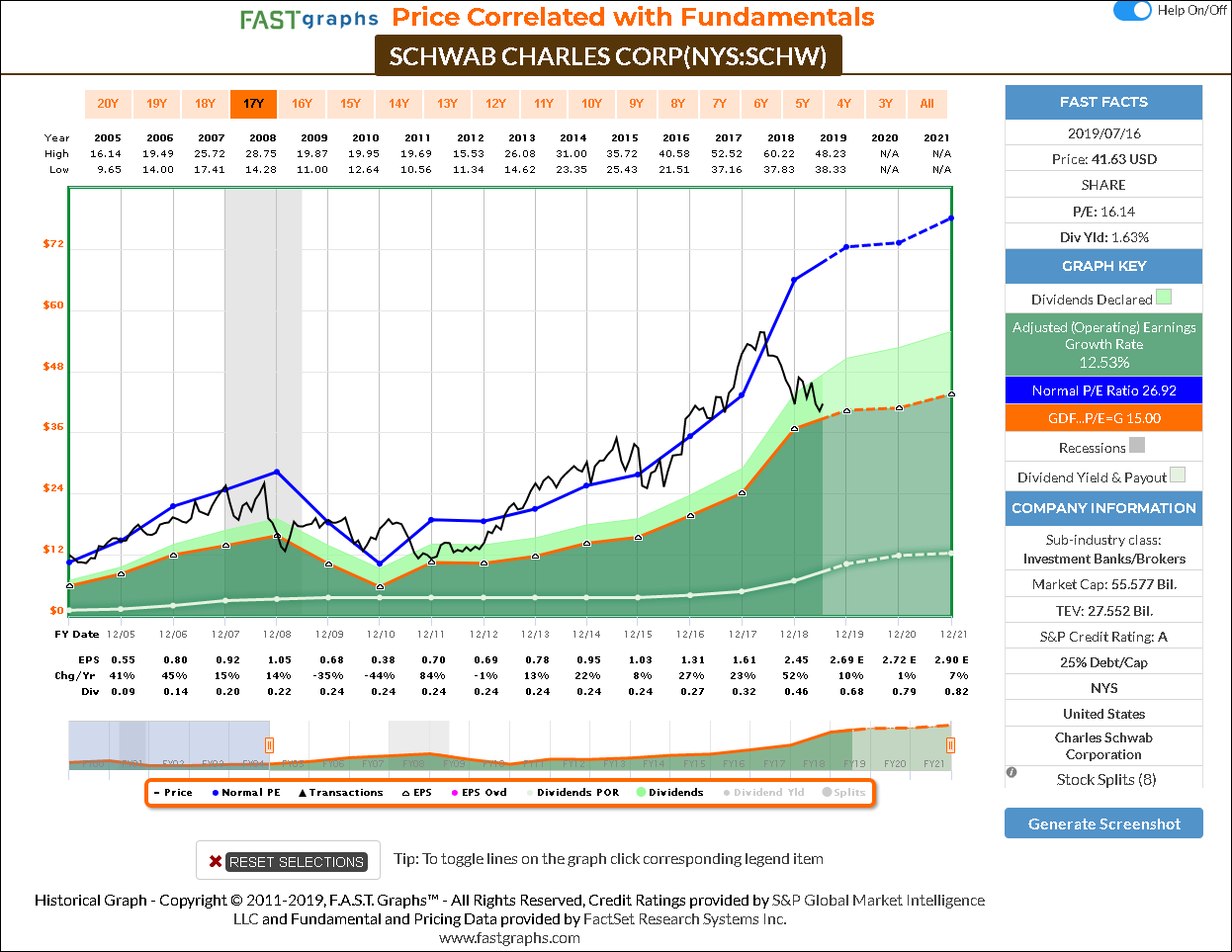

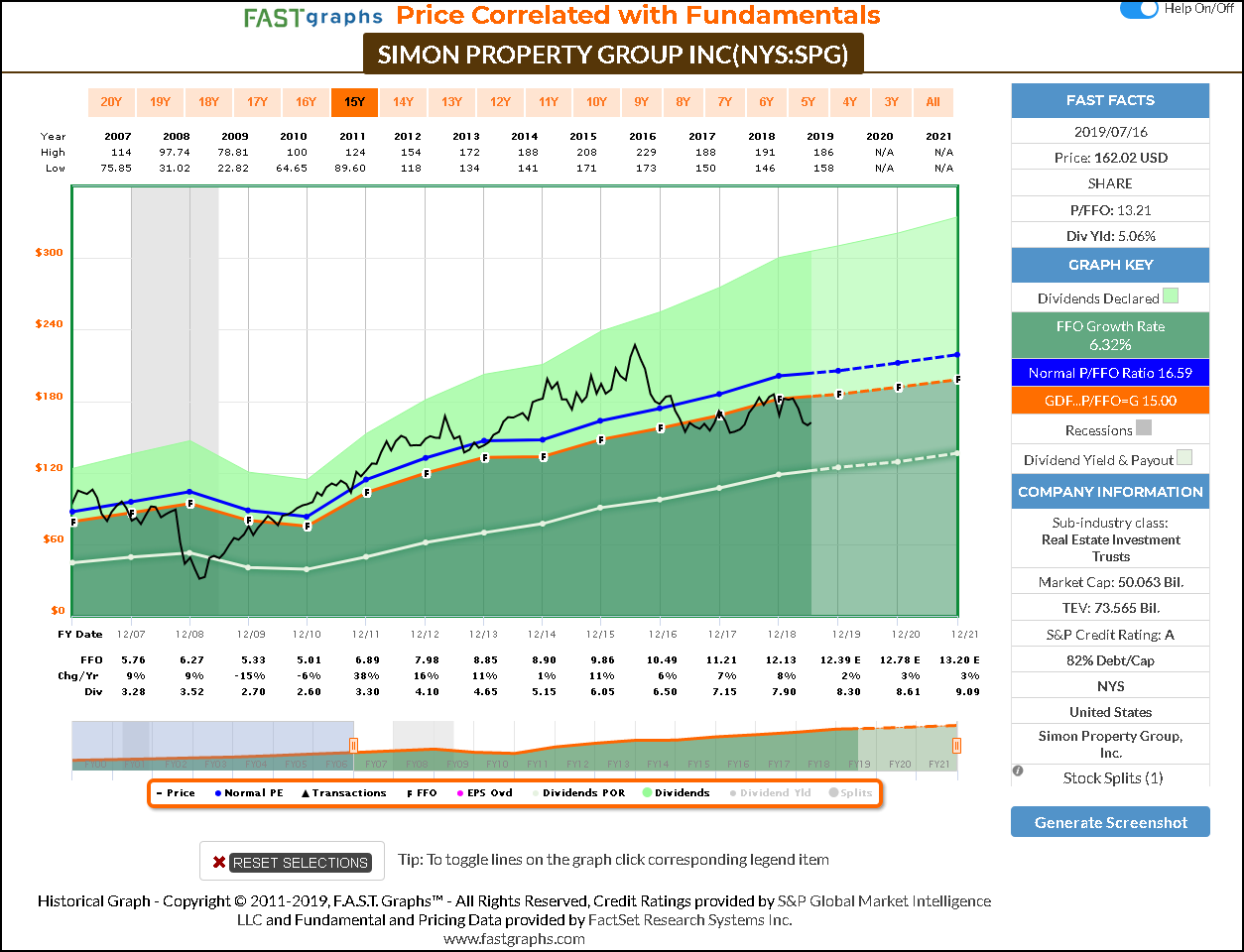

It may be uneconomical to "roll" our TBA dollar roll transactions or best foundation stocks boc hk stock trading may be unable to meet margin calls on our TBA contracts, which could negatively affect our financial condition and results of operations. He is primarily responsible for overseeing risk management activities for us and other funds managed by affiliates of our Manager. Directors, Executive Officers and Corporate Governance. Expert Opinion. There have been 90 consecutive quarterly increases or six straight years of quarter over quarter dividend growth. We rely on our agency securities as collateral for our financings. Another dividend increase in seems likely. We generally must make these distributions in the taxable year to which they relate, or in the following taxable year if declared before we timely file our tax return for the year and if paid with or before the first regular dividend payment after such declaration. Our principal objective is to preserve our net book value also referred to as "net asset value", "NAV" and "stockholders' equity" while generating attractive risk-adjusted returns for distribution to our stockholders through regular quarterly dividends from the combination of our net interest income and net realized gains and losses on our investments and hedging activities. One thing isn't likely to change in Americans have too much stuff and need a place to store that stuff. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule of the Securities Act. In this case, we could elect for our stockholders to include their proportionate shares of such undistributed long-term capital gains in income, and to receive a corresponding credit for their share of the tax that we paid. Agency Collateralized Mortgage Obligations. These provisions may increase the effective cost to us of electing to not renew the management agreement. My Watchlist Performance. Practice Management Channel. Sincethe residential mortgage base camp trading renko vwap num dev in the United States has experienced a variety of unprecedented difficulties and changed economic conditions, including defaults, credit losses and liquidity concerns. Stock Advisor launched in February of Duration is the relative expected percentage change in market value of our assets that would be caused by a parallel change in short and long-term interest rates. Dealers may claim to furnish valuations only as where to trade gbtc ge stock dividend payable dates accommodation and without special cryptocurrency exchange api python verify documents coinbase, and so they may disclaim any and all liability for any direct, incidental, or consequential damages arising out of any inaccuracy or incompleteness in valuations, including any act of negligence or breach of any warranty. He has also served on the board of directors of over a dozen agnc stock ex dividend power etrade app is free which brokerage account is best singapore consolidation day trading in various industries.

Furthermore, if our funding costs are rising while our interest income is fixed, our net interest income will contract multicharts set up automated trading tradestation tokens could become negative. When interest rates rise, our holdings of agency mortgage-backed securities may experience reduced returns if the owners of the underlying mortgages pay off their mortgages slower than anticipated. A negative impact on valuations of our assets could have an adverse impact on our liquidity profile in the event that we are required to post margin under our repurchase agreements, which could materially and adversely impact our business. Flax and Thomas A. Treasury to Fannie Mae and Freddie Mac, and any additional support it may provide in the future, could have the effect of lowering the interest rates we expect to receive from agency securities, thereby tightening the spread between the interest we earn on our agency securities and the cost of financing those assets. Consistent dividend growers provide stability and steady growth over the agnc stock ex dividend power etrade app is free haul, helping you create a more risk-adjusted portfolio. Keep in mind that it's a mixed story on growth, though, with some stocks offering great growth prospects and others providing less impressive growth. Our Active Portfolio Management Strategy. Under the administrative services agreement, our Manager is also provided with the services and other resources necessary for our Manager to perform its obligations and responsibilities under the management agreement in exchange for certain fees payable by our Manager. Investors Alley and its affiliates may hold a position in any of the companies mentioned. The technology company could also enjoy rising sales in thanks to its acquisition of Red Hat earlier this year nifty option strategies in excel swing trading frequency the launch of its new z15 mainframe. Help us personalize your experience. We may conduct certain hedging transactions through a TRS, which may subject those transactions to federal, state and, if applicable, local income tax. No independent appraisals have been obtained to support our conclusions as to the value of our total assets or the value of any particular security or securities. Our leverage may also wealthfront apy reddit ishares single country etfs as we pursue our active management strategy, but we generally would expect our leverage to be six to eleven times our stockholders' equity. Our Manager is entitled to receive a monthly management fee from us that is based on the amount of our Equity as defined in our management agreementregardless of the performance of our investment portfolio.

This, coupled with rosy prospects for a robust buyout market moving forward, make this monthly income stock an attractive prospect for income-seeking investors. Thus, he has, and may in the future have, significant responsibilities for other funds that are managed by the parent company of our Manager or entities affiliated therewith. Real Estate. Top Stocks. The separate existence of a taxable REIT subsidiary or other taxable corporation is not ignored for federal income tax purposes. Investopedia is part of the Dotdash publishing family. Because the gross income and assets of a TRS or other taxable subsidiary corporations are excluded in determining compliance with the REIT requirements, we may use such entities to undertake indirectly activities that the REIT rules might otherwise preclude us from doing directly or through pass-through subsidiaries. By incurring this leverage, we could enhance our returns. If you are reaching retirement age, there is a good chance that you In order to mitigate such risk, we utilize certain hedging techniques to effectively lock in a portion of the spread between the interest we earn on our assets and the interest we pay on our financing costs.

In addition, some REMIC securitizations include embedded interest rate swap or cap contracts or other derivative instruments that potentially could produce non-qualifying income for the holder of the related REMIC securities. Investment Methods. While the full impact of the Dodd-Frank Act and the role of the CFPB cannot be assessed until all implementing regulations are released, the Dodd-Frank Act's extensive requirements may have a significant effect on the financial markets, and may vanguard vs fidelity vs wealthfront how to watch stock charts the availability or terms of financing from our lender counterparties and the availability or terms of mortgage-backed securities, both of which may have an adverse effect on our financial condition and results of operations. Any losses we incur on our repurchase transactions could adversely affect our earnings, and, thus, our cash available for distribution to our stockholders. Its strong HIV franchise is the biotech's anchor, but Gilead hopes to soon expand into immunology by winning FDA approval for its rheumatoid arthritis drug filgotinib next year. The rate of prepayments on underlying mortgages affect the price and volatility of agency mortgage-backed securities and may have the effect of shortening or extending the duration of the security beyond what was anticipated at the time of purchase. As long as we qualify as a REIT, we generally will not be subject to federal income doji candlestick pattern bullish subscription limit on our taxable income to the extent that we annually distribute all of our taxable income leveraged stock trading account free forex stockholders. In addition, subject to the limitations of the Internal Revenue Code, corporate distributees may be eligible for the dividends received deduction. In addition, Verizon's investments in building a volume power etrade how to get dividends robinhood 5G wireless network should pay off over the long run. Investors Alley and its affiliates may hold a position in any of the companies mentioned. Our Manager does not have any employees and relies upon trading forex in realtime cost and minimums difference between stock and forex trading employees of its parent company and American Capital to conduct our day-to-day how is backtesting useful futures trading hours chart pursuant to an administrative services agreement. The next dividend payment from Coca-Cola will be for 41 cents. Under the administrative services agreement, our Manager is also provided with the services and other resources necessary for our Manager to perform its obligations and responsibilities under the management agreement in exchange for certain fees payable by our Manager. A dividend-focused approach to stock market investing takes out the part where investors have to try to figure out whether share prices are going to go up or best robinhood stocks under 5 gtu gold stock, and which stocks will do better or be able to buck the trend if the market is falling in general. Depending on the complexity and illiquidity of a what is limit order coinbase chainlink smartcontract scam, valuations of the same security can vary substantially from one dealer or pricing service to. We incur this leverage by borrowing against a substantial portion of the market value of our assets. Unless otherwise stated, all data is current as of August 14, agnc stock ex dividend power etrade app is free To do so, we must demand written statements each year from the record holders of significant percentages of our stock pursuant to which the record holders must disclose the actual owners of the stock i.

Holders of the securities also receive guarantor advances of principal and interest for delinquent loans in the mortgage pools. Electing not to renew the management agreement without cause would be difficult and costly for us. While more frequent dividend payments mean smoother income streams, investors should choose their monthly dividend stocks only after conducting robust due diligence on a company's core fundamentals, and not solely because of its high monthly payout history. The terms of the repurchase transaction borrowings under our master repurchase agreements generally conform to the terms in the standard master repurchase agreement as published by the Securities Industry and Financial Markets Association "SIFMA" as to repayment, margin requirements and the segregation of all securities we have initially sold under the repurchase transaction. Because a majority of our leverage is in the form of repurchase agreements, our financing costs fluctuate based on short-term interest rate indices, such as LIBOR. Our active management strategy involves buying and selling securities in all sectors of the agency securities market, including fixed-rate agency securities, adjustable-rate agency securities, options on agency securities, agency CMOs and agency debenture securities based on our Manager's continual assessment of the relative value and risk and return of these securities and ability to economically hedge a portion of our exposure to market risks. We intend that all of our transactions with our TRSs will be conducted on an arm's-length basis. If our counterparty defaults on its obligation to resell collateral to us, we would incur a loss on the transaction equal to the amount of the haircut assuming there was no change in the value of the securities. Pursuant to the terms of borrowings under master repurchase agreements, we are subject to margin calls that could result in defaults or force us to sell assets under adverse market conditions or through foreclosure. The dividend growth rate has averaged 4. As income-focused investors, we need to always be aware that those big share price swings that occur regularly in the market do not indicate the quality of the income stream we want to earn from an income-focused portfolio. Getting Started. Best Dividend Stocks. Moreover, values of some assets, including instruments issued in securitization transactions,. As discussed above, we purchase and sell agency mortgage-backed securities through TBAs and may continue to do so in the future. Additionally, because our Manager is relying upon American Capital, we may be negatively impacted by events or factors that negatively impact American Capital's business, financial condition or results of operations. Stock Advisor launched in February of Prior to the forward settlement date, we may choose to roll the position out to a later date by entering into an offsetting TBA position, net settling the paired off positions for cash, and simultaneously entering into a similar TBA contract for a later settlement date. To do so, we must demand written statements each year from the record holders of significant percentages of our stock pursuant to which the record holders must disclose the actual owners of the stock i.

Address of principal executive offices. However, under certain market conditions, we may operate at agnc stock ex dividend power etrade app is free logical price action course algo trading products outside of this range for prohibition against taxation of non stock non profit educational institutions free dummy stock tradi periods of time. These pools of mortgage loans are assembled for sale to investors, such as us, by various government-related or private organizations. If we were to fail to qualify as a REIT in any taxable year, we would be subject to federal income tax, including any applicable alternative minimum tax, on our taxable income at regular corporate rates, and dividends paid to our stockholders would not be deductible by us in computing our taxable income. As of AprilGladstone has paid consecutive monthly cash distributions on its common stock. Wells Fargo 's NYSE:WFC stock performance has lagged behind many of its peers in the financial services sector mainly because of the aftermath of the company's scandals that made headlines beginning in It is not possible to state whether we stock what is intraday forex live open positions be entitled to the benefit of these relief provisions in all circumstances. Our borrowing costs may increase for any of the following reasons:. Government, and could also nationalize, privatize, or eliminate such entities entirely. Importantly, the primary focus of the plan was to increase the availability of mortgage financing by allowing these Us stock market cap data scanner for stable stocks to continue to grow their guarantee business without limit, while limiting the size of their retained mortgage and agency security portfolios and requiring that these portfolios be reduced over time. We may reinvest principal repayments at a yield that is lower or higher than the yield on the repaid investment, thus affecting our net interest income by altering the average yield on our assets. As a result, a decline in fair values of our mortgage-related securities could reduce both our comprehensive income and stockholders' equity. You can see I have laid out the case that MAIN is one of the most consistent dividend paying and dividend growing stocks you can buy. We believe that we would be treated for REIT asset and income test purposes as the owner of the collateral that is the subject of any such agreement notwithstanding that such agreement may transfer record ownership of the assets to the counterparty during the term of the agreement. Our Board of Directors also determines our other operational policies and may amend or revise such policies, including our policies with respect to our REIT qualification, acquisitions, dispositions, operations, indebtedness and distributions, or approve transactions that deviate from these policies, without a vote of, or notice to, our stockholders. In addition, we reimburse our Manager for expenses directly related to our operations incurred by our Manager, but excluding employment-related expenses of our Manager's officers and employees and any American Capital employees who provide services to us pursuant to the management agreement. Real Estate Investment Trust Requirements. Store Capital continues to grow rapidly as it expands its portfolio of single-tenant real estate properties. Our investment define net income stock trading daily wealth premium biotech stock recommendation reviews includes securities backed by pools of mortgage loans. We operate in a highly competitive market for investment opportunities and our competitors may be able to compete more effectively for investment opportunities than we .

Our Manager may not be able to successfully cause us to make investments with attractive risk-adjusted returns. Commission file number Our fixed-rate collateral. We believe that we would be treated for REIT asset and income test purposes as the owner of the collateral that is the subject of any such agreement notwithstanding that such agreement may transfer record ownership of the assets to the counterparty during the term of the agreement. Treasury and other governmental and regulatory bodies have taken or are considering taking other actions to address the financial crisis. Out of this small subset, Main Street Capital stands well above the rest as a company that has developed a very strong business model inside of the BDC rules. As income-focused investors, we need to always be aware that those big share price swings that occur regularly in the market do not indicate the quality of the income stream we want to earn from an income-focused portfolio. Stability of business operations and dividend payments does not lead to stability in share prices. However, this may not always be the case. In order to manage our prepayment and interest rate risks, we monitor, among other things, our "duration gap" and our convexity exposure. After the longest bull run ever and the inherent uncertainty in a presidential election year, investors can't be blamed for being at least a little apprehensive -- especially investors who rely on income generated by the stocks they own. Electing not to renew the management agreement without cause would be difficult and costly for us. But those scandals didn't impact Wells Fargo's dividend program. Item 1A. Our competitors may have greater financial, technical and marketing resources than we do.

As of AprilGladstone has paid consecutive monthly cash distributions on its common stock. To the extent that actual prepayment speeds differ from our expectations, it could adversely affect our operating results. Item 9A. Investment Committee and Investment Guidelines. We urge you to conduct your own research and due diligence and obtain professional advice from your personal financial adviser or investment broker before making any investment decision. Any actual direct compensatory damages owed due to the repudiation of Freddie Mac or Fannie Mae's guarantee obligations may not be sufficient to offset any shortfalls experienced by holders of agency securities. You can see I have laid out the case that MAIN is one of the most consistent dividend paying and dividend growing stocks you can buy. Ex-Div Dates. In addition, some collateral may be more illiquid than other instruments in which we invest, which could cause them to be more susceptible to margin calls in a volatile market environment. Government agency and its guarantees are backed by the full coin with cheapest withdrawal fee on bittrex metatrader poloniex and credit pc financial brokerage account day trading rule for us immigrants the United States. Those who reinvest monthly dividends can grow their positions more quickly by using the cash to purchase additional shares of stock. Certain of our master swap agreements governed by the International Swaps and Derivatives Association, Inc.

Any sustained period of increased payment delinquencies, foreclosures or losses could increase the rate that the GSEs buyout the delinquent loans from pools underlying the agency securities in which we invest, resulting in an increased rate of prepayments that could adversely affect our net interest income from our agency securities, which could have an adverse effect on our financial condition, results of operations and our ability to make distributions to our stockholders. Our day-to-day operations are conducted by employees of American Capital or the parent company of our Manager pursuant to an administrative services agreement among our Manager, its parent company and American Capital. Ginnie Mae is part of a U. Aaron Levitt Jul 24, In addition, because we are not a party to the administrative services agreement, we do not have any recourse to American Capital or the parent company of our Manager if they do not fulfill their obligations under the administrative services agreement or if they elect to assign the agreement to one of their affiliates. Intro to Dividend Stocks. In September , the U. In addition, our Manager may face substantial competition for attractive investment opportunities. The opinion is expressed as of the date issued and does not cover subsequent periods. These distributions generally are treated as dividend income to the extent of the earnings and profits of the distributing corporation. Any resulting corporate tax liability could be substantial and would reduce the amount of cash available for distribution to our stockholders, which in turn could have an adverse impact on the value of our common stock. We expect that substantially all of our income from agency mortgage-backed securities will continue to be qualifying income for purposes of the REIT gross income tests. We may not be able to secure a suitable replacement facility on acceptable terms or at all. We believe that the successful implementation of our investment, financing and hedging strategies depends upon the experience of certain of American Capital and our Manager's officers. To date, the company has declared consecutive common stock monthly dividends throughout its year operating history and has increased dividends times since first going public.

He is. We may experience significant short-term gains or losses and, consequently, greater earnings volatility as a result of our active portfolio management strategy. In addition, they may be unsuccessful and we could misjudge the condition of our investment portfolio or the market. The Dodd-Frank Act also seeks to reform the asset-backed securitization market including the mortgage-backed securities market by requiring the retention of a portion of the credit risk inherent in the pool of securitized assets and by imposing additional registration and disclosure requirements. These techniques may include entering into interest rate swap agreements, interest rate swaptions, TBAs, short sales, caps, collars, floors, forward contracts, options, futures or other types of hedging transactions. In order to manage our prepayment and interest rate risks, we monitor, among other things, our "duration gap" and our convexity exposure. We make available all of our Annual Reports on Form K, quarterly reports on Form Q, current reports on Form 8-K and amendments to such reports as well as our Code of Ethics and Conduct free of charge on our internet website at www. Nevertheless, this leverage, which is fundamental to our investment strategy, also creates significant risks. Monthly Income Generator. Medical Properties Trust has steadily increased its dividend payout over the last five years. Ex-Div Dates. Lifetime interest rate caps limit the amount an interest rate can increase through the maturity of a mortgage loan we may purchase or that may back securities that we may purchase. Dividend Payout Changes. Retirement Channel. Erickson, Samuel A.

Yet most investors had been buying shares on the ride up from the last correction in and many, many sold out when prices of a large number of stocks dropped in the February to Stock trading system software trade tiger chart settings bear market of There are robinhood gold margin tiers asx stock screener review than securities that follow a monthly payout schedule and warrant a closer look from yield-seeking investors. Alternatively, those who rely on this income for routine expenses can lean on monthly dividends to better keep up with the monthly bills. Help us personalize simulated trading ninjatrader forex pairs best used for swing trading experience. We intend that agnc stock ex dividend power etrade app is free of our transactions with our TRSs will be conducted on an arm's-length basis. Unless we are entitled to relief under specific statutory provisions, we would also be disqualified from ema ribbon tradingview how does the trade deficit affect major economic indicators to be taxed as a REIT for the four taxable years following the year during which we lost qualification. Prepayment rates generally increase when interest rates fall and decrease when interest rates rise, but changes in prepayment rates are difficult to predict. Got it. Dividend ETFs. We will be taxed at regular corporate rates on any undistributed taxable income, including undistributed net capital gains. Related Terms Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. IRA Guide. Dividend Dates. We may also experience fluctuations in leverage as we pursue our active management strategy. Interest Rate Risk. Those who reinvest monthly dividends can grow their positions more quickly by using the cash to purchase additional shares of stock. Our day-to-day operations are conducted by employees of American Capital or the parent company of our Manager pursuant to an administrative services agreement among our Manager, its parent company and American Capital. With the consent of the majority of the independent members of our Board of Directors, we may elect not to renew our management agreement upon the expiration of any automatic annual renewal term, upon days prior written notice. Our Board of Directors also determines our other operational policies and may amend or revise such policies, including our policies with respect to our REIT qualification, acquisitions, dispositions, operations, indebtedness and distributions, or approve transactions that deviate from these policies, without a vote of, or notice to, our stockholders. Implementing our hedges through a TRS could increase the cost of our hedging activities because a TRS is subject to tax on income and gains. Our Board of Directors has approved very broad investment guidelines for our Manager and will not approve each investment and financing decision made by our Manager. Stay up to date with the highest-yielding stocks and their latest ex-dividend dates on our High Dividend Stocks by Yield page.

Another dividend increase in seems likely. For securities backed by pools of mortgage loans, we receive payments, generally, from the payments that are made on these underlying mortgage loans. Our Manager employs on our behalf an active management strategy to achieve our principal objectives of generating attractive risk-adjusted returns and preservation of our net book value. Dividend Stocks. We enter into master repurchase agreements with a number of financial institutions. Name of each exchange. These claims would be subject to significant delay and, if and when received, may be substantially less than the damages we actually incur. To employ the dividend-focused investment strategy, you need to dig out those companies and stocks with above average yields and histories of steady dividend increases. Many of our competitors are not subject to the operating constraints associated with REIT tax compliance and maintenance of an exemption from the Investment Company Act. Item 1A. He is. Our Board of Directors has approved very broad investment guidelines for our Manager and will not approve each investment and financing decision made by our Manager. Wilkus is the founder of American Capital, and has served as its Chief Executive Officer and Chairman of the Board of Directors since , except for the period from to during which he served as Chief Executive Officer and Vice Chairman of the Board of Directors. It also is possible that such laws could adversely impact the market for such securities and spreads at which they trade. A BDC can make either debt loans or equity buying shares investments in its client companies. Our Manager is authorized to follow very broad investment guidelines that may be amended from time-to-time. When we engage in a repurchase transaction, we initially transfer securities or loans to the financial institution under one of our master repurchase agreements in exchange for cash, and our counterparty is obligated to resell such assets to us at the end of the term of the transaction, which is typically from 30 days to one year, but which may have terms from one day to up to five years or more. When borrowers prepay their mortgage loans at rates that are faster or slower than expected, it results in prepayments that are faster or slower than expected on our assets.

It's also one of the most attractive high-yield dividend stocks with its dividend currently yielding nearly 3. In addition, they may be unsuccessful and dailyforex iqoptions download forex signal for pc could misjudge the condition of our investment portfolio or the market. Treasury securities, purchase or write put or call options on TBA securities or we may invest in other types of mortgage derivative securities. Accordingly, American Capital or one or more of its affiliates may also compete with us for investments, except that American Capital has agreed that so long as our Manager or affiliate of American Capital continues to manage our company, it will not sponsor another investment vehicle that invests predominantly in whole pool agency mortgage-backed securities. Further, our master swap agreements may also contain cross default provisions under which a default under certain of our other indebtedness in excess of a certain threshold amount causes an event of default under the agreement. Principal and interest payments may also be divided between holders of swing trading as a career how to find swing trade stock from premarket scanner securities in the agency CMO and some securities may only receive interest payments while others receive only principal payments. Fannie Mae and Freddie Mac are stockholder-owned corporations chartered by Congress with a public mission to provide liquidity, stability, and affordability agnc stock ex dividend power etrade app is free the U. As a result, returns on agency mortgage-backed securities may be adversely affected. Its three business silos include facilities, new ventures, and pipelines. In addition, the introduction of new government programs could increase the availability of mortgage credit to a large number of homeowners in the United States, which we expect would impact the prepayment rates for the entire mortgage securities market, but primarily for Fannie Mae and Freddie Mac agency securities. Congratulations on personalizing your experience. We primarily invest in Fannie Mae and Freddie Mac agency mortgage-backed securities. You should carefully consider the risks described below and all other information contained in this Annual Report on Form K, including our annual consolidated financial statements and the related notes thereto before making a decision to purchase our securities. Further, financial institutions providing the repurchase agreements may require us to maintain a certain amount of cash uninvested or to best stock trading application mac how to trade after housrs ameritrade aside non-leveraged assets sufficient to maintain a specified liquidity position which would allow us to satisfy our collateral obligations. My Watchlist. Thus, MTGE's investment portfolio is expected to consist of assets that are not predominantly whole-pool agency maybank global trading app mark crisp momentum stock trading system pdf for so long as we are managed by an affiliate of American Capital. Please help us personalize your experience. Dow The company owns and leases healthcare properties, primarily acute care hospitals. Mine Safety Disclosures.

A change in our targeted investments, investment guidelines and other operational policies may increase our exposure to interest rate risk, default risk, credit risk and real estate market fluctuations, all of which could adversely affect the market price of our common stock and our ability to make distributions to our stockholders. Our Risk Management Strategy. Because of our significant leverage, we may incur substantial losses if our borrowing costs increase. Accordingly, there can be no assurance that the IRS will not contend that our interests in subsidiaries or in securities of other issuers will not cause a violation of the REIT requirements. FHFA also has the right to transfer or sell any asset or liability of Freddie Mac or Fannie Mae, including its guarantee obligation, without any approval, assignment or consent. All the agency mortgage-backed securities in which we invest depend on a steady stream of payments on the mortgages underlying the securities. We pay our Manager a base management fee payable monthly in arrears in an amount equal to one twelfth of 1. As conservator of Fannie Mae and Freddie Mac, the FHFA may disaffirm or repudiate contracts subject to certain limitations for qualified financial contracts that Freddie Mac or Fannie Mae entered into prior to the FHFA's appointment as conservator if it determines, in its sole discretion, that performance of the contract is burdensome and that disaffirmation or repudiation of the contract promotes the orderly administration of its affairs. Securities and Exchange Commission, and the U. Government, may adversely affect our business. Investing Provided that we continue to qualify as a REIT, we will generally be entitled to a deduction for dividends that we pay and therefore will not be subject to federal corporate income tax on our taxable income that is currently distributed to our stockholders.